Not so fabulous adventures in banking

I've banked with First Tech Credit Union since 1994, when they were the only bank that would give a non-resident Microsoft intern like me an account. I had nothing but good service from them for many years, but in the last couple years things have gone really downhill, (starting right around the time they merged with another credit union; probably not a coincidence).

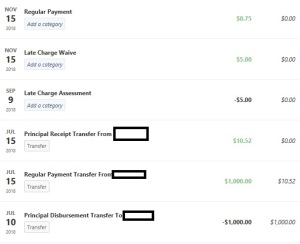

The final straw was this evening; here's a screenshot of their web site showing my balance on my home equity line of credit:

On July 10th I must have needed some cash for something, so I borrowed $1000 and my balance went from $0 to $1000. Five days later I paid it back, and it said that my new balance was $10.52. Now, this seems like exorbitant interest on a five-day loan, but whatever, as you can see, I paid the $10.52, and my balance went back to zero.

A couple months later I was assessed a late fee of $5. I did not notice this, since my balance was still listed on the web site as zero.

This afternoon I did a credit check and discovered that my credit score had gone down 111 points. 111 points!

I called up First Tech and they cheerfully explained to me that they had charged me $0.75 interest on the $10.52 of interest, and that since I had not paid it in 60 days, they reported my account as delinquent.

As you can see, they were good enough to waive the five dollar fee, and I transferred over the seventy-five cents. Hopefully they will remove the delinquency from my credit report, but we'll see.

This is the third time this has happened in the last two years. The first time it was for 7 cents, and the second time it was for 17 cents. I informed them at the time that I would be taking my business elsewhere if there was a third time, and that was today.

Add to that a number of other recent issues - during the merger they somehow managed to lose about a years worth of my online bill payment records. A bank lost my banking records. At tax time. And I recently got what I think was a sales call from a representative that was so confusing, uninformed, vague and generally incompetent that I called them back because I genuinely believed I was probably being phished.

So, long story short: first, do not bank with First Tech. They cannot make a web site that shows you your balance, and they will mark an account as delinquent for a discrepancy that does not show up on the web site. I've just had my credit ruined over the price of a pack of gum.

Second, I need recommendations for a credit union in the Seattle area that does not suck. Anyone have recommendations? Whack 'em down in the comments!

UPDATE: I had a meeting with my local branch manager, who was the first person in this saga to apologize to me for my inconvenience and clearly state that it was a bad idea to ruin people's credit over the price of a cup of coffee. But the super amusing part was that he said that this happens all the time.

How? Well, the HELOC has an annual fee, and fee is considered part of the loan, so you end up having to pay a few cents interest on it if you do not pre-pay it, but that interest does not show up in the balance on the web site. So a great many people do not discover this until it goes to collections or shows up on their credit report.

Apparently, he told me, people getting their credit ruined because of a seven cent charge they didn't know they had is bad for customer satisfaction metrics.

That's some high quality Business Intelligence analysis right there.

What kind of clown town operation are these people running? Like I said, this has happened to me three times, over a period of several years, and apparently I am not alone. The only conclusion I can come up with is that the problem is not bad enough to bother fixing.

The branch manager asked me for advice, which seemed to me to be rather backwards, but, hey, I'll answer the question. First Tech, the suggestions I gave your manager were:

- Stop marking these accounts as delinquent. Put a WHERE clause in the SQL query that determines which accounts get flagged for collections or delinquency that filters out accounts that are delinquent by less than the price of, say, a Big Mac.

- Fix your web site to show the actual balance in the "balance" column.

- I was super irritated when I was on the phone getting this sorted out, but the mortgage specialist I spoke with was most interested in telling me that this was my fault, and that what they did was legal. But the problem is not that I think you're criminals! The problem is that I think you're incompetent clowns who are actively making my life worse. Staff who are asked to speak to irate customers should be trained on how to solve the real problem, which is retaining the customer's business and good will.

I think those are reasonable suggestions that could be implemented in pretty short order, and any one of them would have mitigated the problem. Maybe do all three.

UPDATE #2:

- On December 4th my credit rating went back up by 109 points, so likely the delinquency has been removed from my account.

- I've spoken to I think five different customer service representatives, most of whom were sympathetic and apologetic.

- I've been informed that credit unions are required by law - the Fair Credit Reporting Act or some such thing - to report all delinquencies, even if they are a penny. I understand that you don't want banks to selectively apply sanctions to "undesirable" customers; that invites all sorts of abuses. But if we're in a situation where reporting is mandatory, then it is beholden upon the banks to ensure that tiny, accidental delinquencies don't happen if it can be avoided by any means. I had plenty of money in my accounts when this happened; auto-payment of accounts that are about to become delinquent by less than a dollar should be the default. There should be a great many such mechanisms; this sort of customer service failure should be rare, but I am assured that it is common.

- This was in many ways a failure of communication, and I recognize that communicating effectively is hard. But banks need to recognize the role they've played in making it hard. Let's look at some of the ways its hard.

- I got a letter from my bank saying that I was in arrears by 75 cents. Did I read it? Of course not. I get pointless, ignorable letters from my bank constantly so I have been trained to ignore them. I get multiple statements a month, I get privacy policy change notifications, and solicitations for services, and tax documents. You open a few hundred envelopes that have a document inside that says either "we're letting you know that everything is fine, for no reason" or "please sign up for a service you didn't ask for and don't want", or "we've made a minor change to our privacy policy", and why would you open the 101st in a timely manner? And if you did, and it said "you owe us $0.75", would that suggest a need for immediate action? Maybe I am being naive and foolish, but let me tell you, when Internet Explorer puts up a "security alert" over nothing a thousand times, and you dismiss it a thousand times, and then the 1001st time your machine gets compromised, I don't get to say "you shouldn't have clicked OK that time".

- The same goes for email. Emails from my bank are sorted automatically into the "promotions" folder. Guess how often I read that? If you said "only when I think there's miscategorized email in there", you're right.

- The same goes for phone calls. The vast majority of the phone calls I get are from a boiler room in India full of angry young men trying to sell me fake Viagra. (I'm not sure how they got my phone number, but they sure are persistent, and pretty mad when I ask them to stop calling.) The last phone call I got from my bank, as I noted above, was so confusing that I was pretty sure I was being phished.