Healthcare is the next wave of data liberation

Why can we see all our bank, credit card and brokerage data on our phones instantaneously in one app, yet walk into a doctor's office blind to our healthcare records, diagnoses and prescriptions? Our health status should be as accessible as our checking account balance.

The liberation of financial data enabled by startups like Plaid is beginning to happen with healthcare data, which will have an even more profound impact on society; it will save and extend lives. This accessibility is quickly approaching.

As early investors in Quovo and PatientPing, two pioneering companies in financial and healthcare data, respectively, it's evident to us the winners of the healthcare data transformation will look different than they did with financial data, even as we head toward a similar end state.

For over a decade, government agencies and consumers have pushed for this liberation.

This push for greater data liquidity coincides with demand from consumers for better information about cost and quality.

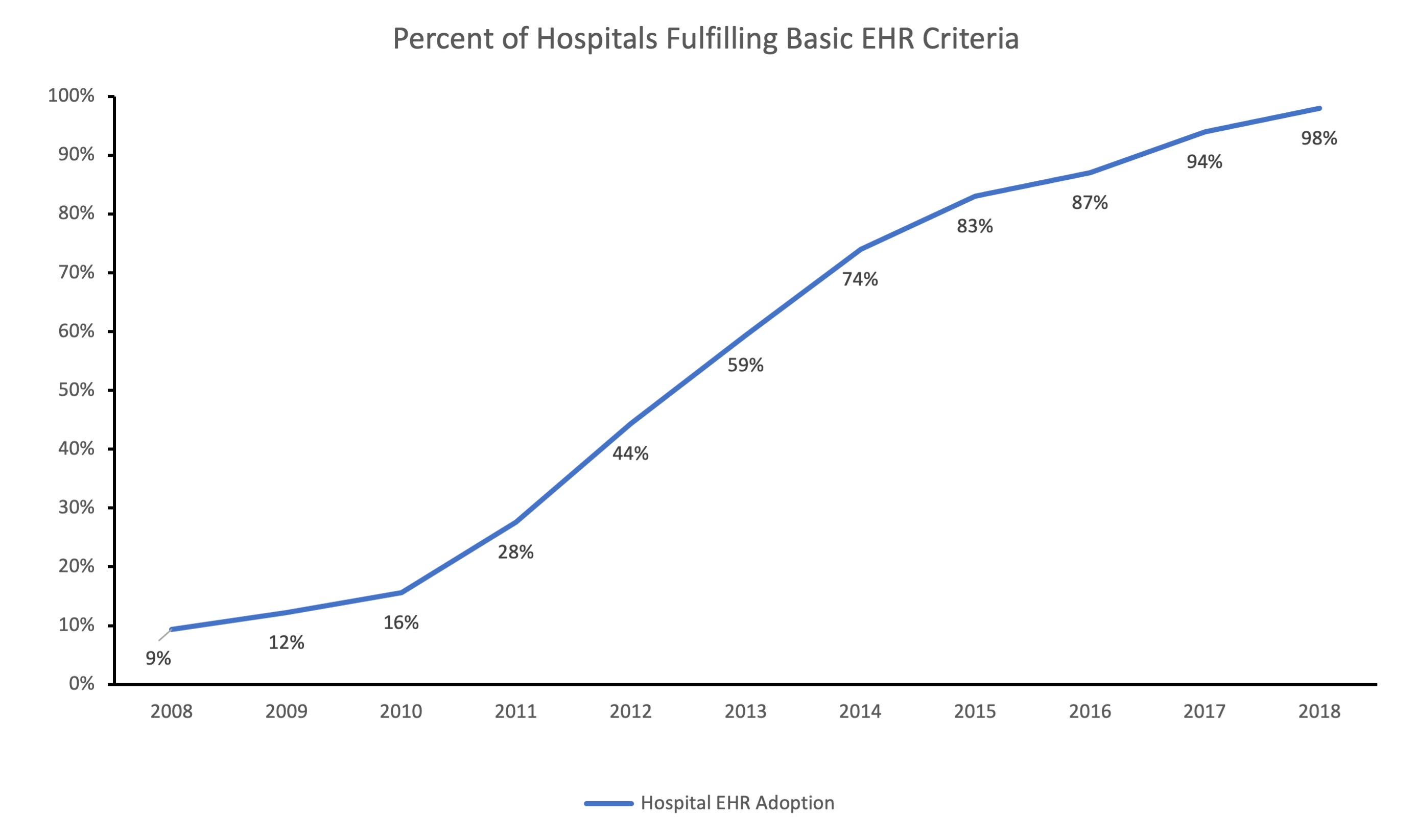

In 2009, the Health Information Technology for Economic and Clinical Health Act (HITECH) gave the first big industry push, catalyzing a wave of digitization through electronic health records (EHR). Today, over 98% of medical records are digitized. This market is dominated by multibilliondollar vendors like Epic, Cerner and Allscripts, which control 70% of patient records. However, these giant vendors have yet to make these records easily accessible.

A second wave of regulation has begun to address the problem of trapped data to make EHRs more interoperable and valuable. Agencies within the Department of Health and Human Services have mandated data sharing among payers and providers using a common standard, the Fast Healthcare Interoperability Resources (FHIR) protocol.

Image Credits: F-Prime Capital

This push for greater data liquidity coincides with demand from consumers for better information about cost and quality. Employers have been steadily shifting a greater share of healthcare expenses to consumers through high-deductible health plans - from 30% in 2012 to 51% in 2018. As consumers pay for more of the costs, they care more about the value of different health options, yet are unable to make those decisions without real-time access to cost and clinical data.

Image Credits: F-Prime Capital

Tech startups have an opportunity to ease the transmission of healthcare data and address the push of regulation and consumer demands. The lessons from fintech make it tempting to assume that a Plaid for healthcare data would be enough to address all of the challenges within healthcare, but it is not the right model. Plaid's aggregator model benefited from a relatively high concentration of banks, a limited number of data types and low barriers to data access.

By contrast, healthcare data is scattered across tens of thousands of healthcare providers, stored in multiple data formats and systems per provider, and is rarely accessed by patients directly. Many people log into their bank apps frequently, but few log into their healthcare provider portals, if they even know one exists.

HIPPA regulations and strict patient consent requirements also meaningfully increase friction to data access and sharing. Financial data serves mostly one-to-one use cases, while healthcare data is a many-to-many problem. A single patient's data is spread across many doctors and facilities and is needed by just as many for care coordination.

Because of this landscape, winning healthcare technology companies will need to build around four propositions: