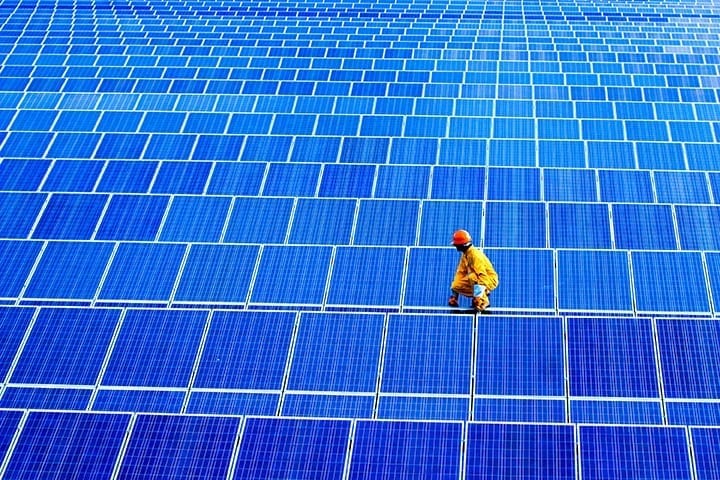

IEA Calls for More Diverse Solar PV Supply Chains

The International Energy Agency (IEA) is urging the development of more diverse solar PV supply chains, suggesting the sector's heavy reliance on China has led to imbalances that pose risks to its future growth.

A dedicated study of the world's solar PV supply chain issued by the Paris-based autonomous intergovernmental organization on July 7 acknowledges that government policies in China have contributed to a cost decline for solar PV of more than 80% through economies of scale and continuous innovation. But because global manufacturing capacity for solar panels has increasingly moved out of Europe, Japan, and the U.S. and into China over the past decade, China's share in all key solar panel manufacturing stages now exceeds 80%. For key elements, including polysilicon and wafers, China's share is set to rise to more than 95% in the coming years, based on current manufacturing capacity under construction," the agency said.

However, this concentration of PV supply chains poses specific vulnerability and risks to the industry that the world is banking on to achieve substantial decarbonization, it said. Annual solar PV capacity additions need to more than quadruple to 630 GW by 2030 to be on track with the IEA's Roadmap to Net Zero Emissions by 2050. Global production capacity for polysilicon, ingots, wafers, cells and modules would need to more than double by 2030 from today's levels," the study says. For solar PV supply chains to be able to accommodate the requirements of a net-zero pathway, they will need to be scaled up in a way that ensures they are resilient, affordable and sustainable."

Cycles of Glut and Market TightnessThe study notes that global solar panel manufacturing has passed through cycles characterized by gluts and market tightness. Currently, there's a glut: Global capacity for manufacturing wafers and cells-key solar PV elements-and for assembling them into solar panels exceeded demand by at least 100% at the end of 2021. At the same time, however, the world is seeing a critical bottleneck in the production of polysilicon, a key material for solar PV, in the otherwise oversupplied supply chain. This has led to tight global supplies and a quadrupling of polysilicon prices over the last year," the IEA said.

Today, China's Xinjiang province accounts for 40% of global polysilicon manufacturing. Moreover, one out of every seven panels produced worldwide is manufactured by a single facility. This level of concentration in any global supply chain would represent a considerable vulnerability; solar PV is no exception," it added.

At the beginning of the solar PV demand boom in 2010, by comparison, the market was characterized by even participation from producers in the European Union, U.S., Germany, South Korea, Japan, and China. Despite rapid demand growth between 2010 and 2020, the overcapacity situation persisted as Chinese manufacturers continued to invest in new production facilities. Meanwhile, low prices have led producers in Japan, Korea, and the United States to downsize or close their polysilicon plants," the IEA said.

As of June 2022, polysilicon prices remained high (at a monthly average of $35/kilogram) even though 60 GW of additional polysilicon capacity was commissioned in China last year. While the commissioning of new plants is expected to increase global polysilicon capacity from around 220 GW in 2021 to almost 400 GW in 2022, rapidly growing global PV demand, fires and maintenance in existing plants in China, and slow ramp-up period for new plants, are all expected to keep the polysilicon market tight," the study says. These challenges have resulted in delays in solar PV deliveries across the globe and higher prices," the IEA noted.

The IEA said governments and other stakeholders around the world are increasingly paying attention to solar PV's manufacturing supply chains because high commodity prices and supply chain bottlenecks have led to a solar panel price surge of around 20% over the last year.

These disruptions come amid general volatility that has rattled energy supply chains worldwide, it notes. The world continues to reel from COVID-19 impacts, record commodity prices, and Russia's invasion of Ukraine. These events have shed light on vulnerabilities related to energy imports, raw material shortages, and manufacturing bottlenecks.

A Long List of Solar PV Supply Chain RisksThe study, meanwhile, highlights several other risks facing the solar PV supply chain. Among them is a growing demand for critical minerals. Today, China plays a dominant role in producing many critical minerals used for solar PV. Despite improvements in using materials more efficiently, the PV industry's demand for minerals is set to expand significantly," the agency said. In the IEA's Roadmap to Net Zero Emissions by 2050, for example, demand for silver for solar PV manufacturing in 2030 could exceed 30% of total global silver production in 2020-up from about 10% today. This rapid growth, combined with long lead times for mining projects, increases the risk of supply and demand mismatches, which can lead to cost increases and supply shortages," the study says.

Banking on China, meanwhile, poses specific geographic concentration risks, including disruption by natural hazards, such as earthquakes, fires, and extreme weather events. Blackouts or energy shortages could also roil geographically concentrated supply chains, the agency noted.

Trade restrictions pose another substantial set of risks. Since 2011, the number of antidumping, countervailing and import duties levied against parts of the solar PV supply chain has increased from just one import tax to 16 duties and import taxes, with eight additional policies under consideration. Altogether, these measures cover 15% of global demand outside of China," the IEA said.

The long-term financial sustainability of the solar PV manufacturing sector is also a concern. Given the dramatic plunge in solar PV prices, the profitability of all supply chain segments has been volatile, resulting in several bankruptcies despite policy support," the study says.

Diversification Necessary, But May Not Be EasyThe study argues that policymakers should address key vulnerabilities to avoid future constraints on the solar supply chain. As countries accelerate their efforts to reduce emissions, they need to ensure that their transition towards a sustainable energy system is built on secure foundations," said IEA Executive Director Fatih Birol. Solar PV's global supply chains will need to be scaled up in a way that ensures they are resilient, affordable, and sustainable."

But for now, it appears that the world will almost completely rely" on China for the supply of key building blocks for solar panel production at least through 2025, the IEA predicted. So far, only a few countries and regions with ambitious decarbonization targets, like the U.S., Europe, and India, are considering or already implementing policies to attract investment to localize manufacturing in multiple solar PV supply chain segments," the study says.

While effective diversification will require establishing stiff competition with Chinese producers, competitiveness will depend on multiple factors such as investment requirements, electricity prices, carbon emissions, and manufacturing costs. Energy costs could be a major driver. Retail electricity prices are one of the factors that determine whether markets can produce solar PV supply chain elements competitively, especially energy-intensive polysilicon, ingots and wafers. For wafers, electricity accounts for nearly 20% of production costs, and for polysilicon over 40%," the agency noted.

Currently, however, about 80% of the power consumed for polysilicon production in Chinese provinces is priced on average at $76/MWh, almost 30% below the global industrial average price, which is just under $90/MWh. Low electricity prices in China are a result of access to relatively low-cost coal, particularly in Xinjiang, Inner Mongolia and Jiangsu, where it makes up three-quarters of the generation mix. However, these prices may not represent the true cost of power, as additional subsidies or preferential rates can apply at the provincial level," the IEA says.

Competitively achieving a low carbon intensity for solar PV manufacturing could also emerge as a solid driver for where new industries are sited. Globally, the average carbon intensity of solar PV manufacturing is estimated at 270 kg CO2/kW," the study notes. The IEA estimates there are over 100 countries where hosting the entire solar PV supply chain would emit less CO2 compared to where production takes place today. However, maintaining competitiveness will require access to power at costs comparable with or lower than today's global averages. When this is taken into account, the number of potential locations where new manufacturing is competitively less carbon-intensive drops from 100 to around 30," the study says.

In Europe, only Sweden currently has low enough industrial power prices for competitive manufacturing. In North America, the U.S. could offer affordable low-carbon power. Canada's price of electricity is at the threshold, potentially posing competitive challenges. Several sub-Saharan African and Eurasian countries relying heavily on hydropower could also be good candidates for wafer and polysilicon manufacturing. Hydropower could be key to lower emissions from wafer and polysilicon manufacturing because it offers affordable, carbon-free electricity to manufacture these products competitively," the IEA said.

-Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

The post IEA Calls for More Diverse Solar PV Supply Chains appeared first on POWER Magazine.