Two Years Without Health Insurance (and What I’m Doing Now)

Two years ago, I was unsatisfied with my options for health insurance. The premiums were rising even as the quality dropped in the form of an ever-increasing deductible. I am guessing that you might feel the same way these days - most of us Americans are in the same boat.

I felt like I was being squeezed from both ends and it was starting to piss me off. So I decided to take some action, by doing the math for myself using a spreadsheet. I needed to answer the question, Is this insurance really as bad a deal as I think it is?"

Sure enough, the risks and rewards of the coverage did not justify the premiums, so I decided to try an experiment and simply drop out of the market and insure myself. In other words, just rolling the dice and going through life with no form of health insurance at all.

Doubling down on the bikes, barbells and salads, I did my best to eliminate any risk factors that are in my control, while accepting that there are still much less likely but more random factors that are not.

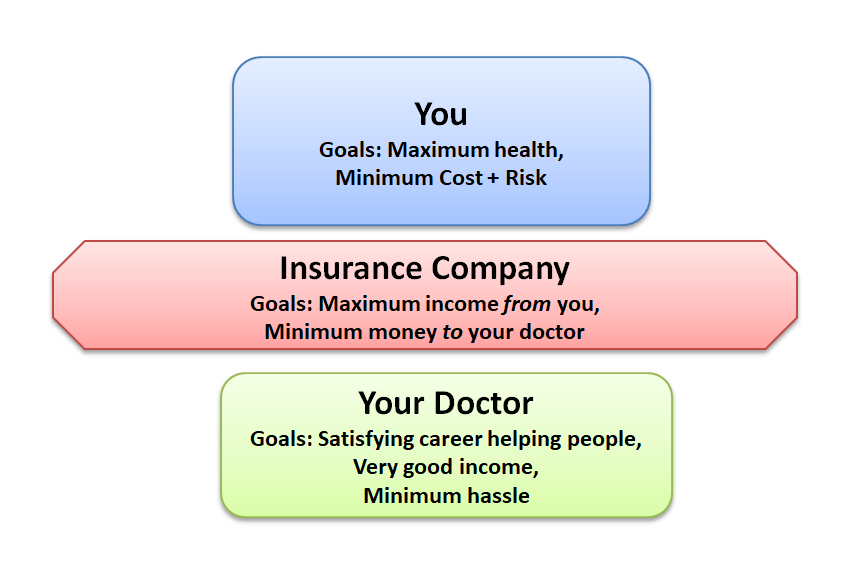

Figure 1 - DIY Health Care

Figure 1 - DIY Health CareAlmost two years and $10,000 in premium savings later, I have found the experiment to be a success: I have slept well and not worried about the fact that I could be on the hook for a big bill if I did ever need major care. And as luck would have it, I also enjoyed the same good health as always over this time period - probably the best in my life so far because the extra healthy living has been working its magic.

But.

This situation has not been quite ideal, because my life is not a very useful model for everyone to follow. Most people don't have the luck of perfect health, many have a larger family than I do, and very few people are in a financial position to self-insure for all possible medical bills.

Also, I found myself wishing I had a doctor that actually knew me, who I could call or visit on short notice if I ever did need help.

Finally, I wanted to switch back to having some form of insurance so that I could learn about it and write about it as time goes on. But was I really willing to be part of that unsatisfying and broken insurance model?

Then something magical happened: I learned about the new and vastly improved world of Direct Primary Care physicians.

What is DPC?

DPC is a fairly new trend in the US, but it is also a return to a very old tradition: a direct relationship between you and your doctor, with no insurance company in the way.

As a customer, you pay for a monthly subscription (somewhere around $100), and in exchange you get unlimited access to super elite, personalized medicine for the vast majority of your medical needs. Diagnoses, prescriptions, skin conditions, stitches, even fixing a broken bone if you don't need surgery. All covered, with no co-pay and in an environment that feels to me like Presidential-level health care, in striking contrast to some of my past experiences where I felt like an anonymous numbered ticket in a sloshing sea of bureaucratic institutional medicine.

Oh, and direct email, phone and text message contact with your doctor, prescriptions over phone or video call, and in some cases even house calls depending on the practice and the situation.

Through some sort of magic, the Direct Primary Care model offers much better medical care and much lower prices, at the same time.

How could it be? It's because of the incentives.

Figure 2: The Insurance Model for Health Care

Figure 2: The Insurance Model for Health CareIn our famously broken US healthcare model, an insurance company is wedged in between you and your doctors, and it has different objectives than you do.

You just want the best overall health for yourself, and when the shit does hit the fan and you need medical care, you want it to be quick, effective, and at minimum cost. And you don't want to be hounded with years of stressful stray bills after an expensive medical procedure.

Your Doctor wants to help as many people as possible and make a good living, without having to wade through a sea of paperwork or stress or lawsuits.

Your Insurance company wants to make as much profit as possible, which means maximizing the amount they collect from you, and minimizing the amount they pay to your doctor. In theory, they benefit from helping you to stay healthy. But they have also developed elaborate contracts (putting in as many loopholes as possible to allow them to drop your coverage or deny claims), become masters of delaying payments, limiting which procedures and tests they will authorize doctors to do, and just generally throwing the biggest monkey wrench into the system that they can.

Over the decades, there has been a complex battle of lawmaking, lobbying, compromise and complexity to try to regulate away some of these problems. Sometimes the new laws help, sometimes they don't, but the end result will never be optimal simply because there are a lot of people involved, and big crowds of humans make for slow and shitty decision making.

The Direct Primary Care Model

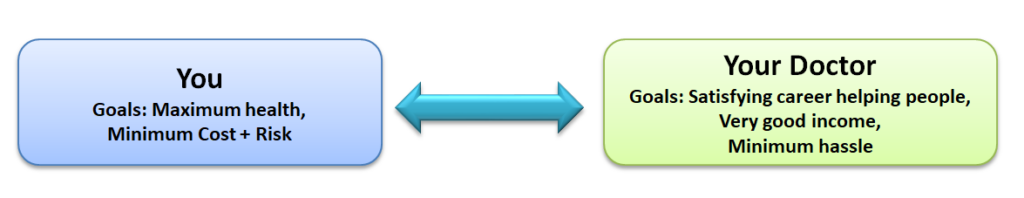

Figure 3: The Direct Primary Care Model

Figure 3: The Direct Primary Care ModelWith DPC, it's just you and your doctor. You both have the same incentives, but now the model works much better because there is no chaotic and expensive force in the middle to mess things up.

And because you operate on a subscription, the doctor gets paid whether you come into the office or not. At the same time, you are free to come in whenever you do need something, at no additional cost. So she has an incentive to keep you healthy, so that you have no need to come into the office in the first place.

On top of this, you get to decide together what is the best course of healthy prevention and treatment, without the overhead and complexity of constantly fighting with insurance companies. This drastically cuts the costs by eliminating the large staff of paper-pushers and attorneys that you normally need to operate a medical office, and frees up the doctor to spend more time with each patient during each visit.

How could the doctor possibly make a living with such low fees?

As it turns out, a small practice with one or two doctors and a few credentialed medical assistants can handle over 1000 subscribers while still giving each person much more time than they get under the old model. At $100 per month, this is $1.2 million in annual gross subscriber income, which is enough to pay everybody well, and rent a suitable clinic space. And as you scale up the operation, some economies of scale on things like space and equipment make it even better.

Just as importantly, running a practice like this tends to make a dramatic improvement in a doctor's quality of life. It's better medicine, with more flexibility and less hassle and stress. No wonder this model is growing rapidly and has become a favorite of physicians who happen to be MMM readers, as I hear from more of them every month.

Direct Primary Care is now a nationwide movement, with many hundreds of practices spanning the country and many more opening each year. Today's screenshot of https://mapper.dpcfrontier.com/ shows the current state of the market.

In fact, it turns out this whole trend might even be a Mustachian-originated phenomenon, as I joined my own local practice called Cloud Medical, met the founder Dr. David Tusek, and he revealed halfway through our introductory visit that he was both a founder of DPC pioneer Nextera Healthcare in 2009, and a lurking reader of this blog for several years before I discovered him right here in my own town.

A note for locals: if you are considering joining Cloud, mention that you would like the MMM discount to save a further $12/month! (we have no affiliation, they are just looking to expand the practice and I'll remove this notice if they fill up)

My experience (so far) with Cloud Medical

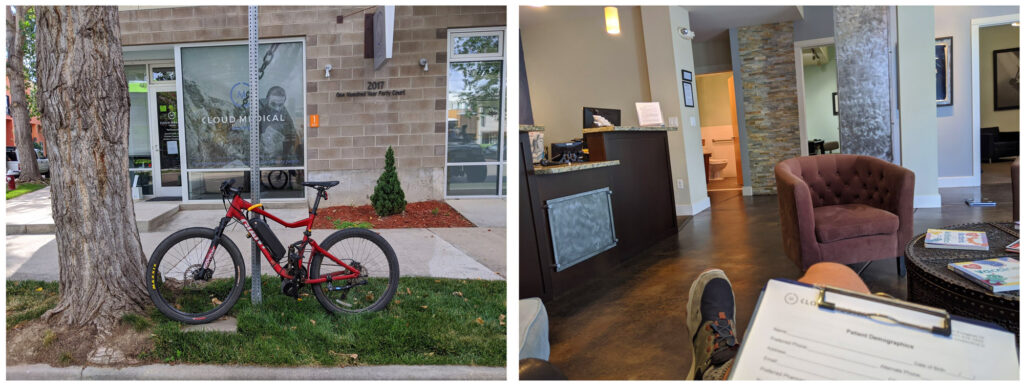

Cloud Medical's Longmont office - definitely a step up over past medical office experiences! (although they do need to add a proper bike rack)

Cloud Medical's Longmont office - definitely a step up over past medical office experiences! (although they do need to add a proper bike rack)I signed up with Cloud this past summer, about five months ago. Although I have been feeling great, I figured it was time to put myself through an extensive battery of middle-aged man" tests just to make sure I am not missing any hidden problems.

With the doctor's guidance, I did a very thorough blood test, plus an electrocardiogram scan of my heart performance and ultrasound Carotid artery scan which involves a practitioner lubing up your neck and sliding a Star-Trek-style probe around on it while recording images of your body's most critical plumbing to check for signs of clogging. Plus the usual checks of an annual physical exam. All clear.

I also finally got around to a long-awaited diagnosis and prescription for my Adult Attention Deficit Disorder condition, something which took me seven years to get organized enough to achieve, paradoxically one of the crippling effects of ADD. Although this is a very personal health detail, I mention it here because there are many friends and readers who also suffer from this condition, and I encourage you to learn more about it and seek help if appropriate. It can be life-changing. I found this process was much easier in a DPC environment, because of the more personal nature of the doctor-patient connection.

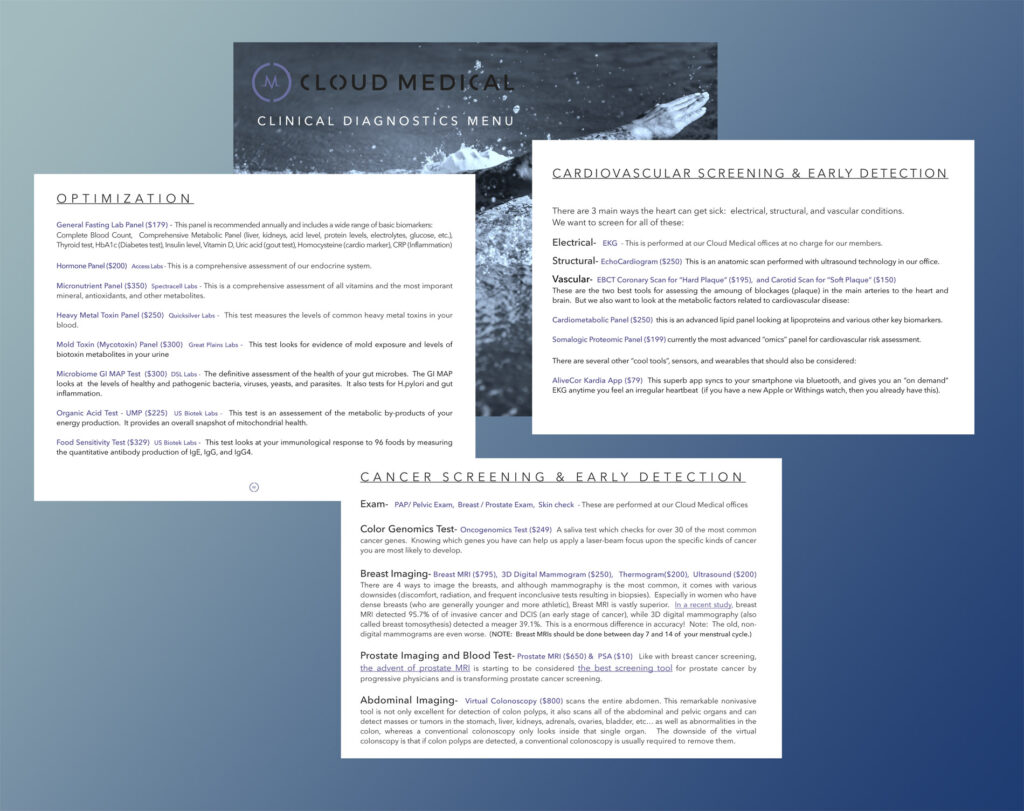

This DPC model addresses perhaps 90% of typical medical needs in-house, and a menu" of optional specialists knocks out another 5%.

Cloud and other DPC practices have a menu" of standardized prices, typically much lower than traditional offices. Full PDF here.

Cloud and other DPC practices have a menu" of standardized prices, typically much lower than traditional offices. Full PDF here.But there is still a chance you will need the more rare (and expensive) services of a hospital or specialist. In this case, your DPC physician can provide referrals and guidance to allow you to get the right help at a discounted, direct-pay price, or even handle your needs with a conventional insurance company.

Part Two: But What About Bigger Expenses?

Health share options, with the one I chose (Sedera) in the center.

Health share options, with the one I chose (Sedera) in the center. At this point, you can add another layer of protection: High deductible conventional insurance, or a health share membership which offers a similar end-result while being careful not to be classified as insurance.

A Disclaimer before we begin:I think of health shares as a form of emergency medical bill reimbursement", rather than full fledged insurance. They are suitable for mostly-healthy people who want financial protection in the event of a major medical event. But they are not insurance, and often not too useful for someone with an existing, expensive condition.

Update 11/12: This blog post has triggered lots of fine-print-reading and discussion among readers, which led us to follow up with various insurance and health share companies.

The final word on one issue of debate: most conventional insurance and health shares do not cover voluntary abortions, while they do cover medically necessary ones, just under the different name of Maternal Complications".

Health shares in particular also don't offer much ongoing drug reimbursement, which includes a lack of coverage for birth control. While I disagree with this policy, from a practical perspective it just means you need to budget for this expense separately.

For situations where a health share membership falls short, the subsidized and regulated insurance available through employer-based plans or the state exchanges via the Affordable Care Act, are probably a better bet.

But with all that in mind, I still chose one for myself, so let's get into it!

Health sharing groups started out catering only to members of certain religions. Then a provider called Liberty Health Share opened up the market slightly while still requiring some fairly specific spiritual affirmations.

The latest incarnation is a company called Sedera* , which has addressed some of the shortcomings of earlier companies, has far less religious basis, and now seems to be the place that most of my more analytical friends and their families are ending up. Even my DPC physician Dr. Tusek is now recommending Sedera.

Sedera is worth a whole separate article in itself, and in fact I am starting a dedicated page for questions and answers and discussion on the experience. But for now, we'll take a shortcut and just say that I was convinced and willing to give it a try, so I signed myself up as a Sedera customer.

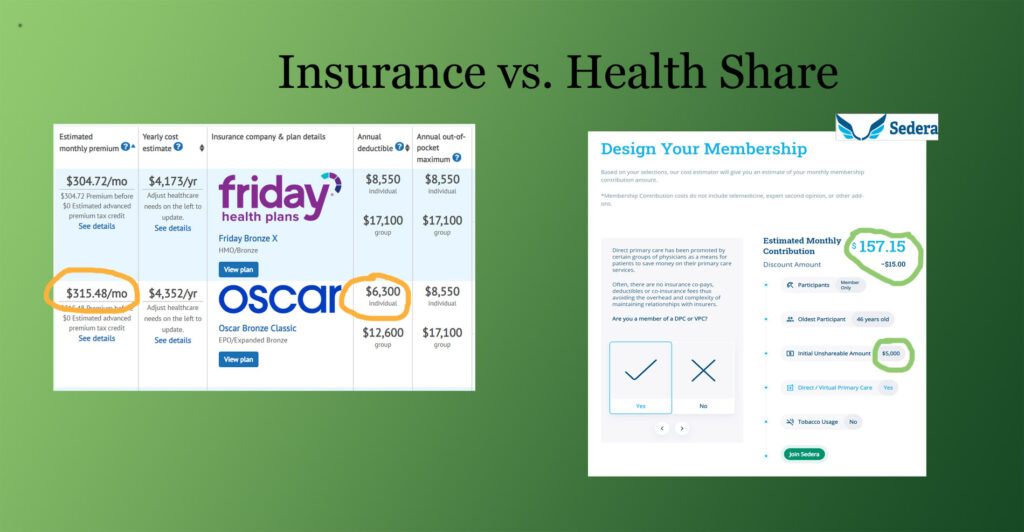

A quick comparison of the closest standard insurance plan I could find on the standard Colorado health insurance exchange, versus what I got from Sedera (click for larger version):

For me, Sedera cuts my monthly cost in half, even while delivering better coverage.

For me, Sedera cuts my monthly cost in half, even while delivering better coverage.Another thing I like about all this is that there is no concept of in network" and out of network" doctors or hospitals. You can even use hospitals in other countries while traveling, and get reimbursed in US dollars after you return home. It's simpler, cheaper and more flexible.

So in the end, by combining DPC with a health share membership, I am hopefully ending up with the best of all worlds:

- The best personalized, advanced medicine and quick response time, possibly anywhere in the world through my DPC subscription, with unlimited free" (zero co-pay) doctor visits.

- Flexible coverage for any additional needs and support for decision-making and billing, even when traveling internationally

- A financial backstop just in case things get really expensive

- At a total monthly cost that is still lower than the most basic ho-hum plan on standard insurance

- A further bonus - Sedera incentivizes you to be a member of a DPC, with a solid discount if you are, because they know their costs to cover you will be lower if you are healthier and have hassle-free access to a doctor.

This all sounds good to me, but it is important to state that this is an experiment. I still don't have much experience with the US healthcare system - it helped deliver my son in 2006, and then repair that same boy's broken arm in 2016. Conventional insurance offered some halfhearted support for both of those expenses, but aside from that I don't have many stories to tell.

By collecting more information from readers and from my new helpers at Cloud Medical and Sedera, we should be able to make more sense of all this. And hopefully continue to expand and improve this new, better form of health care so it is accessible to more US residents.

If it gets big enough, we might end up solving this whole problem together - better, cheaper health care for everyone.

But What About the Affordable Care Act?

I think that DPC and ACA could work together perfectly - we keep the idea of the personal relationships, the subscription-based model, and the open and competitive pricing from hospitals for all procedures. But we just don't need conventional insurance companies. If our society wants to help less-wealthy people to afford the best health care (which I think is a great idea), we could just subsidize their DPC memberships and offer a public insurance option at low or zero cost which covers hospitalizations. The reason this is better than the ACA: direct care and no insurance companies.

Conclusion

My past articles and experiences have shown that for many of us, a big hurdle when considering early retirement or self-employment is what about health insurance"? Hopefully the is DPC + Healthshare method will put that question to rest for many of us. After all, shouldn't our career and life choices be separate from our healthcare?

--

Interested in Learning More?

A long-time friend of mine (and fellow early-retiree, and co-owner of the HQ coworking space) Bill and his family have been Sedera customers and enthusiasts for about two years. So much that he even took it upon himself to meet the company's management, sign himself up as a representative to streamline some of the inefficiencies he perceived when joining, and then teach me about the whole thing.

Because of that, I am sharing Bill's Sedera signup link in this article. His is unique among the Sedera affiliates in that he charges zero administrative fee, typical brokers charge $25 per month and up.

https:/sedera.community/thefireguild1

(Sedera also has an option with a different enrollment process for employers. If you run a business and you're interested, send an email to info@thefireguild.com for more info.)

*note: Sedera does pay its affiliates a small referral fee for new customers, which does not affect your monthly bill - in fact, this link offers a lower price than subscribing directly through the company's website. Thus, we believe this is the lowest cost way on the Internet to get this coverage.

As mentioned above, I'm giving Bill his own page to maintain on this site, where he can share his ongoing research and updates and answer questions: mrmoneymustache.com/sedera

Further Reading:

I was quite moved by this piece that Cloud Medical's Dr. David Tusek wrote about the ten heartbreaks" that led him to work since 2009 towards accelerating this better way to do healthcare.

An interesting story from Bill's hometown, from a doctor who took this path way back in 2013:

South Portland Doctor Stops Accepting Insurance, Posts Prices Online

(from the Bangor Daily News)