Cementing Coal Power Phaseout, Germany Sets Out to Shutter 40% of Current Generation Mix

The post Cementing Coal Power Phaseout, Germany Sets Out to Shutter 40% of Current Generation Mix appeared first on POWER Magazine.

Germany's federal cabinet on Jan. 29 approved a nationwide phaseout of coal power generation by 2038, paving the way for the country, which has already initiated a nuclear phaseout, to rely even more heavily on renewables.

The federal cabinet's approval of the "Reduction and Termination of Coal Power Generation" (Gesetz zur Reduzierung und zur Beendigung der Kohleverstromung) draft law implements January 2019-issued recommendations by the June 2018-appointed federal coal commission, and it supplements the cabinet's August 2019-issued legal framework to support coal-reliant regions. The German federal parliament, the Bundestag, is now expected to adopt the draft law's text by mid-2020.

A Massive OverhaulThe draft law essentially sets out how the country will reduce its share of coal generation, which made up about 29% of its power mix at the end of 2019. (That's more than in the U.S., where coal power made up 24% of the generating mix in 2019.) It envisions that combined, hard coal and brown coal power plant capacity, which stood at about 44 GW in November 2019, will plunge to 15 GW by 2022.

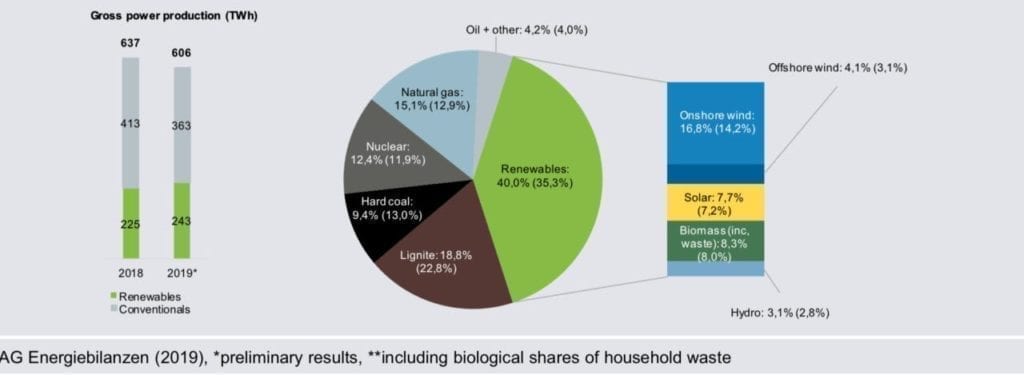

Germany's electricity generation mix in 2019. At the end of 2019, renewables provided as much electricity as coal and nuclear combined in Germany, spurred mostly by additions of solar photovoltaics (PV) and good conditions for wind generation. Values for 2018 are in parentheses. Courtesy: Agora Energiewiende

More hard coal plants will be shuttered compared to lignite plants (or brown coal, which is considered more polluting, owing to its lower energy density) in the following years, owing to schedules related to coal generator compensation, which has emerged as a specific sticking point that Germany has grappled with.

Owing to reliability concerns-mainly because Germany eight years ago embarked on a plan to phaseout its nuclear fleet by 2022-for now, the government plans to review how the coal phaseout is affecting power supply security, power prices, and climate goals in 2022, 2026, 2029, and 2032. In 2026, it plans to assess whether the phaseout can be fast-tracked to 2035. As it stands, however, the draft law mandates that the last coal plant be shuttered by 2038 or earlier.

For the country's 21-GW lignite fleet, power plants will be decommissioned through contractual agreements with operators. "Among other things, the contract is to agree to a waiver of action by the operator. If no contract is concluded by the end of June 2020, the federal government can issue a regulation to reduce and end lignite-based electricity generation," the government said in a statement on Wednesday.

Meanwhile, the phaseout envisions a more imminent 2026 deadline to shutter its entire 23-GW hard coal fleet. As an incentive to spur early closures, the newly approved draft law sets a maximum compensation for hard-coal generators of a165,000 ($182,026)/MW in 2020, falling to a155,000 ($170,994)/MW in 2021 to 2022, and by 25% per year, reaching a49,000 ($54,056)/MW in 2026, when compensations will end. Carbon dioxide emissions under the European Union Emission Trading Scheme (ETS) related to these coal-fired power plants will also be canceled then.

A Highly Complex PhaseoutThe draft law takes into consideration Germany's climate goals to slash its greenhouse gas (GHG) emissions by 55% by 2030 compared to 1990, and it underscores a major turnaround for Chancellor Angela Merkel's conservative-Social Democrat coalition, which in 2017 abandoned an unachievable 2020 target.

Meanwhile, on Jan. 16, the government struck a deal worth more than a40 billion ($44 billion) with coal-mining regions in Brandenburg, Saxony, and Saxony-Anhalt in the east and North-Rhine Westphalia in the west. Companies in those regions, which include giant power generator RWE (which will shutter two coal plants) and coal miner Mibrag, will get a4.35 billion under that deal.

In a statement that lambasted the coal phaseout and underscored the vast impact it would have on its profitability and workforce, RWE noted that despite government assurances of a2.6 billion ($2.9 billion) in compensation payments over the next 15 years, it would still suffer financial damages of about a3.5 billion ($3.9 billion), including a500 million ($551 million) in special write-downs on power plants and opencast mines.

Significantly, however, the draft law, allows for the controversial commissioning of Uniper's 1.1-GW Datteln 4 coal-fired power plant, because the plant's startup was approved before the phaseout was planned. The a1.5 billion ($1.65 billion) project could begin operations as soon as mid-2020. The government said that a decision to halt the plant's commissioning "could only be achieved with very high compensation payments." It reasoned that the phaseout is focused on reducing carbon emissions, not on individual plants. "It makes sense to first take older, more inefficient hard coal power plants out of operation than not to start up the highly modern Datteln IV power plant and to pay a high compensation for this."

'Special Precautions' to Ensure Reliability, AffordabilityAs notably, Germany plans to embark on the coal phaseout with "special precautions." As it noted on Wednesday: "Ensuring the energy supply is permanent and as cost-effective as possible, even during the reduction and termination of coal-based electricity generation, is an essential goal of the law."

Over the medium term, coal will likely be "completely replaced" by renewables, which will be regulated separately, the government said. It will also attempt to replace heat generated by coal-burning combined heat and power plants by extending the Combined Heat and Power Act until the end of 2029, which would likely create additional incentives for biomass cogeneration systems.

Meanwhile, if the phaseout raises power prices, the draft law provides for "relief" for private and commercial consumers in the form of an annual "network cost subsidy" that will be paid from household funds starting in 2023. Energy-intensive firms could then also receive subsidies to offset higher power costs. Finally, coal plant or open pit employees who are more than 58 years old and lose their jobs as a result of the phaseout will likely receive adjustment allowances as a "bridging aid" for five years until they retire.

Power Companies Accelerate Shutdowns, Call for ReformsThe Cabinet's approval of the draft law on Wednesday prompted immediate action from some of Germany's biggest generators.

Uniper, a company formed in 2016 after after being spun off from E.ON in response to a series of German power market disruptions, including Energiewendeand the nuclear phaseout, on Jan. 30 announced that it would shut down 1.5 GW of hard coal capacity by year-end 2022. Those facilities include three generating units at the Scholven power station in Gelsenkirchen and Wilhelmshaven power station. Uniper also plans to close another 1.4 GW at the Staudinger and Heyden power stations by 2025 "at the latest." Since 2015, the company has already shuttered 2.4 GW, including units at the Datteln, Scholven, Knepper, Veltheim, and Shamrock power stations.

Uniper said it is now developing "forward-looking" schemes to replace that power. Efforts will involve plans "to build and operate new gas-fired combined-heat-and-power plants that produce district heating, to design innovative solutions for providing nearby industrial customers with steam, heat, cooling, and electricity, and to develop solutions that produce hydrogen on an industrial scale," the company said.

EnBW Energie Baden-Wi1/4rttemberg AG (EnBW)-a company that POWER recognized with a Top Plant award in 2019 for its operation of RDK8, one of the world's most efficient coal-fired power units-noted the Cabinet's approval of the coal exit law offered "greater clarity about specific conditions" of the looming phaseout. However, the company said some individual measures and rules "are in urgent need of improvement." For one, it pointed out, contrary to a pathway identified by the federal coal commission, the law will allow older and carbon-intensive lignite plants to operate longer than "significantly more modern hard coal power plants with heat extraction that generate less emissions."

EnBW also noted that the draft law only envisages compensations for decommissioning plants up to 2026-even though, owing to the "grid factor," hard coal generators in southern Germany "do not have any realistic chance of being able to disconnect their power plants from the grid at an earlier date." It added: "Due to the early decommissioning of these power plants in accordance with the regulatory process without any economic compensation, these operators will also lack the financial funds for important investments in climate-friendly alternatives." It urged the government "in the spirit of equal competition and to promote the investment that is still required for the Energiewende," to amend and improve the tender and compensation regulations.

Complicating the Phaseout: A Collapse of the Wind ExpansionAccording to Agora Energiewende, a think tank partly funded by the European Climate Foundation, Germany's consumption of renewable power rose to almost 43% in 2019-for the first time, matching total generation from nuclear, lignite, and hard coal combined, owing in part to an expansion of solar PV capacity and "beneficial climatic conditions for wind generation."

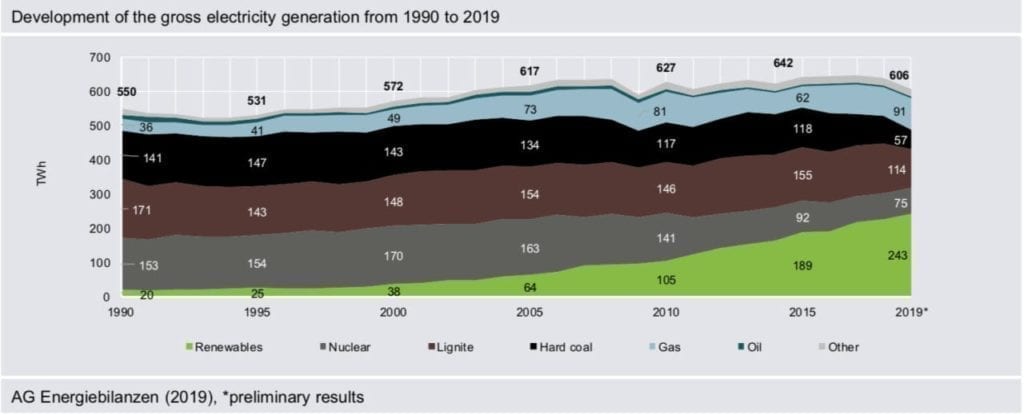

Development of Germany's gross electricity generation from 1990 to 2019. Courtesy: Agora Energiewende

In an annual industry overview published earlier this month, the think tank noted hard coal generation continued a downward trend, falling 31% compared to 2018. Hard coal power prices competed fiercely with natural gas generation, which experienced a notable 11% surge in 2019, owing to favorable prices. Lignite generation, meanwhile, fell 22% in 2019 compared to 2018, reaching its lowest level since 1990. Nuclear power, which has remained constant for years, declined at the start of 2020, as the 1.4-GW Philippsburg 2 plant went off the grid, in accordance with the Nuclear Phase Out Act.

Coal's share was also dented dramatically by competitive renewable pricing. Today, wind and solar often produce power more cheaply than all other types of power, Agora Energiewende said. In 2019, Germany and Luxembourg were the top two European countries with the lowest wholesale power prices. In 2019, meanwhile, Germany saw less frequent negative pricing, and the country experienced no supply shortages, it said.

"Nevertheless, the energy transition is entering the 2020s with a heavy burden," warned Agora Energiewende Director Dr. Patrick Graichen.

"The expansion of wind energy has collapsed by more than 80% over the last two years and has thus nearly ground to a halt. Furthermore, as bids from industry to construct wind farms did not fully exploit the capacity budget in 2019, we will not see robust expansion figures for wind energy in the coming years either. It is now up to the federal government to make policy adjustments so that wind power capacity continues to expand," he explained. "Wind is the workhorse of the energy transition, and without wind power, we cannot succeed in phasing out coal or meeting our climate protection targets."

Germany's energy predicament is complicated by its carbon emissions targets and growing demand, owing to electrification, said Graichen. "We need to build more renewables to offset the phase-out of nuclear power up to 2022 and also generate enough electricity for electric vehicles and heat pumps," he said.

-Sonal Patelis a POWER senior associate editor (@sonalcpatel, @POWERmagazine)

Updated (Jan. 30): Adds reactions from Uniper, RWE, and EnBW

The post Cementing Coal Power Phaseout, Germany Sets Out to Shutter 40% of Current Generation Mix appeared first on POWER Magazine.