Despite New Jersey Senate Vote on Nuclear Subsidies, Bill May Not Clear Lame-Duck Session

New Jersey's full Senate is scheduled on January 4 to vote on a bill to subsidize two of the state's nuclear power plants. However, industry observers posit that the measure won't clear the full Assembly before the state legislature's lame-duck session ends on January 9.

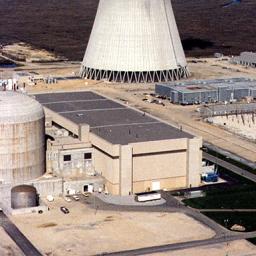

S.3560 was introduced on December 14 after a preliminary hearing earlier that month in which Public Service Enterprise Group (PSEG) warned that if market pricing didn't change, the company could be forced to shutter its 2.3-GW Salem and 1.2-GW Hope Creek nuclear generating stations within the next two years.

Ralph Izzo, chairman, president, and CEO of Newark-headquartered PSEG told lawmakers that the two plants are currently "in the black" bolstered by contracts at above-market prices. However, he said, running the two plants required $1 billion per year. "So if our nuclear plants are failing to cover their costs-which is the forecast trajectory as our hedge contracts roll off-and I am forced to make the decision to shut them down, it will not be a difficult decision from a business perspective," he said.

The bill, which directs the Board of Public Utilities to issue Nuclear Diversity Certificates (NDCs) to selected nuclear power plants, barreled through review at the state Senate Environment and Energy Committee and the Assembly Telecommunications and Utilities Committee, and the joint committee unanimously voted to advance the bill on December 20.

But while the Senate is scheduled to vote on S.3560 today, Assembly Speaker Vincent Prieto (D-Secaucus), has hesitated posting the bill for a vote in the lower house, according to NJSpotlight.com, a decision reportedly reached after a meeting with Gov.-elect Phil Murphy.

For PSEG, the bill's demise doesn't mean the fight is over. "The fate of New Jersey's nuclear generation is an urgent concern," company spokesperson Michael Jennings told POWER on January 4.

"PSEG will continue to educate New Jersey's legislators and policymakers on the economic threat facing the nuclear plants that serve our state-and the risk of increased air pollution, reduced resiliency, lost jobs and higher energy bills. These risks warrant greater attention, as well as action that extends beyond the boundaries of any legislative calendar." Jennings added that the challenges facing nuclear power have been the focus of PSEG's educational efforts for more than 18 months, and that the company is confident nuclear's role won't be overlooked. "We applaud the leadership of our State's policy makers in considering this important issue," he said.

Opposition in High GearOpponents of the bill, which include a number of independent power producers-who are legally challenging nuclear subsidies implemented in New York and Illinois-and consumer advocate and environmentalist groups, have expressed concerns about how quickly the bill has powered through the legislative process.

The "New Jersey Coalition for Fair Energy"-comprising Calpine, Dynegy, NRG Energy, and the Electric Power Supply Association-on January 3, meanwhile, circulated an economic analysis performed by energy think tank Energyzt that concludes the Hope Creek and Salem plants "have been incredibly profitable" since they came online in the 1970s. The plants continue to be profitable owing to PSEG and Exelon's hedging programs that locked in prices of more than $40/MWh versus cost requirements (including a reasonable return on investment) of between $30 and $35/MWh, it claims.

Over the mid- and long-term, a number of market changes could ensure higher revenues, including New Jersey's participation in the Regional Greenhouse Gas Initiative, the Department of Energy's proposed rule to reward resiliency by nuclear and coal power units, and PJM's proposals to revise pricing formation rules. "Market changes will only bolster profitability," the report suggests. "No legislative action is required at this time to support the New Jersey nuclear units."

"This study clearly shows that PSEG's money grab is not warranted, and certainly not at this time," said David Gaier, a spokesperson with NRG Energy. "There's no persuasive evidence that PSEG's nuclear plants are actually in jeopardy, and New Jersey ratepayers can't afford these increases."

According PSEG's Jennings, however, the report "conveniently ignores the issue at hand and focuses on what happened in the past or may happen in the future. It actually, in a brief discussion, confirms the bleak outlook for the plants. And then suggests no action is needed because of potential policies changes. We have been discussing this issue for years during which time many proposals have been offered, but none implemented," Jennings added. "The bill anticipates those proposals may be implemented and [ any] support provided through the bill would be reduced if additional support is received through those programs."

Jennings told POWER that PSEG has been upfront about the plants' profitability. "But that is changing," he noted. "The plants are breaking even now because of cost cutting and hedging-contracts to sell some of the plants' output that were entered into in prior years at prices that are above the current market prices. As those contracts expire, some already have, they will be replaced with ones reflecting current prices, which are below our costs. Then we will be facing a financial cliff and have to make a decision about the plants' future. Maintaining the plants requires a $100 million to $200 million annual investment. No company would commit to invest hundreds of millions in a business that is expected to lose money."

The report also misses another key point, according to Jennings: "The plants won't receive any support through this bill until we demonstrate there is a financial need. If there is no need, there is no support. If the need is reduced or goes away, the support is reduced or goes away."

Developments ElsewhereNew Jersey's attempt to subsidize PSEG's nuclear plants are being closely watched as measures in a handful of other states develop. As nuclear subsidies in Illinois and New York are being challenged in federal court, state efforts are also taking shape in Connecticut, Ohio, and Pennsylvania. The Federal Energy Regulatory Commission is meanwhile required to act on the controversial federal notice of proposed rulemaking by January 10.

Connecticut's Department of Energy and Environmental Protection and its Public Utilities Regulatory Authority are preparing to release a final report concerning the current and final viability of continued operation of Dominion Energy's Millstone nuclear plant on February 1. The agencies in December published a state-commissioned evaluation, prepared by Boston-based energy management consulting firm Levitan & Associates, that concludes the plant is likely to operate profitably from the early 2020s to the mid-2030s, even under lower-than-anticipated natural gas prices.

Gov. Dannell Malloy in November signed a bill allowing Millstone-the state's only nuclear power plant, and a facility that generates about 45% of the state's power-to enter into a competitive procurement process with other zero-carbon energy sources.

Dominion told POWER on January 4 that it provided DEEP and PURA "actual confidential financial information about Millstone's costs and revenues" in November, adding that the company is committed to working with the agencies so that Millstone-specific information is included in the final report.

The company noted, however, that while the report lays out the consequences Connecticut faces without the nuclear plant, it "misses the mark" on Millstone's costs and revenues. "However, DEEP and PURA readily acknowledged that error resulted from time constraints. The report is based on industry assumptions premised on a comparison with nuclear plants very much unlike Millstone in terms of design, operating expenses and the local cost environment. It is like deciding what to wear today in Hartford based on the weather forecast for Atlanta."

-Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)

The post Despite New Jersey Senate Vote on Nuclear Subsidies, Bill May Not Clear Lame-Duck Session appeared first on POWER Magazine.