Is Geothermal Power on the Brink of a Boom?

The post Is Geothermal Power on the Brink of a Boom? appeared first on POWER Magazine.

An erupting geothermal geyser showing areas of geothermally altered ground. Photo credit: Sigurdur William Brynjarsson/Geothermal Resources Council

An erupting geothermal geyser showing areas of geothermally altered ground. Photo credit: Sigurdur William Brynjarsson/Geothermal Resources CouncilAfter several years of stagnancy, prospects for the geothermal power industry are heating up. Over the past year, it has seen a flurry of legislative boosts, an uptick of power purchase agreements, and increased research and development focus and funding.

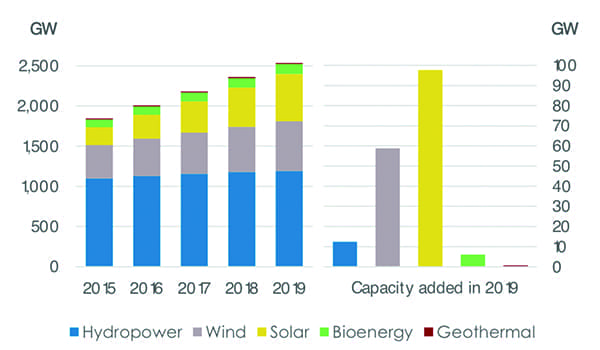

When visualized in the context of all renewable power capacity in 2019, geothermal power's 14 GW contribution is a slim, almost invisible sliver of the 2,537 GW global total. Yet, as a renewable power source, geothermal's technical potential is thought to be substantially larger. In the U.S., which leads the world with an installed geothermal capacity of 2.5 GW-half of it built in the 1980s-the technical potential is 60 GW, according to the Department of Energy's (DOE's) comprehensive June 2019-released GeoVision study. Globally (Figure 1), technical potential is thought to range between 50 GW and 200 GW.

|

1. In 2019, the world's geothermal power capacity stood at 13,931 MW-up 40% from 9,992 MW in 2010, according to the International Renewable Energy Agency (IRENA). In 2019, 682 MW of new capacity came online, with Turkey leading the expansion (232 MW); followed by Indonesia (185 MW); Kenya (160 MW); Italy (33 MW); and the U.S. (14 MW). Courtesy: IRENA |

The slow cumulative growth of the resource has been a cause of concern for its advocates because on its face, it is the perfect renewable. Whereas wind and solar intermittency require reactive flexibility measures, geothermal can provide baseload power and heat. But it can also complement other renewables, providing grid reliability, resiliency, and security both through traditional services, such as regulation reserve, frequency response, and contingency reserves, and nontraditional services, such as flexible capacity voltage control, inertia, and black-start capabilities.

Asked why geothermal's uptake has lagged behind other renewables despite its obvious benefits, Will Pettitt, executive director of international industry trade group Geothermal Resources Council (GRC), pointed to several concerns. The most glaring is that geothermal has been typically limited to areas with suitable hydrothermal reserves. As significantly is that geothermal power development requires relatively high upfront capital costs and carries sizable investment risks because of long project lead times and payback periods. Good market conditions are crucial to help it thrive, Pettitt told POWER in March. Compared to the 1980s, for example, when about 100 MW of geothermal capacity was added in the U.S. each year, installations have slowed, owing largely to their short geographical reach, declining wholesale power prices, and cutthroat competition with other renewables.

An Extraordinary Year for GeothermalThe past year, however, has been so remarkable for the industry that some insiders believe it is on the brink of a boom," Pettitt noted. The DOE's GeoVision study, which essentially outlined specific improvement scenarios that could expand geothermal deployment nearly 26-fold so that it would make up 57% of U.S. baseload renewable generation by 2050, was like a call to action" to federal lawmakers. Last year a record three hearings on the resource were held on Capitol Hill, he said.

Ensuing legislation retroactively revived and extended the full production tax credit (PTC) for geothermal facilities that expired in 2017 through 2020. Congress has also crucially furnished the DOE with more funding to pursue development of enhanced geothermal systems (EGS) on top of the agency's Frontier Observatory for Research in Geothermal Energy (FORGE) project in Utah. That project is one of two endeavors that are seeking to demonstrate EGS, which promises to tap into subsurface heat resources, and essentially remove geothermal's geographical limitations, and advances it has made have already been applied in conventional systems. (The other project is being spearheaded by Bill Gates' Breakthrough Energy Ventures.)

A key initiative of federal EGS research involves improving costs associated with drilling and well construction. As the National Renewable Energy Laboratory's (NREL's) Kate Young explained to the Senate Committee on Energy and Natural Resources last year, the cost of geothermal development is split 50% on the surface (such as for power plants and piping) and 50% below ground. Many of the below-ground costs are borne at the front end of the project development, which can make project financing challenging," she said. And though drilling and well construction activities are present in many industries, time and costs are significantly higher for geothermal."

Because it typically involves boring into harder, hotter rocks, with more lost circulation, geothermal drilling averages about 150-200 feet per day, compared to oil and gas wells that average more than 750 feet per day, and sometimes are as fast as a mile a day (a.k.a. MAD' wells)," she noted. But breakthroughs are possible with the right research focus and funding, such as have been achieved by the oil and gas industry, Young said.

So far, to boost geothermal drilling efficiency in the near-term, NREL has embarked on a number of measures, including holding its first collaborative workshop with oil and gas efficiency experts last year. Research is also underway to develop sensing electronics for data collection, and machine learning to improve geothermal reservoir management. As critically, NREL is focusing on materials development for well construction, which poses another significantly high cost of geothermal development.

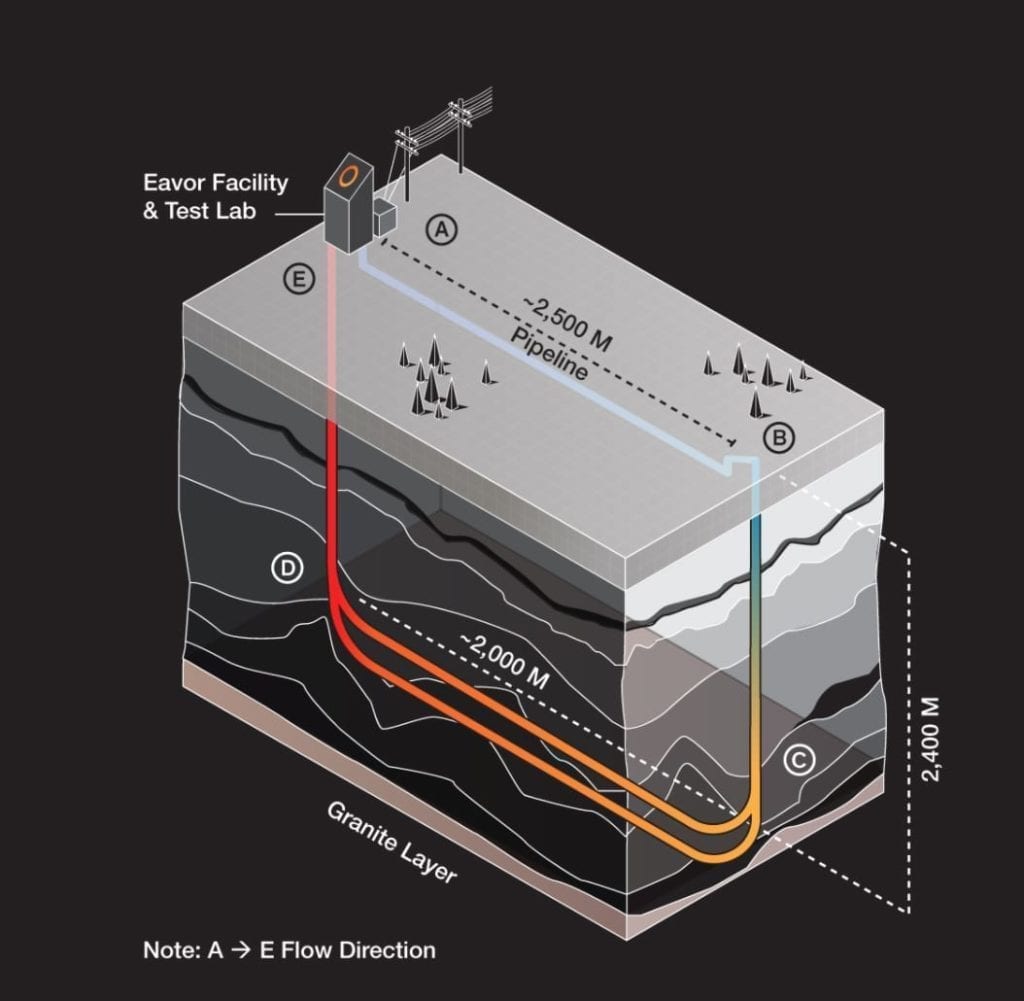

The developments promise insights for EGS, as well as for advanced geothermal systems (AGS), another set of technologies that could reshape geothermal's trajectory. AGS essentially uses horizontal drilling techniques borrowed from oil and gas to drill small, sealed horizontal boreholes between wells to allow for circulation of fluids that bring the heat to the surface. Modeling suggests this can be done feasibly with temperatures as low as 150C," Young said.

At least one project is showing good potential for AGS. This February, Calgary, Alberta-based Eavor Technologies' completed and third-party validated a demonstration of its Eavor-Loop technology at the full-scale Eavor-Lite facility (Figure 2) near Rocky Mountain House in Alberta. Drilling, which began in August 2019, involved using two Precision Drilling rigs to connect two vertical wells through multi-lateral horizontal wellbores at a depth of 2.4 kilometers-essentially to create a closed buried-pipe system. The system uses a proprietary working fluid that is added at the surface and then circulated to harvest heat from deep in the earth. After drilling was completed on time (within 46 days) and construction of surface facilities were constructed, it was commissioned and switched to thermosiphon mode" in December. As well as developing the project, Eavor said it has assembled a multi-year, multi-billion-dollar prospect pipeline," and it is now working with strategic partners and investors to begin first commercial projects.

2. Advanced geothermal system technologies focus on using horizontal drilling techniques to drill small, sealed horizontal boreholes between wells to allow for circulation of fluids that bring the heat to the surface. One example is Eavor Technologies' Eavor-Loop" system, which completed a successful demonstration at the Eavor-Lite facility in Alberta, Canada, in February 2020. Courtesy: EavorIndustry Interest Is Ramping Up

2. Advanced geothermal system technologies focus on using horizontal drilling techniques to drill small, sealed horizontal boreholes between wells to allow for circulation of fluids that bring the heat to the surface. One example is Eavor Technologies' Eavor-Loop" system, which completed a successful demonstration at the Eavor-Lite facility in Alberta, Canada, in February 2020. Courtesy: EavorIndustry Interest Is Ramping UpFor now, however, The immediate future for geothermal power is conventional' geothermal, where you seek hot water in place," said Pettit. Though burdened by protracted regulatory timelines, the industry at least has the backing of state environmental goals. I think any form of policies that can help alleviate the risk on the projects are really welcomed by the industry," he said. So far, at least 25 states and the District of Columbia include geothermal as an approved resource to meet renewable portfolio standards (RPSs).

Meanwhile, more immediate-and heartening-signals that interest in geothermal is surging has been an uptick of signed power purchase agreements (PPAs). Last year, there were one or two, and so far in 2020, there are six PPAs in place," said Pettitt. These include one for supply to Utah (from a Cyrq Energy plant in Nevada); one to Hawaii from an Ormat plant; and the other three to California.

As Pettitt noted, while California has always been a hotbed for geothermal activity-in 2018, it produced 11.5 GWh from 43 operating geothermal power plants (most concentrated north of San Francisco in the Geysers resource area)-it hasn't built new geothermal plants in nearly a decade. But since 2018, when it adopted a 100% by 2045 RPS, the state's focus, previously heavy on wind and solar additions, has re-engaged with geothermal for its reliability value. The PPAs will bolster completion of a 14-MW Ormat project in Mono County that is slated to come online in 2021; two Open Mountain Energy projects in Nevada with a total capacity of 15.5 MW; and the massive 140-MW Hell's Kitchen project being developed by Australian firm Controlled Thermal Resources (CTR) in Imperial County near the Salton Sea.

Lithium Recovery-a Lucrative Revenue Prospect The Salton Sea, a shallow, highly saline, rift lake located in a closed basin that lies more than 200 feet below sea level in an unforgiving desert landscape in Riverside and Imperial Counties in Southern California, is characterized by hot springs, boiling mud pots, and mud volcanoes. Considered by some as the richest source of geothermal energy in the U.S., geothermal exploration has been ongoing at the southern end of the 35-mile-long butternut squash-shaped body for more than 40 years, and today, it hosts 14 geothermal power units. Interest in exploiting the region's mineral-rich geothermal brine has also been explored for years. One notable project that is making headway is Australian firm Controlled Thermal Resources's Hell's Kitchen integrated power plant, which would produce geothermal power as well as directly extract lithium from its geothermal brine. Courtesy: CTR

The Salton Sea, a shallow, highly saline, rift lake located in a closed basin that lies more than 200 feet below sea level in an unforgiving desert landscape in Riverside and Imperial Counties in Southern California, is characterized by hot springs, boiling mud pots, and mud volcanoes. Considered by some as the richest source of geothermal energy in the U.S., geothermal exploration has been ongoing at the southern end of the 35-mile-long butternut squash-shaped body for more than 40 years, and today, it hosts 14 geothermal power units. Interest in exploiting the region's mineral-rich geothermal brine has also been explored for years. One notable project that is making headway is Australian firm Controlled Thermal Resources's Hell's Kitchen integrated power plant, which would produce geothermal power as well as directly extract lithium from its geothermal brine. Courtesy: CTR While development of CTR's Hell's Kitchen project began in 2014 and the plant has yet to be built, it points to a lucrative new direction for geothermal power: co-production via the direct extraction of lithium-and potentially other minerals-from geothermal brine. As Young explained to the Senate Committee last year, geothermal power plants produce a large volume of brine, which contains dissolved chemical components, including critical and strategic minerals-such as lithium, manganese, copper, silver, and even gold-at various concentrations.

Brine mineral recovery is not a new concept, and it has been explored for years. Owing to the explosion of demand of lithium for batteries in recent years, Currently, there is a plethora of potential lithium recovery processes with little confirmation of their bankability, economics, and experience operating in realistic conditions," she said. But as Pettitt explained, the reason industry is closely watching the CTR project is because its novel extraction method promises to boost the value of geothermal co-production in Salton Sea, at least, where active power plants alone have reported the potential to produce nearly 90,000 metric tons per year of lithium.

|

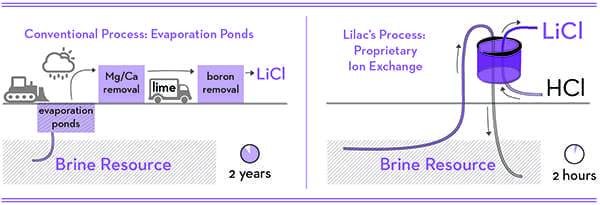

3. Controlled Thermal Resources' 140-MW integrated lithium extraction and geothermal plant will use Lilac Solutions' ion-exchange technology to extract lithium from mineral-rich geothermal resources at the Salton Sea in Imperial Valley, California. This graphic illustrates Lilac's proprietary process in comparison to conventional evaporation pond mining. Courtesy: Lilac Solutions |

As CTR's Chief Operating Officer Jim Turner, who has managed geothermal power plants in the Salton Sea region for more than 20 years, noted, extracting lithium from geothermal brines traditionally involves mining of hard rock or evaporation ponds, which have come under increasing scrutiny for negative environmental impacts. One of the issues with past attempts to extract lithium from geothermal brines was bolting-on' lithium extraction systems downstream from existing power plants. These systems were basically force-fed' spent brine, which was not ideal," Turner said. CTR will use Oakland, California-firm Lilac Solutions' direct lithium extraction (DLE), which is a closed-loop system that returns spent brine to its original source, uses 100% renewable power and steam for processing, and takes hours-not months-to produce (Figure 3). That means, as CTR notes on its website, the project is essentially an integrated lithium extraction and geothermal plant."

To date, the company and its project management partner Hatch Ltd. have completed a preliminary economic assessment, which means it's fully permitted and could begin delineation well-drilling and pilot-plant construction by the end of this year (though the COVID-19 pandemic may affect planned timeframes). As part of the first stage, which it plans to conclude by 2023, CTR will deliver its first 17,350 metric tons of battery-grade lithium carbonate, along with 140 MW of geothermal power. About 95 MW of that power will be sold to regional utilities, including through the 25-year PPA it snagged this January with Imperial Irrigation District for a maximum hourly generation of 40 MWh. About 35 MW will be used for steam provided to the lithium plants, and 10 MW will be consumed internally." In the second stage, which CTR plans to conclude in 2025, lithium carbonate production will be scaled up to 34,700 metric tons per annum at estimated first quartile production costs."

CTR, which is still seeking investors, has said its prospects for the novel project were bolstered by the California Public Utilities Commission's 2019 mandate to purchase 1,700 MW of new geothermal power by 2030. As CTR CEO Rod Colwell noted in April, To put that number in perspective, that's around a 60% increase in new geothermal power development in less than 10 years." Combining this with production of battery-grade lithium-demand for which is forecast to outstrip supply by 2023-the company is powerfully positioned," he said.

-Sonal Patelis a POWER senior associate editor.

The post Is Geothermal Power on the Brink of a Boom? appeared first on POWER Magazine.