Prime Movers Lab raises $245 million for second fund to invest in early stage science startups

After revealing its first fund just last year, a $100 million pool of investment capital dedicated to early stage startups focusing on sustainable food development, clean energy, health innovation and new space technologies, Prime Movers Lab is back with a second fund. Prime Movers Lab Fund II is larger, with $245 million committed, but it will pursue the same investment strategy, albeit with a plan to place more bets on more companies, with an expanded investment team to help manage the funds and portfolio.

There are a lot of VCs out there," explained founder and general partner Dakin Sloss about the concept behind the fund. But there aren't many VCs that are focused exclusively on breakthrough science, or deep tech. Even though there are a couple, when you look at the proportion of capital, I think it's something like less than 10% of capital is going to these types of companies. But if you look at what's meaningful to the life of the average person over the next 30 years, these are all the companies that are important, whether it's coronavirus vaccine,s or solar energy production, or feeding the planet through aquaponics. These are the things that are really meaningful to to making a better quality of life for most people."

Sloss told me that he sees part of the issue around why the proportion of capital dedicated to solving these significant problems is that it requires a lot of deep category knowledge to invest in correctly.

There's not enough technical expertise in VC firms to choose winners intelligently, rather than ending up with the next Theranos or clean tech bubble," he said. So that's the first thing I wanted to solve. I have a physics background, and I was able to bring together a team of partners that have really deeply technical backgrounds."

As referenced, Sloss himself has a degree from Stanford in Mathematics, Physics and Philosophy. He was a serial entrepreneur before starting the fund, having founded Tachyus, OpenGov and nonprofit California Common Sense. Other Partners on the team include systems engineer Dan Slomski, who previously worked on machine vision, electro-mechanical systems and developing a new multi-phase flow fluid analyzer; Amy Kruse, who holds a PhD in neuroscience and has served as an executive in defence technology and applied neuroscience companies; and Carly Anderson, a chemical engineer who has worked in biomedicine and oil & gas, and who has a PhD in chemical and biomolecular engineering. In addition to core partners with that kind of expertise, Prime Movers Lab enlists the help of venture partners and specialist advisors like former astronaut Chris Hadfield.

Having individuals with deep field expertise on the core team, in addition to supplementing that with top-notch advisors, is definitely a competitive advantage, particularly when investing in the kinds of companies that Prime Movers Lab does early on in their development. There's a perception that companies pursuing these kinds of hard tech problems aren't necessarily as viable as a target for traditional venture funding, specifically because of the timelines for returns. Sloss says he believes that's a misperception based on unfortunate past experience.

I think there are three big myths about breakthrough science or hard tech or deep tech," he said. That it takes longer, that it's more capital intensive, and that it's higher risk. And I think the reason those myths are out there is people invested in things like Theranos, and the clean tech bubble. But I think that there were fundamental mistakes made in how they underwrote risk of doing that."

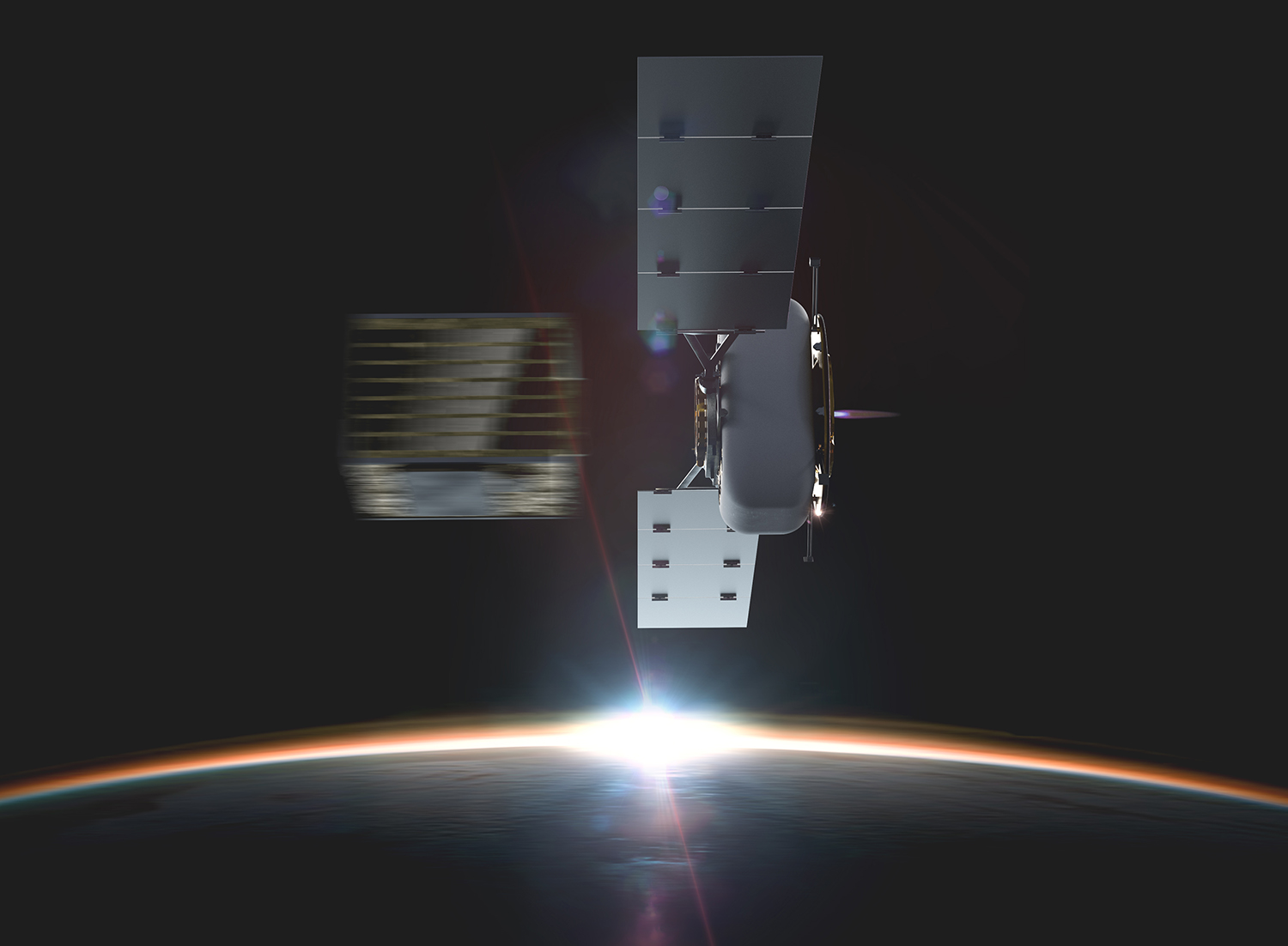

Image Credits: Momentus

To avoid making those kinds of mistakes, Sloss says that Prime Movers Lab views prospective investments from the perspective of a spectrum of risk," which includes risk of the science itself (does the fundamental technology involve actually work), engineering risk (given the science works, can we make it something we can sell) and finally, commercialization or scaling risk (can we then make it and sell it at scale with economics that work). Sloss says that if you use this risk matrix to assess investments, and allocated funds to address primarily the engineering risk category, concerns around timeframes to return don't really apply.

He cites Primer Movers Lab's Fund I portfolio, which includes space propulsion company Momentus, heading for an exit to the public markets via SPAC (the company's Russian CEO actually just resigned in order to smooth the path for that, in fact), and notes that of the 15 companies that Fund I invested in, four are totally on a path to going public. That would put them much faster to an exit than is typical for early stage investment targets, and Sloss credits the very different approach most hard science startups take to IP development and capital.

The inflection points in these types of companies are actually I think faster to get to market, because they've spent years developing the IP, staying at relatively low or attractive valuations," he said. Then we can kind of come in, at that inflection point, and help them get ready to commercialize and scale up exponentially, to where other investors no longer have to underwrite the difference between science and engineering risk, they can just see it's working and producing revenue."

Companies that fit this mold often come directly from academia, and keep the team small and focused while they're figuring out the core scientific discovery or innovation that enables the business. A prime example of this in recent memory is Wingcopter, a German drone startup that developed and patented a technology for a tilt-wing rotor that changes the economics of electric autonomous drone flight. The startup just took its first significant startup investment after bootstrapping for four years, and the funds will indeed be used to help it accelerate engineering on a path towards high-volume production.

While Wingcopter isn't a Prime Movers Lab portfolio company, many of its investments fit the same mold. Boom Aerospace is currently working on building and flying its subscale demonstration aircraft to pave the way for a future supersonic airliner, while Axiom Space just announced the first crew of private tourists to the International Space Station who will fly on a SpaceX Falcon 9 for $50 million a piece. As long as you can prove the fundamentals are sound, allocating money turning it into something marketable seems like a logical strategy.

For Prime Movers Lab's Fund II, the plan is to invest in around 30 or so companies, roughly doubling the number of investments from Fund I. In addition to its partners with scientific expertise, the firm also includes Partners with skill sets including creative direction, industrial design, executive coaching and business acumen, and provides those services to its portfolio companies as value-add to help them supplement their technical innovations. Its Fund I portfolio includes Momentus and Axiom, as mentioned, as well as vertical farming startup Upward Farms, coronavirus vaccine startup Covaxx, and more.