The UK government gave away cheap money for property purchase deposits, which the wealthy abused, driving up property prices and leaving UK taxpayers exposed

In 2013, the UK coalition government of David Cameron's Tories and the Libdems' Nick Clegg launched a "Help to Buy" scheme that gave incredibly cheap, taxpayer subsidised loans to first-time homebuyers, who got their money interest free for five years and thereafter had to repay it at 1.75% interest.

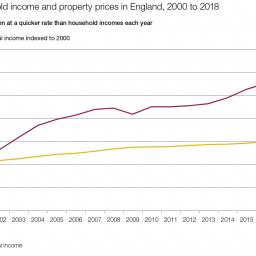

Now, six years and billions of pounds later, the National Audit Office has published its report on the scheme, revealing that 63% of those who got free government money actually needed it to buy a house (4% of those who got the loans were on incomes of more than 100,000/year), and the net effect of flushing all these billions into the housing market was to massively drive up the cost of housing -- home prices in the UK have risen by an inflation-adjusted 35% since the programme went into effect.

Some of the abuses of the programme by the wealthy are just jaw-dropping: for example, in 2016 the Conservative MP Peter Boone bought a new house with a subsidised 35,000 loan that he took out in his wife's name.

This has all been great for developers, who have funneled much of the gains from the rise in new home buyers into their pockets, but it's a potential disaster for the exchequer.

Now that the housing prices in the UK have been driven up, and now that the British taxpayer has issued billions in loans for these inflated properties, the national treasury is in line to lose billions of housing prices decline and borrowers start defaulting -- say, if the British economy is destroyed by a precipitous, ill-planned move to leave the EU.

Through the scheme, the government has so far issued around 211,000 loans worth 11.7 billion ($14.8 billion) to home buyers. According to the NAO, this has helped increase sales of new-build properties from 61,357 a year in 2013-14 to 104,245 a year in 2017-18. That, in turn, has helped fuel a spike in profits for the UK's biggest home builders. The nine largest builders dished out 2.3 billion in dividends in their most recent financial year, 39 times greater than the 53 million they paid out in 2012, a year before the scheme was introduced.

The NAO estimates that over the last six years, about 40% of all new-build properties have been bought by buyers using the scheme. This has not only helped to line the pockets of large home builders and banks, it has also transformed the UK government into a major player in the UK housing market.

UK Government Blew Billions on "Help to Buy" Scheme that Enriched Home Builders and Drove Up Home Prices. Taxpayers on the Hook When Prices Sink, New Report Warns [Don Quijones/Wolf Street]

(via Naked Capitalism)