A new $12 billion US chip plant sounds like a win for Trump. Not quite.

On Friday, May 15, the Taiwan Semiconductor Manufacturing Co. (TSMC), the world's largest contract chipmaker, announced that it will build a $12 billion plant in Arizona, to open by 2024. It expects the facility to employ roughly 1,600 people and indirectly generate thousands of other jobs.

At first blush, the announcement looks like a victory for the Trump administration, which has been pushing to disentangle its technology supply chain from China-both by regaining its high-tech manufacturing capacity from Asia and by cutting off its own equipment and intellectual property from Chinese tech giants like Huawei. But the impact of the TSMC deal is far from clear cut and instead highlights just how intertwined the countries' supply chains really are.

TSMC is one of only three manufacturers in the world that produce the most advanced computing chips-those containing transistors 10 nanometers or smaller. The other two are South Korea-based Samsung Electronics and US-based Intel, which mostly reserves its advanced chips for its own products. For comparison, China's largest domestic chipmaker, Semiconductor Manufacturing International Corp. (SMIC), can't produce anything smaller than 14-nanometer chips. Because of this, TSMC has increasingly found itself at the center of US-Chinese competition for technological dominance.

Among TSMC's largest customers are both Apple and Huawei, which the US Department of Commerce placed on its so-called entity list last year. Huawei's inclusion on the list, along with 114 of its related affiliates, banned US companies from selling their technology to those firms without a special license. The department said the decision was made on the grounds of national security. It's no coincidence that Huawei also plays a critical role in China's technological development and expansion overseas, especially with the country's AI and 5G strategies.

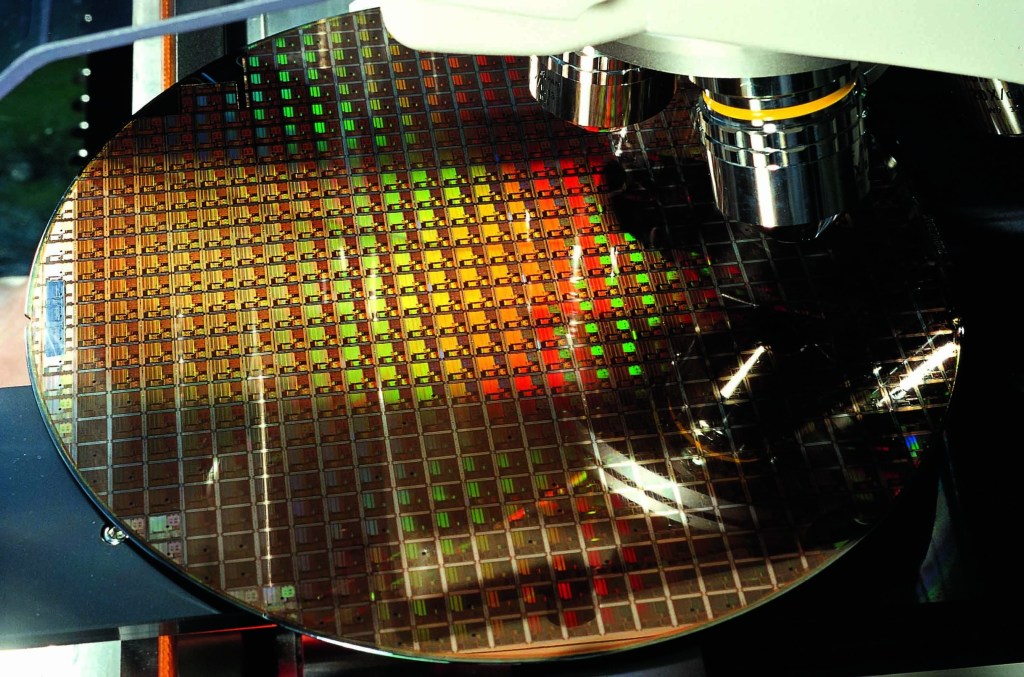

A silicon wafer in TSMC's fabrication lab.TAIWAN SEMICONDUCTOR MANUFACTURING CO., LTD

A silicon wafer in TSMC's fabrication lab.TAIWAN SEMICONDUCTOR MANUFACTURING CO., LTDBut the initial blacklist didn't affect TSMC because it is not a US company. This offered Huawei a loophole to continue accessing the cutting-edge chips used to power its smartphones, AI projects, and 5G networks. On May 15, hours after TSMC's plant announcement, the Department of Commerce sought to tighten that loophole by updating its export rules. Under the expanded regulations, any non-American chip producers that use American chipmaking equipment must also obtain a special license in order to sell to Huawei. Because the US is one of only a handful of countries dominating the design and production of such high-precision manufacturing equipment, which can often cost north of $100 million per machine, the rules thus bind TSMC as well as other advanced chipmakers that would be hard pressed to find alternatives. This effectively places Huawei's supply of chips under the US Commerce Department's control. As of May 18, TSMC had already stopped accepting Huawei's orders, according to Nikkei Asian Review.

Semiconductor equipment is the weak link in China's supply chain that America is really zooming in on," says Neil Thomas, a senior research associate at the think tank Macro Polo, who studies US-China relations and the semiconductor supply chain. Huawei can design state-of-the-art chips, just as good as perhaps chips that Apple can design. But what China can't do is actually build those chips."

Within this context, the planned plant takes on additional meaning. On Monday, the blow intended for Huawei inadvertently struck TSMC, which saw its stock price slip by 2.5% along with other Huawei suppliers. Some analysts now foresee the US Commerce Department granting it a license to continue selling to Huawei anyway, in order to keep the company on good terms to carry out its $12 billion deal. Whether TSMC made its announcement with knowledge of the upcoming change to the export ban is unclear, but Reuters reported that the decision to locate the plant in the US has already generated good will" within the department all the same.

The plant will do little to affect US reliance on Asia-based manufacturing. It is slated to produce 20,000 wafers a month once it opens-only a small fraction of the 12 million wafers that TSMC made last year alone. And by the time the plant opens, the 5-nanometer chips that it is designed to produce will no longer be the most cutting-edge chips available. The company already has plans to move to 3-nanometer chips and smaller in its Taiwan-based plants during the next few years. Given the capital costs and time it would take to transition the Arizona plant to the latest technology, this means the US would still need to maintain its supply of chips from overseas plants to access the newest advancements.

In order words, the plant will do nothing to disentangle the two countries' supply chains from each other. It's probably too small to really have any huge impact on the global picture," Thomas says.

Inside a TSMC fabrication facility.TSMC

Inside a TSMC fabrication facility.TSMCIf the expanded export ban did in fact hold, it could also introduce unintended consequences. China accounts for a lion's share of the revenue for a number of American semiconductor companies, such as Qualcomm, which relies on the country for two-thirds of its income. In the long term, the lost sales to Huawei and potentially the broader Chinese market could slow US innovation in chipmaking. Capital expenditure and research and development are really high in the semiconductor industry-about 30% of total revenue," Thomas says.

In recent years, the trade war has spurred China to double down on investing in its semiconductor industry. On the same day as the US government's updated export ban, the Chinese government announced a $2.2 billion injection into its largest domestic chipmaker, SMIC. The country's hope is that Chinese chipmakers will catch up to the state of the art within a few years and complete its domestic supply chain for cutting-edge computing hardware. In the interim, Huawei would rely on the TSMC chips that it has been stockpiling for a year, in anticipation of further US restrictions.

Thomas says there are still a lot of unknowns as to how this will shake out. The uncertainty is to what extent China can innovate itself out of this dilemma," he says.

Either way, TSMC's Arizona plant isn't so much a signal of the Trump administration's success in reshoring high-tech manufacturing. Instead, its presence highlights a complicated network of relationships that may eventually be severed on China's terms rather than the US's.

The US is taking a gamble," Thomas says.