Is There a Market for Small Modular Reactors?

The nuclear industry has been expecting big things from small modular reactors (SMRs) for a long time, but to date, no SMRs have reached commercial construction phase. That may change soon. Utah Associated Municipal Power Systems has a plan to deploy NuScale Power's Integral Pressurized Water Reactor at a site in Idaho. Will others follow suit?

There are currently 64 nuclear reactors under construction around the world, according to the International Atomic Energy Agency. Most are large units with capacities greater than 1,000 MW, such as Westinghouse's AP1000 (1,110 MW), KEPCO's APR1400 (1,400 MW), and AREVA's EPR (1,600 MW) designs.

Conventional wisdom suggests that bigger is better; any economist can tell you about the benefits of economies of scale. It's not particularly surprising that factories realize cost advantages with increased size, output, or scale of operation. As fixed costs are averaged out over greater units of output, the cost per unit decreases. Operational efficiencies can also be achieved in many cases, which lead to lower variable costs per unit as well.

The Nuclear Scaling EffectBut does conventional wisdom apply to nuclear power? Tony Roulstone, a nuclear energy consultant and director of UK-based Bracchium Ltd., doesn't think so. Roulstone, speaking at the International SMR and Advanced Reactor Summit in Atlanta, Ga., in mid-April (POWER was a media partner for the Nuclear Energy Insider -hosted event), said that when you actually look at the data from large reactors, the scaling factors just don't work out.

"If you have a scaling factor of 0.6, if you have a 1% increase in scale, you would expect 0.65% fall in the unit costs. But in fact, what you find is the 1% increase in size also has an increase in build schedule and costs associated with that of 0.78%, and you net the two off and you find, instead of getting falling costs as the size goes up, you get an increase in costs of 0.13%," Roulstone said, citing a study conducted by R. Cantor and J. Hewlett.

In other words, the scaling method that is the norm in the nuclear industry-the driver behind the trend toward larger and larger reactor designs-is flawed. The truth is, as you get bigger reactors, they're more complex, they take longer to build, and the benefits of scaling are defeated.

"When you have a complex site-most of the cost for nuclear reactors is site work-it doesn't work," said Roulstone. "The scaling does apply for factory-designed products, but there's no scaling effect for site space work."

Smaller = FasterTime is not on your side when you're building a nuclear power plant. The longer a plant takes to build, the more it costs, and the longer owners have to pay interest on the money before the facility starts producing power. In the case of large nuclear construction projects, a history of drawn-out schedules and incessant delays are two of the biggest factors that keep ground from being broken on new plants.

"Clients really like short schedules," Roulstone said. "They like a short construction period because they get to revenue more quickly. If you can get to revenue in three years, that's great. You don't want 10 and 12 years."

And that's where the small modular reactor (SMR) comes into play. There are several designs in various states of development (see "Small Modular Reactors Speaking in Foreign Tongues" in the January 2015 issue), but the one that seems to be making the most progress in the U.S. is NuScale Power's Integral Pressurized Water Reactor (IPWR, see "NuScale Puts Single-Minded Focus on Small Modular Reactor" in the October 2013 issue).

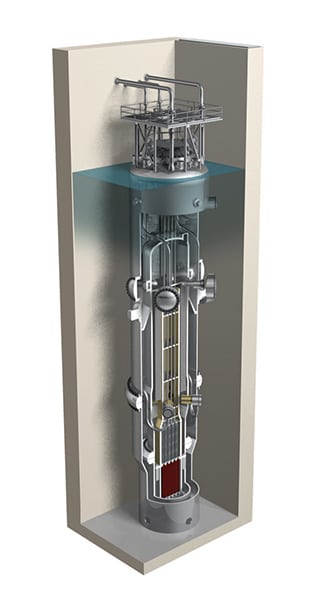

NuScale, majority-owned by Fluor Corp., estimates that a plant designed with 12 of its modules (Figure 1)-a 600-MW facility-could be constructed from mobilization to mechanical completion in 51 months. Completion of discrete module systems is said to allow earlier electricity generation, as the first modules to be constructed can begin operating while later modules are still being installed. Factory manufacturing and modularization reduces onsite construction time, financial risk, and financing costs, according to the company.

"There's much greater certainty about the schedule if it's short," Roulstone said, speaking about SMRs in general. "It's much more controllable". Short schedules are important," he said.

Taking a Seat at the Nuclear TableTeaming with NuScale, on what could become the first deployment of its SMR technology, are Utah Associated Municipal Power Systems (UAMPS) and Energy Northwest. UAMPS is a political subdivision of the state of Utah that provides comprehensive wholesale electricity, on a nonprofit basis, to its members located throughout the Intermountain West. Its membership includes 45 community-owned power systems in Arizona, California, Idaho, Nevada, New Mexico, Oregon, Utah, and Wyoming.

As it stands now, UAMPS's generation portfolio is largely fossil-based. It includes portions of Hunter Station Unit 2, San Juan Station Unit 4, and Intermountain Power Project-all coal-fired plants-as well as the natural gas-fired Nebo Power Station, a combined cycle plant. UAMPS has other projects, such as a 57.6-MW wind farm near Idaho Falls that it developed, constructed, and later sold to a private investor after entering into a power purchase agreement for the entire output, but its pursuit of an SMR facility-its "Carbon Free Power Project"-is the boldest undertaking in its 36-year history.

So what led a relatively small, wholesale power provider that supplies a group of municipalities to toss its hat into the nuclear ring while other supposedly savvy companies have been content to sit on the sidelines? Is this the result of naiveti(C) or inspired vision? Should other companies (see sidebar) be considering the SMR option?

Eric Larsen, UAMPS board member from Fillmore City, Utah, provided an overview of the project review process in a UAMPS-produced video. He said, "New projects are brought to the UAMPS board. Presentations are made. The staff does investigations that help us to understand what the project is all about. A complete rundown of every aspect of the project is brought out. If it looks like it's going to be a good project, we will invest more energy, more time, get more staff involvement. Sometimes the board gets involved in helping us to make decisions about new projects, whether or not they will work well for some or even all the members. As new projects are looked at, not all members will become involved because of the diversity of the board."

According to UAMPS's 2015 Annual Report, 32 of its 45 members had signed onto the Carbon Free Power Project. However, its two largest members-Lower Valley Energy (with roughly 27,500 customers and about 210 MW of peak demand) and City of St. George (with roughly 28,700 customers and about 188 MW of peak demand)-had not elected to participate. Regardless of that fact, UAMPS believes its coal plants may have to be replaced with carbon-free generation within the next 10 years, and it sees SMR technology as the safe, stable, long-term solution.

For its part in the venture, Energy Northwest holds first right of offer to operate the project (Figure 3). The company operates the 1,190-MW Columbia nuclear plant located north of Richland, Wash., and welcomes the opportunity to operate the first SMR plant in the U.S.

|

3. NuScale control room simulator. With a 12-module facility, the NuScale design includes 12 identical operating and monitoring stations in a single power plant control room, like the simulator shown here in Corvallis, Ore., which has been operational since May 2012. Courtesy: NuScale Power |

NuScale claims that its IPWR safely shuts down and self-cools indefinitely with no operator action, no electrical power, and no additional water. The plant's containment vessel is submerged in an ultimate heat sink for core cooling in a below-grade reactor pool structure, housed in a Seismic Category 1 reactor building (Figure 4).

|

4. An integral package. Each NuScale power module is installed below-grade in a seismically robust, steel-lined, concrete pool. Courtesy: NuScale Power |

"Safety was a huge selling point for us," Doug Hunter, CEO of UAMPS, said during the Atlanta event.

With no reactor coolant pumps (the nuclear steam supply system is designed to operate at full power using natural circulation due to density differences for core coolant flow), a small nuclear fuel inventory (roughly 5% of the fuel contained in a 1,000-MW reactor), and integrated reactor, steam generators, and pressurizer (eliminating large primary piping), there is less to go wrong than in a large conventional PWR. NuScale's design only requires a handful of safety valves to be opened in the event of an accident to actuate the emergency core cooling system. The safety valves are designed to fail in their safe condition, that is, following a loss power, they mechanically realign to their required emergency position.

"The other thing is they're scalable," said Hunter. "We're a municipality. UAMPS as a whole, we're about 1,500 MW of load, but I have some members that are a megawatt of load."

Hunter said that having a dozen 50-MW reactors, deployable as needed, would allow UAMPS to dice up the output into small pieces and sell it to a variety of very small utilities. He sees that as a big advantage. He also said that funding an SMR project is not as difficult as one might think. In fact, according to Hunter, it is much easier than building a new coal-fired power plant. UAMPS has signed an agreement with Bank of America Merrill Lynch and is also working with two other large national banks to line up financing.

Looking ForwardIn February, UAMPS and the Department of Energy (DOE) entered into a use agreement that allows UAMPS to explore certain locations for plant development on the Idaho National Laboratory (INL) site near Idaho Falls. UAMPS's compliance strategy for meeting National Environmental Policy Act requirements is to have the DOE conditionally agree to future actions pending the Nuclear Regulatory Commission (NRC) completing its permitting process.

There are essentially three areas being considered on the INL site, but the ultimate spot (Figure 5) won't be designated until after the NRC completes the combined license application (COLA) approval process. UAMPS has a cost-sharing cooperative agreement with the DOE through NuScale to help pay for the COLA development.

|

5. A petite footprint. The 600-MW NuScale design only requires 34.5 acres to accommodate the fenced-in protected area. Courtesy: NuScale Power |

A look at UAMPS's preliminary schedule shows a lot of work needs to be done before the first SMR begins commercial operation. Among the 2016 milestones are selecting the site, finalizing the plant design, and submitting a design certification application to the NRC.

UAMPS expects to submit its COLA in 2018. The following year, site mobilization and preparation are scheduled to begin, and UAMPS expects to place an order for the modules. Assuming the NRC issues the COL on schedule in 2021, the first safety concrete pour is slated to take place that year. Ultimately, if all goes as planned, the first module could enter commercial operation by the middle of 2024. a-

-Aaron Larson is a POWER associate editor.

The post Is There a Market for Small Modular Reactors? appeared first on POWER Magazine.