Spotify podcast listeners to top Apple’s for the first time in 2021, forecast claims

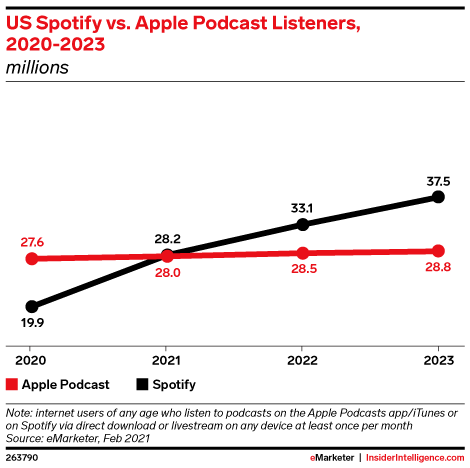

Investors have been waiting for Spotify's multimillion-dollar bet on podcasting to pay off, in terms of increased paid subscriptions or improved revenues. But before that can occur, Spotify has to get more people listening to podcasts through its app. On that front, the streaming service has momentum. According to a new market forecast, Spotify's U.S. podcast listenership will surpass Apple Podcasts for the first time this year when 28.2 million U.S. users will listen to podcasts on Spotify at least monthly, compared with 28.0 million via Apple Podcasts.

This shift will come on the heels of expected 41.3% in 2021, the analysts at eMarketer are predicting.

In the two years that follow, Spotify will widen the gap with Apple, reaching 33.1 million monthly U.S. podcast listeners by 2022, versus 28.5 million for Apple Podcasts. And by 2023, Spotify will see 37.5 monthly million listeners in the U.S., compared with Apple's still flat 28.8 million.

Image Credits: eMarketer

The firm notes that Apple has been losing podcast listener share since it first began tracking the market back in 2018. At that point, Apple Podcasts had a 34% market share, which will fall to 23.8% this year.

Overall, there will be 117.8 million people in the U.S. who listen to podcasts on a monthly basis in 2021, a 10.1% year-over-year increase. Podcast listeners will also account for 53.9% of monthly digital audio listeners, surpassing 50% for the first time, eMarketer says. This growth is also likely to benefit Spotify at Apple's expense.

Apple, unlike other streaming music services - including Spotify, Amazon, and Pandora, for example - has split off podcasts into their own app instead of offering an integrated experience with music and podcasts combined. That means it's missing out from some of the crossover that occurs when someone is streaming music or thinking of doing so, but then decides to listen to podcasts instead and vice versa. In other apps, making the jump between music and other audio is easier - and there are even ways to listen to music and podcasts combined, as with Pandora Stories or Spotify's Shows with Music and its other mixed-media playlists.

By putting podcasts and music in one place, Spotify quickly became the convenient one-stop-shop for everything digital audio," noted eMarketer forecasting analyst Peter Vahle. Apple was the de facto destination for podcasts for a long time, but in recent years, it has not kept up with Spotify's pace of investment and innovation in podcast content and technology. Spotify's investments have empowered podcast creators and advertisers through its proprietary hosting, creation, and monetization tools," he said.

Apple today still seems to be experimenting with podcasts. It recently began calling attention to quality podcasts, through increased editorial curation. It's dabbled in releasing a few podcasts of its own, as with its recently launched For All Mankind" companion podcast for its Apple TV+ series or its original podcasts focused on music. But Apple seems to have largely ignored the market momentum around the format, instead focusing on expansions to new areas - like streaming TV and movies or subscription-based fitness.

Spotify, which already has a set of originals and exclusives via acquisitions, is moving ahead to what's next. Last week, for instance, it announced a number of upcoming products and features, including paid podcast subscriptions, WordPress integrations to turn blogs into podcasts, and tools to make its podcasts more interactive - the latter an attempt at challenging the growing interest in social audio apps like Clubhouse.

The company is also newly investing in the advertising business around podcasts with plans to launch an audio ad marketplace, the Spotify Audience Network.

Image Credits: eMarketer

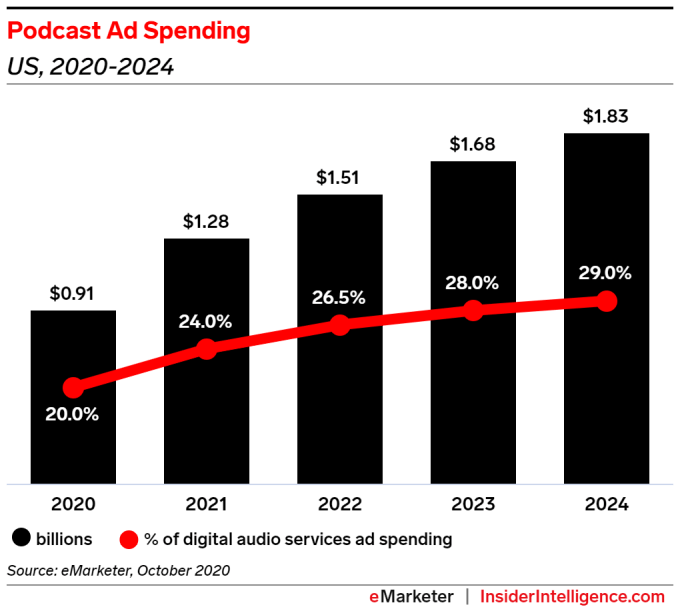

That could be a timely launch, eMarketer's forecast indicates. The firm is predicting that podcast advertising will top $1 billion for the first time in 2021, reaching $1.28 billion - a 41% year-over-year increase. This figure will continue to grow in the years to come, with podcasts going from a 24% share of the total digital audio ad spend in 2021 to 29% by 2024.

To what extent Spotify can actually follow through on converting its podcast listenership to paid subscribers of some sort, or whether it can successfully monetize them through advertisements, remains to be seen, of course. After all, Spotify today is losing money, as The Wall St. Journal recently pointed out in covering its Q4 2020 earnings. That's because it's still prioritizing investments in subscriber growth and podcasting over turning a profit for the time being. And there are some early indications that its exclusive model could have issues - last year, for example, it lost its first big podcast star, Joe Budden, when it failed to reach a new agreement.

Meanwhile, Apple has been said to be exploring a podcast subscription service of its own, too - something it could bundle into a higher-value subscription that includes other services like cloud storage, streaming TV, games and more. And Amazon just made its own investment in podcast with the acquisition of podcast network Wondery. These factors could come into play over the next few years, potentially disrupting this forecast and Spotify's future podcast listenership growth.

Early Stage is the premiere how-to' event for startup entrepreneurs and investors. You'll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We'll cover every aspect of company-building: Fundraising, recruiting, sales, legal, PR, marketing and brand building. Each session also has audience participation built-in - there's ample time included in each for audience questions and discussion.