Peak Oil, a Specimen Case of Apocalypic Thinking

Photo: Khalid Guerdou/Getty Images

Photo: Khalid Guerdou/Getty Images Predictions of when we would run out of oil have been around for a century, but the idea that peak production was rapidly approaching and that it would be followed by ruinous decline gained wider acceptance thanks to the work of M. King Hubbert, an American geologist who worked for Shell in Houston.

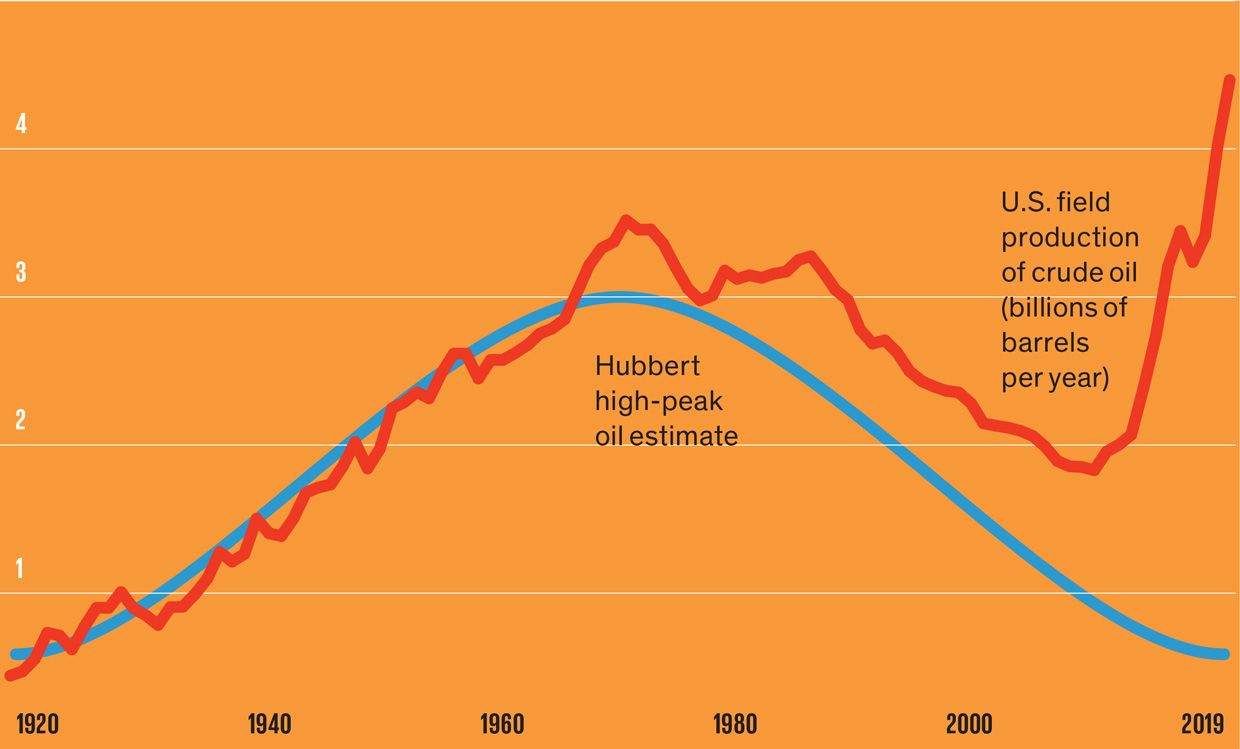

In 1956, he predicted that U.S. oil output would top out during the late 1960s; in 1969 he placed it in the first half of the 1970s. In 1970, when the actual peak came-or appeared to come-it was nearly 20 percent above Hubbert's prediction. But few paid attention to the miss-the timing was enough to make his name as a prophet and give credence to his notion that the production curve of a mineral resource was symmetrical, with the decline being a mirror image of the ascent.

But reality does not follow perfect models, and by the year 2000, actual U.S. oil output was 2.3 times as much as indicated by Hubbert's symmetrically declining forecast. Similarly, his forecasts of global peak oil (either in 1990 or in 2000) had soon unraveled. But that made no difference to a group of geologists, most notably Colin Campbell, Kenneth Deffeyes, L.F. Ivanhoe, and Jean Laherrire, who saw global oil peaking in 2000 or 2003. Deffeyes set it, with ridiculous accuracy, on Thanksgiving Day, 24 November 2005.

Since 2009 the trajectory of the U.S. crude extraction has been on the rise, and it is now surpassing the record set in 1970.These analysts then predicted unprecedented economic disruptions. Ivanhoe went so far as to speak of "the inevitable doomsday" followed by "economic implosion" that would make "many of the world's developed societies look more like today's Russia than the United States." Richard C. Duncan, an electrical engineer, proffered his "Olduvai theory," which held that declining oil extraction would plunge humanity into a life comparable to that of the hunter-gatherers who lived near the famous Kenyan gorge some 2.5 million years ago.

In 2006, I reacted [PDF]to these prophecies by noting that "the recent obsession with an imminent peak of oil extraction has all the marks of a catastrophist apocalyptic cult." I concluded that "conventional oil will become relatively a less important part of the world's primary energy supply. But this spells no imminent end of the oil era as very large volumes of the fuel, both from traditional and nonconventional sources, will remain on the world market during the first half of the 21st century."

Production vs. Prediction Up Again: Peak oil did happen, but still the prophecies of doom have proved false: Oil production is trending up again.

Up Again: Peak oil did happen, but still the prophecies of doom have proved false: Oil production is trending up again. And so they have. With the exception of a tiny (0.2 percent) dip in 2007 and a larger (2.5 percent) decline in 2009 (following the economic downturn), global crude oil extraction has set new records every year. In 2018, at nearly 4.5 billion metric tons, it was nearly 14 percent higher than in 2005.

A large part of this gain has been due to expansion in the United States, where the combination of horizontal drilling and hydraulic fracturing made the country, once again, the world's largest producer of crude oil, about 16 percent ahead of Saudi Arabia and 19 percent ahead of Russia. Instead of following a perfect bell-shaped curve, since 2009 the trajectory of the U.S. crude oil extraction has been on the rise, and it is now surpassing the record set in 1970.

As for the global economic product, in 2019 it was 82 percent higher, in current prices, than in 2005, a rise enabled by the adequate supply of energy in general and crude oil in particular. I'd like to think that there are many lessons to be learned from this peak oil-mongering, but I have no illusions: Those who put models ahead of reality are bound to make the same false calls again and again.

This article appears in the May 2020 print issue as "Peak Oil: A Retrospective."