AngelList wants to improve comparing VC fund performance with new metrics and calculator

There is immense opacity in the venture capital industry, and that has made comparing venture funds notoriously difficult.

Traditional benchmarks calculated by groups like Cambridge Associates bucket VC funds into vintage years" and place funds into quartiles based on metrics like IRR (rate of return adjusted for time) and DPI (or the amount of capital returned to limited partners against dollars paid into a fund). Everyone strives to be in the first quartile (the top 25%), and many fund CFOs have a bevy of tricks to squeeze a few more points out of their metrics to get their funds above that key cutoff line.

Comparing performance gets even more challenging though as you get more granular with the data. Let's say a fund invested into a startup at the seed, did a follow on in the series A, and did pro rata investments in the series B and C rounds. When the company exits, the acquirer pays for the investment with three tranches of cash over 18 months. How do you calculate IRR? How do you make that comparable with other funds and their underlying portfolio investments?

AngelList hopes that its latest project can start to solve these challenges, and in the process, bring more transparency to performance within the VC asset class.

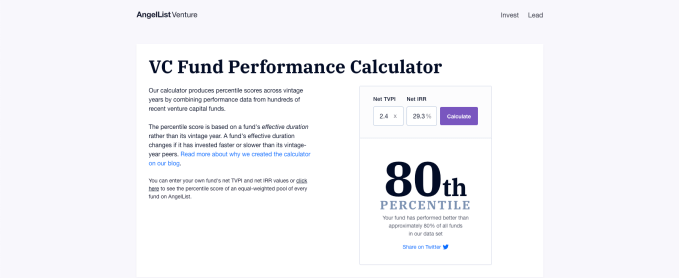

The company's data science team built out a fund performance percentile calculator" for its fund managers to compare their performance against other funds using detailed data from AngelList's own syndicates and funds plus performance data from other sources. Going beyond quartiles, the calculator provides a specific percentile score of each fund's performance.

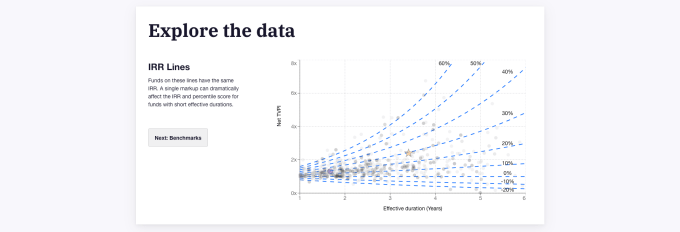

Underlying this calculator is a redefined notion of the investment window for VC funds which AngelList calls effective duration." This gets at the problem I noted earlier where a VC fund might invest multiple times into one startup or spreads its investments over multiple years - how do you benchmark when those investments really take place? Aggregating all investments made over several years into a single vintage year" or all exit returns for an investment into a single exit date" seems like a blunt instrument, and so the calculator weights performance based on capital invested and returned over time, providing a more direct comparison between funds regardless of the velocity of their investments.

Photo via AngelList

Abe Othman, the head of data science at AngelList and the leader of this project, explained that using effective duration" removes a lot of the ambiguity and gamesmanship around VC benchmarking.

He gives the example of how VC funds often keep large sums of their committed capital in reserve as a way to invest in future rounds of their portfolio companies. That process has the secondary benefit of inching up IRRs, since the capital deployed by the fund is committed later in the fund's life cycle.

One of the interesting things about my job is having the data to discover the mathematical groundings of a lot of venture folk wisdom, and I think kind of one of the things that came through in the study here," Othman said.

Building the actual percentiles required a large dataset of venture performance, and few organizations have that level of detail available outside AngelList and groups like Cambridge Associates. Othman said we used more than 400 funds to make this calculator," which is why it can be so precise in terms of percentile score for fund performance.

One interesting note Othman made about what the percentiles show is that even scores that might seem very low, say the 40th percentile, can actually still have good underlying IRR metrics.

Photo via AngelList

AngelList is using the data internally as part of its own fund-of-funds to direct money to top performing managers. This is not about sort of releasing data that we have on how big name venture funds are performing and how our venture funds do better," Othman said. It's more about allowing the emerging managers that we host on our platform to identify themselves as being top performers, share their data, and hopefully help them raise more money in the future."

Outside AngelList, Othman and his team hope that the new calculator and updated metrics will eventually help to make the venture industry more transparent and ultimately better able to communicate the asset class' returns.