Strike first, strike hard, no mercy: How emerging managers can win

- A COVID-19 resilience test for B2B companies

- Discovering that deckhands make great waiters - and why this matters

Like many of us during COVID-19, I've found myself watching a bit more TV than I'm typically accustomed to. My latest binge? The Karate Kid" series continuation Cobra Kai" on Netflix.

A long-time fan of The Karate Kid," I find my style's a bit more Miyagi-Do, but, in reflecting upon my last few years as a founding GP at a young VC firm, I see some parallels between what it takes to win as an emerging manager and the mantras by which the Cobra Kai school abides.

Before diving into that, let me quickly set the stage for what the competitive landscape looks like for emerging managers these days. I'll focus primarily on the seed landscape here, but the Cobra Kai framework applies just as readily to later stage funds as well.

Leading up to the coronavirus pandemic, the venture industry saw a record number of dollars raised by seed funds less than $100 million in size. As is the case across stages however, there has been a notable decline in seed volume in the wake of COVID-19.

U.S. fundraising activity for sub-$100M seed rounds. Data source: PitchBook-NVCA Venture Monitor. Image Credits: Fika Ventures

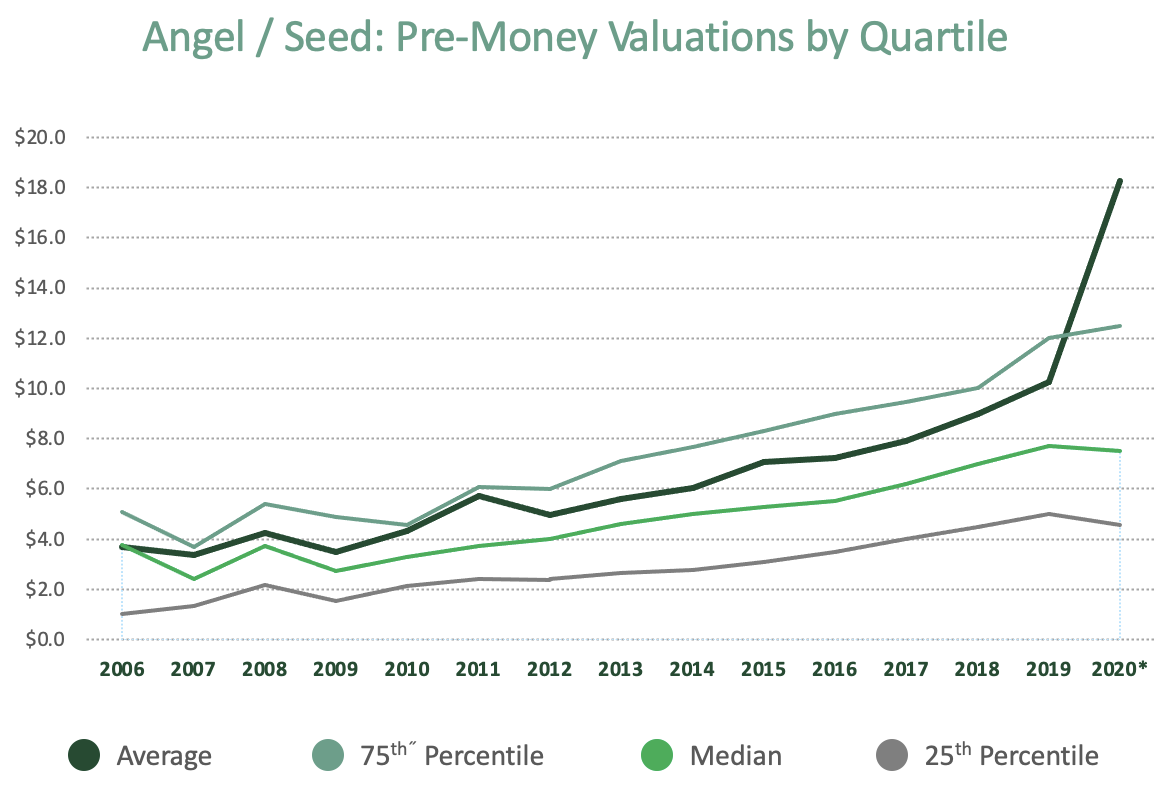

The opposing dynamics of a contraction in deal volume and an unprecedented amount of readily available investable capital has led to a tremendous amount of competition for the highest-quality deals. This flight to quality can be clearly seen in the rise of seed valuations in the upper quartile compared to the decline in other cohorts. Amid a backdrop of COVID chaos, upper quartile valuations have hit an all-time high.

Angel/seed pre-money valuations by quartile. Data source: PitchBook-NVCA Venture Monitor. Image Credits: Fika Ventures

Due to their smaller fund size and prescriptive portfolio construction mandates, emerging managers have little leeway in terms of the valuations at which they can invest - their ownership requirements and check size limits impose a hard ceiling to which their investors hold them strictly accountable.

If budging on valuation is not a viable tactic to compete against established firms - which, in addition to their ability to be less price sensitive also boast more recognizable brand names, larger teams and higher AUM that affords them higher budgets for platform resources - how can emerging managers win? Enter Cobra Kai.

Strike firstLet's face it. As an emerging manager, the chances of you winning a deal once the established players start to circle drops precipitously. In order to win, you need to have a first-mover advantage.

On a practical level, there are two windows of opportunity to achieve this: