How Does Uranium Price Increase Affect Nuclear Power Plant Profitability?

Uranium has been one of the best-performing asset classes in 2022, according to data supplied by HANetf's Sprott Uranium Miners UCITS ETF (URNM). In fact, the uranium spot price has increased 24.12% during the year through Oct. 31, according to the fund.

October was a particularly strong month for uranium oxide (U3O8), which is used to make fuel for nuclear power plant reactors. The spot price of U3O8 increased 8.32% in October, while broader commodity markets gained just 1.67%.

We believe that strong demand for uranium conversion and enrichment, coupled with a shift away from Russian suppliers, supports a further increase in the U3O8 uranium spot price," Jacob White, senior analyst for URNM, said in a statement issued to POWER.

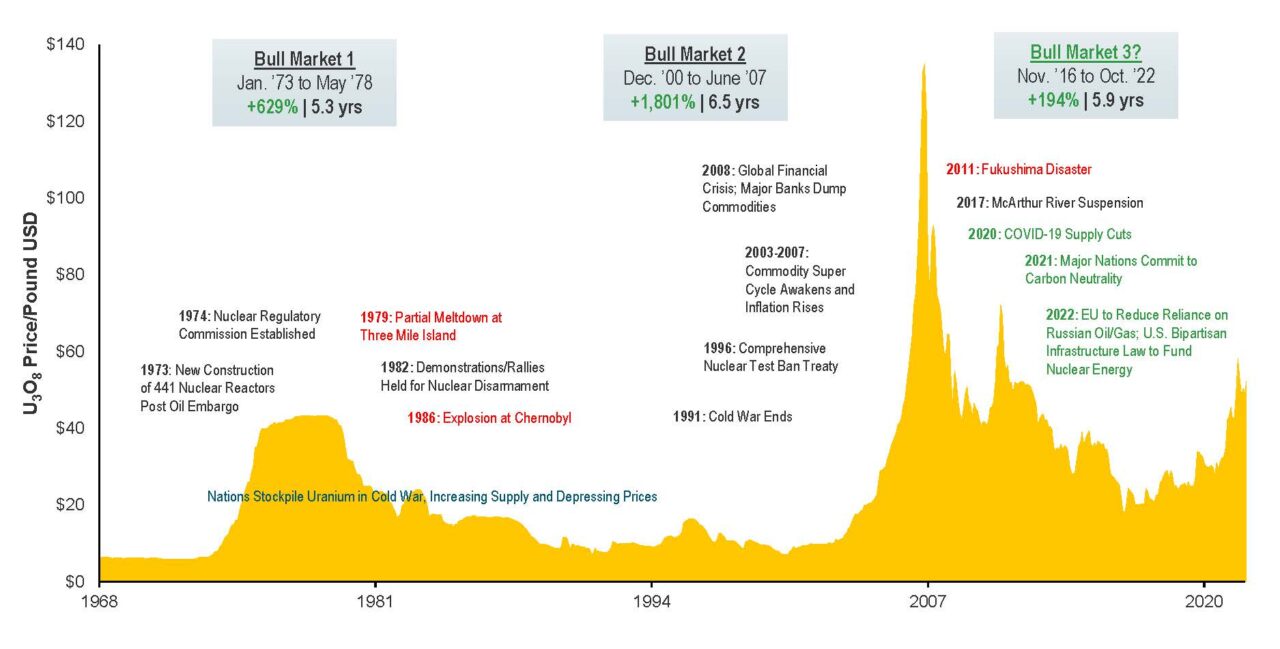

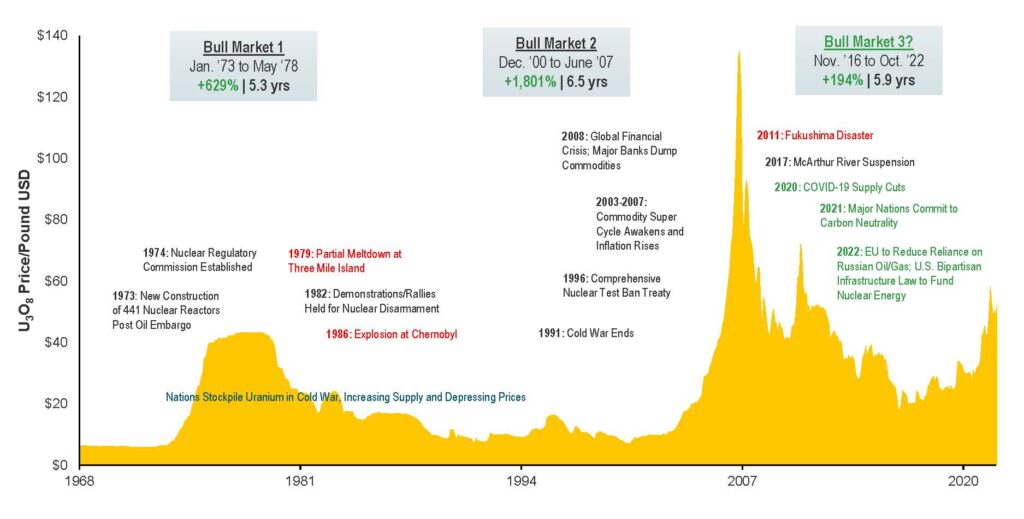

A new uranium bull market may be underway, potentially with room to run, according to Sprott.

A new uranium bull market may be underway, potentially with room to run, according to Sprott.Growing production/demand imbalance and future utility contracting provide primary price support, the firm says. Courtesy: Sprott

The majority of demand for uranium comes from the nuclear power generation industry. Most nuclear power plants operate on an 18-month or 24-month refueling cycle, and nearly all owners secure contracts for fuel well in advance of their refueling outages.

The International Atomic Energy Agency said 437 nuclear power reactors were operational throughout the world at the end of 2021, with a total net capacity of more than 389 GW. The agency said 56 additional units were under construction at the time.

In a Sprott report released on Nov. 11, White expressed optimism for uranium based in part on an International Energy Agency forecast. The agency expects nuclear energy generation to grow 53% from 2021 to 2050 based on current stated government policies in place, 84% based on announced government targets, and 109% on its net zero emissions by 2050 scenario," White wrote.

Yet, while the underlying fundamentals may be strong for U3O8 spot, conversion, and enriched uranium prices, the effect this will have on nuclear power plant profitability may be negligible. The World Nuclear Association (WNA) reports that fuel costs are a minor portion of total generating costs for nuclear power plants. Nuclear power plants are expensive to build but relatively cheap to run," the association said.

In a report the WNA published several years ago, it says the economics of new nuclear plants are heavily influenced by their capital cost, which includes the cost of site preparation, construction, manufacture, commissioning, and financing nuclear power plants. As most people know, building a nuclear power plant takes thousands of workers, huge amounts of steel and concrete, thousands of components, and many interrelated systems to provide electricity, cooling, ventilation, information, control, and communication.

Financing costs change materially for nuclear projects in relation to time to complete the plant construction and with the interest rate and/or mode of financing employed. It's not uncommon for capital costs to account for more than 60% of the levelized cost of electricity (LCOE) from a nuclear facility. Therefore, while uranium demand may continue to gain momentum and prices for U3O8 may continue to rise, it probably won't markedly affect the overall economics of most nuclear power plants.

-Aaron Larson is POWER's executive editor (@AaronL_Power, @POWERmagazine).

The post How Does Uranium Price Increase Affect Nuclear Power Plant Profitability? appeared first on POWER Magazine.