DOE Considers Subsidies Modeled on Renewables for Small Modular Nuclear Reactors

State-imposed standards and financial incentives such as those used to spur widespread adoption of renewables technologies offer a promising model to address challenges to commercialize small modular reactors (SMRs), says a report by the U.S. Department of Energy's (DOE's) Office of Nuclear Energy.

But to make a meaningful impact, nearly $10 billion in incentives will be needed to deploy 6 GW of SMR capacity by 2025, it acknowledges.

The report, "Examination of Federal Assistance in the Renewable Energy Market," was prepared by Kutak Rock and Scully Capital under contract with the DOE and made public on November 15. It notes that while uncertainty attached to the rapidly evolving market environment is shadowing long-term investment decisions at electric utilities in the U.S, current trends in the power sector present an opportunity for SMR development "as a flexible, carbon-free baseload generation resource which can be built on a smaller scale than traditional nuclear plants." However, efforts to commercialize SMR technologies have lagged owing to several challenges. These include development of a manufacturing ecosystem, licensing risks, developmental timelines, first-of-a-kind costs, and uncertainty in long-term energy markets.

Federal financial assistance such as tax and credit incentives could help curb reductions in the cost of power from SMRs, while demand mandates would assure off-take at predictable prices, it posits.

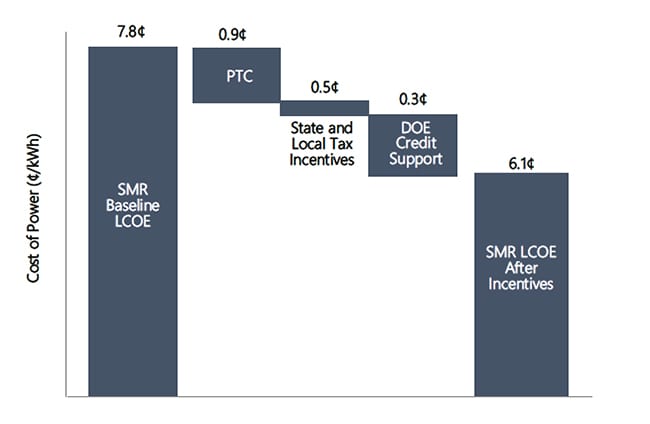

Citing data from a September 2017 economic study conducted by U.S.-based consortium SMR Start, the report says that allowing SMRs to receive production tax credits (PTCs) could reduce the cost of power by just under 1 cent per kWh. Credit incentives (loan guarantees) could further slash the cost of power by another 0.3 cents, and. state and local tax incentives, such as sales and use tax exemptions and property tax abatements, could further reduce costs by 0.5 cents. "Altogether, these would reduce the cost of power by 22%," it concludes.

Levelized Cost of Electricity of Small Modular Reactors. Source: DOE

But to meaningfully impact commercial deployment, financial incentives would need to be applied to several SMRs in combination with demand mandates "to assure off-take," it suggests. "Construction of 6 GW of SMR capacity by 2035 would comprise about 5% of total capacity additions through that year. This would amount to 15 SMR projects with capacity of 400 MW each." If the federal government backed 15 SMR projects with PTCs and DOE loan guarantees, total taxpayer-funded costs could amount to about $10 billion.

However, the report argues: "While this level of support is significant relative to the capacity deployed, the high capacity factors and long operating lives of SMRs support an attractive return on the government's investment." Government-backing of SMRs could even prove cheaper than its support for renewables, it adds. "Specifically, the $10 billion assistance estimate equates to approximately $0.0034/kWh.

By comparison, the investments in wind and solar equaled approximately $0.0108/kWh." Federal expenditure for SMRs could be impactful even if on a smaller scale than the $51 billion that the government spent on solar and wind through mandates, tax incentives, loans and research grants from 2005 to 2015, the report says. It notes that 90% of the $51 billion came in the form of subsidies, which included investment and production tax credits. One reason that SMRs compare favorably to renewables is that they are "expected to realize capacity factors of 92.1% or above and have very long operating lives."

Still, the report notes that significant questions remain about how much commercial deployment of SMRs will actually cost-and whether 6 GW of induced capacity would be enough to develop the industrial capabilities necessary to support the industry over the long-term.

The Lag in SMR CommercializationInterest in SMRs has ramped up in recent years owing to applications in niche electricity or energy markets where large reactors would not be viable-such as for cogeneration in countries with small grids, remote and off-grid areas, and for nuclear/renewable hybrid projects. Modular attributes may also enable SMRs to target the economics of serial production, offering shorter construction timeframes.

But though significant advancements have been achieved for more than 50 key SMR technologies worldwide in recent years, most continue to crawl through the development pipeline (see POWER's November 2018 Big Picture infographic and a related story, "Big Gains for Tiny Reactors" for more). Despite the simplicity of their designs, commercialization of SMRs has been slow, mainly due to licensing challenges, notes the World Nuclear Association. "Design certification, construction and operation [license] costs are not necessarily less than for large reactors, placing a major burden on developers and proponents," it said.

In the U.S., federal efforts to support SMR development include a DOE open solicitation for loan guarantees for nuclear projects, including SMRs. The DOE awarded NuScale nearly $50 million this year to support the design development and licensing of its SMR technology. The Oregon-based company's design is currently under review by the U.S. Nuclear Regulatory Commission and it could become the nation's first advanced commercial SMR by 2026. Earlier this year, Congress also voted to extend nuclear PTCs beyond their expiration in 2020, which will benefit projects completed after 2020.

More Federal Backing NeededHowever, the report recommends the government will need to do more to help SMRs to commercialization. Steps include examining the potential market associated with SMRs in order to establish a business case for federal financial assistance. The study should include financial, legal, regulatory, and technical issues related to SMR grid integration, as well as a consideration of the entire value chain and cost competitiveness. Specifically, it should "confirm the suitability of SMRs to address the baseload power replacements which will be driven by coal and conventional nuclear retirements," and "identify how the SMR supply chain will need to develop in order to achieve the nth-of-a-kind cost targets," it suggests.

It also calls on the DOE to analyze specific impacts of financial incentives focused on levelized cost of electricity. "This feasibility analysis would seek to identify the cost of service of a proposed SMR and would measure the impact of incentives and the uncertainties that could increase costs, identify key risks and mitigants, and integrate financial, legal, regulatory, and technical considerations," it says.

Any analyses should also identify obstacles that require legislative action. "This would be informed by the findings of the project-level business case analysis, and could focus on matters such as identifying appropriate existing legal authorities for supporting Federal power purchase agreements, finding ways to modify or extend existing incentives, creating budget scoring alternatives or developing roadmaps for implementing new programs or legislation."

-Sonal Patelis a POWER associate editor (@sonalcpatel, @POWERmagazine)

The post DOE Considers Subsidies Modeled on Renewables for Small Modular Nuclear Reactors appeared first on POWER Magazine.