Lime takes over JUMP as part of big Uber investment deal

Lime's green bikes are gone, but now the company owns JUMP and its formerly-competing red bikes.

Seattle's final operational bike share service just changed hands in yet another major shakeup in the private bike share saga.

Uber led a $170 million investment in a majorly devalued Lime, and Lime will take on Uber's JUMP bike and scooter service as part of the deal. Though no valuation was made public, The Information reports that Lime's value had dropped to $510 million, 79% lower than its valuation during its previous round of investments.

It's not yet clear what this means for JUMP bike share service in Seattle, given that scooter-focused Lime pulled its own competing e-bikes from Seattle streets in December. Will Lime see this an opportunity to get back into bikes with better bikes? Lime's e-bikes were often broken and had some dangerous battery fire problems. The company's bike operations in Seattle never seemed to recover from a summer 2019 warehouse fire caused by an exploding battery.

Or will Lime kill JUMP and continue focusing on scooters? If they do, that could essentially be the end of fully private bike share. Lyft owns Motivate, the operator of major systems like Biketown in Portland, Citibike in New York and Divvy in Chicago. But though Lyft has long been in the permitting process for launching in Seattle, they have not done so.

For now, JUMP bikes can still be unlocked using the Uber app, though Lime announced on Twitter that users will soon be able to unlock JUMP bikes through the Lime app:

Big News! Starting soon, you will be able to unlock JUMP bikes and scooters through the Lime app! 2nd Street with the deets!

https://t.co/nB5RFqKj4S

- Lime (@limebike) May 7, 2020

Though private bike share was clearly already struggling, the outbreak has been tough for companies that were already operating without turning profits. Lime had to close markets across the world, and it's not clear how eager people are going to be to touch shared bikes and scooters for the duration of the outbreak. JUMP staff have been disinfecting bikes whenever they are serviced, but not between all uses. It is up to users to take precautions.

Meanwhile, demand for buying (and repairing) personal bikes seems strong, though sales figures are complicated by the fact that so many bike sellers, distributors and makers have been closed for all or some of the outbreak period. Shimano, a major bike component maker, says first quarter sales were down 15% versus a year earlier. As with so many things right now, it may be a while before we really understand the impact of COVID-19 on the bike industry at large.

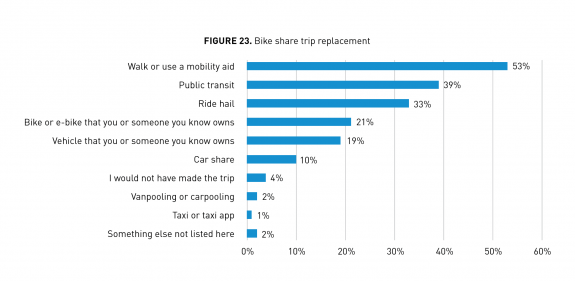

SDOT measured 2.2 million bike share trips in Seattle in 2019 between Lime and JUMP. A third of users said they have replaced ride hailing trips (like Uber) with bike share. 20% said they have replaced private car trips. And more than a third of users said they use bike share to connect to transit.

From SDOT. Users could pick more than one (so they do not add up to 100%).

Hopefully, JUMP bikes continue operating in Seattle. Bike share's popularity has been a major reason biking was increasing so quickly before the outbreak hit. It's not just the trips on bike share that matter, it's also the fact that bike share helps people get back into biking in general. Bike share trips do not account for all the growth, but having bike share around likely inspired many people to give city biking a try.

Hopefully, JUMP bikes continue operating in Seattle. Bike share's popularity has been a major reason biking was increasing so quickly before the outbreak hit. It's not just the trips on bike share that matter, it's also the fact that bike share helps people get back into biking in general. Bike share trips do not account for all the growth, but having bike share around likely inspired many people to give city biking a try.

But prices rose a lot last year, now at $0.25 per minute for a JUMP bike, and the number of competitors keeps shrinking. It may be wise to start thinking about the value city's get from bike share and what role governments should play in making sure convenient and affordable bike share is available. But, of course, major budget shortfalls are coming to all levels of government due to the outbreak, making any near-term talk of public bike share investment tough.