Six Investing Trends Reshaping Power and Utilities Sector Despite COVID

The post Six Investing Trends Reshaping Power and Utilities Sector Despite COVID appeared first on POWER Magazine.

Investors in the global power and utilities sector embraced agendas that created long-term value during the first half of this year, as the COVID-19 pandemic roiled the world. Recent activity points to several interesting trends that will likely persist in a post-crisis world and may even accelerate change in the sector, new analyses from global consulting firm Ernst & Young (EY) suggests.

According to EY's Aug. 6-released Power and Utilities Transactions and Trends report, during the first half of 2020, the Power & Utilities (P&U) sector saw global deal value soar to $58.8 billion-a 24% increase compared to the same period in 2019-but much of it was in Asia-Pacific, Europe, Africa, and the Middle East.

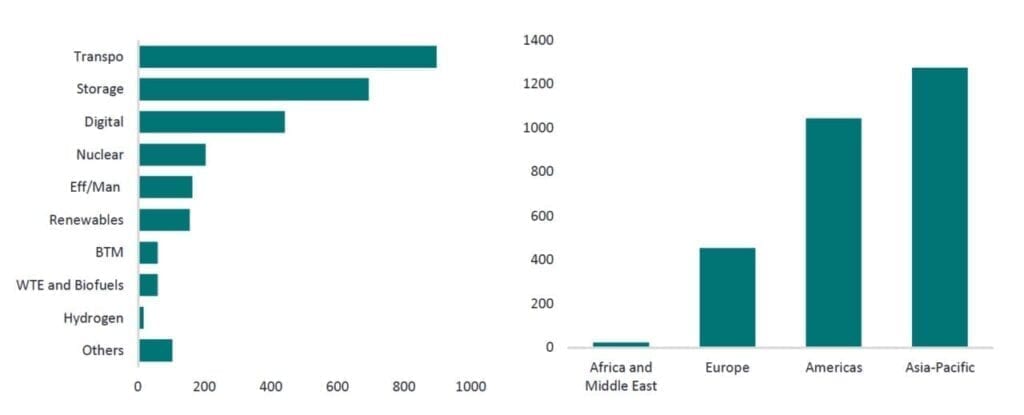

The total venture capital funding in technology for the period was $2.8 billion, most of which was invested in electric transport, storage, and digital platforms. And despite the pandemic-prompted rollercoaster ride," debt and equity capital markets ended the first half on a positive note," said Miles Huq, a partner at EY Strategy and Transactions.

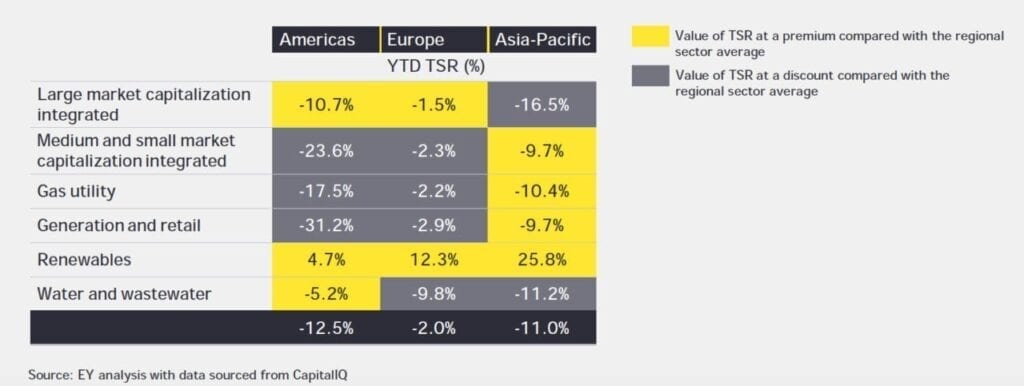

Still, total returns were eroded across the global P&U segment, and utilities generally underperformed when compared to respective regional benchmarks through the end of the first half. A look at the regional broader market indexes indicate 1H 2020 period ended down only -3.1% (S&P US 500); -2.0% (STOXX Europe 600); and -4.9% (NIKKEI Asia-Pacific 225). However, the EY P&U analyses for Americas, Europe and Asia-Pacific have lagged and are down -12.5%, -2.0% and -11.0%, respectively, during 1H 2020," Huq said.

The relative underperformance of the P&U sector is puzzling, given the sector's defensive profile offering superior dividend yield to investors and considering most P&U companies are well-capitalized and have enjoyed access to the capital markets through the worst of the pandemic thus far."

EY analyses suggests investments in utilities across the globe performed poorly in the first half of 2020. Total shareholder returns (TSR) were eroded across the sector. The renewable segment was the only segment to record positive returns, led by 25.8% returns in Asia-Pacific region, 12.3% in Europe, and 4.7% in Americas. Source: EY Strategy and Transactions.

EY analyses suggests investments in utilities across the globe performed poorly in the first half of 2020. Total shareholder returns (TSR) were eroded across the sector. The renewable segment was the only segment to record positive returns, led by 25.8% returns in Asia-Pacific region, 12.3% in Europe, and 4.7% in Americas. Source: EY Strategy and Transactions. However, Huq suggested the macroeconomic environment is gradually improving. With interest rates expected to remain low, there will be significant capital available in both the debt and equity markets to fund growth investments," he said.

A few trends that emerged point to specific investment hotspots.

1. Renewables Maintained Investor Trust. Of the 257 deals made globally over the first half of 2020, most were announced in the first quarter, and more than 60% involved renewables, the report says. The accelerated focus on [environmental, social, and governance (ESG)] among investors provide continued confidence in the long-term picture for clean energy," it adds.

The report also suggests an overall investment emphasis on long-term value. It cites, for example, a recent letter from Larry Fink, chairman and CEO of American global investment management giant BlackRock, which suggests climate risk is investment risk." EY noted, BlackRock announced removing companies from its actively managed portfolio that generate more than 25% of their revenues from thermal coal and will closely scrutinize other businesses that are heavily reliant on thermal coal as an input."

Among notable deals in the first half that involved renewables was the acquisition of TerraForm Power, which holds a 4.2 GW renewables power portfolio, by Brookfield Renewable Partners to create one of the largest pure-play renewable power companies in the world." Brookfield's portfolio already includes 19 GW of hydro, wind, solar, and storage facilities in North America, South America, Europe, and Asia, and it has 13 GW in the development pipeline. In Canada, Hydro-Quebec acquired a 19.9% stake in Innergex for $490 million, leading to a strategic alliance" and combined renewable building capabilities.

2. Integrated Utilities Are Divesting to Focus on Core Assets. Integrated utilities remained the segment with the largest investment by financial players-total deal value in the segment rose 45% from $24 billion in the first quarter of 2020 to $34.8 billion in the second quarter. Among notable deals was the $20.3 billion merger of Abu Dhabi Power Corp. and Abu Dhabi National Energy Co. (TAQA) to create one of the largest utility companies in the Middle East region.

Earlier this year, EnBW also moved to divest its 28.35% stake in EVN AG, an Austrian power producer and retailer with businesses in 16 countries to Vienna utility Wiener Stadtwerke GmbH for $800 million, to allow EnBW to focus on renewables acquisitions. Centerpoint Energy sold its natural gas retail business to Energy Capital Partners for $400 million, to focus on its core electric and natural gas utility business. Marking an uptick of similar dealmaking in the third quarter, Dominion Energy recently announced it would cancel its Atlantic Coast Pipeline project with Duke Energy and sell the bulk of its gas transmission and storage assets for $9.7 billion to Berkshire Hathaway Energy.

3. Activist Investors Are Pressuring Utilities to Consider Sustainability. As EY's report notes, in April 2020, several Japanese banks-including Mizuho, Sumitomo Mitsui, and Mitsubishi UFJ (MUFG)-announced new, tighter coal financing policies. In March, Kansas-based utility Evergy agreed to reassess its business and consider an asset sale at the request of Elliott Management Corp., a U.S.-based activist hedge fund that owns a significant stake in the utility. Elliott also invested US$1.4b along with other players in CenterPoint Energy, leading the latter to form a committee to evaluate its strategic options," the report says.

Other utilities affected by the recent wave of activist investors are NRG, Sempra, FirstEnergy, AES and Hawaii Electric Industries. As these investors continue to aggressively pursue their agendas, utilities can themselves and align them with renewables, climate change, deleveraging and so on."

4. Investment in Energy Storage Is About to Increase. While the Americas accounted for only about 14% of global deal activity, given the pace of change expected in the P&U sector, once we get to the other side of the pandemic, there are many factors coming together that suggest this could be a very active deal market," the report says, citing EY Americas P&U Utilities analysis. EY is especially bullish on energy storage, which it projects is set to more than double in 2020, rising from 523 MW deployed in 2019 to 1,452 MW in 2020, before tripling to 3,646 MW in 2021."

Factors driving this surge include the U.S. Department of Energy's launch of the Energy Storage Grand Challenge, which is aimed at making the U.S. a global leader in storage utilization and exports, with a secure domestic manufacturing supply chain that does not depend on foreign sources of critical materials. Earlier this year, a federal court also upheld the Federal Energy Regulatory Commission's Order 841, affirming that energy storage connected at the distribution level must have the option to access wholesale markets. Order 841 is expected to open up new opportunities for energy storage developers and aggregators that historically relied on state-by-state [request for proposals]," the report says. Utilities, too, are banking heavily on storage. NextEra Energy plans to spend $1 billion on energy storage in 2021, while Dominion is targeting 24 GW of renewables and storage to align with Virginia's clean energy goals.

5. Investments in Infrastructure to Enable Transportation Electrification Are Surging. By 2050, the percentage of electric vehicles (EVs) on the road could reach 65% in the U.S., according to EY research-up from just 2% estimated for 2020. Understandably, EV adoption is highly correlated with the presence of EV charging infrastructure, suggesting that this availability tends to precede EV growth." Several utilities have outlined plans for EV infrastructure programs. On July 21, the New York Public Service Commission allowed investor-owned utilities to collect up to $701 million from customers through 2025 to fund the EV Make Ready Program, a cost-sharing program that incentivizes utilities and charging station developers to site electric vehicle charging infrastructure in places that will provide a maximal benefit to consumers."

6. Digitalization, Nuclear, Efficiency, and Manufacturing Among Other New Technologies That Garnered Investment Interest. While transportation and storage led global deal value in new technology, a diverse set of technology developers also cemented lucrative venture capital funding. These include product and services providers related to digital and analytics products and services; advanced nuclear; efficiency and manufacturing; behind-the-meter technology (BTM); waste-to-energy (WTE) and biofuels; and innovative power generation systems or technology related to hydrogen.

As the power and utilities sector reaches an inflection point, emerging technology is playing a significant role in shaping industry strategy," said Huq. Companies are realizing new technology adoption is not only important for their growth but also for their survival."

Global deal value in new technology (from announced deals in the first half of 2020) by sector and region. Source: EY analysis with data sourced from Pitchbook.

Global deal value in new technology (from announced deals in the first half of 2020) by sector and region. Source: EY analysis with data sourced from Pitchbook.-Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

The post Six Investing Trends Reshaping Power and Utilities Sector Despite COVID appeared first on POWER Magazine.