The POWER Interview: Fluence Exec Offers Insight on Energy Storage

There's global growth in energy storage. The latest evidence is a report that BlackRock, the New York-based asset manager and a major player in energy sector, is ready to buy Akyasha Energy, an Australian company that specializes in battery storage and renewable energy projects.

BlackRock in an Aug. 16 news release said it would commit about $700 million to develop more than 1 GW of battery energy storage. The group said it would at a future date expand Akyaysha projects across Taiwan and Japan.

Virginia-based Fluence, a battery energy storage system (BESS) integrator launched in 2018 by Siemens and AES, and with offices worldwide, has become a global leader in the development of energy storage products and services, and also is active in the Australian market-along with helping drive U.S. adoption of storage. The company, part of some of the largest U.S. BESS installations, earlier this month said it is setting up a new contract manufacturing facility in Utah to serve the U.S. energy storage market.

The facility will start shipping Fluence Cubes in September. Fluence said the Cube is the building block of its Gridstack, Sunstack, and Edgestack energy storage products, and uses LFP-280LC (lithium iron phosphate) battery modules from supplier CATL.

The U.S. manufacturing plant is part of Fluence's effort to expand its production beyond Asia, better serve delivery to the U.S. market, and address ongoing supply chain constraints, according to the company. At a time when the energy storage industry has seen increased supply chain disruptions, this production hub will be particularly important in strengthening business continuity and improving flexibility for meeting customer needs," said Carol Couch, senior vice president and chief supply chain and manufacturing officer at Fluence.

Couch, who joined Fluence in May 2021, recently answered questions from POWER and provided insight into the company's work in the energy storage space.

POWER: Why is it important to establish U.S. manufacturing of energy storage equipment?

Couch: At Fluence, we take pride in delivering the lowest Total Cost of Ownership (TCO) systems to our customers. We believe that the establishment of U.S. manufacturing goes in that direction of providing highly competitive TCO systems for our key U.S.-based customers while increasing resiliency in our ability to serve them during times of increased supply chain volatility and disruption.

Carol Couch

Carol Couch

Many companies are moving back to regional manufacturing, especially in the EV (electric vehicle) and energy industries. I believe there are three primary benefits to regional manufacturing:

- Flexibility for the customer: These programs are very complex and moving fulfillment close to the customer will allow us to flex with their schedule needs.

- Decrease impact of supply chain disruptions: By moving final assembly to the region, we will be able to minimize logistics failures (port congestion, environmental delays, etc.)

- Cost stability: We can smooth out manufacturing plans and material movements without having to expedite.

POWER: How has the energy storage industry been impacted by reliance on foreign manufacturing?

Couch: Any manufacturing impacts that Fluence has experienced have stemmed from the COVID-19 pandemic, including supply chain disruptions and pricing fluctuations. Additionally, this is a global issue and it not unique to a specific geography. Fluence has developed a global supply chain with a regionally focused operational model to partner with innovative suppliers and assemble products in proximity to major markets. This creates a strong foundation for new product introductions and regionalized supply chains and strengthens our commitment to serving as lifecycle partners for our customers.

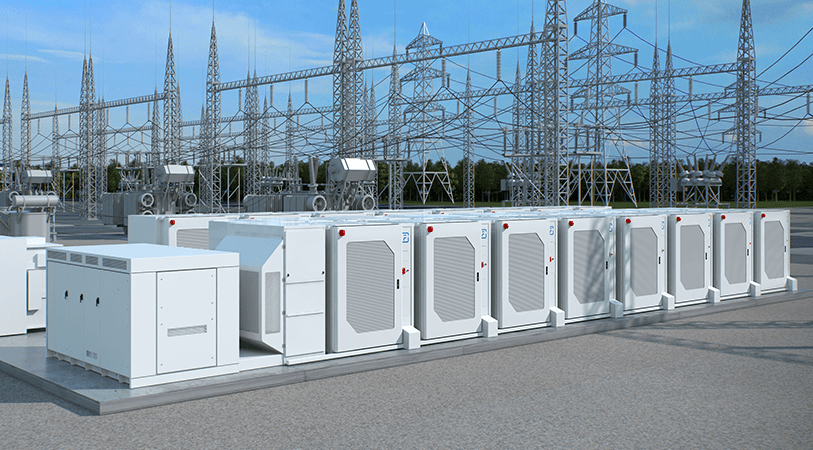

Fluence has several energy storage systems, including Gridstack, Sunstack, and Edgestack. The systems can be configured for grid, renewable, and commercial and industrial applications. Source: Fluence

Fluence has several energy storage systems, including Gridstack, Sunstack, and Edgestack. The systems can be configured for grid, renewable, and commercial and industrial applications. Source: Fluence

POWER: What has been the impact of the pandemic on the U.S. (and/or global) energy storage industry?

Couch: Delivery delays and increased pricing has hit every sector of the value chain, from EV auto companies to battery manufacturers and energy storage solution providers. While there have been some project delays because of supply chain constraints, global demand for applications of energy storage-which are continually expanding-remains robust in the U.S. and globally. We do not believe the impacts will cause long-term disruption in the industry or affect long-term clean energy goals. As a leader in the industry, Fluence is focused on strengthening our foundations and being the long-term partner customers can trust as we navigate these challenges together.

POWER: Are there steps that can be taken by U.S. officials to lessen supply chain disruptions, and support the domestic mining of rare earth minerals needed for energy storage?

Couch: We applaud the passage of the Inflation Reduction Act. A stand-alone energy storage Investment Tax Credit will help incentivize accelerated storage deployment and renewable energy integration while creating local, good-paying clean energy jobs and a resilient electrical grid. While supply chain and manufacturing diversification has been part of our corporate strategy for some time now, the IRA provisions will strengthen this strategy by providing more options for Fluence by increasing the number of parties interested in manufacturing within the U.S. In the more immediate term, the White House and USTR (United States Trade Representative) could provide even more business certainty to the storage community by easing tariffs, even for a time-limited basis, on imported storage inputs such as batteries, to help support long-lead time manufacturing and procurement efforts plan.

POWER: How has Fluence been able to move forward with its energy storage initiatives even absent certainty of government support, and regulatory certainty?

Couch: Supply chain and manufacturing diversification has been part of our corporate strategy for some time now and Fluence has been moving to a more regionalized business model over the last couple of years. We strongly believe that regional fulfillment will provide more flexibility for our customers and reduce the impacts of supply chain disruptions that we have experienced since the onset of the COVID-19 pandemic in 2020. We are focused on providing greater flexibility and service to our customers by moving to a more regional model.

POWER: Where is the best growth potential for energy storage? Is it with utility-scale development, commercial and industrial distributed generation sites, or with residential energy storage?

Couch: The primary customers that we serve globally are utilities and independent power providers. We are currently finding that the business cases for deploying energy storage are more profitable than ever before. Many customers that are pursuing storage today are doing so to realize highly valuable business cases that yield high teen IRRs (internal rates of return). The passage of the Inflation Reduction Act creating the stand-alone Investment Tax Credit for storage will make this even more attractive. We believe this will potentially open newer customer segments in the U.S. for Fluence. In addition, storage as transmission application is increasingly gaining momentum in many parts of Europe and Asia. This has the highest potential to accelerate in the U.S. in the coming years.

-Darrell Proctor is a senior associate editor for POWER (@POWERmagazine).

The post The POWER Interview: Fluence Exec Offers Insight on Energy Storage appeared first on POWER Magazine.