|

by David on (#6ZR0M)

Quantum economics/finance is based on the idea that you can use quantum probability to model financial markets. Over the past several years I have had numerous discussions on the topic with physicists, and often (not always) they seem to follow the same track. To save time in future, I will summarise the steps briefly, using [...]

|

The Future of Everything

The Future of Everything

| Link | https://futureofeverything.wordpress.com/ |

| Feed | https://futureofeverything.wordpress.com/feed |

| Updated | 2025-12-18 15:34 |

|

by David on (#6Z9CY)

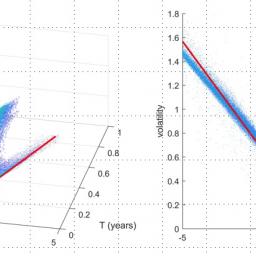

The Qvar Shiny app is now live at:https://david-systemsforecasting.shinyapps.io/qvar/ The app provides an interactive way to explore q-variance - a property that links price changes and volatility in a way not anticipated by traditional models. It draws on ideas from quantum probability to test whether a universal variance relationship holds across major stocks. What Is Q-Variance?In [...]

|

|

by David on (#6Y5A9)

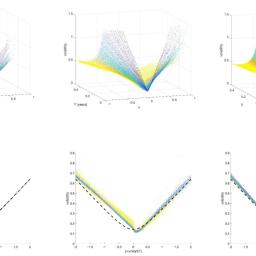

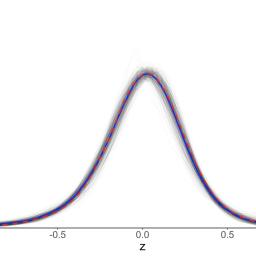

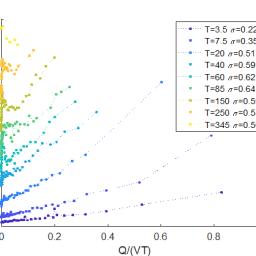

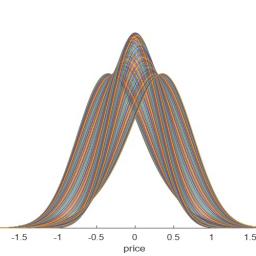

As seen in QEF15, stock market data follows q-variance and the q-distribution. Q-variance refers to the property that the expected variance of log returns x, corrected for drift, over a period T follows to good approximation the formula V(z)=^2+z^2/2 where z=xT. This property follows because we model price change as the displacement of a quantum [...]

|

|

by David on (#6Y5AA)

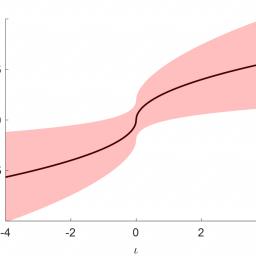

Q-variance refers to the property, described previously in QEF14, that the expected variance of log returns x, corrected for drift, over a period T follows to good approximation the formula V(z)=^2+z^2/2 where z=xT. Q-variance follows because we model price change over a period as the displacement of a quantum harmonic oscillator (here we are not [...]

|

|

by David on (#6R5XM)

Back in 2021 I heard about a new film out of South Africa called Gaia. According to the plot synopsis, the story starts with two characters Gabi and Winston exploring a forest in South Africa. When they leave, Gabi tells Winston that we can't just leave our trash here." It then turns out that Winston [...]

|

|

by David on (#6JVE0)

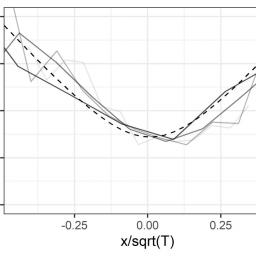

The quantum implied volatility (QIV) model is a minimalistic model of an implied volatility surface. The aim is to capture the main features of implied volatility using a small number of parameters. The model is derived by assuming that the implied volatility is the volatility which, when used as input to the Black-Scholes model, will [...]

|

|

by David on (#6JF0S)

Since I started working in quantum economics, a persistent problem was finding suitable venues for publication. Journals in economics or finance wanted nothing to do with it (the exception was Wilmott magazine), so most papers were published in physics journals like Physica A, which meant that no one working in economics ever heard about them. [...]

|

|

by David on (#6G2H7)

This interview with E-International Relations was edited by Cecile Pomarede and originally posted here. Where do you see the most exciting research/debates happening in your field? In economics, the most exciting project in my view involves building an alternative to mainstream theory that is based on quantum rather than classical thinking. The field of economics [...]

|

|

by David on (#6CQ7K)

It was a pleasure speaking yesterday at the Quant Insights conference marking the 50th anniversary of the Black-Scholes model. My talk presented nine predictions which came out of the quantum model - things that I had not been aware of, but that were suggested by the model and proved correct after empirical tests. And they [...]

|

|

by David on (#6CQ7M)

I'm a big fan of uncertainty. I'm more interested in what we don't know than what we do know. In physics, that obviously leads naturally into quantum ... where the idea of uncertainty is baked into the theory itself.Shohini Ghose In a Perimeter Institute podcast, quantum physicist Shohini Ghose discussed the role of uncertainty, applying [...]

|

|

by David on (#6CQ7N)

Since I became involved in quantum economics, I have got used to hearing people announce that they are skeptical about the field. In the piece, I want to lay out the reasons why I too am skeptical. Most people, when asked why they are skeptical, will point to physics envy, or compare the field with [...]

|

|

by David on (#6CQ7P)

Whether you can observe a thing or not depends on the theory which you use. It is the theory which decides what can be observed. Albert Einstein, 1926 Mathematical models can be used to illuminate a system and make predictions about its behaviour, but they can also lead to a form of blindness. A historic [...]

|

|

by David on (#6CQ7Q)

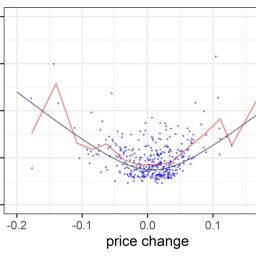

The answer to this question, according to quantum finance, is both. The volatility smile refers to the phenomenon in options trading where the implied volatility has a smile-like shape as a function of strike price (see Figure 1 below for an example). The volatility is lowest for at-the-money options where the strike price is the [...]

|

by David on (#6CQ7R)

This post answers some questions that typically come up when discussing the quantum approach to economics and finance. For a list of broad objections (and responses) to the use of quantum probability outside of physics, see the post Ten reasons to (not) bequantum. Why use quantum probability instead of classical probability? The main difference between [...]

|

by David on (#6CQ7S)

The neoclassical X-shaped supply and demand diagram is featured in every introductory textbook, is the basis for mathematical models of the economy, and has shaped our view of the economy for over a century, but as critics have pointed out many times it has a few basic problems (see Economyths for a summary). It assumes [...]

|

|

by David on (#6CQ7T)

We've seen how the quantum model of supply and demand can be used to model transactions and here we're going to look at how we can use it to simulate the stock market. With the quantum model supply and demand we have propensity functions for the buyer and the seller and the joint propensity function [...]

|

1