Ammonia Gas Turbine Combustion Has Economic Potential, GE-IHI Study Suggests

Ammonia could be a potentially lower-cost alternative fuel for gas turbines in Japan than liquid hydrogen if the full import value stream is considered, suggests a joint study between GE Gas Power and Japanese heavy industry manufacturer IHI Corp.

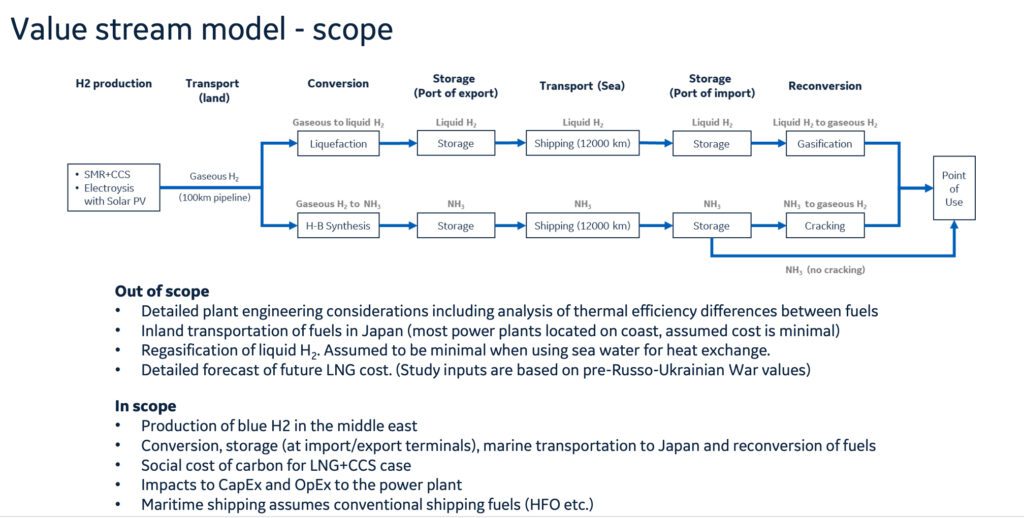

As part of the year-long study, the companies mapped a value stream for hydrogen and ammonia from their points of production to their point of use as fuel in a power-generating gas turbine. While the study was focused on Japan, it provides useful insight into the techno-economics of using the low-carbon fuels gas turbines, noted Jeffery Goldmeer, GE Power's director of Emergent Technologies, Decarbonization, who unveiled the study's findings on Feb. 22 at POWERGEN International. A key takeaway, he said, is that it's very clear that ammonia has some real potential."

GE and IHI jointly examined the use of ammonia as a gas turbine fuel and compared to the use of hydrogen and/or ammonia cracked back to hydrogen in Japan. The study considered myriad processes involved in the hydrogen and ammonia value stream, spanning hydrogen production to reconversion. Courtesy: GELanded Costs v. LCOE

GE and IHI jointly examined the use of ammonia as a gas turbine fuel and compared to the use of hydrogen and/or ammonia cracked back to hydrogen in Japan. The study considered myriad processes involved in the hydrogen and ammonia value stream, spanning hydrogen production to reconversion. Courtesy: GELanded Costs v. LCOEThe first part of the study sought to pin down landed costs. To understand the landed cost, you've got to understand the whole process, starting with the cost of hydrogen, whether produced from electrolysis or from steam methane reforming," Goldmeer said. Landed costs include costs associated with hydrogen liquefaction, storage, and transportation, as well as regasification, he said.

The landed cost is agnostic to end use-it's just the cost of fuel," he noted. However, it relies on a lot of variables, including market volumes, supply chains, and ease of transportation. Transportation is a key factor," Goldmeer said. For example, while about 18 million tons of ammonia is transported by sea per year, only one ship in the world can currently move liquid hydrogen.

The second part of the study, meanwhile, sought to provide a range for the levelized cost of electricity (LCOE) for the two fuels if combusted in a gas turbine. While the study was based on gas turbines manufactured by GE, Goldmeer suggested these costs would be similar for other original equipment manufacturers (OEMs).

We know that LCOE is so dependent on fuel costs," he noted. However, the study also considers new costs that will likely arise if hydrogen or ammonia are combusted in a gas turbine. If you're going to upgrade your power plant to burn hydrogen or ammonia, what are some of the balance of plant requirements that come along with that? It's not as simple as I'll just give you a new combustor, maybe add some new piping, new control systems, and new valves," he said.

The upgraded power plant's cost profile will need to include pollution controls to address increased nitrogen oxide emissions from burning ammonia, he said. Meanwhile, Ammonia from a toxicity perspective is a very different fuel than hydrogen or natural gas. And so that's likely to add cost to your power plant. So we've included some of those factors," Goldmeer said.

Ultimately, these costs could add up, making ammonia more expensive than liquefied natural gas. That's because you're doing physical upgrades. From an LCOE perspective, it's not just the fuel is more expensive, but you're adding more investment into the power plant. And we accounted for that," he added.

GE and IHI Corp.'s joint study suggested ammonia-direct or cracked to hydrogen-has a lower landed cost (and lower levelized cost of electricity) than hydrogen in Japan. Courtesy: GE

GE and IHI Corp.'s joint study suggested ammonia-direct or cracked to hydrogen-has a lower landed cost (and lower levelized cost of electricity) than hydrogen in Japan. Courtesy: GEGoldmeer noted the study's evaluation was largely based on greenfield applications. LCOE on a retrofit is complicated because it depends on so many factors like what your depreciation is to date," he said. However, existing plant owners can still leverage the study's learnings, specifically to understand why the LCOE from liquid hydrogen stands much higher than ammonia's.

Well, number one, the fuel costs [for ammonia and liquid hydrogen] are dramatically different," he said. And even if you took away just any capital improvements, you just look at the impact of fuel costs, fuel costs are the single largest lever of why your LCOE goes up. So putting aside any technology differences, and assuming that you could just run it without changing the power plant, your LCOE would go up automatically," he said. But now you start layering on how much it is going to cost for the combustor for ammonia versus hydrogen, or plant changes [required] for ammonia versus hydrogen."

Ultimately, the study suggests that fuel costs for hydrogen could be 50% more than for ammonia. If you're a baseload unit, $10/MMBtu adds up to be a staggering amount of money over a year," he said. And likely the capital investment differential between the two is a fraction of what it would be."

GE, IHI to Jointly Develop Ammonia Combustion by 2030The study stems from GE and IHI's June 2021-signed memorandum of understanding (MoU) to define an ammonia gas turbine business roadmap," which intends to support the use of ammonia as a carbon-free fuel in existing and new gas turbines. Under the MoU, the companies agreed to conduct research on the marketplace volume of ammonia, as well as feasibility studies for ammonia as feedstock for gas plant installations in Japan and Asia. In January, notably, the companies signed another MoU to develop ammonia combustion technologies by 2030 that could enable GE's F-class heavy-duty gas turbines (6F.03, 7F, and 9F gas turbines) to fire up to 100% ammonia.

Goldmeer told POWER Japan presented a good case study because Japan is actionably pursuing ammonia as a decarbonized power generation fuel. Current targets require that 10% of Japan's electricity by 2050 and at least 1% (around 1 GW) by 2030 will come from hydrogen or ammonia.

GE's gas-fired fleet, meanwhile, represents close to 50% of gas-powered capacity in Japan-comprised mainly of F-class units (7Fs and 9Fs, 50-Hz and 60Hz units). Goldmeer noted that interest in ammonia is also soaring in other Asian countries with substantial thermal generation fleets. It's such a large fleet for us in Asia. So as we think about these technologies, why not make sure that we're thinking about them and maybe we provide [the technologies] for what is our largest fleet of units," he said. And not just for [GE's] fleet-think about the F-class fleet for all OEMs."

However, Goldmeer said the study's learnings could shed light on the complex dynamics related to the cost of moving hydrogen and ammonia all over the world. You could change the distance that the fuel is being shipped, but the answer doesn't really change dramatically." In the U.S., for example, if a power plant's hydrogen source and its gas turbine are relatively closely coupled, it's not clear from an economic perspective why you would go through ammonia-you've just added cost and complexity," he said. So you can apply that argument to lots of places around the world if your source of hydrogen and the end-use application of hydrogen are reasonably geographically connected." Ultimately, ammonia may be better suited to very large distances, where you're going to put a molecule on a ship and shipping liquid hydrogen isn't economically viable," he said.

Experts have noted countries with limited direct access to sources of low-carbon power could use ammonia as a vector for hydrogen imports, because ammonia has a high hydrogen content per unit volume, and it can be easily liquefied. Ammonia can also be cracked to yield pure hydrogen for use in gas turbines, but it can also be combusted, directly fed into, or co-fired at existing coal plants or gas turbines. Finally, like hydrogen, it can also be used as a seasonal storage medium for the power sector, offering a potentially cheaper alternative to batteries.

Goldmeer pointed out, however, that ammonia combustion remains challenging."If we use natural gas as our reference, hydrogen is a much more reactive fuel. Ammonia is the other side-ammonia has a much less reactive fuel. And so the question becomes, how do you handle a fuel that has very different combustor capabilities or characteristics?" he said.

Managing nitrogen oxide emissions associated with ammonia combustion also poses a substantial challenge, he noted. There are lots of studies being done by universities all around the world looking at just that fundamental problem because what we don't want to do is start using a carbon-free fuel that creates another emissions problem."

Ammonia Gas Power Gaining Interest in AsiaStill, interest in ammonia as a fuel for gas turbines is gaining steam, bolstered by recent technological developments, spearheaded mainly by firms in Asia.

Mitsubishi Power, a Japanese gas turbine maker, in March 2021 announced it would develop a 40-MW class gas turbine that can directly combust 100% ammonia under an initiative that responds to Japan's roadmap for ammonia fuel. In September 2022, Mitsubishi Power's parent company Mitsubishi Heavy Industries (MHI) agreed with Indonesian research entity Institut Teknologi Bandung (ITB) to conduct joint research on the development of an ammonia-fired gas turbine-and eventual demonstration on an H-25 gas turbine.

MHI has since also teamed with Singapore-based energy solutions firm Keppel New Energy to carry out a feasibility study for the development of a 100% ammonia-fueled power plant at a site in Singapore. MHI and JERA, notably, in August 2022, set out to jointly explore establishing a 100% ammonia-fired combined cycle plant in Jurong Island in Singapore.

IHI Corp. has meanwhile also marked steady milestones. In June 2022, the company said tests to mono-fire liquid ammonia in a newly developed combustor installed on a 2-MW class IM270 gas turbine yielded a greenhouse gas reduction rate exceeding 99%, even when the ammonia fuel ratio is at 70~100 %." Compared with natural gas and gaseous ammonia, liquid ammonia has an inherently lower flammability, making it harder to burn," the company noted.

Until now, when operating gas turbines at ammonia co-firing rate of over 70%, nitrous oxide (NO) which has a greenhouse warming effect around 300 times that of CO, was susceptible to formation, nullifying the effect of reducing CO2 emissions." IHI said it is now working to further reduce NOx levels, improve operability, evaluate long-term durability, and proceed with efforts toward the practical application of a 100% liquid ammonia combustion gas turbine in 2025."

IHI in June 2022 announced it successfully combusted liquid ammonia at an IM270, a 2-MW class gas turbine, at IHI Yokohama Works in Japan. Courtesy: IHI Corp.

IHI in June 2022 announced it successfully combusted liquid ammonia at an IM270, a 2-MW class gas turbine, at IHI Yokohama Works in Japan. Courtesy: IHI Corp.The effort stems from an IHI initiative to actively promote the creation of an ammonia value chain. This demonstration is important because it is necessary to bring together the parties who are related to production, transportation, storage, and utilization in shared efforts to create the ammonia value chain," the company said. IHI so far has agreements to explore supply chain prospects or undertake ammonia co-firing at coal power plants with companies in Japan, Indonesia, Malaysia, the United Arab Emirates, and India. On Feb. 21, notably, IHI signed an MoU with Indian renewable energy firm ACME to investigate the feasibility of producing and utilizing green ammonia.

In January, IHI and partners NYK Line and Nihon Shipyard Co. also obtained a pioneering approval in principle from ClassNK for a floating ammonia storage and regasification barge (A-FSRB). An A-FSRB is an offshore floating facility that can receive and store ammonia that has been transported via ship as a liquid, warm and regasify ammonia according to demand, and then send it to a pipeline onshore," the company explained. And in November, it invested in Starfire Energy, an American startup that has developed a green ammonia production process and cracking technology.

-Sonal Patelis a POWER senior associate editor (@sonalcpatel,@POWERmagazine).

The post Ammonia Gas Turbine Combustion Has Economic Potential, GE-IHI Study Suggests appeared first on POWER Magazine.