Circle is a good example of why SPACs can be useful

In the wake of Coinbase's direct listing earlier this year, other crypto companies may be looking to go public sooner than later. That appears to be the case with Circle, a Boston-based technology company that provides API-delivered financial services and a stablecoin.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Circle will not direct list or pursue a traditional IPO. Instead, the company is combining with Concord Acquisition Corp., a SPAC, or blank-check company. The transaction values the crypto shop at an enterprise value of $4.5 billion and an equity value of around $5.4 billion.

The offering marks an interesting moment for the crypto market. Unlike Coinbase, which operates a trading platform and generates fees in a manner that is widely understood by public-market investors, Circle's offerings are a bit more exotic.

The offering marks an interesting moment for the crypto market. Unlike Coinbase, which operates a trading platform and generates fees in a manner that is widely understood by public-market investors, Circle's offerings are a bit more exotic.

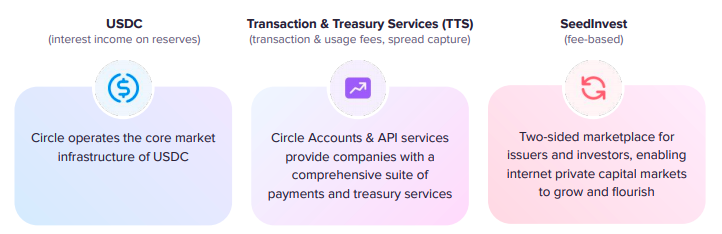

Circle's SPAC presentation details a company whose core business deals with a stablecoin - a crypto asset pegged to an external currency, in this case, the U.S. dollar - and a set of APIs that provide crypto-powered financial services to other companies. It also owns SeedInvest, an equity crowdfunding platform, though Circle appears to generate the bulk of its anticipated revenues from its other businesses.

For more on the deal itself, TechCrunch's Romain Dillet has a piece focused on the transaction. Here, we'll dig into the company's investor presentation, talk about its business model, and riff on its historical and anticipated results and valuation multiples.

In short, we get to have a little fun. Let's begin.

How Circle's business worksAs noted above, Circle has three main business operations. Here's how it describes them in its deck:

Image Credits: Circle investor presentation

Let's consider each one, starting with USDC.

Stablecoins have become popular in recent quarters. Because they are pegged to an external currency, they operate as an interesting form of cash inside the crypto world. If you want to have on-chain buying power, but don't want to have all your value stored in more volatile, and tax-inducing, cryptos that you might have to sell to buy anything else, stablecoins can operate as a more stable sort of liquid currency. They can combine the stability of the U.S. dollar, say, and the crypto world's interesting financial web.