You can ask to skip your Apple Card payment for March, Apple tells customers

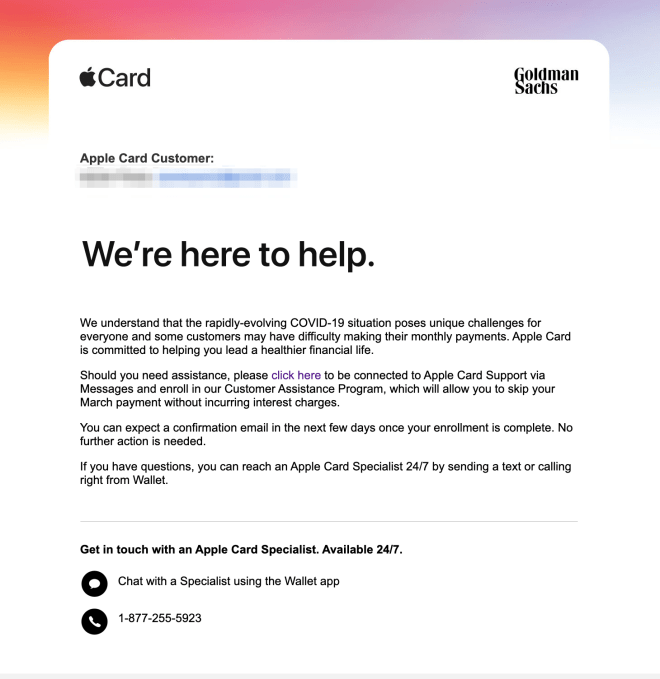

Apple and Goldman Sachs will allow Apple Card holders to skip their March payment without incurring interest by signing up for a Customer Assistance Program, Apple is informing its customers. Existing cardholders were alerted to the option via an email sent out over the weekend, which explains that, in light of the challenges posed by the COVID-19 situation, some customers may have trouble making their usual payment.

"Apple Card is committed to helping you lead a healthier financial life," the email said.

To join the Customer Assistance Program, Apple Card customers can either click the link in the email (here) or message or call an Apple support rep directly through the Apple Wallet app.

The process of joining the program via iMessage is fairly simple. After clicking the link, an automated message responds: "We understand how difficult this could be for you, and we want to help."

You're then directed to connect with Goldman Sachs to continue enrollment.

After clicking on the link that's sent, you receive a second automated iMessage text that explains what the Customer Assistance Program offers - specifically, a way to skip a payment without incurring interest. It then asks if you'd like to join.

Once you request to join, Apple says you can expect to receive a confirmation email in the next few days when your enrollment is complete. No further action is needed.

Though the sign-up process is straightforward - and even easier through iMessage than having to place a call - it's harder to get questions about the program answered via iMessage chat. In a test, we asked the Apple chatbot a question, and it said: "Let me get you to an Apple Specialist at Goldman Sachs." That was over an hour ago, as of the time of writing, and no support rep has yet to answer.

Getting personal support via the provided phone number (1-877-255-5923) was much easier, despite what one rep described as a "surge" in call volumes. After you're informed of the option to join the program via the automated phone system, you can opt to press 2 to connect to a support rep directly. Surprisingly, there was little hold time as of this afternoon - a rep answered almost right away.

We understand the program doesn't have any sort of limit in terms of the balance on your card at the time you're requesting a waiver. But reps couldn't provide any information as to how asking for a waiver would impact your credit report or score. During natural disasters, however, there's a process for lenders to flag customers who have been affected so non-payments won't negatively damage their credit.

Reps also couldn't say if the program would continue into April, as that's not something that's been decided yet.

Apple Card isn't the only card waiving payments.

Citi said earlier this month it had assistance programs in place for customers, including credit-line increases and collection forbearance. PNC Bank, Capital One, Bank of America, Chase, Discover, U.S. Bank, Wells Fargo, Fifth Third and others also recently alerted customers about their respective offers to help during the coronavirus outbreak.

Amex told us it's helping customers, too, when asked.

"American Express is ready to assist our customers having financial difficulties due to the effects of COVID-19. They can reach our Customer Care Professionals anytime by calling the number on the back of their card or through our digital servicing channels - online chat or the Amex app," a spokesperson said. The company said it would work with customers individually on things like waiving late fees, return check fees and interest charges.

"We have several financial hardship programs offering a range of short-term to long-term assistance," they added.

According to NerdWallet's guide to protecting your finances during the coronavirus outbreak, several other lenders and credit card issuers may be working with customers on an individual basis, too.

"Besides working with customers on a one-on-one basis, some banks are making some changes across the board. Citi, for example, began waiving a number of fees on March 9 (for 30 days), including bank account monthly service fees and penalties on early CD withdrawals," a NerdWallet spokesperson noted. "Take advantage of these offerings if you need help, because they can take some of the burden off your plate and give you time to regroup and create a plan for yourself going forward," they said.