Eight International Power Sector Trends to Watch in 2021 and Beyond

The post Eight International Power Sector Trends to Watch in 2021 and Beyond appeared first on POWER Magazine.

Roiled over 2020 by the COVID-19 pandemic, two much-watched international power market outlooks surveying short-term and long-term implications caution the road ahead will be ridden by complexity.

The International Energy Agency's (IEA's) assessment of 2020 trends and 2021 forecasts, contained in its Dec. 14-released Electricity Market Report (EMR2020), warns of lax electricity demand in all major economies over the next year, with the notable exception of China, accompanied by a general plummet in wholesale power prices. The report-which is the agency's inaugural electricity-focused analysis and which it plans to follow with future editions on a half-yearly basis-also suggests coal is expected to bounce back. But in the IEA's annual World Energy Outlook 2020 (WEO2020), which it released in late October to provide an outlook through 2040, coal's share in energy demand could dip below 20% for the first time in modern energy history while renewables are predicted to meet 90% of strong growth in global electricity demand. The projection is based on the IEA's Stated Policies Scenario" (STEPS), which considers stated ambitions, including energy components of announced stimulus packages and climate goals, but which does not consider the recent surge in net-zero emissions targets, which the IEA incorporates in its legacy report for the first time under a Net Zero Emissions by 2050 case" (NZE2050).

Although both reports caution that much uncertainty remains owing to the pandemic, power sector experts from around the world told POWER in November that their assessments are generally aligned with expectations from the world's diverse power markets. Here's a list of the biggest insights these sources offered.

1. Global Electricity Demand Hinges on Pandemic Recovery. Over the past 15 years, electricity demand has almost stagnated in developed economies despite economic growth, and, in total, 93% of worldwide net growth in power demand originated in emerging and developing economies-58% in China alone. In 2021, after a sluggish year owing to the pandemic, demand could surge 3% to levels even higher than 2019, the EMR2020 suggests. However, two-thirds of additional demand is centered in the Asia Pacific region-mostly in China and India, but also in Southeast Asia.

One significant effect of the pandemic's lockdowns was a drop in electricity consumption in both the industrial and commercial sectors, which have led sector use. Between 2005 and 2018, industry consumed 29%, followed by residential (22%), and the commercial and services sector (15%). Looking ahead to 2040, the WEO2020 suggests electrification of light industry will become the largest driver of demand growth to 2025.

New commitments to develop electrolytic hydrogen production could also significantly increase demand. In the STEPS, about 10 TWh could be used to produce 0.4 million tonnes of oil equivalent (Mtoe) of hydrogen by 2030. Residential demand is also set to increase under STEPS owing to electrification of heating and cooling-and particularly due to a surge in air conditioner sales in emerging markets. Under STEPS, electricity demand in the transport sector could also soar by 2030, when a fleet of 110 million electric cars and other vehicles could account for more than 500 TWh of demand. By 2040, the WEO2020 suggests transportation's share of global power demand will rise to 6%, well above 2,000 TWh.

2. Solar Is Generation's New King. Despite the pandemic, net additions of renewable capacity reached a new record of 200 GW in 2020, and total capacity will surge to about 218 GW in 2021, growth that is driven by projects delayed by lockdowns and lapses in investment. In 2025, renewables are expected to overtake coal as the primary means of producing global electricity, the WEO2020 suggests. In particular, solar PV is now the cheapest source of electricity in most countries and it has been the most-built power technology over the past three years," noted IEA analyst Yasmine Arsalane. We are definitely entering a new era and solar PV is becoming the new king."

Most growth will be supported by cheap financing availability. In the leading solar market, financing costs are extremely low, and it reflects very low revenue risk under prevailing policy frameworks," she explained.

Uptake of wind turbines is also driving short-term growth, with about 68 GW-89% of which is onshore-set to be installed in 2021. Offshore wind capacity will also soar to a record level of 7 GW in 2021, with more than half in China, starting with the installation of its first large-scale offshore project in Chinese Taipei.

3. Coal, Nuclear, and Gas Face a Squeeze. Outlooks for coal, nuclear, gas, and even oil, are notable owing to stiff competition they face from renewables. About 13 GW of new nuclear are set to begin operation in 2021-and many units are advanced reactors. China is set to begin operations at Shidawowan, a high-temperature reactor; Fuqing 6, the first Hualong One design; and two other ACPR-1000s. India is targeting operation of its Bhavini, its first fast reactor, as well as a domestically designed 700-MW heavy-water reactor at Kakrapar. Meanwhile, Argentina is expected to begin running the 29-MW Carem, a small modular reactor; the United Arab Emirates (UAE) is scheduled to put Barakah 2 online; Finland may finally commission Olkiluoto 3; and Southern Co. plans to begin operations at Vogtle 3. Other reactors include Ostrovets 2 in Belarus, an APR1400 in South Korea, and an ACP1000 in Pakistan. The U.S., however, is set to retire 5.5 GW of nuclear capacity, and three of the remaining six units in Germany are slated to go offline before the country fully phases out nuclear in 2022.

Global coal capacity, meanwhile, is set to soar to 2,140 GW in 2021, driven by 30 GW of new capacity in China, with minor additions in India, Japan, Indonesia, Vietnam, and Bangladesh. Also notable: the UAE is expected to commission Hassyan 1, the first coal unit in the Middle East outside of Israel. Coal retirements will proliferate, however, with the U.S. set to decommission 3 GW in 2021 (in addition to about 10 GW in 2020), as well as 12 GW in Europe. Closures slated in Portugal, Belgium, Austria, and Sweden over 2021 will complete phase-outs in those countries.

Natural gas capacity, meanwhile, is slated to rise by 30 GW. About 7 GW is in the U.S.-in Texas and Ohio-and another 7 GW is in the Middle East, in Iran, Saudi Arabia, and the UAE. Additionally, 10 GW is in Asia, mostly in China and Malaysia.

4. Flexibility Is Now a Cornerstone of Electricity Security. Owing to shifting power profiles-mainly an increase in variable capacity-wavering demand, and pandemic-related fuel supply disruptions, 2020 showed how important flexibility is and will be to electricity security. One point of consistency across all WEO2020 scenarios is that flexibility needs are set to rise," noted IEA analyst Tim Goodson.

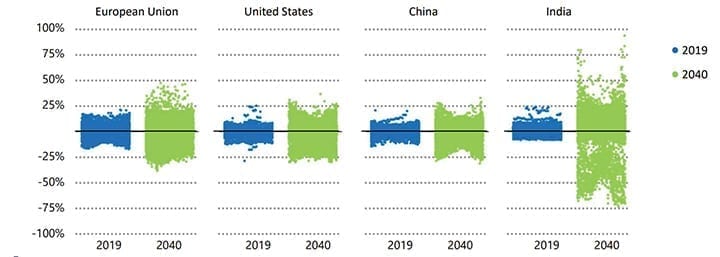

In the STEPS, flexibility needs are set to double globally out to 2040 (Figure 1). The good news is that there are many flexibility sources available from power plants to electricity networks, storage technologies, and demand response measures," Goodson said. Today, coal and gas-fired power plants are the main source of flexibility in many systems, with additional major contributions from low-carbon sources like hydro and nuclear power. Looking ahead, storage and demand-side response could play central roles in flexibility with the right policies and regulations."

|

1. Global flexibility needs, measured as hour-to-hour adjustments here, are set to double by 2040 in the International Energy Agency's (IEA's) Stated Policies Scenario" (STEPS). However, today's market designs may not bring sufficient investment, for example, in power plants, networks, demand-side response and energy storage, including batteries," it said. Courtesy: IEA, World Energy Outlook 2020 |

5. Market Forces Are a Wildcard. While the IEA has noted a general decline in wholesale power prices since 2019, the trend accelerated in 2020, owing partly to a COVID-driven fall in spot natural gas prices of between 20% and 50%, and a decline in power demand. The decline was especially prominent in Nordic countries.

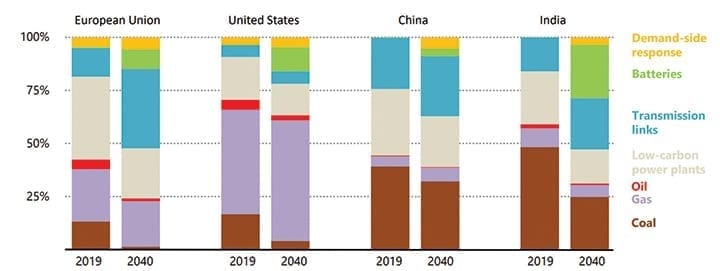

Separately, COVID's effect on utility finances could have repercussions for continued investment in technologies direly needed to ensure electricity security, said IEA's Arsalane. Because the grid will serve as a bedrock of [a] clean and secure electricity future," enabling adequate flexibility could require grid extensions totaling 16 million kilometers in the STEPS. It's an increase of 80% compared to the past decade," she said (Figure 2). The problem is-and we see this in 2020-that depressed revenues for grid operators due to the pandemic are creating risks for this step-up of investment and the timing of these investments." Regulatory reforms may be needed to ensure sufficient cash flow for timely grid investment, which if unaddressed, will pose risks to electricity security as well as slow the pace of the clean energy transition, she said.

|

2. Sources of power system flexibility in the IEA's STEPS. Courtesy: IEA, World Energy Outlook 2020 |

6. Low-Carbon Policies, Ambitions Are on the Rise. The EMR2020 highlights a dramatic increase in national policy objectives, alongside local power market structures, fuel taxes, and efficiency and renewable support measures to enable decarbonization of the power sector. Carbon pricing, which introduces a price signal for the cost of carbon emissions, has been implemented in several regions to provide investment signals and sway electricity dispatch merit orders. In 2021, joining 31 regional emissions trading systems (ETSs), China will start a national ETS to initially cover power and heat generation from coal and gas plants. When operational it will be by far the world's largest emissions trading system, alone covering more than 14% of global CO 2 emissions from fossil-fuel combustion," the IEA noted.

Several countries have meanwhile announced net-zero targets, including China, Japan, South Korea, and European Union members. A number of major power companies have also declared net-zero ambitions, although long-term strategies to achieve them remain murky. In the U.S., despite the lack of federal mandates to meet climate goals, as of December, 70% of the 30 largest electric and gas utilities had net-zero equivalent targets.

While government targets are laudable, long-term vision on how they can be achieved sustainably must be a priority, suggested Karthik Ganesan, Power Sector Lead for India's Council for Energy, Environment and Water, during an IEA panel discussion on Nov. 17. India, which has set a target to install 175 GW of renewable energy by 2022, for example, has auctioned out a lot of capacity, especially in the last two years in phenomenal numbers," but at least 20 GW of capacity contracted to developers by government intermediary Solar Energy Corp. have no off-takers from distribution companies (DISCOMs). Part of the issue stems from declining utility finances, which have suffered more owing to pandemic-related payment waivers, he said. Effecting real change will require ultimate innovation of moving the Indian bulk procurement system or market to a true market. It's still going to be through [power purchase agreements (PPAs)], bilaterally contracted [deals], which I think precludes us from getting the efficiencies that we see in the rest of the world, and I think that is ultimately the biggest challenge that India sees."

Yet another issue that will emerge is how governments deal with legacy power systems. India's coal fleet, which is already paid for, is relatively new, noted Ganesan. Operators are still holding on to earlier PPAs they've signed even if the variable costs are high. They're not retiring older plants and as a result I think there's a backlog of renewable energy projects that are not willing to come onboard" owing to overcapacity risks, he said.

7. Oil's Notable Comeback. Oil, which still accounts for about 3% of global generation, in 2020 benefited from the OPEC+ agreement, which put significant pressure on associated gas production for a number of OPEC producers in the Middle East. In Kuwait, owing to reduced gas burn for power and desalination, the power sector's use of crude oil surged 11% in the first nine months. Saudi Arabia also increased direct crude and heavy fuel oil burning, as did the UAE, Iraq, and Iran to meet record-high peak summer demand. Elsewhere in the world, coal and gas competed fiercely for market share, according to the EMR2020, with gas gaining due to price drops in the U.S. and Europe. However, the sharp recovery in gas prices since the beginning of June has started to erode the competitive position of gas-fired power plants since September," the report notes.

8. Sectoral Coupling Poised to Reshape Power. In a boost to flexibility efforts, global utility-scale battery storage capacity is set for a 20-fold increase between 2019 and 2030, with 130 GW of installed batteries globally projected in the STEPS by 2030, the WEO2020 says. Global potential to tap into demand-side response, enabled by digitalization and automation, is also expected to increase by another 1,500 TWh, mainly in the buildings sector, but also in the residential and transportation sectors.

But according to Doug Arent, executive director of Strategic Public Private Partnerships at the U.S. National Renewable Energy Laboratory (NREL), several other near-term innovations may be poised to reshape how power is produced and consumed. Examples include hybrid resources, blackstart from inverter-based resources, and advanced forecasting to enable sub-hourly scheduling and dispatch. However, It's not just innovations within the [classic generator] system, it's innovations that interfaces with different sectors, which we have classically seen as load sectors,' but increasingly they also become sources of flexibility for us, and we have to more holistically manage all of those," Arent said. These include grid-efficient interactive buildings, including an evolution of smart controls, building controls, and variable-speed motors. Buildings are also adopting innovations in air conditioning-such as ice energy storage-and smart hot water heaters, he noted, while mobility electrification is offering new opportunities for visibility into distributed grids.

Dr. Jochen Kresuel, market innovation manager for technology giant Hitachi ABB Power Grids, highlighted a synergy between the power sector and what he called the molecule-based sector," which integrates gases like hydrogen as both feedstock and energy. However, he cautioned, enabling these changes will require a rethink of the way grids are regulated. We still need efficiency and quality of service, but we also need to have future functionality," said Kresuel.

While regulation and legislation in the past sought to ensure a system operated properly, we are now talking about regulating a system that we have not yet built," but may integrate many aspects, from the demand side and highly distributed generation side, and could involve millions, instead of a few hundred, active elements," he said. According to Kresuel, that will require vision. I say technology is not the bottleneck, and I continue to say that, but nowadays, we need to agree on which technologies we want to use where, and how they should inter-operate. That means regulators, operators, and the users of the network, and maybe also technology providers, have to do that jointly."

-Sonal Patelis POWER's senior associate editor (@sonalcpatel,@POWERmagazine).

The post Eight International Power Sector Trends to Watch in 2021 and Beyond appeared first on POWER Magazine.