Big Gains for Tiny Nuclear Reactors

As the hubbub of interest and activity surrounds development of small modular reactors (SMRs) hovering between 60 MW and 300 MW, and medium-sized nuclear reactors of under 700 MW, several nuclear technology vendors have quietly been developing micro-reactors-which are of 10 MW or less. According to the Nuclear Energy Institute (NEI), it's highly possible that a first-of-its-kind micro-reactor could be successfully deployed at a domestic U.S. defense installation by the end of 2027.

Since the 1950s, when nuclear power generation became established, the size of reactor units has evolved from 60 MW to more than 1,600 MW. In June, China General Nuclear Power Corp., for example, grid-connected Taishan 1, the world's first EPR, a 1,600-MW third-generation pressurized water reactor (PWR) developed by French companies EDF and Framatome. On October 11, Westinghouse and China State Nuclear Power Technology Corp. also launched commercial operation of Sanmen 1 (Figure 1), the first 1,000-MW AP1000 reactor, which is also a third-generation two-loop PWR.

But interest in smaller power reactors has also grown in recent decades, due partly to high capital costs associated with large power reactors and the need to serve smaller grids. According to the World Nuclear Association (WNA), only three small reactors currently operate around the world today: a 300-MW CNP-300 in Pakistan; a 220-MW PHWR-220 in India; and an 11-MW EGP-6 at the Bilibino cogeneration plant in Siberia.

Among small reactor designs under construction are the 35-MW KLT-40S and 50-MW RITM-200 in Russia; the 27-MW CAREM-25 in Argentina; and two 250-MW HTR-PM units and the 60-MW ACPR50S in China. Development is well-advanced for 10 other reactor designs, including NuScale's 60-MW SMR, Holtec's 160-MW SMR-160, and Terrestrial Energy's 192-MW molten salt reactor. Despite the simplicity of their designs, however, commercialization of SMRs has been slow, mainly due to licensing challenges, noted the WNA. "Design certification, construction and operation [license] costs are not necessarily less than for large reactors, placing a major burden on developers and proponents," it said.

Over the last decade, the nuclear power sector is also facing a significant disruption as power consumption patterns shift. As more distributed energy resources (DERs) are added to the grid, they have empowered end-users to produce energy locally-signifying a break away from a historic top-down supply structure, and forcing many large and medium-sized baseload power generators to seek flexible operations. The proliferation of physical threats-both natural and manmade-and cybersecurity concerns are also afflicting larger grids, prompting concerns about resiliency and reliability.

For these reasons, and to ensure market viability, nuclear technology vendors are pouring time and funding to development of very small reactor designs of 10 MW or less. Some of the companies involved in projects follow.

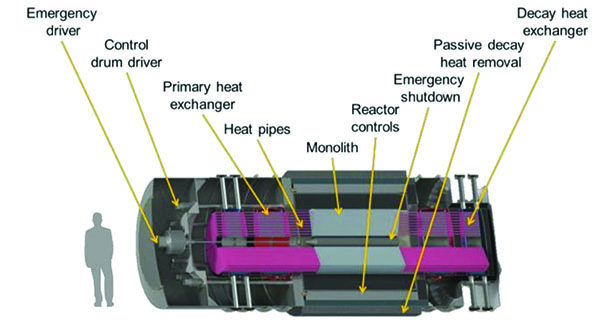

Westinghouse. Recently emerging from bankruptcy prompted in part by steep cost overruns at four large-scale AP1000 units that it began building in the U.S., Westinghouse is developing the eVinci micro-reactor (Figure 2), which ranges from 200 kW to 15 MW. Westinghouse says that it could develop and demonstrate the eVinci micro-reactor in less than six years, owing to its size and "high technology readiness level of individual components." For now, it wants to develop a full-scale electrical demonstration unit by 2019 and then build an integral test with nuclear fuel, aiming for commercial deployment by 2024.

NuScale. The frontrunner in the SMR race, NuScale expects the U.S. Nuclear Regulatory Commission (NRC) to approve its 60-MW design by September 2020, with commercial deployment slated in the mid-2020s. At the end of September, NuScale announced it selected Virginia-based BWX Technologies to start the engineering work to manufacture its SMR. However, the company is also evaluating several micro-reactor concepts in the 1 MW to 10 MW range, and two of these light-water micro-reactor concepts-the single-unit NuScale Power Module (NPM) and the reduced-size NPM-could leverage current design and licensing efforts.

General Atomics (GA). GA, which has supplied 65 TRIGA research reactors under 10 MWth, is developing a 4-10 MWe mobile nuclear power supply that fits within a standard military shipping container and has a refueling period of greater than 10 years. The compact power supply also leverages GA's development of high-temperature, accident-tolerant materials and fuels that enable high performance, a high degree of safety, and protection against potential threats, the company said in October.

Oklo. This Silicon Valley-based company is developing a 2-MW fast reactor that fits into a containerized system and has a refueling period of more than 10 years. The company told a U.S. House committee in July 2017 that its reactor design can use fuel 300 times more efficiency than current reactors. The reactor design has a small core, is not pressurized, operates without pumps, and does not have a large coolant inventory.

X-energy. While this Maryland-based firm this fall began discussing the design of its larger 75-MWe (200-MWth) Xe-100, a high-temperature gas-cooled (HTGR) pebble bed advanced reactor, with the NRC, it is also developing the road-transportable X-battery, which is 10-MWth. The company has reportedly tested various fuel cycles in the design, including uranium and thorium, and can operate the unit for about 10 years with a single core load. Company president Harlan Bowers told a House committee in September that X-energy is working to complete its first demonstration Xe-100 by the mid-to-late 2020s.

According to the NEI, the first micro-reactor deployment could be at a U.S. Department of Defense (DoD) domestic installation within 10 years. About 90% of military installations have an average energy use that can be met by an installed capacity of 40 MW or less, and it notes that resilience is of utmost importance to DoD installations, which rely almost entirely on the grid. "Micro-reactors will be able to provide heat and other products, such as desalinated water and hydrogen that can meet the needs of DoD installations," it noted. "Micro-reactors can also enhance DoD's use of new technologies, such as advanced computing, 'big data' analytics, artificial intelligence, autonomy, robotics, directed energy, hypersonics, and biotechnology."

The NEI projects that most DoD installations will seek one or more micro-reactors in the 2 MW to 10 MW range, initially for power rather than heat. However, the nuclear lobby, which published a comprehensive roadmap this October aimed at making that a reality, notes that first deployment will face several hurdles. Among them are delays rooted in technology validation and licensing, though it notes that "the NRC should be able to review and approve the first micro-reactor design on the shorter side of their standard review schedules, even though new technologies sometimes take longer to review than designs based on technologies that have been previously approved."

Fuel supply issues could also hamper quick deployment. The NEI notes that the commercial nuclear fuel industry currently only produces fuel enriched up to 5% by weight of U-235, but that some micro-reactors will use fuel enriched up to 20% by weight of U-235, known as "high-assay low-enriched uranium" or "HALEU." Establishing a commercial supply of HALEU would require sufficient demand and a minimum of 7 years to develop fuel cycle infrastructure, but that could be mitigated if the Department of Energy (DOE) taps into its access of high-enriched uranium, which it says can be down-blended to supply HALEU needs until a commercial supply is available. "It is estimated that it would take DOE 1.5 to 3 years to supply HALEU, with a nominal target of 2 years for the first micro-reactor deployment," NEI said. Other challenges involve used-fuel disposal and operator training.

In a press conference hosted by the NEI on October 4, Troy Warshel, director of operations at the Pentagon's Office of the Deputy Assistant Secretary for Operational Energy, indicated that the DoD may be on board. The NEI also noted that Congress in August directed the DOE to report to Congress within a year on the requirements and components needed for a pilot program to "site, construct and operate at least one licensed micro-reactor that provides resilience for national security infrastructure at a DoD or DOE facility."

Other nations are also closely examining the use of micro-reactors. Both Canada and the UK reportedly have advanced government programs underway with the goal of deploying small reactors within the next decade. The Canadian Nuclear Safety Commission, for example, is wrapping up the first phase of pre-licensing design review for an Ultra Safe Nuclear Corp. and Global First Power jointly submitted 5-MW to 10-MW high-temperature gas reactor. Other designs, like the eVinci, are in various stages of review.

This June, meanwhile, the UK government confirmed that nuclear fuel supplier URENCO was one of eight participants selected to receive funding under its Advanced Modular Reactor (AMR) program to develop its U-Battery, which is a 4-MW "micro modular reactor" powered by Tristructural-isotropic (TRISO) fuel that can be delivered in a cogeneration configuration of 750C process heat. The UK Department for Business, Energy, and Industrial Strategy could invest up to 44 million in AMR feasibility and development work, and under the program, it could award a single, successful applicant up to 4 million.

URENCO wants to demonstrate the technology by 2024. U-Battery General Manager Steve Threlfall said in June that the government's green light to progress the U-Battery to Phase 1 of the government's AMR Programme "will involve receiving a first tranche of funding to produce a feasibility study in which we outline the commercial and technical case for U-Battery. The feasibility study will be produced over the next six months, before being submitted to Government."

-Sonal Patelis a POWERassociate editor.

Correction (Nov. 5, 2018): This article originally and incorrectly stated that the U-Battery was furnished with the full 44 million that may be allocated for the AMR program. URENCO is in the running for the UK government's award along with seven other companies, which also got contracts to produce feasibility studies as part of the the program's first phase:Advanced Reactor Concepts (for its 100-MW ARC-100, a sodium-cooled reactor that employs metallic fuel); DBD Ltd. (for its high-temperature gas-cooled reactor); Blykalla Reaktorer Stockholm (for its 40-MW lead-cooled reactor, SEALER-UK); Moltex Energy (for its stable salt reactor); Tokamak Energy (for its spherical tokamak, which is a small modular fusion reactor); Ultra Safe Nuclear Corp. (for its 15-MWth high-temperature gas-cooled reactor); and Westinghouse(for its 400-MW lead-cooled fast reactor).

The post Big Gains for Tiny Nuclear Reactors appeared first on POWER Magazine.