Cloudflare files for initial public offering

After much speculation and no small amount of controversy, Cloudflare, one of the companies that ensures that websites run smoothly on the internet, has filed for its initial public offering.

The company, which made its debut on TechCrunch's Battlefield stage back in 2010, has put a placeholder value of the offering at $100 million, but it will likely be worth billions when it finally trades on the market.

Cloudflare is one of a clutch of businesses whose job it is to make web sites run better, faster, and with little to no downtime.

Recently the company has been at the center of political debates around some of the customers and company it keeps including social media networks like 8Chan and racist media companies like the Daily Stormer.

Indeed the company went so far as to cite 8Chan as a risk factor in its public offering documents.

As far as money goes, Cloudflare is - like other early-stage technology companies - losing money. But it's not losing that much money, and its growth is impressive.

As the company notes in its filing with the Securities and Exchange Commission:

We have experienced significant growth, with our revenue increasing from $84.8 million in 2016 to $134.9 million in 2017 and to $192.7 million in 2018, increases of 59% and 43%, respectively. As we continue to invest in our business, we have incurred net losses of $17.3 million, $10.7 million, and $87.2 million for 2016, 2017, and 2018, respectively. For the six months ended June 30, 2018 and 2019, our revenue increased from $87.1 million to $129.2 million, an increase of 48%, and we incurred net losses of $32.5 million and $36.8 million, respectively.

Cloudflare sits at the intersection of government policy and private company operations and it's potential risk factors include a discussion about what that could mean for its business.

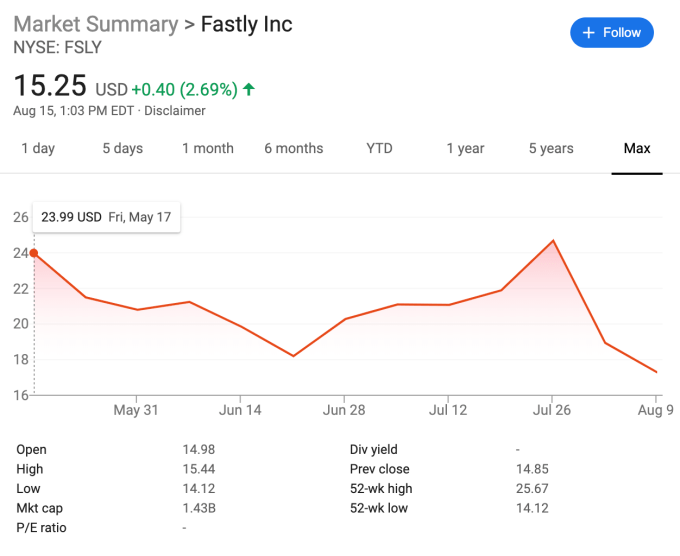

The company isn't the first network infrastructure service provider to hit the market. That distinction belongs to Fastly, whose shares likely have not performed as well as investors would have liked.

Cloudflare has raised roughly $332 million to date from investors including Franklin Templeton Investments, Fidelity, Union Square Ventures, New Enterprise Associates, Pelion Venture Partners, and Venrock. Business Insider reported that the company's last investment gave Cloudflare a valuation of $3.2 billion.

The company will trade on the New York Stock Exchange under the ticker symbol "NET." Underwriters on the company's public offering include Goldman Sachs, Morgan Stanley, J.P. Morgan, Jefferies, Wells Fargo Securities and RBC Capital Markets.