The Not Company, a maker of plant-based meat and dairy substitutes in Chile, will soon be worth $250M

The Not Company, Latin America's leading contender in the plant-based meat and dairy substitute market, is about to close on an $85 million round of funding that would value it at $250 million, according to sources familiar with the company's plans.

The latest round of funding comes on the heels of a series of successes for the Santiago-based business. In the two years since NotCo launched on the global stage, the company has expanded beyond its mayonnaise product into milk, ice cream and hamburgers. Other products, including a chicken meat substitute, are also on the product roadmap, according to people familiar with the company.

The Not Company is looking to start a food revolution from Chile

NotCo is already selling several products in Chile, Argentina and Latin America's largest market - Brazil - and has signed a blockbuster deal with Burger King to be the chain's supplier of plant-based burgers. It's in this Burger King deal that NotCo's approach to protein formulation is paying dividends, sources said. The company is responsible for selling 48 sandwiches per store per day in the locations where it's supplying its products, according to one person familiar with the data. That figure outperforms Impossible Foods per-store sales, the person said.

NotCo is also now selling its burgers in grocery stores in Argentina and Chile. And while the company is not break-even yet, sources said that by December 2021 it could be - or potentially even cash flow positive.

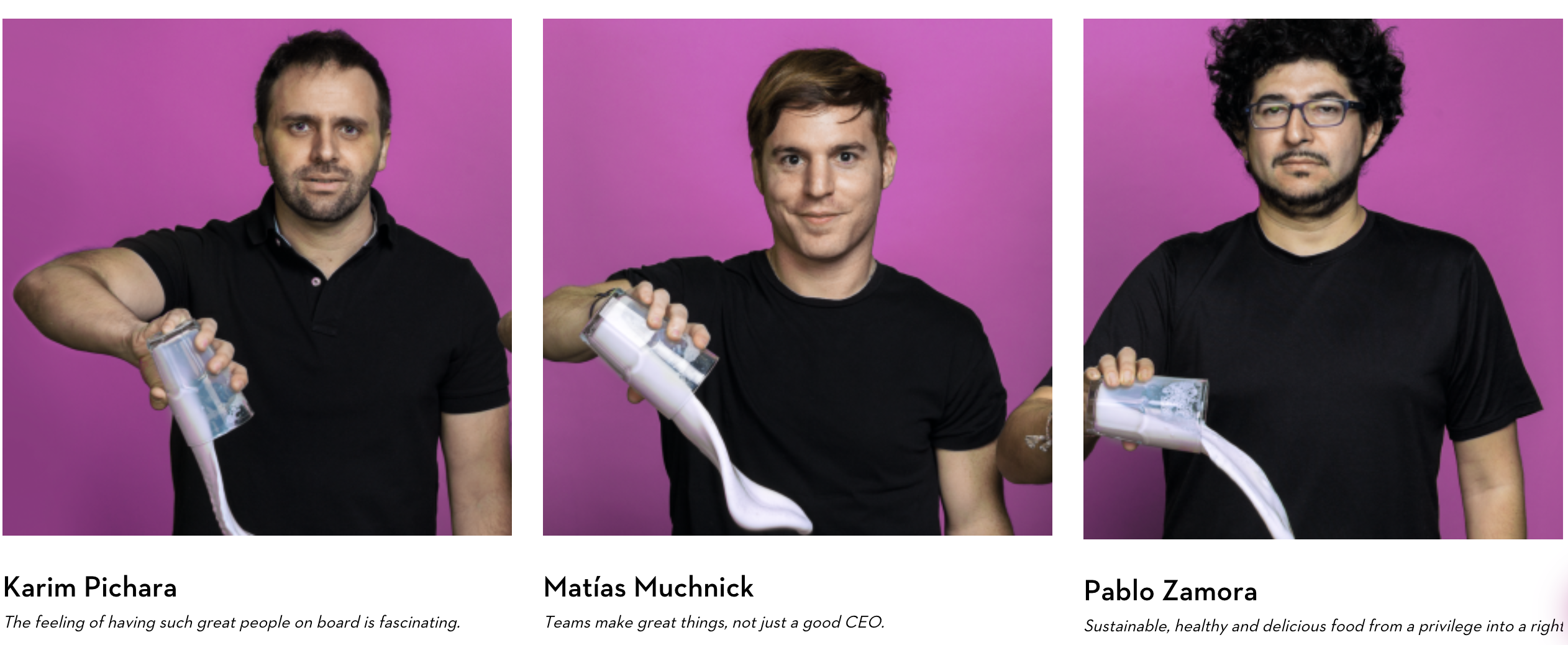

NotCo co-founders Karim Pichara, Matias Muchnick and Pablo Zamora. Image Credit: The Not Company

With the growth both in sales and its diversification into new products, it's little wonder that investors have taken note.

Sources said that the consumer brand-focused private equity firm L Catterton Partners and the Biz Stone-backed Future Positive were likely investors in the new financing round for the company. Previous investors in NotCo include Bezos Expeditions, the personal investment firm of Amazon founder Jeff Bezos; the London-based CPG investment firm, The Craftory; IndieBio; and SOS Ventures.

Alternatives to animal products are a huge (and still growing) category for venture investors. Earlier this month Perfect Day closed on a second tranche of $160 million for that company's latest round of financing, bringing that company's total capital raised to $361.5 million, according to Crunchbase. Perfect Day then turned around and launched a consumer food business called the Urgent Company.

These recent rounds confirm our reporting in Extra Crunch about where investors are focusing their time as they try to create a more sustainable future for the food industry. Read more about the path they're charting.

Meanwhile, large food chains continue to experiment with plant-based menu items and push even further afield into cell-based meat using cultures from animals. KFC recently announced that it would be expanding its experiment with Beyond Meat's chicken substitute in the U.S. - and would also be experimenting with cultured meat in Moscow.

Behind all of this activity is an acknowledgement that consumer tastes are changing, interest in plant-based diets are growing, and animal agriculture is having profound effects on the world's climate.

As the website ClimateNexus notes, animal agriculture is the second-largest contributor to human-made greenhouse gas emissions after fossil fuels. It's also a leading cause of deforestation, water and air pollution and biodiversity loss.

There are 70 billion animals raised annually for human consumption, which occupy one-third of the planet's arable and habitable land surface, and consume 16% of the world's freshwater supply. Reducing meat consumption in the world's diet could have huge implications for reducing greenhouse gas emissions. If Americans were to replace beef with plant-based substitutes, some studies suggest it would reduce emissions by 1,911 pounds of carbon dioxide.