Additional Solutions Needed for California Power Market

The post Additional Solutions Needed for California Power Market appeared first on POWER Magazine.

Late last week, to manage a potential large-scale power outage driven by triple-digit temperatures, the California Independent Service Operator (CAISO) called on utilities to implement rolling outages across the California grid. The shutdown of three natural gas power plants and a significant decline in available wind power were cited as the primary reasons behind the move.

The CAISO manages one of the largest wholesale power markets in the world, providing electricity to more than 80% of the state and a small portion of Nevada. Most of the market is made up of three large investor-owned utilities (IOUs), Southern California Edison, Pacific Gas & Electric, and San Diego Gas & Electric.

COMMENTARY

The heatwave struck California on August 14, and has persisted, with high temperatures expected for another several days. CAISO on August 13 issued a statewide Flex Alert, a call for voluntary electricity conservation from 3 p.m. to 10 p.m. the following day.

The grid operator predicted high electricity demand driven by residential air conditioning use. Flex Alerts are issued when the power grid is under extreme stress driven by high temperatures, and there is a potential for large plant and transmission outages.

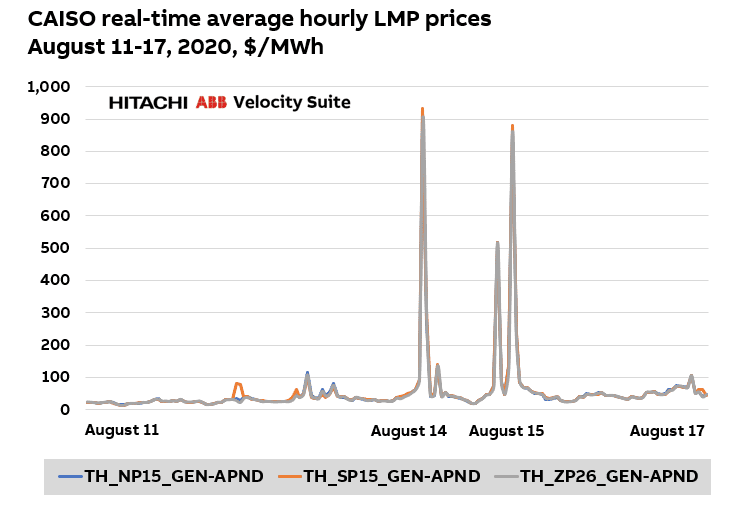

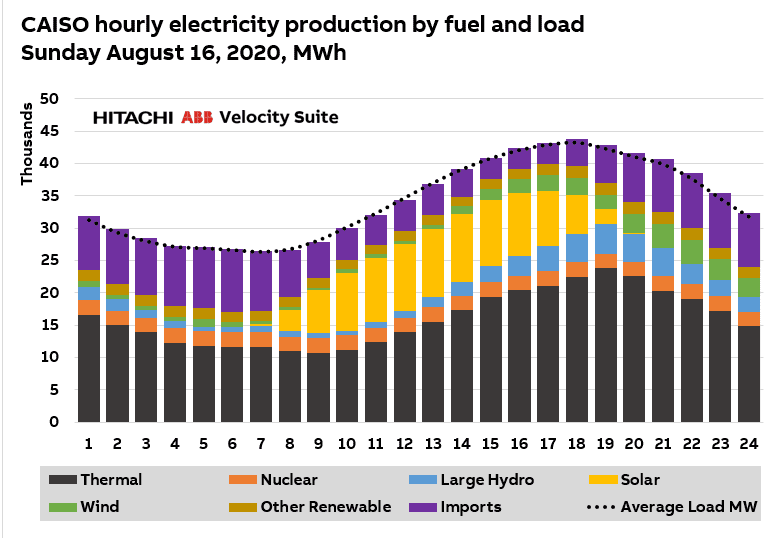

After the first Flex Alert was issued late last week, subsequent alerts have been issued every day since.

Surprisingly, daily peak demand has been less than similar peak periods in years past. On August 16, peak demand occurred during hour 17 at just under 44 GW-the all-time CAISO peak was about 50.3 GW recorded on July 24, 2006, during hour 14. The next highest peak occurred on September 1, 2017, during hour 15, when load topped 50.1 GW. Driven by higher natural gas prices and elevated power import costs, electricity prices spiked on both August 14 and August 15, but then calmed during the days that followed.

Recent Thermal and Nuclear Plant Retirements Have an Impact

Recent Thermal and Nuclear Plant Retirements Have an ImpactAccording to data compiled by Hitachi ABB Power Grids' Velocity Suite research team, there have been more than 13.6 GW of gas-fueled capacity retired since 2013-67.8% (9.1 GW) in just the past five years. In 2013, the huge 2.3-GW San Onofre Nuclear Plant shuttered, adding to the rapid reduction of dispatchable generation resources in California. Between now and the end of 2025, there are 4.6 GW and 2.3 GW of natural gas and nuclear capacity scheduled for retirement across the state, respectively.

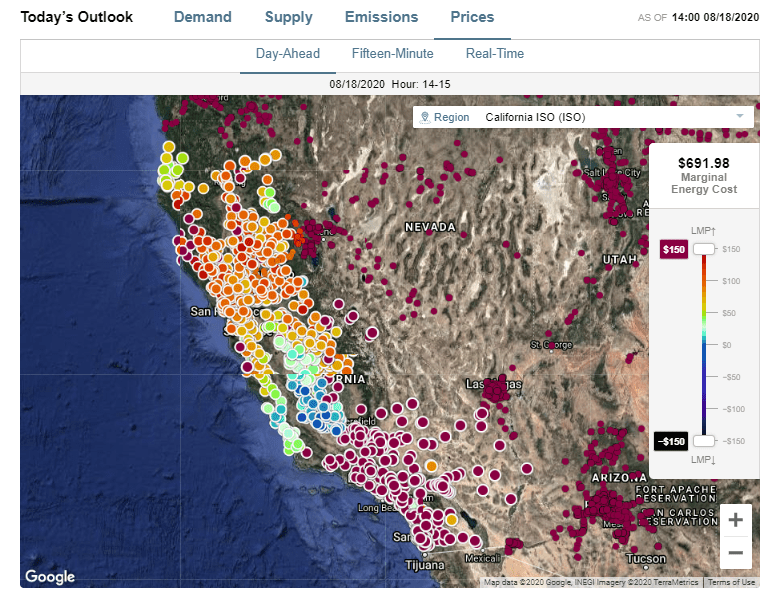

There are several drivers behind the market stress, including natural gas prices, which at SoCal Citygate exceeded $13/mmBtu on August 18, and show no sign of subsiding through the next few days.

The potential to import power into California is diminished since the entire western United States is experiencing higher-than-normal temperatures and increased power demands. Unlike historic summer peak power events, the peak hour this year, driven in part by the shelter-in-place restrictions and higher demand for power to cool homes and businesses later in the day, the peak hour has shifted to the 6 p.m. to 8 p.m. timeframe, when the sun is headed toward setting. CAISO today has a significant amount of solar on the grid, resulting in significant (8 to 10 GW) three-hour ramping rates for non-solar resources.

Exacerbating the market stress are the heavily loaded transmission lines necessary to import power from outside of California. The more heavily congested the transmission grid becomes, the higher the price to move electricity becomes. Power prices at nodes in the Tahoe area spiked into the thousands of dollars per megawatt hour on Saturday, resulting in electricity prices up to 10X higher than average for this time of the year.

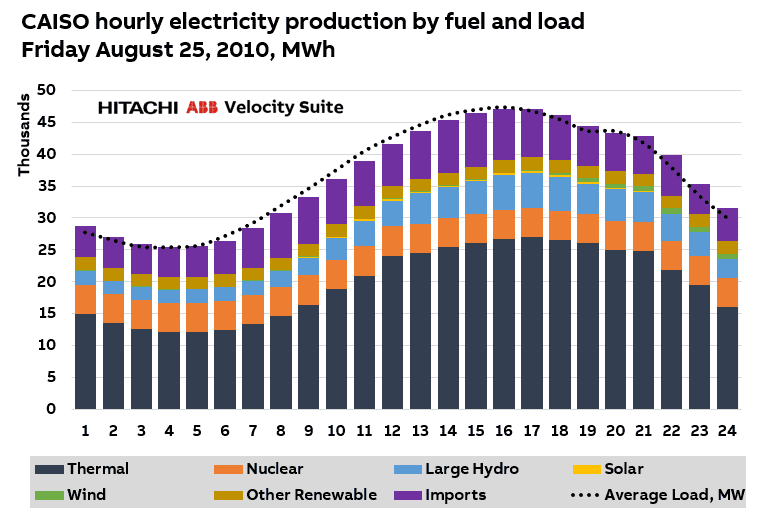

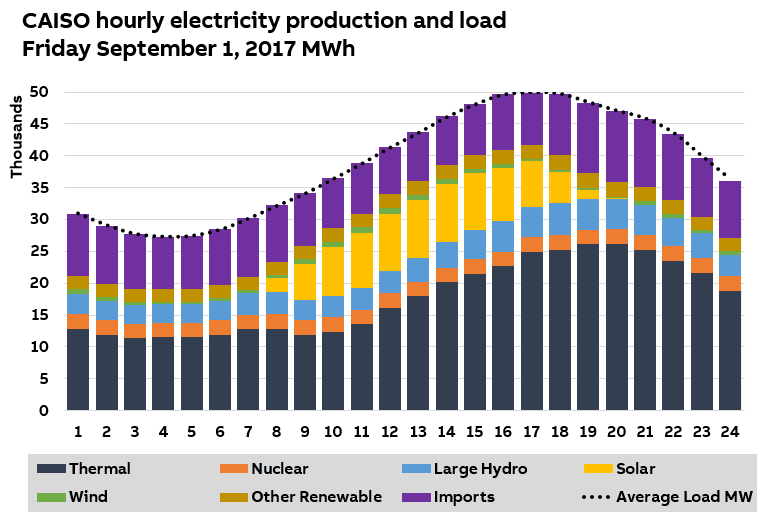

Supply Dynamics Have ChangedA comparison prepared by the Velocity Suite team of the 2010, 2017, and 2020 peak hour days, highlights the shift from dispatchable thermal and nuclear resources to intermittent resources like utility-scale solar and distributed rooftop solar over time.

During the 2010 summer peak, recorded on August 25 (a Friday) that year, the resource mix was much different than today. That day, peak demand was about 47.4 GW. Solar was virtually non-existent. Most of the load was met from thermal and nuclear resources (66.3%) and power imports (17%) from outside CAISO. Solar and wind accounted for less than 1% of supply at the time.

Fast forward to the summer of 2017, when the peak occurred on September 1 (also a Friday) during hour 15, reaching 50.1 GW. During that hour, thermal and nuclear resources accounted for 54.5% of supply, while power imports stayed steady at about 16.3%. Wind and solar topped 15.1%, with solar accounting for 95.1% of that total.

This past Sunday, peak demand occurred during hour 18 and, like historic peaks, was supplied primarily by thermal and nuclear resources (56.5%), while power imports represented only 9.7% of the total demand. Solar and wind represented a robust 19.6% of supply at the time, but a few hours prior, during hour 13, solar alone accounted for 26.9% of total supply. In terms of dispatchability, a few hours can make a big difference. The shift in peak demand to the early evening hours after the sun has gone down is a good indicator of how large-scale battery storage could lesson grid stress when deployed at a significant amount.

During the three different time periods evaluated, large-scale hydro generated various levels of electricity. In 2010, during the peak hour, hydro represented 11.8%, while in 2017 it generated 9.6%, and this past Sunday hydro accounted for 10.2 % of total power supply.

CAISO's 2020 Summer Readiness Plan ReviewedAccording to CAISO's 2020 Summer Readiness Plan, the forecast peak for 2020 was estimated at 45.9 GW, relatively unchanged from 2019. The plan assumed about 1.9 GW of generation retirements and about 2.0 GW of new generation. Hydroelectric conditions were forecast to be below normal.

The plan, published in January of this year, highlights the risk of late summer heat combined with low hydropower and reduced imports. The report suggested that those elements could cause energy shortfalls which are now being experienced this week.

On a positive front, the Flex Alert program appears to be working, since many of the forecast peaks expected this week have not been reached. Some of the mitigation activities include:

Setting air conditioning thermostats to 78F.

Deferring use of major appliances until off-peak hours.

Turning off unnecessary lights.

Unplugging unused electrical devices.

The heatwave enveloping California is expected to continue over the next few days. The combination of extreme heat, transmission constraints, lower-than-average available hydropower, and higher natural gas demand will keep California electricity markets strained and energy prices high. There are numerous mitigation strategies that could alleviate similar circumstances in the future, including slowing the closure of dispatchable resources like natural gas and nuclear until there are adequate renewable resources in place and enough energy storage resources have been developed.

On a bright note, so far this week, the market's Flex Alert program, asking for voluntary customer cutbacks on electric usage, is working to reduce electric demand.

The grid stress driven by the recent high demands on the state's electric system will require additional solutions, including discussions surrounding the balance of dispatchable and non-dispatchable resources, and the exploration of new technologies necessary to alleviate system stress. These new technologies include energy storage, sophisticated new grid infrastructure, and operations management software. We'll be keeping a close eye on the market as the warmer-than-normal weather continues to impact California and the western U.S.

-Kent Knutson is a content specialist focusing on energy market intelligence for Hitachi ABB Power Grids. He has more than 30 years of experience designing and developing intelligence products for some of the largest information providers in the power generation and transmission industries, including, FT Energy (Pearson PLC), Platts (S&P Global), Resource Data International, Energy Central, PennWell Corporation and ABB. He holds an MBA in marketing from Regis University and an MA degree in geography from the University of Denver.

The post Additional Solutions Needed for California Power Market appeared first on POWER Magazine.