UK’s Drover raises $26M for to take its car subscription marketplace to Europe

The future of transportation is in flux, and that continues to provide opportunities for tech companies to build solutions provide new ways for us to get from A to B. In the latest development, a startup out of the UK called Drover that provides access to flexible car subscriptions for private users - longer than a typical rental, shorter than a lease or purchase, and easy to shorten or extend as needed - is announcing some funding to continue its growth.

The company has picked up 20.5 million ($25.7 million) in a round of funding co-led by three firms: Target Global, RTP Global (the Russian company formerly known as ru-Net) and Autotech Ventures. New investors Channel 4 Ventures and Rider Global, as well as previous backers Cherry Ventures, BP Ventures, Partech, Version One and Forward Partners all also participated. Drover is not disclosing its valuation, and it's raised 27.5 million to date.

The plan, CEO and founder Felix Leuschner said in an interview, is to use the money to continue investing in the technology it uses to calibrate prices and personalise offers for individuals, as well as to hire more talent and gear up for more expansion. Founded in the UK, Drover opened France earlier this year, but in theory, wherever cars are sold and used is game. Drover's growth to date seems to point to it being a strong candidate for driving ahead to new frontiers.

That's because despite the huge drop in the economy in the last several months because of COVID-19, perhaps because of its flexible model - fitting for when you don't know what is coming around the corner - Drover has seen business go up.

May and June have been our best two months on record for us since launching three years ago," said Leuschner, who added that it is continuing to see an acceleration in the business, doubling in revenues year on year. Every month should be the best month when you're a growing startup, but we've seen acceleration even beyond that."

Car ownership is going through an critical phase at the moment.

It was not that long ago when many people believed that the Ubers of the world, combined with other innovations in transportation like autonomous driving, improved public and communal transport models, on-demand rentals and new vehicles like electric bikes and scooters, would all combine to make it easier for individuals to forego traditional private car ownership altogether - the idea being that collectively, they would provide an economical, convenient and eco-friendly enough mix to make buying and maintaining a car obsolete.

That idea might still have some mileage longer term (excuse the pun!), but current events have thrown it for a loop: the COVID-19 pandemic has meant that people are staying at home a lot more, and when they do go out, many are proactively eschewing transportation forms that involve sharing space or touching surfaces that others have touched.

We think this will lead to a renaissance for cars," Leuschner said - a fact echoed by its investors.

Drover offers an attractive and affordable alternative to car ownership, which has proven to be extremely robust during the recent COVID-19 crisis with record high subscriber bookings," said Anton Inshutin, partner at RTP Global, in a statement. We fully share in Felix's vision for Drover as the future European leader in the car-as-a-service market, and offered our support to the company in both Series A and Series B financings."

But even without a global health pandemic, there were a number of signals that pointed to the fact that disruption" might not have been a quick and seamless transition anyway. We're a long way off from actual autonomous cars (you know, the ones that are predicted to be so expensive and tricky to maintain that most will not own them but will subscribe to services to be driven around). The Ubers of the world haven't actually sorted out their unit economics. Scooters can be dangerous. Etc.

For better or worse, all of that brings us back to private cars, and the opportunity to play around with different ways of providing these to individuals, opening the door to companies like Drover to tap those who may have started to part with the idea of owning a car outright, but have yet to let go of the idea of using a private car altogether.

For better or worse, all of that brings us back to private cars, and the opportunity to play around with different ways of providing these to individuals, opening the door to companies like Drover to tap those who may have started to part with the idea of owning a car outright, but have yet to let go of the idea of using a private car altogether.

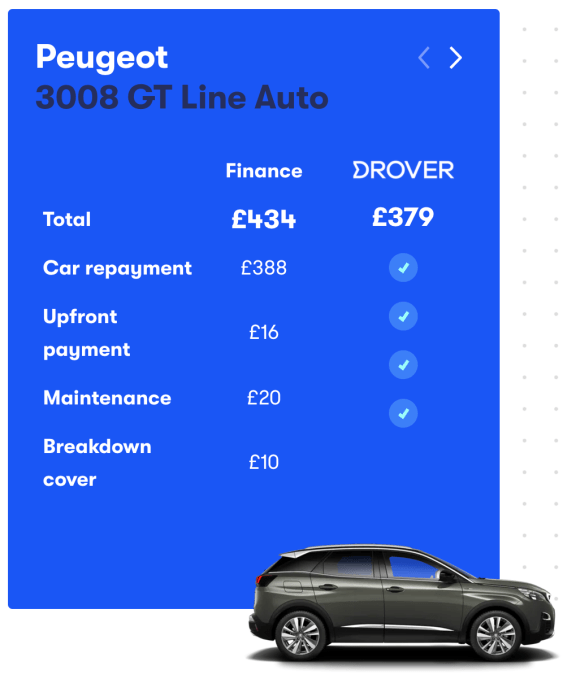

Target demographics, Leuschner said, are people in their 20s and 30s who have some disposable income for a car and are more likely to be keen to pay the premium on incremental ownership to forego total cost of ownership, if it proves to be cheaper than leasing for the one-month minimum of usage on Drover (which appears to be Drover's main competitor).

Not all is FairOthers have attempted to tackle the subscription car market before, also focusing on customers that want to have the use of cars for more than just an hour or a day or even a week but don't want to pay out to own them outright or get locked into long leases.

One of those - Fair in the US - looked to be especially promising with big-name founders raising hundreds of millions of dollars in equity and debt from companies including Softbank. But it ultimately faced a spectacular implosion, unable to get the business model right.

Leuschner contends that while Drover might sound like the same model as Fair, it's actually a very different vehicle on the inside. For starters, some two-thirds of its inventory is sourced from dealerships, OEMs and others that distribute cars.

They use Drover as another channel, in part to diversify distribution, and in part as a way of tapping stock that it's not able to sell through other channels. The remaining one-third is bought in by Drover, which means that the startup gets better margins on those vehicles as the owner of the vehicles, but also means higher risk for the startup - one of the areas where Drover's technology comes into play.

It's an optimisation game for us," said Leuschner. When you have open inventory you get a better margin but more risk. We are at that point where we know what the best vehicles are for our customer base and we have a lot of data and trading history. We're comfortable taking some risk and higher margin structure in those cases."

Another key difference is that Drover is also only focusing squarely on private individuals, rather than working on subscriptions for professional drivers. That has meant that the drop off in business from those users, which some car leasing companies have seen as a knock-on effect from the fall in demand on ridesharing platforms, hasn't had an impact for Drover.

It's nonetheless a big market with many opportunities for growth. Online car sales are still only one percent of all sales in the UK, he said, which is far below the rate of sales for retail goods at 20% (one reason that might be obvious: the bigger the ticket, the more likely people will want to see the goods in person). All of that is gradually shifting - not least because more recognised names are coming into the fold, and providing more legitimacy and guarantees in the process, and that opens the door to companies like Drover, too

By tapping into ongoing digitalisation and on-demand trends in tandem, Felix and his team are well poised to aggressively seize market share from traditional car retailers," said Ben Kaminski, partner at Target Global, in a statement. This new capital injection is a testament to both the team and the tech behind Drover which is disrupting the car-ownership model for the better. We're excited to offer our support as Drover continues to scale throughout Europe."

Daniel Hoffer, MD at Autotech Ventures added in his own statement: After studying the European landscape closely, we believe that Drover's unique focus on a next-generation customer experience enabled by an asset-light approach has the potential to revolutionize how Europeans relate to car ownership. Bolstered by strong execution, Drover is poised to emerge stronger as a result of COVID-19 and recession-driven changes to consumer preferences in the ground transportation domain."