GE Hitachi, TerraPower Team on Nuclear-Storage Hybrid SMR

The post GE Hitachi, TerraPower Team on Nuclear-Storage Hybrid SMR appeared first on POWER Magazine.

GE Hitachi Nuclear Energy (GEH) and Bill Gates' nuclear innovation startup TerraPower are ready to demonstrate a cost-competitive" advanced nuclear reactor system that will integrate a 345-MWe sodium fast reactor (SFR) with a molten salt energy storage system under a unique energy system architecture.

The advanced nuclear technology developed under a joint development agreement is called Natrium." It blends the best of" TerraPower's Traveling Wave Reactor (TWR) and GEH's PRISM technology, but it boosts them with additional innovations and improvements" to ramp up the SFR's performance and economics and render it competitive in the U.S. and other countries, the companies told POWER on Sept. 2.

Because Natrium leverages the breadth and depth of the team's expertise and resources"-which takes into account work on multiple reactor designs and efforts across the nuclear lifecycle-the technology has sped beyond the research and development phase" and is ready for demonstration.

The demonstration plant is designed to be delivered in the next seven years," TerraPower told POWER on Wednesday. That means the Natrium technology will be available in the late 2020s," which would make it one of the world's first commercial advanced nuclear technologies, it said.

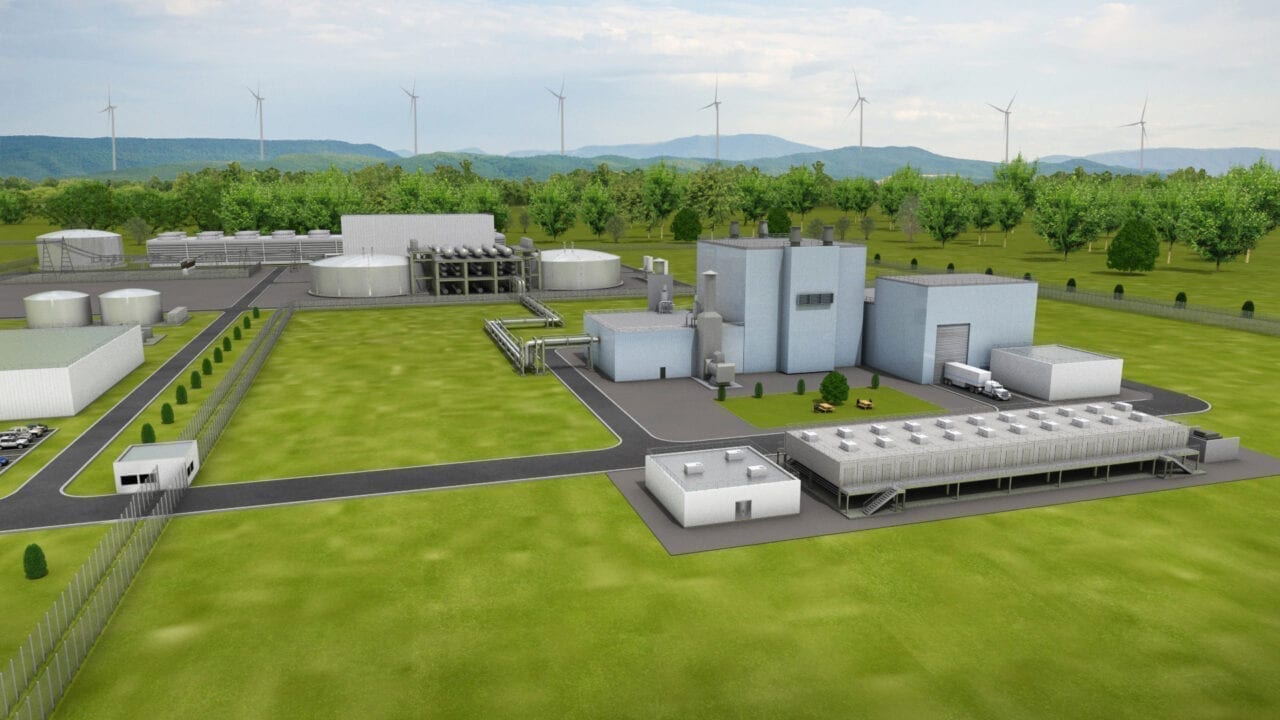

A Simplified ArchitectureKey to the system's cost-effectiveness is its tight energy system architecture, which simplifies previous reactor types. A typical Natrium site, for example, will span about 44 acres, with a nuclear island of about 16 acres. When normalized to power rating, the Natrium system has a smaller footprint compared to other Generation IV reactors. Similarly, Natrium has a smaller footprint than most multi-unit plants with light water reactors operating today," TerraPower said. One benefit of a plant with the Natrium technology the companies highlighted is its significantly reduced emergency planning zone, which allows it to be sited in many locations without affecting local population centers."

The system design also involves fewer equipment interfaces, which could dramatically slash the amount of nuclear-grade concrete by 80% compared to larger reactors. Non-nuclear mechanical, electrical and other equipment will be housed in separate structures, reducing complexity and cost," TerraPower said. The design is intended to permit significant cost savings by allowing major portions of the plant to be built to industrial standards."

The Natrium system features a 345-MWe reactor and can be optimized for specific markets. For instance, its thermal storage has the potential to boost the system's output to 500-MWe of power for more than five and a half hours when needed. Courtesy: TerraPowerBoosting Nuclear's Flexibility, Storage Capability

The Natrium system features a 345-MWe reactor and can be optimized for specific markets. For instance, its thermal storage has the potential to boost the system's output to 500-MWe of power for more than five and a half hours when needed. Courtesy: TerraPowerBoosting Nuclear's Flexibility, Storage CapabilityTerraPower and GEH's emphasis on cost reductions for the Natrium design is a crucial consideration for commercial success in a burgeoning global SMR market, where more than 50 designs and concepts with varying levels of technology readiness are vying for first customers. But so is the companies' specific Natrium business model, which addresses shifting market needs and expectations. As the International Atomic Energy Agency (IAEA) noted as it launched a three-year-long economic appraisal for SMR this March, the market itself should be large enough to sustain demand for components and industrial support services. The economic impact of SMR development and deployment has to be quantified and communicated to gain societal support."

According to TerraPower and GEH, development of Natrium's functionality has been as important as cost-reductions. The technology's end-goal is a system that provides firm, flexible power that seamlessly integrates into power grids with high penetrations of renewables," they said.

Its most significant attribute, perhaps, is that the system can generate power with the heat produced by the SFR or store it using nitrate salt molten salt energy storage technology, which has the potential to boost the system's output to 500 MWe of power for more than five and a half hours when needed."

Natrium's system notably derives from concentrated solar power (CSP) applications. It is employed successfully at similar scale at the operating Solana Generating Station in Arizona and at additional solar thermal facilities in the U.S. and around the world," TerraPower said. Natrium's technology essentially leverages those solar facilities' equipment and system design but it applies it with best practices and lessons learned to its own unique application. So, While the molten salt energy storage technology is commercially available, there are numerous technical developments that enable a nuclear reactor to charge the molten salt energy storage system. Many of these improvements in nuclear reactor design and nuclear site layout are proprietary," it said.

TerraPower said the companies went with nitrate molten salt as the storage coolant because it offers the best combination of non-nuclear industrial properties and compatibility with sodium. Nitrate salts also overlap the Natrium technology's operating temperatures better than any other competing reactor coolant. The Natrium system has the best base technology to leverage molten salt-based thermal storage," it said.

The storage aspect will allow the reactor to participate in changing power markets, because the nuclear design can follow daily electric load changes and helps customers capitalize on peaking opportunities driven by renewable energy fluctuations. But it will also give nuclear generators a new source of revenue.

Our collective experience brings unparalleled capabilities in design and construction that ensure the Natrium product can drive value for our customers," noted Jay Wileman, GEH President and CEO. We designed this system with operator input to potentially increase their revenues by 20% through the use of energy storage."

Teaming on the Versatile Test ReactorSo far, the Natrium system has garnered the attention of numerous utilities through the U.S. Department of Energy's (DOE's) Advanced Reactor Demonstration Program (ARDP). PacifiCorp, a subsidiary of Berkshire Hathaway Energy, Energy Northwest and Duke Energy have expressed their support for the commercialization effort, which will provide energy and energy storage to the electrical grid," they said.

GEH and TerraPower, notably, are also part of a team led by Bechtel National Inc. that was recently selected by Battelle Energy Alliance (BEA) to spearhead the design and build phase of the DOE's Versatile Test Reactor (VTR), a one-of-a-kind research facility designed to give U.S. companies access to fast spectrum irradiation testing. Negotiations on that contract are ongoing.

GEH and Bechtel had previously joined forces to provide a conceptual design for the VTR project that featured GEH's PRISM technology. Kemal Pasamehmetoglu, executive director of the VTR project, told POWER on Tuesday that the unique test reactor, which is still awaiting Critical Decision-1, will likely be a 300-MWth sodium-cooled pool-type fast reactor based on the PRISM design that will use fuels with metallic alloys, including high-assay low-enriched uranium fuel.

Pasamehmetoglu was confident that technical implementation of the test reactor wouldn't pose a challenge. But he noted that while the DOE has pushed for a 2026 completion date to allow a wide range advanced and existing nuclear technology developers to test their concepts, the project's timely completion hinges on Congressional appropriations.The $295 million requested by the DOE in FY2021 to kick off the project remains uncertain, and funding delays could push the project's completion to 2031, he said. That would in turn pose a significant hurdle for an array of advanced nuclear developers that are banking on the facility to commercialize their technologies in the late 2020s.

The only viability for testing fast spectrum irradiation currently accessible to U.S. companies is the BOR-60 reactor in the Russian Federation," which is problematic from several standpoints, including export control concerns for materials and fuels testing, intellectual property rights, quality assurance and transportation issues, Pasamehmetoglu noted. Existing test reactors, like the Advanced Test Reactor at Idaho National Laboratory and the High Flux Isotope Reactor at Oak Ridge National Laboratory, are thermal neutron reactors and are not capable of sustaining neutrons at concentrations and speeds high enough to perform accelerated testing of innovative nuclear technologies under development."

The VTR's urgency is highlighted by a ARDP funding award opportunity (FOA) released by the DOE this May to provide $160 million to industry in the first year of funding for the construction of two reactors that can be operational within the next five to seven years. The period to submit applications to FOA closed on Aug. 19, and a selection of the demonstration pathway award (or awards) is likely in October 2020.

Natrium Under Consideration for DOE's Advanced Reactor Demonstration ProgramTerraPower confirmed to POWER on Tuesday that it submitted a proposal based on the Natrium system to the ARDP FOA as part of a consortium that includes GEH and Bechtel. Both TerraPower and GE Hitachi have extensive sodium fast reactor design, analysis, licensing, and testing experience spanning decades," the company said. For the ARDP proposal, Bechtel adds current and unmatched experience managing and executing large nuclear projects and the team's utility partners bring operating capabilities alongside a market demand for utility-scale advanced nuclear technologies," it said.

TerraPower also confirmed it did not specifically submit an application for its traveling wave reactor (TWR) because the Natrium system combines the best of the [TWR] and GE Hitachi's PRISM technology."

POWER has asked whether TerraPower will continue development of the TWR, a liquid sodium-cooled fast reactor that garnered substantial industry interest because it uses depleted uranium as fuel. While it did not receive an immediate response, a fact sheet TerraPower published on its website this July (and updated on Aug. 4) suggests a TWR could be operational in the mid-2020s, years earlier than projections for other Generation IV technologies."

TerraPower adds that the TWR's conceptual design is nearly complete" and it is now embarking on engineering, which will involve testing fuels and materials, building a database of experience, fabricating metallic fuel, obtaining required licenses and permits and continuing the development of a supply chain of companies that will be able to fabricate the necessary equipment and components for the TWR plant." The company also says it has worked for a decade to create the necessary supply chain for TWR materials, components, and fuel, adding it continues to utilize American companies to provide best-in-class products and services."

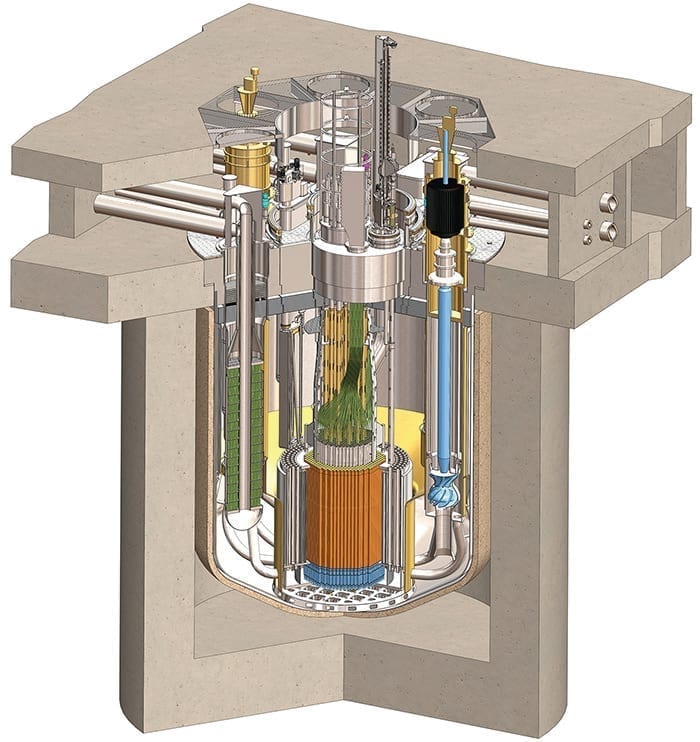

TerraPower's traveling wave reactor (TWR) is designed to be a liquid sodium-cooled fast reactor that uses depleted uranium as fuel. Courtesy: TerraPower

TerraPower's traveling wave reactor (TWR) is designed to be a liquid sodium-cooled fast reactor that uses depleted uranium as fuel. Courtesy: TerraPowerAt the same time, notably, TerraPower is exploring a 1,200-MWe molten chloride fast reactor (MCFR) design that uses molten chloride salt fuel as both the fuel and the coolant. The company said the concept presents a low-cost reactor that can operate safely in high-temperature regimes," and also offers potential in alternative industrial markets, such as process heat and thermal storage. Development for the MCFR has trudged along boosted with a five-year $40 million cost-sharing award from the DOE in January 2016. The project also has industry backing, including from a U.S. public-private partnership that includes Southern Co., Oak Ridge National Laboratory, Idaho National Laboratory (INL), the Electric Power Research Institute (EPRI), and Vanderbilt University.

At the end of June, the DOE said it had invested more than $28 million in cost-shared funds to further identify and test materials used in the reactor. So far, Southern Co. and TerraPower are in the final stages of the design phase for an integrated effects test" in support of the MCFR program. The project partners, which expect to begin testing in the $20 million test facility starting in 2021, have so far successfully scaled up their salt manufacturing process to enable this testing. Data generated from the test facility will be used to validate thermal hydraulics and safety analysis codes for licensing of the reactor," the DOE said. In parallel with testing, Southern Co. and TerraPower plan to begin the design and licensing of a test reactor targeted for operation in the late 2020s.

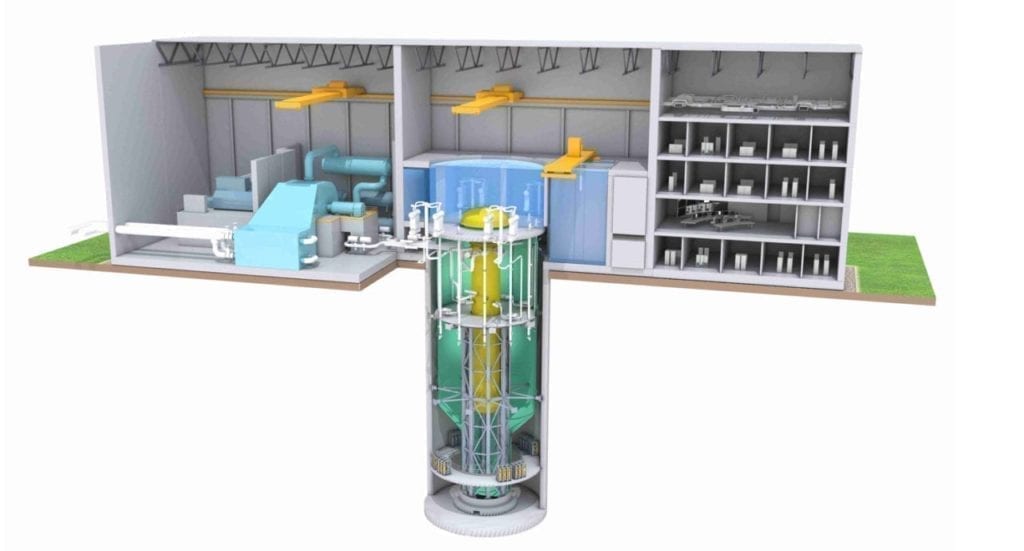

GEH Continues Aggressive Development of BWRX-300GEH, a 2007-established alliance between U.S. conglomerate GE and Japanese technology giant Hitachi, has meanwhile established an aggressive timeline for the commercialization of its BWRX-300, a 300-MW boiling water reactor that it claims could be competitive with natural gas power. According to a June status report from the IAEA's Advanced Reactors Information System database, GEH expects that the first BWRX-300s could begin construction in 2024 and 2025 and enter commercial operation in 2027 and 2028.

Part of its optimism is rooted in its evolutionary technology framework. The BWRX-300 is the 10th evolution of GE's boiling water reactor (BWR) technology, and GEH says it represents the simplest, yet most innovative BWR design since GE began developing nuclear reactors in 1955." On its website, GEH also notes that the design is based on the Gen III+ 1,520-MW ESBWR, which the Nuclear Regulatory Commission's (NRC) certified in 2014.

The BWRX-300 is a ~300 MWe water-cooled, natural circulation Small Modular Reactor (SMR) with passive safety systems. As the tenth evolution of the Boiling Water Reactor (BWR), the BWRX-300 represents the simplest, yet most innovative BWR design since GE began developing nuclear reactors in 1955," GEH says. Courtesy: GEH

The BWRX-300 is a ~300 MWe water-cooled, natural circulation Small Modular Reactor (SMR) with passive safety systems. As the tenth evolution of the Boiling Water Reactor (BWR), the BWRX-300 represents the simplest, yet most innovative BWR design since GE began developing nuclear reactors in 1955," GEH says. Courtesy: GEHGEH is also leveraging the BWRX-300's evolutionary characteristic to speed up licensing, using the NRC's Part 50 approach to licensing based on the certified ESBWR design. We are generating license topical reports (LTRs) that document the key differences between the ESBWR and BWRX-300 design and safety bases," GEH told POWER on Wednesday. The first three LTRs have been submitted and will help form the licensing package for a future construction permit application."

This February, meanwhile, GEH entered into a memorandum of understanding (MOU) to examine the economic and technical feasibility of potentially building a BWRX-300 in the Czech Republic (it already has similar MOUs with Estonia and Poland). Also in February, GEH began a vendor design review with the Canadian Nuclear Safety Commission. And earlier last month, the company revealed that GE Research has created a highly detailed virtual model" of the BWRX-300 and plans to begin a three-year study on how artificial intelligence and computer simulations can help monitor and maintain nuclear reactors-and significantly, slash operations and maintenance costs by a factor of 10- as part of the Generating Electricity Managed by Intelligent Nuclear Assets, or GEMINA" initiative.

Industry observers also suggest the BWRX-300 may be under consideration by the Tennessee Valley Authority (TVA) for its Clinch River Nuclear site in Tennessee. The TVA, which received the NRC's approval for an early site permit for two or more small modular reactor modules (of up to 800-MWe) at the site last December, confirmed to POWER on Sept. 1 that it has applied for the DOE's ADRP FOA. However, it declined to provide details. At this time, details of the proposal are business sensitive and proprietary in nature," the utility said.

Asked whether GEH anticipates any conflicts marketing Natrium as a competitor to the BWRX-300, the company noted that the two technologies can be optimized for different applications."

The BWRX-300 is focused on achieving a cost-competitive design that is ready for rapid deployment. BWRX-300 combines new innovation with proven technology and a certified fuel design, making it ideally suited for the near-term market and solving one of the biggest challenges facing the industry - cost," it explained. Because Natrium operates at higher temperatures, it is ideally suited for applications such as hydrogen production, industrial heat applications and energy storage." Natrium is also capable of consuming used fuel because it operates in the fast neutron spectrum.

We see important applications for each technology," GEH said.

-Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

The post GE Hitachi, TerraPower Team on Nuclear-Storage Hybrid SMR appeared first on POWER Magazine.