Snapchat hits 218M users but big Q4 losses sink share price

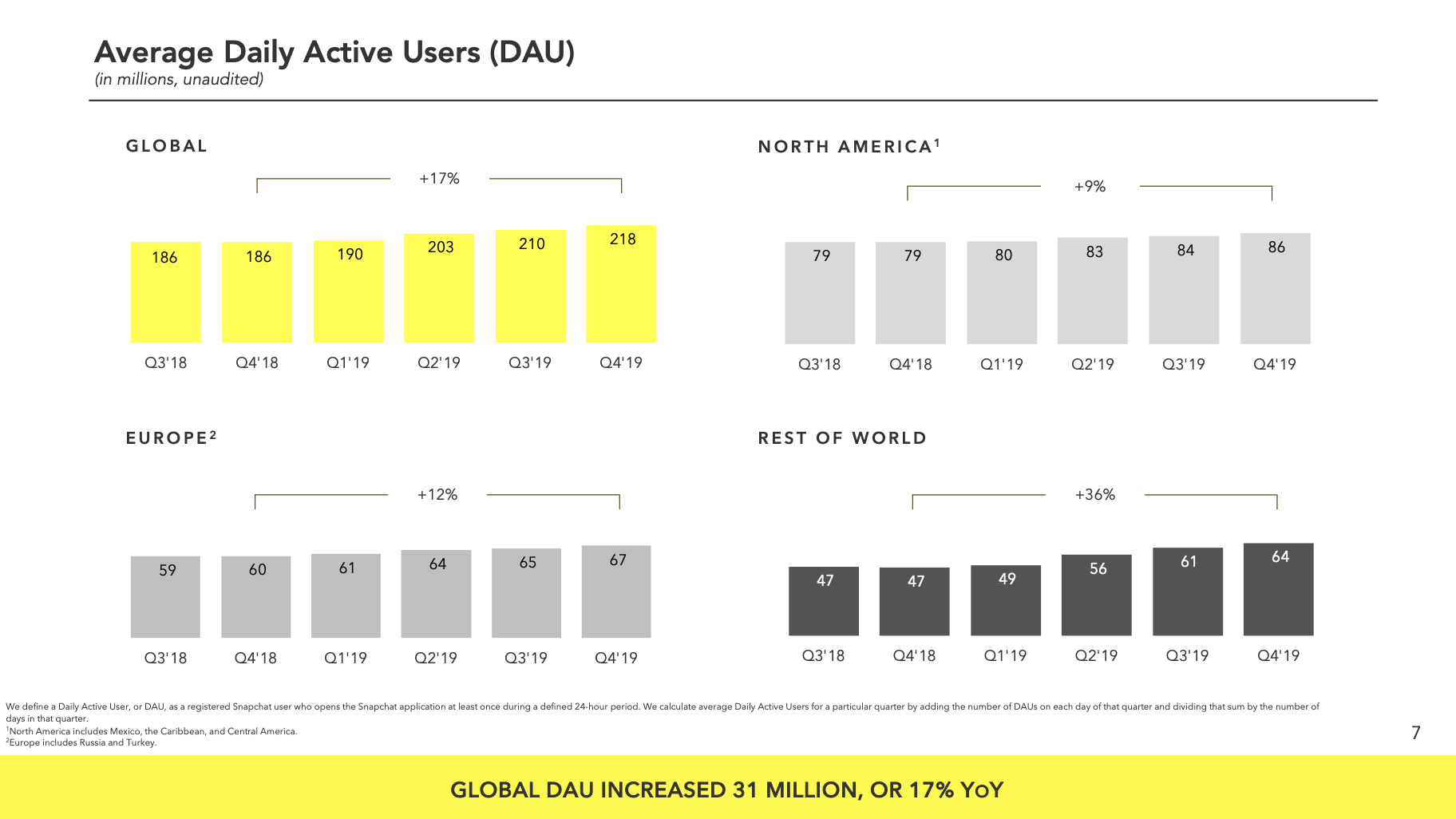

Snapchat still isn't profitable nearly two years after its IPO. In Q4 2019, Snap lost $241 million on $560.8 million in revenue; that's up 44% year-over-year and an EPS of $0.03. That comes from adding 8 million daily users to reach a total of 218 million up 3.8% this quarter from 210 million and 17% year-over-year.

The big problem was a one-time $100 million legal settlement that pushed it to lose $49 million more in Q4 2019 than Q4 2018. That comes from a shareholder lawsuit claiming Snap didn't adequately disclose the impact of competition from Facebook on its business. The IPO was soured by weak user growth as people shifted from Snapchat Stories to Instagram Stories.

Snapchat had a mixed quarter compared to estimates, exceeding the EPS predictions but falling short on revenue. FactSet's consensus predicted $563 million in revenue and a loss of $0.12 EPS. Estimize's consensus came in at $568 million in revenue and an EPS gain of $0.02.

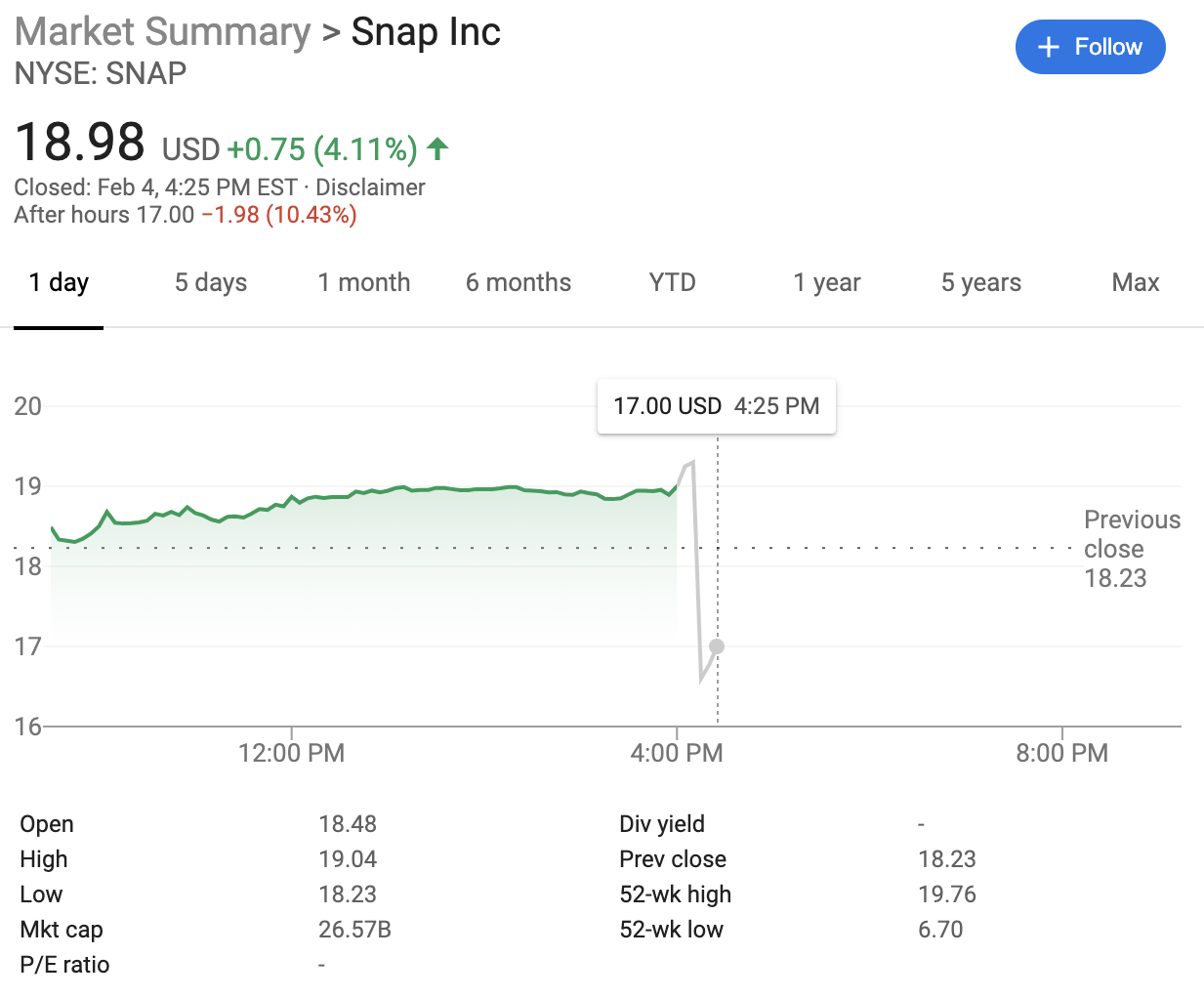

Snapchat shares plunged over 11% in after-hours trading following the announcement. Shares had closed up 4.17% at $18.99 today. That's up from a low of $4.99 in December 2018 when its user count was shrinking under competition from Instagram Stories. It's now hovering around its $17 IPO price, but it's still under its post-IPO pop to $27.09.

Snap gave stronger than expected revenue guidance for Q1 2020 of $450 million to $470 million, and 224 million to 225 million users. The company's CFO Derek Anderson says that "Q4 marked our first quarter of Adjusted EBITDA profitability at $42 million for the quarter, an improvement of $93 million over the prior year." Still, he predicts an Adjusted EBITDA in Q1 of negative $90 million to negative $70 million. That's manageable for Snap without raising more money, since it now has $2.1 billion in cash and marketable securities, down $148 million quarter-after-quarter.

"Throughout the course of 2019, we added 31 million daily active users, largely driven by investments in our core product and improvements to our Android application," said Snapchat CEO Evan Spiegel . "We've recently completed our 2020 strategic planning process and have aligned our teams and resources around our goals of supporting real friendships on Snapchat, expanding our service to a broader global community, investing in our AR and content platforms, and scaling revenue while achieving profitability in order to self-fund our investments in the future."

Some other highlights:

- 1.3 trillion Snaps were created in 2019

- The average Snapchat user engages for 30 minutes per day

- Snapchat reaches 90% of U.S. 13 to 24-year-olds and over 75% of 13 to 34-year-olds

- Total daily time spent by Snapchatters watching Discover increased by 35% year-over-year, and it's up 60% for users over the age of 25

- Over 50 Snapchat shows reached a monthly audience of 10 million viewers or more

- 75% of users engage with augmented reality per day

- 20% of Snaps sent with an AR lens were made with commununity-developed lenses

- 5X more users open the Lens Explorer now versus a year ago, and 10% of users open it every day

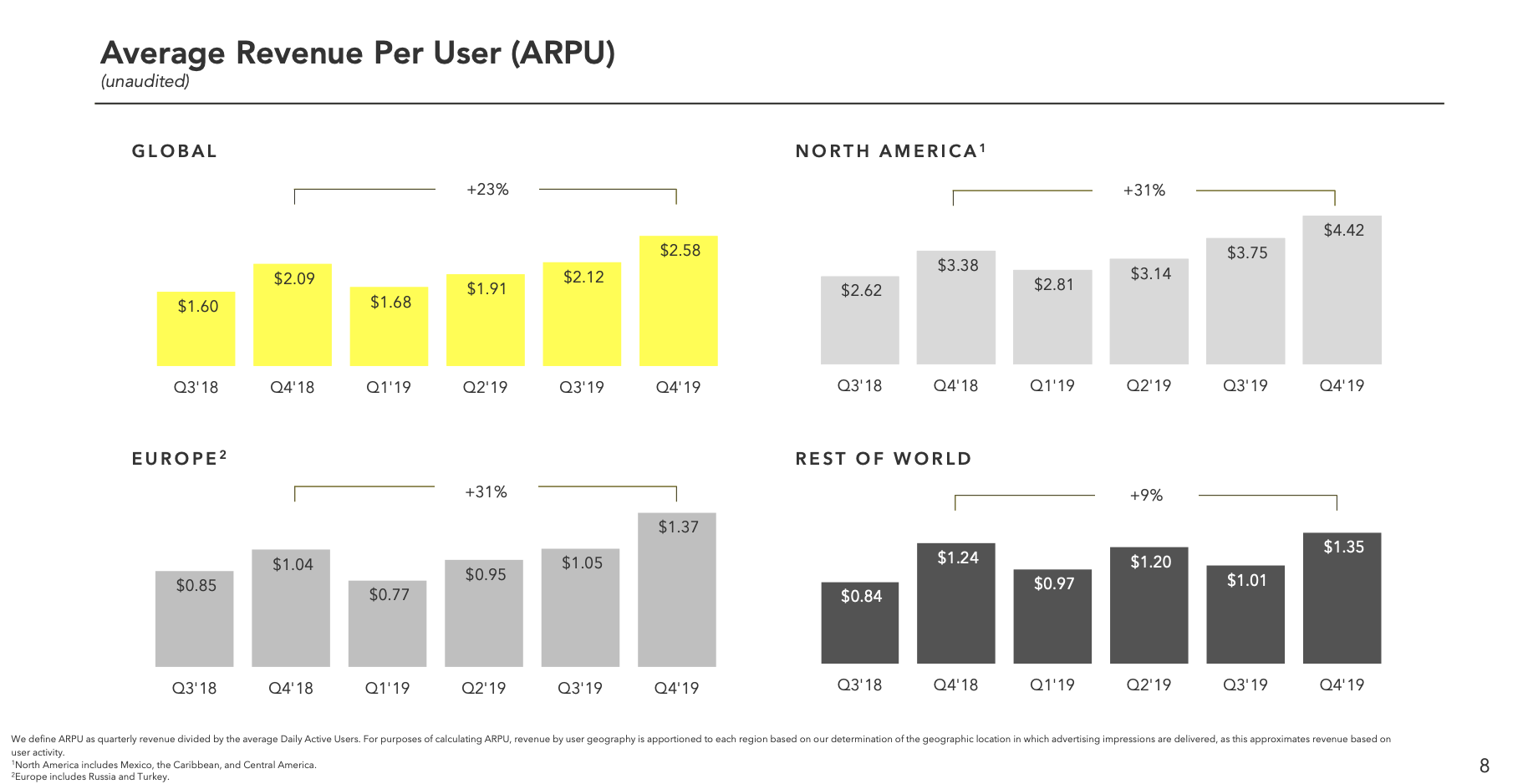

Snapchat's user growth has been on a tear thanks to international penetration, especially in India, after it re-engineered its Android app for developing markets. It gained users in all markets. Crucially, it raised its average revenue per user 23% from $2.09 in Q4 2018 to $2.58, though only from $1.24 to $1.35 in the Rest of World region, where it's growing user count the fastest. Snap will need to figure out how to squeeze more cash out of the international market to offset the costs of streaming tons of video to these users.

Q4 saw Snapchat readying several new products that could help boost engagement and therefore ad views. Cameos, first reported by TechCrunch, lets users graft their face onto an actor in an animated GIF like a lightweight deepfake. Bitmoji TV, which won't run ads initially but could drive attention to Snapchat Discover, offers zany four-minute cartoons that star your Bitmoji avatar. We could see a bump to engagement from these starting in Q1 2020.

To retain its augmented reality filter creators, Snapchat has pledged $750,000 in payouts in 2020. It also expanded the use of product catalog ads, and now lets advertisers buy longer skippable ads.

Outside of the legal settlement, Snapchat is inching closer to profitability, but still has a ways to go. It has managed to develop a strong synergy between its popular chat feature that's tougher to monetize, and the Stories and Discover content where it can inject ads. The big question is whether Facebook Messenger, Instagram and WhatsApp will get more serious about ephemeral messaging that's at the core of Snapchat. If it can hold onto the market and maintain its place as where teens talk, it could ride out its costs and build revenue until it's sustainable for the long-term.

Snapchat launches Bitmoji TV: zany 4-min cartoons of your avatar