California, Again Facing Summer Supply Vulnerabilities, Eyes 20-GW Offshore Wind Goal

The California Energy Commission (CEC) is mulling a preliminary planning goal for 3 GW of offshore wind by 2030 and potentially expanding it to 10 GW to 15 GW by 2045. If finalized, California's offshore wind goals would be the most ambitious in the U.S., surpassing even New York's, which calls for 9 GW by 2035.

In a draft report sent to the state's governor on May 9, the CEC suggested California has an offshore technical potential in federal waters off the California coast of 21.8 GW, based on wind speed, ocean depth, bottom score, and distance to connecting infrastructure. Preliminary planning goals, however, focus mainly on floating offshore wind deployments, given that the deep waters of the Pacific Outer Continental Shelf off California's coast have steep drop-offs and will require offshore wind turbines installed on floating platforms to be anchored to the seabed."

The CEC's draft responds to Assembly Bill 525 (AB 525), a law that took effect this January and requires the CEC to develop a strategic plan" for offshore wind energy developments off the California coast in federal waters. While the law requires the CEC to submit the strategic plan to the California Natural Resources Agency (CNRA) and the California Legislature by June 2023, it requires the CEC to evaluate and quantify the maximum feasible capacity" of offshore wind the state will need to achieve reliability, ratepayer, employment, and decarbonization benefits" in the interim. Under the law, CEC is obligated to establish offshore wind energy megawatt planning goals for 2030 and 2045 by June 1, 2022.

An Even Larger Goal of Up to 20 GW Between 2045 and 2050Though the CEC in its draft cautioned planning goals should not be seen as a floor" or ceiling" for offshore wind procurement in California, to complete the strategic plan, the CEC suggested a 3 GW planning goal for 2030 may be feasible. California's initial offshore capacity could come from a full build-out of the Morro Bay Wind Energy Area (WEA) or a combination of a partial build-out of the Morro Bay WEA and Humboldt WEA," it noted.

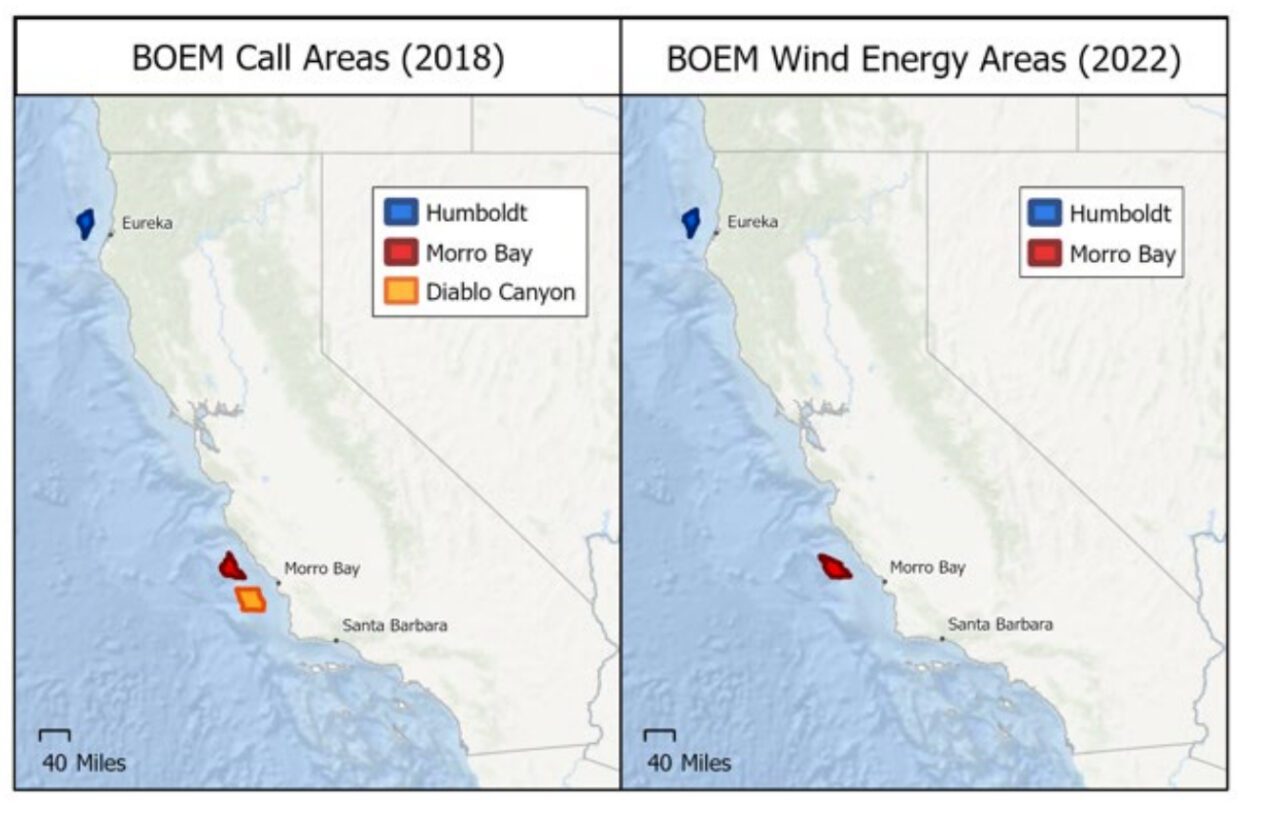

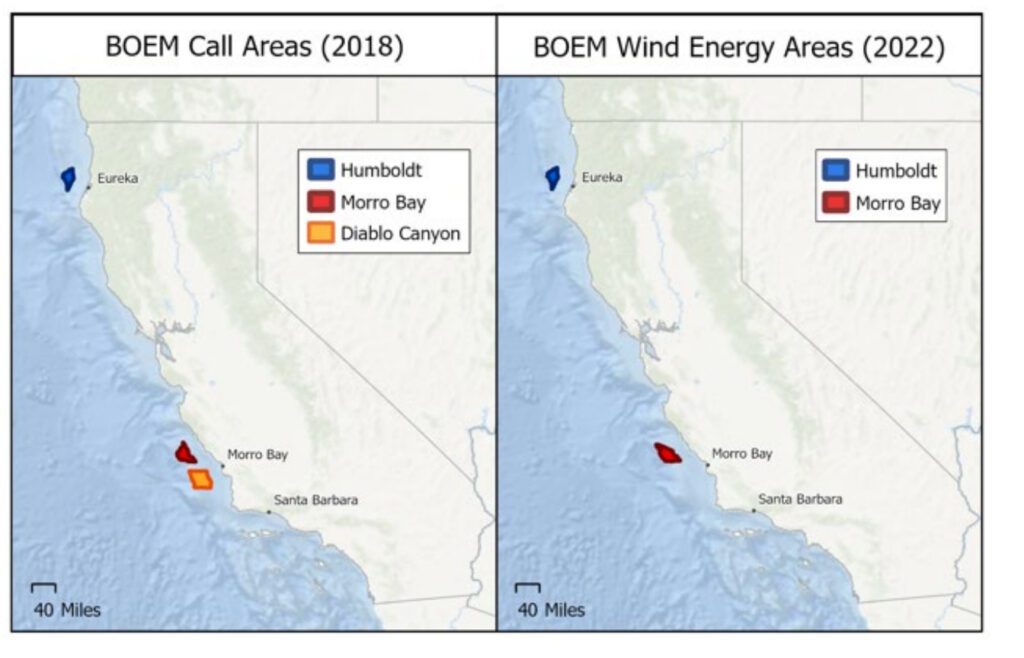

Offshore Wind Call Areas and Wind Energy Areas off the coast of California. Source: CEC

Offshore Wind Call Areas and Wind Energy Areas off the coast of California. Source: CEC

The U.S. Bureau of Ocean Energy Management (BOEM) has so far designated three call areas offshore California: Humboldt, on the North Coast, and Morro Bay and Diablo Canyon, off the Central Coast. According to the CEC, these three call areas have a potential 8.3-GW capacity (assuming 3 MW per square kilometer). BOEM in 2021 designated the Humboldt and Morro Bay wind energy areas (WEAs), with a combined potential generation capacity of 4.5 GW. BOEM suggests the Humboldt WEA could host up to 1.6 GW of energy to the grid, while the Morro Bay WEA could host 2.9 GW.

The CEC's goals for 10 MW to 15 MW for 2045, meanwhile, could inform the development of a strategic plan for floating offshore wind in federal waters off the coast of California. If technological developments and related cost reductions are achieved to enable floating offshore wind components (such as advanced monitoring systems, mooring systems, flexible cabling, and increased turbine size), the CEC suggested offshore wind deployment could progress at a faster rate," potentially supporting an even larger megawatt planning goal of up to 20 GW between 2045 and 2050.

The megawatt planning goals will guide the development of a strategic plan for offshore wind in federal waters off the California coast under AB 525. They may be refined as part of completing the strategic plan as more information becomes available from the analysis of suitable sea space and potential impacts on coastal resources, fisheries, Native American and Indigenous people, and national defense, as well as other strategic plan topics," it said.

So far, however, the CEC has approved a $10.5 million grant for renovations at Port of Humboldt Bay to further offshore project development in areas northwest of Morro Bay and offshore Humboldt County. Potential projects include the 150-MW Redwood Coast floating wind farm, which a consortium comprising Principle Power, Aker Offshore Wind, H.T. Harvey & Associates, Herrera Environmental Consultants, and Ocean Winds North America is developing in Humboldt Bay. Trident Winds is meanwhile developing the 1-GW Castle Wind floating offshore wind project off the coast of Morro Bay, shooting for a 2025 to 2027 operational timeframe.

California Facing Tight SummerThe CEC's draft was made public as state officials on Friday reportedly warned that California faces a projected capacity shortage of up to 1.7 GW at its peak if an extreme event occurs this summer. The issue has received substantial attention, given the state's rolling blackouts in the summer of 2020, and a spate of energy conservation pleas last summer as high heat events hit several parts of the state as well as neighboring states.

The California Independent System Operator (CAISO), however, is poised to brief its Board of Governors on May 12 that overall 2022 summer capacity conditions are better compared to 2021, owing mainly to new resources-especially storage-and despite load changes and hydro conditions. CAISO expects a net increase of 3.2 GW in dispatchable capacity from June 1, 2021, to June 1, 2022, most of which is battery energy storage.

However, the grid remains vulnerable to high loads and availability of imports during widespread heat events, especially in late summer," the briefing says. For the third year, hydropower will be below normal: Snowpack was 38% of average on April 1, compared to last year's 60% of average on April 1, 2021," and Northwest hydropower reservoirs are projected to be 94% of average.

Uncertainties include wildfire events, and an unexpected confluence of extreme heat, drought affecting fire risk, and smoke impacting solar production." Other glaring risks include project development delays, such as those triggered by the recent Department of Commerce investigation of solar panel tariff issues. These types of events tend to be managed in part by additional reliability measures beyond normal resource planning and market operation," CAISO said.

Looking ahead, however, the supply picture remains murky given the impending closure of the 2.3-GW Diablo Canyon Power Plant in 2025 after the nuclear plant's operating licenses expire. While progress has been made in overcoming past supply shortfall conditions, additional resources are needed to ultimately achieve long-term reliability margins," the briefing notes. Conventional planning techniques do not take into account growing risks of more extreme events, stemming from climate change, supply chain disruptions, etc. These pose additional risks not included in this analysis."

Though Diablo Canyon's owner Pacific Gas and Electric Co. (PG&E) had said it would not seek federal funds from the Department of Energy's $6 billion Civil Nuclear Credit (CNC) Program unless the state changes its position, Gov. Gavin Newsom recently reportedly suggested PG&E should consider submitting an application before the CNC's first award cycle's deadline on May 19.

The CEC's offshore wind draft suggests, however, that the near-term" retirement of Diablo Canyon provides an opportunity to repurpose existing infrastructure to integrate wind energy developed offshore the Central Coast." However, there is still a need to do long-term planning for both the sub-sea infrastructure and the ability to use existing onshore infrastructure," it notes.

-Sonal Patelis a POWER senior associate editor (@sonalcpatel,@POWERmagazine).

The post California, Again Facing Summer Supply Vulnerabilities, Eyes 20-GW Offshore Wind Goal appeared first on POWER Magazine.