5 questions from Airbnb’s IPO filing

Airbnb filed to go public yesterday, offering the world a look into its financial performance over the past several years. The company's S-1 detailed an expanding travel giant with billions in annual revenue that was severely disrupted by the COVID-19 pandemic.

But past our overview of Airbnb's core financial results and our look into which investors will make the most from its public debut, there are still questions that need answering.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

We need to to better understand how far Airbnb's bookings fell during the end of Q1 and the start of Q2, when travel first collapsed. And, how far those numbers have come back since. We also want to understand what sort of booking activity is driving those gains - is Airbnb really benefiting from a surge of long-term, local stays?

Then, to close, how profitable was Airbnb when times were good, and what sort of cash stockpile does the company have to get back to its former scale?

Then, to close, how profitable was Airbnb when times were good, and what sort of cash stockpile does the company have to get back to its former scale?

These five questions should help us better understand how Airbnb managed to survive some tough months and still file to go public before 2020 ran out. Let's get to work!

We'll take each question individually, to make our homework today as simple as possible.

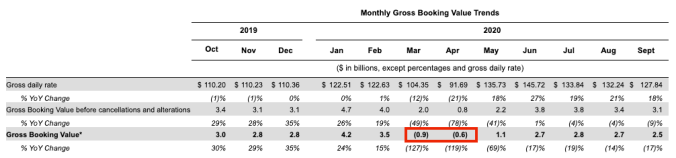

How far did Airbnb's bookings fall during Q1 and Q2?Let's start by looking at Airbnb's gross bookings on a quarterly basis. The company defines gross bookings as net of cancellations and alterations," so these numbers are not artificially inflated.

Here's the chart:

Where does the decline begin? Q1, as we'll see when we dig into monthly data, but the above chart does a good job painting just how bad things got for Airbnb in growth terms as Q1 closed and Q2 kicked off.

As you can see, Airbnb's second quarter gross bookings were its lowest in recent history; Q2 2020 put up the smallest bookings result since at least the first quarter of 2017. For a company that had done $10.0 billion in gross bookings in a single quarter just over a year before, the declines were catastrophic.

But the results are actually worse than that chart shows; Airbnb actually saw gross bookings go negative for a few months.

How is that possible? Recall that the gross bookings figure discounts cancellations and alterations. So, if Airbnb had a big wave of cancellations, its gross bookings number could fall so sharply it goes negative, even if the company were still seeing some new bookings.

That's what happened in March and April. Observe:

So how far did Airbnb's gross bookings fall? They fell to -$900 million in March. More simply, Airbnb saw its expected rental volume fall by nearly $1 billion in a single month. And then in April it fell by another $600 million as more cancellations piled up.

That's why Airbnb cut staff and took on expensive capital; its business had gone from accreting to bleeding in no time at all.

How far have Airbnb's bookings come back since?