Revolut revenue grew by 57% in 2020

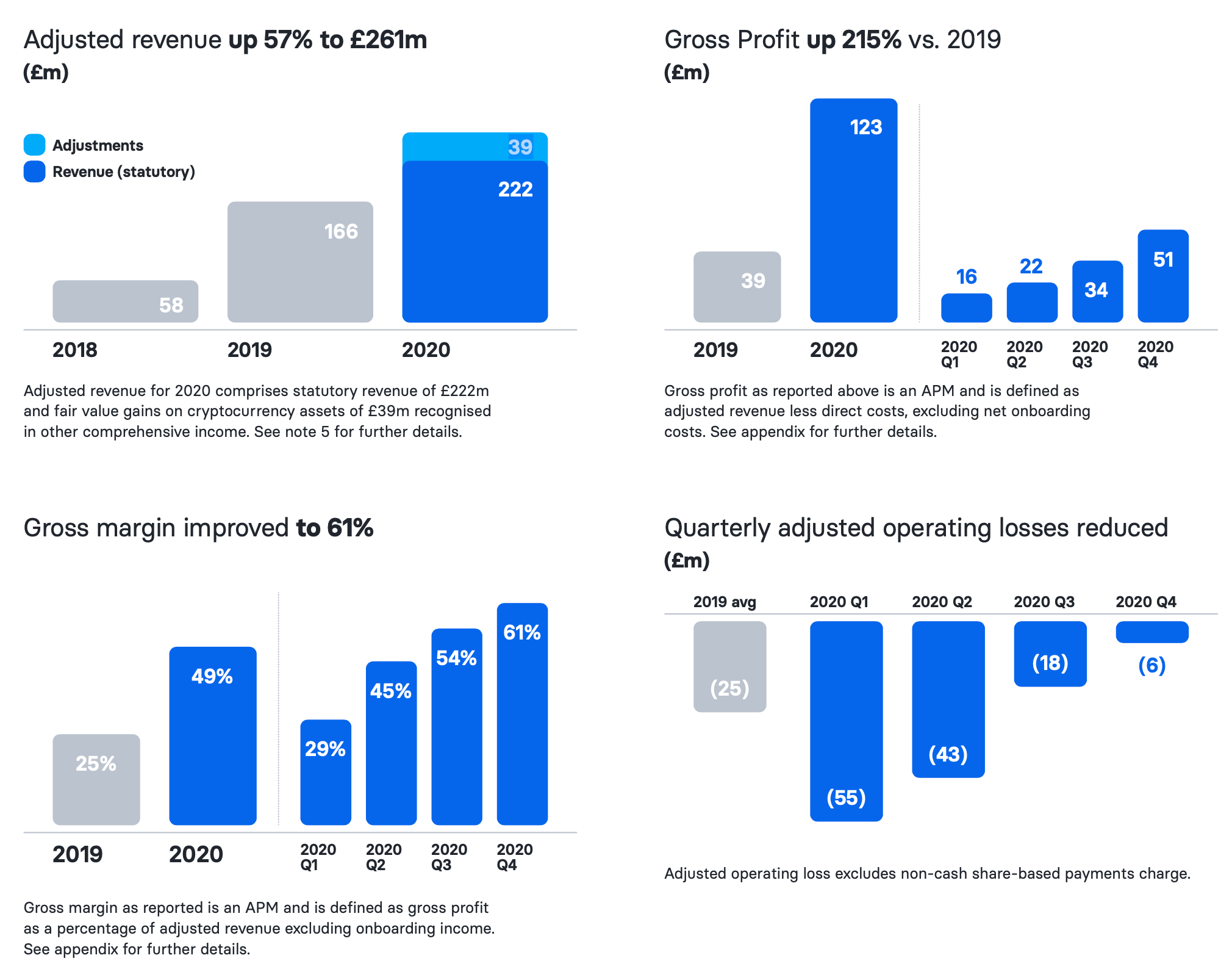

Fintech startup Revolut has filed some financial results and is sharing details with the press. In 2020, the company reported $361 million in revenue (261 million) - that's a 57% increase compared to 2019 revenue of $229 million (166 million).

Interestingly, those revenue figures have been adjusted to include fair value gains on cryptocurrency assets - it means that Revolut holds some crypto assets on its balance sheet. Revolut made $54 million (39 million) in fair value gains on cryptocurrency assets.

Gross profit reached $170 million (123 million) last year. At the same time, the company still reports operating losses. In particular, Q1 2020 was a particularly bad quarter with $76 million (55 million) in adjusted operating loss.

In 2020, total non-adjusted operating loss reached $277 million (200.6 million). Like many tech companies, administrative expenses are responsible for this loss. With a staff of 2,200 people, the company spent $367 million (266 million) on administrative costs alone. But things seem to be improving as you can see:

Image Credits: Revolut

These trends aren't that surprising as I reported that fintech startups spent most of 2020 focusing on profitability and improving their margins. At the end 2020, Revolut had 14.5 million personal customers and 500,000 companies using Revolut Business.

As the extraordinary circumstances of 2020 drove the trend towards digital financial management we continued to innovate for customers to make their financial lives easier and accelerate daily use. We launched 24 new retail and business products, expanded into the US, Japan and Australia and launched banking services in Lithuania, all while significantly improving our profitability," founder and CEO Nikolay Storonsky said in a statement. We began 2021 with a more resilient and productive business that will enhance our trajectory towards rapid growth."

When you compare Q1 2020 to Q1 2021, things are radically different for the fintech company. Revenue increased by 130% year-over-year and gross profit grew by 300% between Q1 2020 and Q1 2021.

Revolut has been launching a ton of products to diversify its sources of revenue. It is increasingly becoming a financial super app with current accounts, debit cards, trading services, insurance products, premium subscriptions, cryptocurrency trading and more.

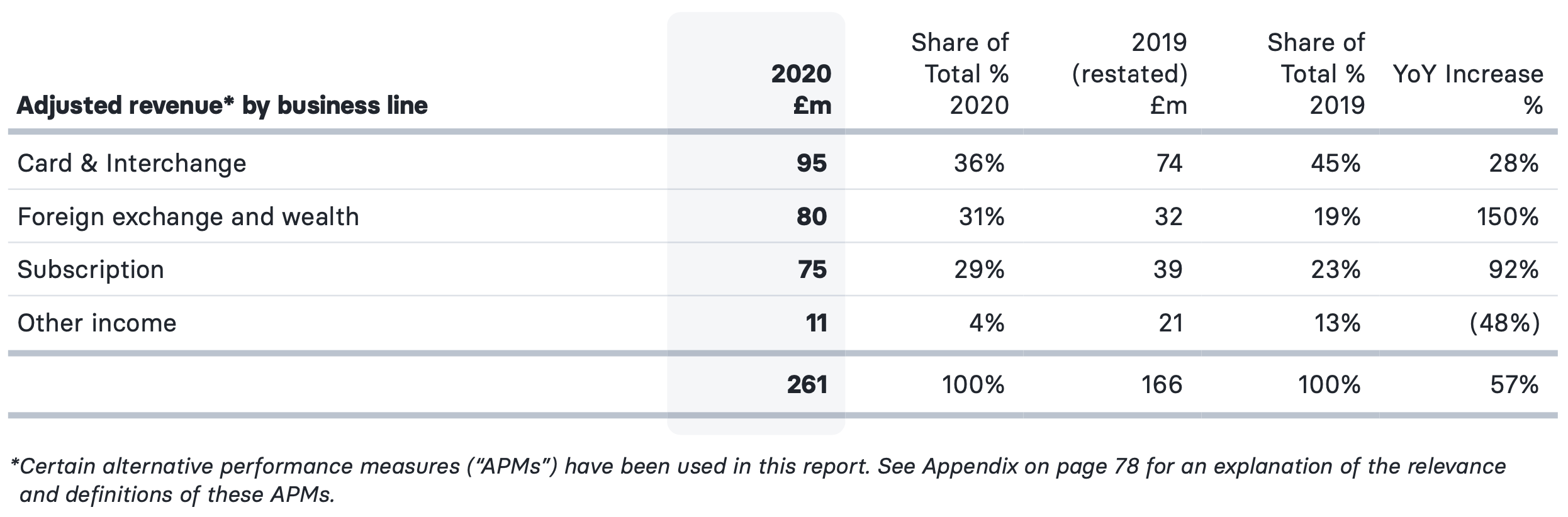

Interestingly, interchange revenue from card transactions represents a good chunk of the company's revenue. In 2020, cards and interchange generated $131 million (95 million) in revenue. Every time a Revolut customer makes a card purchase, the card scheme (Visa or Mastercard) gives back some fees to Revolut. It's an incredibly small percentage-based fee, but it can add up when you generate millions of purchases.

Foreign exchange and wealth generated $111 million (80 million) in revenue. That's another big one. And finally, subscriptions, such as Revolut Plus, Revolut Premium and Revolut Metal, accounted for $104 million (75 million) in revenue.

Those are three strong pillars that all contribute to the company's bottom line. They all represent a bit less or a bit more than a third of the company's overall revenue.

Image Credits: Revolut

While the company has expanded aggressively over the years, the U.K. is still by far its biggest market. In 2020, 88.4% of the company's (non-adjusted) revenue was related to its activities in the U.K. The European Economic Area without the U.K. represented 10.2% of revenue. The U.S., Japan, Australia and other markets were nearly negligible.

Revolut has also raised a mega round of funding in 2020 - a $500 million Series D round that was extended to $580 million in total. I wouldn't be surprised if the company launches an initial public offering within the next 12 months.

Revolut extends Series D round to $580 million with $80 million in new funding