FirstEnergy Looks to Exit Competitive Business, Shutter or Sell Ohio Nuclear Plants

Financially hemorrhaging in 2016 due to uneconomic power plants in its fleet, FirstEnergy Corp. said it may exit the competitive generation business by mid-2018, and shutter its nuclear plants in Ohio, even though it will back legislation to subsidize nuclear power.

In a fourth quarter earnings call on February 22, officials from the Akron, Ohio-based company said that while operating earnings in its competitive business were "slightly better" than expected, commodity margins decreased, owing to lower capacity revenues related to the capacity prices that went into effect last June, as well as a general lower contract sales volume.

FirstEnergy reported a full-year GAAP (generally accepted accounting principles) loss of $6.2 billion. The company's customer count for its competitive business shrank from 1.6 million to 1.1 million in 2016, it noted.

The company also announced that a strategic review launched in November 2016 to move some competitive assets to more regulated or regulated-like constructs, or selling and deactivating units, is "on track."

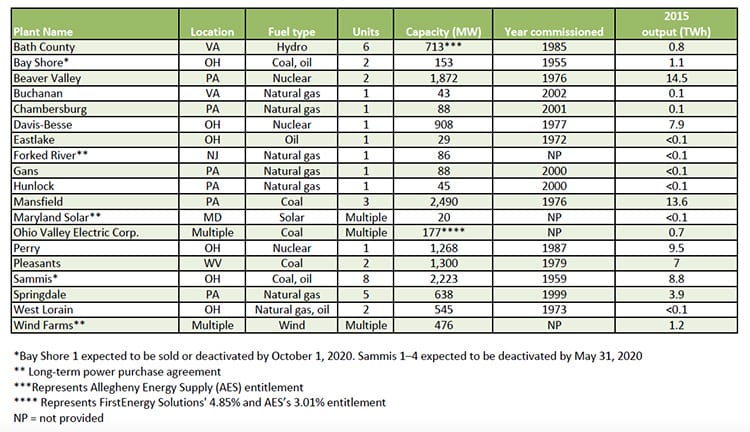

As a first step to becoming a fully regulated utility, the company in January announced an agreement to sell units totaling a combined 1,572 MW for $925 million in an all-cash deal with LS Power. The deal includes the 628-MW Springdale, 88-MW Chambersburg, 88-MW Gans, and 44-MW Hunlock gas-fired units in Pennsylvania, as well as the competitive portion of its 1,212-MW Bath hydro unit in Virginia. All units are owned by FirstEnergy subsidiary Allegheny Energy Supply (Table 1).

Table 1. FirstEnergy's Competitive Energy Services segment generation portfolio. Source: FirstEnergy Corp.

In the earnings call, FirstEnergy President and CEO Chuck Jones said that the company is also exploring the sale of its 545-MW gas-fired West Lorain plant in Ohio and the 88-MW gas-fired Buchanan facility in Ohio.

Nuclear Subsidies or Bust

Jones also said that the company has engaged in "meaningful dialog" with utilities operating in Ohio as well as with legislators "on solutions that can help ensure Ohio's future energy security."

The company's top priority, he said, "is the preservation of our two nuclear plants in the state, and legislation for zero-emission nuclear [ZEN] program is expected to be introduced soon." FirstEnergy will pursue environmental credits and push for the continued operation of the 908-MW Davis-Besse nuclear plant in Oak Harbor, Ohio, and the 1.3-GW Perry nuclear plant in Perry, Ohio, through the ZEN program, he said.

The ZEN program, Jones added, "would preserve not only zero-emission assets, but jobs, economic growth, fuel diversity, price stability, and reliability and grid security for the region."

However, he stressed: "We are advocating for Ohio's support for its two nuclear plants, even though the likely outcome is that FirstEnergy won't be the long-term owner of these assets."

Jones noted that a significant amount of capital risk is associated with running nuclear units. "I'm not sure people are going to be willing to take on the risk of even the next refueling outage, which is very expensive. So, I don't think there's any guarantee, absent some other support for these units, that they're going to keep running far into the future."

FirstEnergy estimates its nuclear assets, including nuclear fuel are valued at around $1.5 billion. "The debt is significantly higher than that," said Jones.

"Absent something to raise the value of these units and make them attractive to a buyer, there's only one way for us to exit this business."

Pushing Through Financial Hurdles

As part of its strategic review to exit the competitive business, FirstEnergy Corp. is also exploring the possibility of engaging creditors to restructure debt at FirstEnergy Solutions (FES), a 1997-formed subsidiary serving residential, commercial, and industrial customers in Ohio, Pennsylvania, and New Jersey, Jones said. Another subsidiary, FirstEnergy Nuclear Operating Co. (FENOC), which operates the company's three nuclear plants, could also see similar measures taken.

"[As] we discussed, there remains the possibility that FES and potentially FENOC may seek bankruptcy protection, although no such decision has been made," Jones said.

He added that the decision to enter bankruptcy won't likely hinge on passage of the ZEN legislation and will ultimately be made by the FES board. "I think, though, it's very unlikely," he said.

"Again, we have much to be proud of in 2016 from solid operating results to our operating performance, and the progress we are making towards our goals," Jones said. "In 2017, we'll remain fully focused on positioning the company for stable, predictable and customer service-oriented growth that will benefit customers, employees and shareholders."

-Sonal Patel, associate editor (@POWERmagazine, @sonalcpatel)

The post FirstEnergy Looks to Exit Competitive Business, Shutter or Sell Ohio Nuclear Plants appeared first on POWER Magazine.