Floating Solar Panel Industry Makes a Splash

Floating solar panel technology has been gaining traction as a favorable and cost-effective alternative to land-based photovoltaic systems. Thriving on the cusp of a massive inclination toward renewable energy adoption, the floating solar panel market stands as one of the highest-potential verticals in the go-green landscape.

The rather stringent regulatory framework advocating mitigation of greenhouse gas (GHG) emissions in tandem with rigorous initiatives for clean power generation have made the photovoltaic (PV) solar panel sector a lucrative investment spot for renewable industry players. The worldwide investment in renewables capacity increased from more than 127 GW in 2015 to a record high of 138 GW in 2016. For the record, hydropower constitutes 53% of the global renewable energy, while wind and solar power account for 24% and 18%, respectively. Though in third place, solar energy has been touted as the fastest-growing source of new energy globally by the International Energy Agency.

In 2016, for the first time ever, more solar capacity (about 75 GW) was reportedly added than any other renewable energy source, including wind, biomass and waste, hydro, and geothermal. A key reason for the increased rate of installations is the sharp decline in installation costs of solar PV and floating panels, which are transforming energy management and land utilization. Moreover, floating solar panel technology has been gaining traction as one of the favorable and cost-effective alternatives to land-based PV systems.

As more and more countries gradually recognize the effective utilization of waterbodies over land space, the floating solar panel market is expected to gain a further edge across myriad geographies. Enumerated in this article are some of the crucial recent developments, along with a review of the regional landscape for the floating solar panel industry.

Asia Pacific Leads the Floating Solar Panel MarketAccording to a report compiled by the International Renewable Energy Agency, Asia accounted for more than two-thirds of the worldwide increase in renewable energy generating capacity in 2017. The growing adoption of clean electricity generation and unavailability of land have been identified as the most-prominent factors impelling the implementation of floating solar panel technology in the region.

With anticipation of economic progression in Asian economies, the region is projected to witness tremendous renewable energy demand in the ensuing timeframe. Furthermore, the commitment of both private and government entities toward developing sustainable infrastructure will have a perpetual impact on the regional trends. For Asia as a whole, renewable energy capacity has almost doubled over the last five years, accounting for 918 GW in 2017. China, Japan, and India were among the top-most contributors to this increase.

China. The government of China has been making herculean efforts to uplift the country's renewable sector to address the nation's insatiable demand for electricity. The rising quest to lower environmental concerns has indeed translated China's renewable energy sector into a lucrative business sphere underlined with a plethora of investments. The country is putting considerable efforts into reducing its reliance on fossil fuels as well as tackling the exponentially rising air pollution in the country-making it one of the most viable grounds for the clean energy revolution.

The region has proclaimed to install a record number of solar power projects in the coming years, on grounds of being one of the world's major carbon emitters. In 2016, the government of China in its 13th Five-Year Plan announced its target to reduce the existing GHG emissions level by 18% by 2020. Amid this backdrop, the region is poised to witness huge investments in deploying large-scale PV projects-a factor further fortifying global floating solar panel industry players to ramp up their investment and production strategies.

Presently, China not only stands as the biggest solar market across the globe, after adding nearly 34 GW of power in 2016-twice the amount added in the U.S.-but it has also cemented its position as a world leader in renewable energy by building the largest floating solar farm located in Huainan, Anhui. The 40-MW power plant comprises 120,000 solar panels. The region is also home to Longyangxia Dam Solar Park, the currently leading solar power plant and a previous POWER Top Plant awardee (see "China's Renewables Strategy Shines in Massive Solar Park" in the December 2017 issue).

With growing investments along the lines of such large-scale projects, it wouldn't be wrong to say that China will be depending largely for its renewable energy and GHG emissions targets on the floating solar power plant. Endorsed with a relatively powerful pipeline with regard to solar energy deployment, China's floating solar panel market is estimated to witness a phenomenal growth rate of more than 30% from 2016 to 2024.

India. In recent years, India's floating solar panel industry growth potential has been commendably high, primarily ruled by favorable regulatory framework. The government of India has set a target of increasing solar power capacity from a mere 5 GW in 2015 to 100 GW by 2022. It has been reported that the country's solar energy capacity has approximately doubled that recorded in 2016 to 19 GW. If reports are to be believed, India contributed more than 10% to the global renewable energy growth in 2017.

Quite overtly, with its proactive plans and commitment toward renewable energy expansion, India has set the stage for lucrative floating solar panel development and has spurred growing interest of several companies to invest in the region. For instance, SoftBank Group Japan recently announced it plans to build 20 GW of renewable energy plants in the region.

The Indian government has also launched an ambitious floating solar power initiative to lift the niche technology development, while investing in advanced solar power projects. According to the latest reports, SECI (Solar Energy Corp. of India) has invited expression of interest from renewable energy project developers to install 10 GW of floating solar power farms over the next three years. The program, in all likelihood, will aid in the accomplishment of the nation's target of achieving 100 GW by 2022.

Japan. As the world's fifth-largest carbon emitter, Japan has gained substantial momentum in the renewable energy cosmos and has an enviable pipeline of solar power projects. Despite being overtaken by India, Japan is currently the fourth-largest solar market and claims to remain a lucrative investment arena for floating solar panel industry majors.

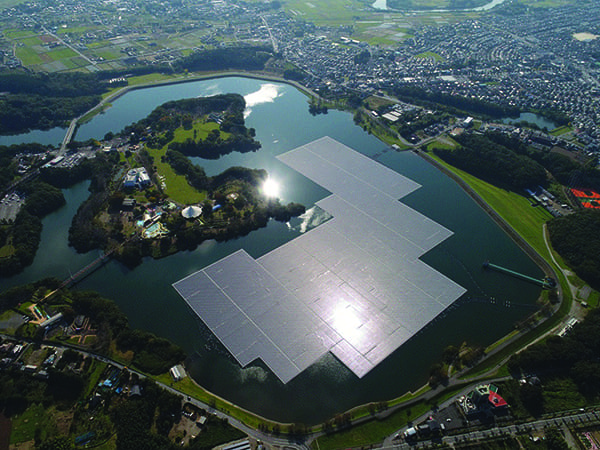

In a recent news release, Japan's Kyocera Corp. announced a floating solar power plant project with a capacity of 13.7 MW, which is also acclaimed as the largest in the nation (Figure 1). The project, which has scarcely become operational, is deemed to possess the capacity to power approximately 4,970 households and curb nearly 8,170 tons of CO2 emissions annually.

Experts speculate such investments and rollouts will provide significant impetus to the regional floating solar panel market. According to reliable sources, Japan's floating solar panel industry size is set to exceed capacity of 400 MW by 2024. The regional fraternity, as reported by Global Market Insights Inc., registered a valuation of $14 million in 2015.

The region has been acclaimed for its strategic measures to ensure its competitiveness with regard to clean energy deployment, which has indeed curtailed its reliance on expensive fossil fuel sources. Not to mention, the scarcity of land space and growing regulatory measures for effective utilization of waterbodies are expected to act as catalysts in the regional floating solar panel industry expansion.

The Netherlands Embraces Floating Solar PanelsThe initial years of transitioning from conventional energy to renewable energy witnessed the Netherlands facing a slew of obstacles, including less available land and high building costs of solar panels. However, post the early stumbling blocks, the Netherlands evolved to be one of Europe's most proactive regional contributors toward the floating solar panel industry. The Dutch government has planned construction of a sufficiently large solar farm spanning 2,500 square meters on the surface of the ocean to further fuel the regional solar energy space. With a targeted completion date of 2021, this farm will be positioned in between two already existing offshore wind turbines and connected to the same cables. This will conveniently pave the way for the expansion of the regional floating solar panel market.

Adhering to the lack of land space, the Dutch government, apart from the oceanic surface also plans to deploy floating solar panels in freshwater reservoirs. Blessed with an inland waterway surface of close to 7,650 square kilometers, the Netherlands would benefit enormously from such projects, laying down a spate of future growth opportunities for regional floating solar panel industry contenders.

Recapping yet another recent instance, Hanwha Q CELLS, one of the leading participants in the South Korean floating solar panel industry, plans to supply more than 6,000 monocrystalline solar modules to a floating solar plant in the Netherlands in 2018. Developed by Tenten Solar Zonnepanelen B.V. on a freshwater reservoir in central Netherlands (Figure 2), this plant is deemed to be the largest of its kind constructed so far in the nation. Renowned companies Ciel et Terre and SolarEdge would also be contributing to this plant-the former will equip the plant with its modular pontoon system, while SolarEdge will provide optimizers and PV inverters.

Fueled by a plethora of highly lucrative initiatives, the Netherlands floating solar panels market is poised to amass commendable proceeds by 2024. As per the Central Bureau of Statistics, the Netherlands' cumulative PV capacity was recorded at 1,485 MW by the end of 2015. Further statistics depict that the region, as of 2018, is endowed with a cumulative capacity of 2.7 GW, with new additions of 700 MW. It is expected that in the ensuing years, the Netherlands will emerge to be one of the most-profitable hotbeds for the European floating solar panel market.

Growth Expected in North AmericaRenewable energy is slowly paving its way to the masses across North America, as the continent continues to harness power from off-grid and on-grid solar plant installations. The last decade witnessed the solar energy space gaining a competitive edge over other sustainable energy counterparts, due to robust investments in solar power technologies. In 2015, for instance, the China-based provider of PV solutions, SPI Energy Co. Ltd., collaborated with Aqua Clean Energy to install floating solar plants of 50 MW collectively in the U.S. and Mexico. Driven by the rapidly increasing investments in solar projects, the U.S. floating solar panel market size is pegged at $250 million by 2024.

The shifting trends toward the growing deployment of green energy facilities across the globe will propel floating solar panel market trends. Currently, the increasing demand for energy and the growing awareness about the hazardous impact of GHG emissions from fossil fuel-based power projects are two major concerns of governments and regulatory bodies. These concerns, however, are being addressed in a systematic basis through heavy investments in renewables, specifically across China, U.S., India, and some European countries. These investments by governments and regulatory bodies in solar power projects have also been generating lucrative opportunities for the players in the floating solar panel industry, which is expected to register a compound annual growth rate of more than 45% from 2016 to 2024. a-

-Sunil Hebbalkarperforms research content development at Global Market Insights Inc., a market research and management consulting company (www.gminsights.com), andOjaswita Kutepatilis an associate content developer with Algos Online.

The post Floating Solar Panel Industry Makes a Splash appeared first on POWER Magazine.