Fintech is transforming the world’s oldest asset class: Farmland

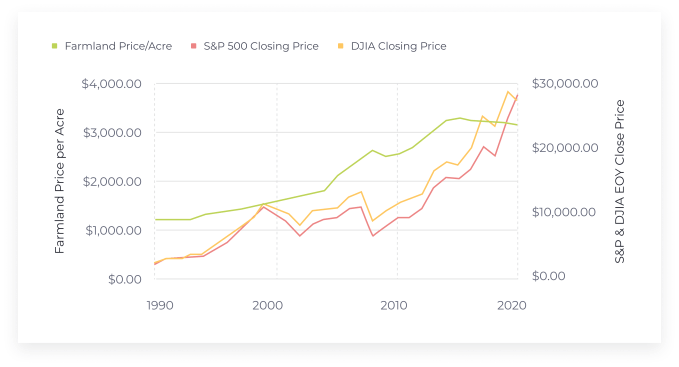

Farmland as an asset class has proven itself to be a stable investment decade after decade. Farmland's negative correlation with the Dow Jones Industrial Average sits at an eye-popping -43% for a three-year hold period, making it an excellent hedge against market volatility.

The asset has also been a steady appreciator since 1987, when institutional investors began incorporating farmland into their portfolios. Equally, investments into sustainably managed farmland have the potential to transform agriculture from one of the largest sources of greenhouse gas emissions to one of the largest carbon sinks.

While farmland investments can provide passive income and a hedge during just about any economic condition, direct investments into the asset have been largely inaccessible to date.

However, while farmland is among the oldest investment classes around, the average investor hasn't had access to farmland the way that billionaires and institutional investors have.

Revolutions in fintech and a host of startups are changing this.

Why farmland?COVID-19 affected the world in ways we couldn't have predicted, and the markets were no exception. The S&P 500 plummeted in mid-March and shed 34% of its pre-COVID peak value. But unlike past crises, the index rebounded just a month later.

This doesn't mean that financial markets have fully recovered, however. We've seen plenty of volatility since, both in the form of rallies and losses. This has caused many investors to move some of their portfolio out of equities.

This is where farmland entered the discussion.

Image Credits: FarmTogether (opens in a new window)

A historically stable asset classWild stock market fluctuations existed well before COVID-19. The latest era of volatility began in 2018 and continued even as the economy grew prior to the pandemic. Given the unpredictability of the equities market, investors need to counterbalance what's in store for stocks and funds.