Should We Employ Our Own Kids? (and How Much to Pay Them)

My Brother Wax Mannequin, training the next generation of workforce last summer.

Way back in 2015, I had a nine year old boy. Even back then, I could see him showing some early flashes of adulthood and maturity, and it got me wondering about his future as it relates to money and freedom.

So I wrote a post called What I'm Teaching My Son About Money, which shared some ideas about how we can raise our next generation of kids to be happy masters of money rather than the stressed-out slaves that most people (even those with high incomes) are today. And now, four years later, some of my predictions and questions from that article are starting to come true, and I'm wondering what to do about it.

To me, the biggest question is this:

Where is the balance between giving your kids a helpful boost, and "helping" them so much that you distort their view of the world and create a generation of Whining Complainypants Adults?

Opinions on this subject can vary widely, and in fact even you and I might have rather different views. But hopefully we can at least agree that the whole thing sits on a spectrum, and that even that spectrum itself is slippery because every child and every upbringing is unique.

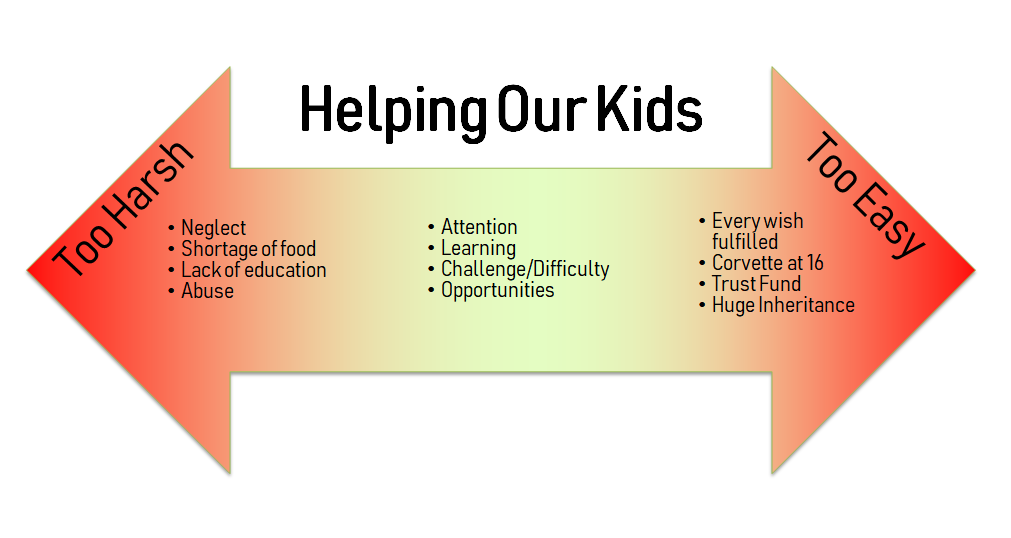

So let's get onto the same page with an attractive and scientific-looking diagram.

Almost any parent would agree that the left side of the spectrum is a bad place for kids to be born. Because it affects not just their childhoods, but their entire lives. So we strive to provide a life that is further to the right, keeping our kids fueled with food, love, and opportunities.

Almost any parent would agree that the left side of the spectrum is a bad place for kids to be born. Because it affects not just their childhoods, but their entire lives. So we strive to provide a life that is further to the right, keeping our kids fueled with food, love, and opportunities.

But as with all human pursuits, we have a tendency to go too far and get into the "Too Easy" end of the spectrum. We may be smothering our kids with too much "help", or perhaps compensating for being so busy with our fancypants careers that we don't have much time to spend with them.

While this all feels like common sense, there's also some biology behind it. Babies and young kids who experience a harsh environment during this critical part of development will tend to grow up more optimized for survival and street smarts, with lower levels of trust and a harder time blending in with a peaceful society*.

And on the more fortunate side of the divide, children raised in peace and security will optimize more for "book smarts" intelligence as well as being more trusting and less prone to violence. The entire apparatus of our brain will end up wired differently, based on the experiences we have in early childhood.

The problem for wealthy people is that the human brain is not wired to stop at "enough", because enough has not been a big part of our shared history.

So we tend to overdo it when creating a comfortable life for our own kids, often justifying it with this exact sentence:

"We work hard, so we can give our kids some of the opportunities and the nice things that we didn't have in our own childhood."

It sounds noble and honorable on the surface, but be careful, because we can ratchet that same justification up far beyond any reasonable lifestyles without realizing we are just stoking our own egos or compensating for our own fears (and perhaps battling our peers/competitors in the Who's-the-Best-Parent Competition on Facebook).

And then these kids respond by developing in a different way that can have its own downsides. Not understanding what it means to be poor. A lack of life's most valuable skill - the skill of efficiency, optimization and reducing waste. And even a lack of life satisfaction and balance in later adulthood, because of a focus on easy consumption rather than the joy of creation.

So with such a slippery slope and those two pointy arrowheads to navigate, what's the ideal strategy for us parents?

I don't have all the answers, but one idea I have been interested in for years seems to have a lot of advantages: Hiring your children to work in your own small business.

Just think about it. You get to do all of these things and more:

- help your kids earn their own money

- teach them the value of hard work

- have more excuses to spend time together solving problems - maybe even as they grow into adults

- potentially cut the family's total tax bill by transferring income from the high tax bracket of the parents, to the low (or zero) bracket of the kids.

Of course, there are also a few traps to watch out for in running a family business:

- the job you give them might be better (or worse) than what they could get elsewhere, leading to a distorted view of what it really means to work for a living

- if you don't get along particularly well, tying your fates together even closer in a company will magnify any problems in your relationship

- your kids might miss out on other, broader life experiences they could have had out there in the real world (like my own formative jobs in the gas stations and convenience stores of my small town, which are still the source of stories and laughs to this day.)

Still, the potential benefits clearly outweigh the risks to me, so the idea remains an exciting one in my mind.

Little MM and the Budding YouTube Project

I have been dabbling with this with my own son for several years - he helped me with the arduous task of mailing out over 1200 MMM T-shirts a few years ago and occasionally helps his mother in her soap production enterprises. His earnings have typically been on a per-shirt or per-soap basis

I have been dabbling with this with my own son for several years - he helped me with the arduous task of mailing out over 1200 MMM T-shirts a few years ago and occasionally helps his mother in her soap production enterprises. His earnings have typically been on a per-shirt or per-soap basis

But things really took a step up this past January when he talked me into dusting off the neglected MMM YouTube Channel and actually starting to produce some shows together. Because we started with the good luck of a partially established audience andwe have put some real effort into it (13 episodes over these first six months), it has taken off a little bit and we now have over 27,000 subscribers and the channel has earned about $1600 in YouTube ad revenue so far.

As a fun incentive, I offered at the beginning to pay him a flat (low) fee for editing and producing each episode, then split the income from this venture equally beyond that. So now, the little dude has made $800 on top of his base fees for the work.

If this continues, it could grow into a real income, which is quite exciting but also brings up some interesting tax questions. After all, right now he is a dependent for tax purposes,which means at least one of his parents get a tax deduction for raising him. But if he earns his own money, he might rise out of this dependence and even start owing taxes on his own. So is it worth it?

Hey, Let's Ask my Accountant!

Outsourcing my taxes to someone younger and more enthusiastic about it than me has worked wonders.

To get better advice, I decided to run this by my own business and personal tax accountant, Chris Care who runs his own firm called Care CPA. We talked over the ideas of family businesses and employing a child in greater detail.

In summary, the results are better than I expected, which explains why people are so keen to hire their children.

Here's my brief Q&A with him. Thanks for your help Chris!

MMM - So the first question is, what are the basic rules about employing one's own child in a family business. My first instinct is that it sounds smart, because you are shifting income from parents in a potentially high tax bracket, to kids in a low tax bracket. So overall as a family, your tax bill falls.

But Is it a good idea? How old do they have to be? Any things to watch out for?

Chris Care: The biggest thing to watch out for is making sure the children are old enough to actually work. A lot of business owners want to pay their 1-year-old $15,000 a year for "modeling" by putting their picture on the company website. To me, this is a stretch.

You also want to make sure you're paying them in accordance with the tasks they're doing. If they are 12 years old and filing paperwork for you, or cleaning your office, or other administrative tasks, you probably can't justify paying them $50 an hour. You should make sure there is a clear job description, and keep an accurate record of the number of hours worked and the tasks performed, just like any other employee does at their job

MMM - What is the current child tax credit amount, and how would it phase out if he started making his own money? And does this scale up and down with the parents income as well?

Chris Care - Currently, the child tax credit is up to $2,000 per child, with up to $1,400 being refundable if the credit exceeds your tax amount.

In general, as long as you can claim the child as a dependent, and your income is below $400k if married filing jointly ($200k otherwise), you can claim the child tax credit no matter how much money your child makes. Above this income, the child tax credit phases out, but it is still not related to the child's own income.

MMM - Oh wow, I didn't realize that. And at what level would he need to start incurring his own income taxes? And as an employer, would I be on the hook for stuff like quarterly tax payments, unemployment insurance, worker compensation, and so on? Could he be more like a contractor and avoid these complexities?

Chris Care - It's unlikely you could classify your own son as a contractor. The IRS used to have a 20-factor test, but recently they have been narrowing and cracking down on this issue - more details here: Behavior, Financial, and Type of Relationship

Aside from that, you'd have to handle things in the standard employee way:

- tax withholding from every paycheck, submitted to the government as part of a standard payroll process. (MMM Note - even I have to do this as an employee of my own LLC, I use a provider called ADP and am evaluating a newer one called Gusto).

- quarterly payroll taxes for social security and medicare

- State unemployment insurance if applicable in your state

- FUTA (A form of Federal Unemployment Tax)

Just like any other taxpayer, the child will need to file a federal tax return if their earned income is above the standard deduction ($12,000 for 2018, and $12,200 for 2019). Note that state filing thresholds are often much lower than federal thresholds - check with your own accountant!

MMM - If a kid is living at home with no expenses, he might be wise to put as much of this into retirement accounts and otherwise defer taxes. If my company offered an employee 401k plan, could he put away the full $19,000 per year, or is there an even better option? Maybe his own tax-deferred college savings plan?

Chris Care - As with any other employee, the child can participate in the company's retirement plan, as long as the plan is written to allow minors to participate. The contribution limits will depend on the type of retirement plan. In your example of a 401k, the child could defer the full employee amount ($19,000 in 2019) as long as wages were at least that amount. He would also get the employer match if your company established one.

College savings plans are an option, though whether or not he can open his own would be a question for your specific provider. Financial service firms tend to get a little hesitant opening accounts for minors. You could always open one, and he could contribute to it.

MMM Summary: Wow, this is much better than I had even hoped. In rough terms terms, it sounds like if I can pay my son $30k from my company's income, I might save about $10k in marginal income taxes, while his resulting tax bill would be quite minimal.

Thus, it makes sense for me to start paying him as a real employee, rather than just paying all the taxes at my own marginal rate and keeping it in our own family spreadsheet, as I do now.

Chris Care - Yes, there are some good opportunities for tax optimization by hiring kids.

In general, if you can justifiably pay your child a wage from the family business, it is an excellent way to lower the family's tax burden, and give them a massive boost in retirement savings (since 401k contributions add up way faster than IRA contributions).

Also, by owning the business, you can administer your own 401k plan - which means you don't have to wonder if your employer's plan will allow for a mega backdoor Roth, since you can design it that way! Just keep in mind, that 401k plan is for all employees, so any attributes you establish for family members would also be there for non-family members that you may hire.

Another optimization: if you were a sole proprietorship, or a partnership where both partners are parents of the child being employed, the child's wages would not even be subject to SS/Medicare taxes.

This means you could pay them the $12,000 standard deduction plus $19,000 401k deferral, with zero income tax, zero SS/Medicare taxes, and zero Federal Unemployment tax. They may still be subject to state income tax and state unemployment tax, but those would be relatively minor.

You can essentially shove $31k into a zero tax situation, from potentially a ~35% situation.

This means it may be worth operating the youtube channel as a separate company, and employing your son as a real employee"

MMM - hmmm, lots to consider! For now, YouTube is still only a few hundred bucks per month so we are not there yet. But it sounds like little MM's future is bright, as long as he remains motivated to work hard and be creative and keep producing.

Which is a good general philosophy for any of us: keep some good hard work as part of every day, whether you're ten or one hundred years old. Doing good work and producing good things tends to lead to a good life.

A Few More Thoughts and Disclaimers from Mr. Care:

- In all of these answers, I have assumed the child is a true employee, where he receives a regular paycheck and a W-2 at the end of the year, and the company is a C Corp or S Corp.

- As with all tax planning, tax credits, and personal situations, there are exceptions and limitations. So we've made some broad assumptions to answer these questions. For me to post an exhaustive list of these would take an entire blog post of its own. Always check with your tax professional, or make sure you understand the IRS guidance.

- generational wealth / inequality / dynasties / buffett

- effective altruism

A Final Thought from MMM:

If all this sounds like wishful thinking to you because you don't own your own business yet, I strongly encourage to start one! For the great majority of early retirees, having a small entrepreneurial pursuit is both a reassuring security blanket and a fascinating and fun way to explore life after the cubicles and commuting stage is over. The Joy Of Self Employment.

* This one of many interesting and sometimes untintuitive insights I got into Human nature when reading the rather excellent book Sapiens.