Fueling a Cleaner Future with a Hydrogen-First Economy: The New Green Energy Disrupting Power Distribution Companies

Today, hydrogen is experiencing unprecedented demand. Its potential to become a key facilitator of a global transition to a net-zero emission economy, and provide a clean energy solution, has not gone unnoticed by industries worldwide-especially in the energy, utilities, and resources sector. But introducing a hydrogen-powered energy economy is no light decision, it will affect all aspects of how we generate and transmit power. Organizations must rely on modern technology and infrastructure to support a shift that will have an impact on the industry for the next 150 years.

Today, hydrogen is experiencing unprecedented demand. Its potential to become a key facilitator of a global transition to a net-zero emission economy, and provide a clean energy solution, has not gone unnoticed by industries worldwide-especially in the energy, utilities, and resources sector. But introducing a hydrogen-powered energy economy is no light decision, it will affect all aspects of how we generate and transmit power. Organizations must rely on modern technology and infrastructure to support a shift that will have an impact on the industry for the next 150 years.Rising concerns about the effects of climate change, pledges to net-zero carbon emissions, and commitments to reducing greenhouse gases populate our energy landscape. Many would agree that hydrogen has the potential to help solve all. From its energy efficiency, lack of emissions, and access readiness to representing the most plentiful energy source on earth and throughout the galaxy-ultimately, hydrogen has the greatest potential to transform energy, utilities, and resources (EUR). So much so, that demand is expected to grow by 44% by 2030.

If there was ever a time to tap into hydrogen's potential for tackling crucial energy challenges, it would be now. Canada leads the charge in North America and worldwide, as a global producer of hydrogen production, with many other countries set to follow suit as they look to advanced technology that can assist in making the transformation possible.

The Importance of Hydrogen ExplainedIn particular, there is now a lot of focus on green hydrogen, an incredibly significant development for the renewable energy space and a huge step toward a decarbonized economy. Its importance comes down to how it is produced, because unlike hydrogen from the existing supply chain, green hydrogen does not rely on natural gasses or fossil fuels for its existence. Instead, green hydrogen is derived from water and renewable energies, such as solar or wind, and is the only type of hydrogen produced in a carbon-neutral manner-an invaluable trait for reaching net-zero emissions by 2050. For this reason, green hydrogen was featured heavily in a number of pledges at the 2021 United Nations Climate Change Conference (COP26) as a driver for decarbonizing a range of industries spanning heavy industry, long-haul freight, shipping, and aviation.

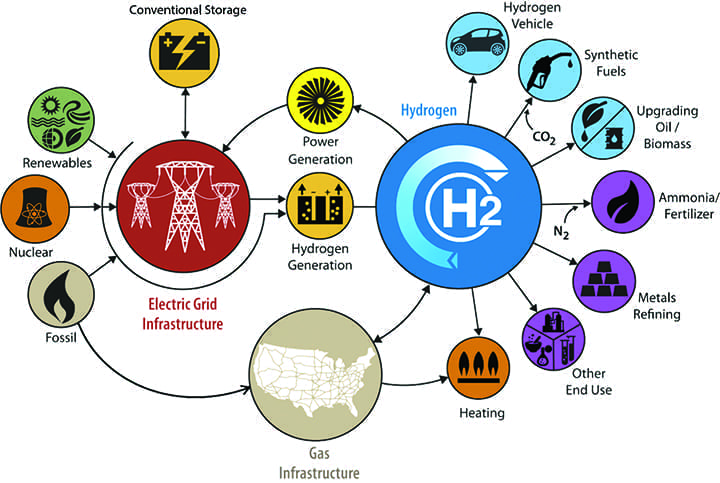

If we take the bigger picture, and the use of hydrogen in general, there is more to it than sustainability benefits. In the long-term, hydrogen has the potential to considerably reduce the cost of energy production and the challenges of transportation and storage. Across the whole value chain, hydrogen presents an abundance of business opportunities-from power generation, energy efficiency, and improvement to the environment, to industrial feedstock, an increased number of high-paid jobs, and benefits in transportation.

The Race to Going Green' Has Begun-Who's Applying the Pressure?As with many sustainability initiatives, consumers sit in the driver's seat for change; in the case for hydrogen, the story is no different. This can be seen in the rising popularity of electric cars. In the U.S., an increasing number of consumers are gravitating toward purchasing cleaner cars," with 7% of adults already owning one and another 39% claiming to be very or somewhat likely to seriously consider buying an electric vehicle. Currently, the move is battery focused, but hydrogen can dramatically transform how these cars are embraced by the majority. From increased efficiencies in consumption, to emitting only water vapor and warm air, to convenience. A hydrogen cell can be refilled just as quickly as today's regular petrol or diesel car.

The pressure doesn't all come from changing consumer preferences though. Changes in regulation surrounding hydrogen will be inevitable as governments and countries begin to set out their own hydrogen roadmaps for the future. We've already seen infrastructure bills in the U.S. to support wide-scale hydrogen deployment, while in Canada, Japan, and several countries within Europe, the drawings of their own roadmaps have commenced. It is this type of forward-thinking that will help organizations, industries, and countries gain a competitive advantage in an increasingly volatile EUR market.

Costs Remain the Primary Challenge to Hydrogen AdoptionIn today's market, the cost of hydrogen is high, and its extreme flammability makes the cost of specialized pipelines and carriers incredibly expensive. For many, this presents a major barrier to hydrogen adoption. However, PwC research suggests that these production costs will reduce over time due to economies of scale, technological advances, and renewable energy costs. PwC predicts that hydrogen costs will decrease by 50% by 2030.

Let's compare hydrogen to solar-powered energy. In the last two decades, the cost of solar power has fallen by 90%, with prices set to drop another 15% to 25% in the upcoming years. Driven by government contributions and environmental concerns, solar is set to become the cheapest source of new electricity generation by 2030 across all U.S. states, Canada, and 15 other nations.

Getting Hydrogen to the User: A Worldwide Grid Transition That Needs New InfrastructureMoving an entire gird to renewable energies is no job for the faint-hearted and will require serious investment into the construction of electricity transmission, distribution, and storage networks. By 2050, demand for energy is set to increase by at least 50%, and future success will hinge on the right infrastructure being in place to keep pace with these unprecedented levels of demand.

As we look at moving the grid, the infrastructure challenge revolves around the positioning of wind and solar farms that are heavily relied upon for green hydrogen. The options are limited. Take North America as an example. The optimal locations for solar farms in North America are in the Midwest, where access to solar energy is consistent, but major consumers reside along the east and west coasts. The disconnect lies in interconnection proximity, and it is up to EUR organizations as well as governments to configure a suitable distribution power network that can transfer energy from the generator straight through to the end consumer.

Big Changes Ahead Mean Energy Companies Need to Be Agile to Be PreparedWhile green hydrogen offers a decarbonized solution, it cannot be achieved without the digital helping hand of technology. For traditional technology companies, a deep understanding of both software and the science behind it will be essential to create a hydrogen generation facility.

In my work at IFS, EUR is a core market, and our industry clients are already at the forefront of looking at how they can integrate more renewable energies into their operations. For example, IFS customer LKAB, Europe's largest iron ore producer, has delivered the first fossil-free steel in the world, made from 100% fossil-free hydrogen. Helping them efficiently make the transition has been a key driving force for investment in new technologies and toolsets, ranging from project and asset management to innovative supply chain capabilities.

All of these technologies can support customers in a new and emerging line of business. Implementing smart information technology (IT) support that leverages artificial intelligence (AI) and machine learning is vital. As EUR organizations diversify, their energy mix will create increasingly complex organizations that require agile and flexible solutions to manage a wide variety of production facilities.

Could Green Hydrogen Be the Future of EUR?

As the need for more energy rises, more organizations will turn to green hydrogen as a power facilitator. With increased efficiency gains, carbon-neutral features, and transferable capabilities, hydrogen will undeniably be a huge part of the energy equation of the future.

The trend will catch on, and big players in the EUR market will increasingly want to stay relevant in a carbon-neutral and sustainable world. To avoid being left behind, it's time to capitalize on all the benefits green hydrogen has to offer; it will shape the future of power transmission and distribution over the next century.

-Carol Johnston is vice president of Industries, Energy, Utilities, and Resources with IFS.

The post Fueling a Cleaner Future with a Hydrogen-First Economy: The New Green Energy Disrupting Power Distribution Companies appeared first on POWER Magazine.