Mr. Frugal Toque on Mortgage Freedom

Foreword from Mustache:

Almost exactly one year ago, our Canadian correspondent Mr. Frugal Toque and his family reached a nice milestone: a mortgage balance of Zero. Although early retirement and financial independence do not strictly require you to pay off your mortgage (or to own a house at all) as long as you have other investments to cover your housing outflows, for many of us there is an irrational and long-lasting glee that comes from owning the place in which you live.

From a rational perspective, sure, stocks and other investments will tend to return more than the 4% you'll save on mortgage interest. But the mortgage "return" is guaranteed, and fully non-correlated to the stock market. Plus your home will always be yours regardless of what shenanigans the financial system might pull.

Whatever the reason, mortgage freedom tends to deliver long-lasting happiness to many of those who buy it, which makes it one of the better ways to spend money in my book.

Mr. Toque wrote the story below right after he first killed the thing, then added an afterword to explain how he felt one year later. Finally I have found the right time to publish it. Enjoy!

--

Mortgage Freeedom

I should say that first because, of all the privileges I've had in my life, developing a hatred of owing someone money has been one of the most profitable. Every time in my life that I've ever borrowed so much as a loonie[1], there's been a flashing red sign over my head: "NEGATIVE $1"^3. Once I forgot to pay back a guy ten bucks I owed him and he had to remind me. I am ashamed to this day.

This has given me an edge in life that I can't overstate. The idea of running a balance on a credit card is so alien to me that I can't believe anyone does it, never mind the breathtaking number of people who are comfortable with it.

On the subject of a mortgage, however, I ascribed to the wisdom of the times. Given the size of house Mrs. Toque and I had decided was appropriate, it made more sense to get in on a fairly cheap market (Ottawa in 2002) rather than rent while gaining no equity. With our down payment, we took out a mortgage for approximately $260 000. For the first couple of years, when we were financially flopping around like fish out of water, we didn't even pay attention to our mortgage.

"Strange," we seem to have been thinking. "In this one hand I have extra money. In this other hand I have a mortgage. I suppose we should buy a big television."

Yeah, we really did stuff like that. Not only is it a sad story, it's also the tragic plot followed by the vast majority of house-"owning" humans in North America.

"Well, you see," common thinking goes, "I've got a 25 year mortgage. Can't do anything about that. I guess this extra money in my bank account should be turned into a boat, some leather clothing and a heated, indoor swimming pool."

Then, about two years ago, when Mustachianism had already started chipping away at our habits, I got laid off. You can read about that in detail, but the relevant bit is that Mrs. Toque and I enjoyed my period of unemployment so much that we became determined to make it a permanent thing.

The first obstacle on that road, from our perspective, was to kill off the mortgage. Neither of us could rest easy knowing that a monthly payment so large would be hovering over our heads. So we looked at our budget. It turns out we live on about $2300, eating fancy seafood and enjoying our family martial arts workouts. Our mortgage, as well, was set at $2k per month. Without going into super personal detail, let's say my salary is quite a bit more than $51k.

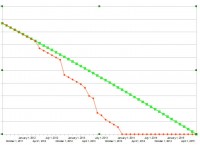

So I went into Kung Fu spreadsheet mode and my predictions looked something like what you see below. The green line is how long it could have taken us. The red line was another, more serious route. I turned to Mrs. Toque to say:

How it could have gone vs. how it really went

"Honey? We can beat this fucking thing into the dirt by the end of next year."

"Really?" she asked.

I waved my hand at the undeniable, mathematical facts displayed on the screen. A tingly, Han-Solo-saves-the-day, euphoria rushed over us both.

"Hell. We're that close?" she said. "Let's do it."

What ensued was a laser like focus that would have made Mr. Mister proud. Oil changes became things done in our own garage. The barely used motorcycle was sold. While I toiled at the 9-5, Mrs. Toque engaged in a culinary conquest that involved making large batches of chilis, sauces and curry dishes and freezing them in yogurt containers. Our house was scoured and cleansed of numerous Products and Outgrown Clothing in exchange for hundreds of dollars through various Internet intermediaries. Every bonus or raise was purposely channeled toward this one goal.

Video game purchases were put off, allocated as exceptional acquisitions belonging to special occasions like Christmas and birthdays. We cut out restaurants in similar ways, doggedly keeping to our $2k budget.

There have been a few times in my life where I have felt something seize hold of me like this: a karate tournament when I was young; the desire to run 10k in under 50 minutes in more recent times.

This was something more intellectually powerful and more enduring than any of those previous desires and it drove the two of us for just about a year and a half.

On January 1, 2014, the Toque family made its final mortgage payment.

My grandmother and her sisters could have drunk you under the table.

As promised, a bottle of whiskey was purchased. You can't really do anything impressive in my family without shots of Crown being involved, and this goes for births, deaths, weddings, birthdays, religious holidays and the stomping into cinders of a mortgage.

And though the shots were hammered back to mark the occasion, the gravity of the situation didn't pull us in right away.

Mortgage freedom, like any other widening of the straits through which we guide our white-water kayaks, takes a while to register. There's this uncomfortable lack of turbulence and drama that makes you think something is about to go wrong.

As February came around, the instinct to "check the bank account" still nagged at me. By March, money was just sitting there, comfortably reassuring us of the reality of our financial situation. I scratched my head in dismay. We're in June now and it's really dawned on us that our monetary burn rate has dropped by half.

Yes, it's exactly like this.

I wake up every morning and I can take a deep, relaxing breath knowing that I don't owe anybody anything. I ease into my morning cup of tea as if I were Patrick Stewart lounging in the ready room. Every paycheque that comes in? That's ours.

The danger now, as with any reduction in stress in our lives, is that we let the new width and relative calmness of the river we fare allow our paddle strokes to become sloppy. This is not the time, in the first months of our mortgage freedom, to start piling up the Lego sets, golden-handled frying pans and $500 bicycles that the 8 year old will outgrow by next summer.

We need only remind ourselves that expensive items, and even expensive experiences, will not make us happier.

As per the advice of the Mustachian horde, we cranked open a Questrade account and started dumping that money into Vanguard ETFs via RRSPs, but we can only do that for so long. The key to our existence now, as we run the last leg of the race to early retirement, is not to let money sit around idly, tempting us with its purchasing power, but to get it stashed away as quickly as possible. Online brokerages make that bit pretty easy: you can deposit money directly from your bank account into RRSP or TFSA accounts (The Canadian equivalent of Roth thingies and 401 what's-its-nuts.)

But that's only the technical side of things.

The heart of the matter is something else entirely. It's looking at the debts side of the spreadsheet and seeing nothing there. It's also a clear, wide open path from this point to the spot on our life journey where neither of us is ever again obliged to work in order to have the necessities of life.

Early retirement wasn't an entirely real thing, at least in my mind, despite having seen that the Mustache family had clearly achieved it. Making our mortgage a thing of the past, however, emotionally solidified the mathematics. The equations and the spreadsheets, like the one you see above, aren't nearly as tangible until you actually see the descending line hit the x-axis. Then, very slowly, you realize that the math was a map of the world as it actually exists. There actually is money piling up in the bank account.

And if the road to mortgage freedom is real, then the road to early retirement is real, too.

Update: January 2015

This article was written some time ago, as the feeling of being mortgage free was just starting to sink into the Toque family. Our primary worry, naturally, was that we might be tempted by all this money floating around into becoming the sort of Consumer Suckas that we detest.

I'm glad to report, on further examination, that no such thing has happened. Our monthly expenses did rise, from $2391/month to $2416/month, which is actually less than inflation. So being mortgage free came without any statistically significant change in our spending habits.

Separately, what have we done with the money? Exactly what we said we'd do: it's all gone to fill up our RRSPs and TFSAs, which still had room from previous years. As I discussed in a previous article, my priorities were: RRSP, Mortgage, TFSA, due to my own hatred of debt. So once the RRSPs are full up for the year, I dump everything into TFSAs. Sadly, I'm going to run out of TFSA room sometime in the next year or so, necessitating further investigation into "Dividend Mutual Funds" and the magic I can work with them.

[1] - no seriously, that's what we call a dollar in Canada.

It is now easy to find everything from Mr. Frugal Toque on this blog since he has his very own category.