High Efficiency Real Estate Investing with PeerStreet

Some of the world's most expensive real estate, displayed oceanside a few blocks from Peerstreet HQ

This Mr. Money Mustache blog recently blew past its fifth birthday. In real life, things haven't changed all that much: I live just a couple of blocks from where I lived in 2011. We are still retired and yet busily employed raising one boy. Still have the same cars and the same level of annual spending.

But when looking back through the posts that relate to technology and personal finance, I'm surprised at how quickly things in the wider world have changed, as the explosion of these touchscreen computers we all carry in our pockets has opened up all sorts of new business opportunities. The world of software has grown and matured and polished itself massively, which means that things that used to be complex and specialized are now streamlined and used by millions.

Some of my favorite changes have been in the world of investing. Index funds and ETFs have become more popular and easier to invest in. High-fee, "I can beat the market" financial advisers and funds are losing popularity. And outside of this traditional world of stock investing, software has opened up many other ways to productively deploy your green paper employees.

Lending Club and Prosper have smashed up the traditional role of big banks and credit cards, and taken over the personal lending market. For over 3 years I've had $30,000 lent out to several thousand people via slightly risky personal loans, and you can watch the results in my Lending Club Experiment page.

But the latest and perhaps the most interesting change to me has been the opening up of the real estate market. Worldwide, real estate represents a breathtaking chunk of humanity's wealth: in the United States, the figure is about $25 trillion, which is about the same as the value of all of businesses of our stock market combined. Real estate has created many millionaires and billionaires (and also many bankruptcies for those less fortunate), but until recently it has been a localized, insider's game.

With the right skills and drive, you can master your local real estate market and build a very nice firehose of cash that will propel you to a prosperous early retirement*. But those of us without that particular personality trait, or those stuck in overpriced cities with terrible rent-to-price ratios, were left behind.

This opportunity has not gone unnoticed, and now there are companies springing up to make real estate investing easier as well. Companies like Fundrise, PeerStreet, Yieldstreet, Patch of Land, GroundFloor, RealtyShares, Money360, RealtyMogul, LendingHome, and any number of additional competitors have been popping up in the news (and in some cases sending me promotional emails) to compete for a share. And while I've been reading about them, I have found it difficult to separate the well-managed from the risky. Before writing about any investment for this blog, I need to learn enough to invest my own money first.

How Peer-to-Peer Real Estate Investing Works

Although real estate provides the sizzle of this new industry, it's a little different from buying an office building or becoming a landlord. As an investor, you're usually funding loans, which are then used to buy and improve real properties, and you get paid for doing so. But because you're not competing in the well-developed 30-year residential mortgage market, you can expect to collect annual interest in the 7-10% range, rather than the 3-4% that mortgage securities pay their owners. This is a newer market, which means more uncertainty and thus more risk. How could I dive into it responsibly, without just blindly throwing money at something I didn't fully understand?

How and Why I Chose PeerStreet

In a handy shortcut, I had been enjoying an extended email conversation since last year with a reader named Liz, who happens to be a San Diego commercial real estate banker in real life. She is highly technical and motivated and has been quietly excelling in that field since 1998. And as we talked through our financial and life strategies, she mentioned that she had started doing some investing with a company called PeerStreet.

Her justification for that choice was that the loans are structured in a safer and less speculative way. As an investor with this company, you are buying only first-lien positions in loans on conservatively valued properties, compared to other companies where you end up with "Equity" in larger deals. Equity is still a valid legal ownership, but the first lienholder is the first one to get paid back in the event of any trouble.

To illustrate the large difference between this type of lending versus unsecured consumer stuff like Lending club, I've had over $8,000 in loans go into default in my Lending Club experiment (and yet it's still profitable because the interest rates are high enough to overcome the defaults). Meanwhile, PeerStreet has not seen a single loan default - zero - since its founding in 2013. The net return to investors is similar, but based on a much more stable pool of money.

After learning a bit about the industry from my friend Liz, I decided to just open a test account with PeerStreet and poke around.

The Deceptively High-Tech Founders

Former Googler Brett Crosby schools us on Peerstreet technology in their meeting room.

No sooner did I create the account than I got an email from co-founder Brett Crosby, who was already familiar with the MMM blog due to a motivated brother (also a tech entrepreneur and bike enthusiast) who keeps sending him articles. With this second conversation started, I figured I had a great insider shortcut to help me learn much more. From various conversations, news stories and a Lend Academy podcast interview with the other founder Brew Johnson, I came away impressed. This is not just a bubble-economy financial firm run by well-connected Wallstreet MBAs. Brett is a software entrepreneur who created an outrageously advanced web analytics system called Urchin which was bought by Google and is now known as Google Analytics. Then he spent the next ten years in Google working on Gmail, Chrome, Docs and Drive. I use every one of these products daily.

Brew Johnson simulates a moment of calm on the Manhattan Beach pier, just a block down the street from headquarters (this image from their website).

Brew Johnson trained and practiced as a real estate attorney, but discovered an entrepreneurial bent and could not help but see market opportunities in his antiquated field. But he's really less of a lawyer and more of a complete Business and Finance Savant. During an extended late-night conversation with him I was charged up by a fantastic and deeply technical analysis of the US finance and debt system that ran at the speed of thought. There are very few people who can talk about this field with both passion and Spock-like logic at the same time. His technical justification for teaming up with Brett to start PeerStreet is simply "We just kept seeing this mis-priced risk, and had to do something about it."

The PeerStreet Experiment

In the end, I decided that this was worth an Official Experiment, so I planned a roadtrip with some interested friends (including Liz the commercial banker) to visit their office in Los Angeles. I also funded my account with $10,000 and made plans to put it to work during this in-person meeting.

A portion of the PeerStreet team poses on our meeting day, with Mustaches they had provided for the event (they must have figured out that I hate serious pictures).

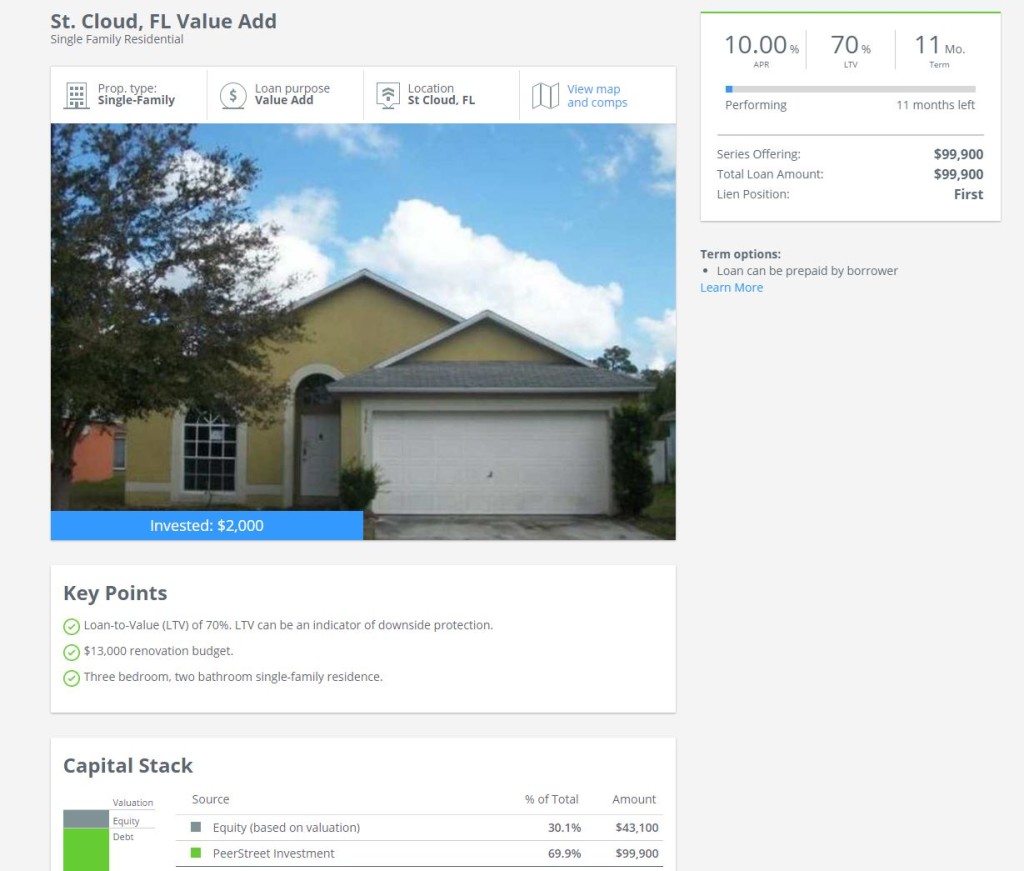

After a great string of interesting conversations and meeting many of the people who develop the PeerStreet system, I set my account to "automated investing" mode to catch a fresh batch of new investments as they came out on that Friday morning. I had configured my account to invest in $2,000 chunks, into deals that that were on the high side of their conservative risk-return spectrum. I ended up with shares of five properties, similar to this one:

The short story is that I'll be collecting interest on this loan at a rate of 10%, until 11 months from now when the loan is suddenly repaid in a balloon payment.

In more detail, what happened is that some time ago, a local real estate fix-and-flip specialist in Florida probably spotted this house for sale at a huge discount. Maybe it was a foreclosure, or storm damage, or some sort of auction for another reason. As an experienced project managing investor, this person needs quick, reasonably priced loans to allow them to buy quickly, deploy a work crew for renovations, and then put the house back onto the market at a higher value. The house fixer turns to a bridge lender (also known as "hard money lender") for this type of loan.

Bridge lenders specialize in understanding which fix-and-flip specialists will actually make money, because this is how everyone stays in business. They fund the loans in exchange for a slice of legal ownership (a lien) on the house. But to grow their business more quickly, they can bring in money from other investors who are willing to buy a portion of these loans in exchange for some of the earnings. It is this role that PeerStreet (and by extension me, as a customer) plays.

There's a lot under the hood at PeerStreet - there is automated statistical data analysis, but also real estate and loan experts on their staff who must do some manual verification and independent appraisals before these loans flow into the system. I'm glad I don't have to do that job myself, but as an investor the experience is quite pleasant.

So Then What Happens?

The idea is, I put in some money and let it grow via these interest payments. As the interest rolls in and loans are repaid, I can choose new projects to fund, or have PeerStreet automatically deploy it for me. Or I can have the interest payments sent to me as a source of retirement income. It compounds over time, and we all get to decide if the investment is a worthwhile competitor to, say, a Real Estate Investment Trust, or stock investing via index funds. If anything unexpected happens, I'll be sure to document that as well.

How to Keep Track of my Investment

I've created a new page called The PeerStreet Experiment, which joins similar ongoing investments I have going with Lending Club and Betterment. I'll keep this up to date on a monthly basis, and it should become more interesting as time goes on and we hear from other fellow investors.

How To Invest Yourself

Like many peer-to-peer platforms, PeerStreet is bound by the rules of Securities and Exchange Commission which insist that only "Accredited Investors" (over $200k of income or $1M net worth) can invest - for now, at least. If you fit into this category, you can simply visit PeerStreet.com and create an account. Read everything on their frequently asked questions page to get the full technical and security background.

And if you still have more questions, type them up in the comments section below and we can invite the relevant people from Peerstreet itself to join in and answer.

Note: I have no affiliation with PeerStreet and so will not benefit financially if you happen to invest with them. As with all posts, this one was done only because I found the company interesting. If they did have an affiliate program I would probably join it (see the blog's Affiliate policy), but in this case they do not.

Further Reading: Lend Academy maintains an enthusiastic and technical coverage of the peer-to-peer lending arena.

*(or in the case of non-MMM readers, a life of ever-increasing consumption where you feel you've made it but just need to push through those last five years until you really have enough).