Enduring Value: Entergy’s More Than 100-Year-Old Story

One man's ambition to electrify the Middle South and improve its economic outlook 110 years ago evolved from a handshake for steam from a boiler powered with waste sawdust into Entergy Corp., a multi-billion-dollar energy giant. Shaped by a legacy of growth, innovation, hardship, and disaster, the company today forms a bedrock in the Gulf Coast, America's new economic powerhouse.

Echoing the geneses of most utilities in the U.S., Entergy's founding began with ambition. On Nov. 13, 1913, a 36-year-old entrepreneur, Harvey Couch, established Arkansas Power and Light (AP&L) with a vision to build an interconnected utility network that could bring affordable and reliable power to the Middle South. In sharp contrast with the founders of other utility giants, however, Couch's intent was shaped by extraordinarily humble beginnings. It's a classic Horatio Alger story that sounds too good to be true: poorly educated farm-boy-turned-mail-clerk strikes out to start an innovative company in a fledgling industry and ends up becoming one of the most influential men of his time," notes corporate historian Heidi Tyline King in the 2013-published commemorative history book We Power Life: Entergy's First Century. But that's exactly what Harvey Couch did," she writes.

Couch's beginnings were bleak. One of six children, he grew up working on a 130-acre farm in Calhoun, Arkansas, a rural town stricken by severe poverty, subsisting on what his family raised, and attending school only long enough to learn the basics of reading and writing. At age 17, when the farm failed, his family moved to Magnolia, Arkansas, and though Couch briefly re-enrolled in school, he quit for good to support his family through a series of odd jobs.

But Couch's ambitions, driven by curiosity, began to take seed when he saw construction workers raising poles for telephone wires. At age 27, armed with a slow-talking style" and a reputation for honesty and hard work, he used savings of $156 to sell coupon books to customers for telephone service, King writes. Using mules and a crew, he established a telephone connection between Bienville and McNeil, Arkansas. Seven years later, that enterprise had expanded into 1,500 miles. In 1911, he sold it to Southwestern Bell for more than $1 million in profit. He then invested the earnings in two failed electric power franchises with intent to establish an interconnected utility network. Under his newly founded venture, Arkansas Power and Light Co., his first deal was to purchase steam from a sawdust-powered boiler from Arkansas Land and Lumber Co., a lumber yard owned by H. H. Foster.

|

1. One of the first generating ventures developed by Arkansas Power and Light, an Entergy predecessor, in 1914 comprised two 550-kW generators sited at a lumber yard in Arkansas. Courtesy: Entergy |

A rapid expansion swiftly followed, first with a dedicated facility next to the lumber yard's boiler room that housed two 550-kW generators (Figure 1), and then for a central generating station in Russellville, which connected to the original system via an 83,000-volt transmission line. Before World War I stymied his progress, Couch's company had acquired six more franchises.

Decades of ExpansionThe early 1920s brought more opportunities for growth. Furnished with financing from New York investors, Couch in 1922 incorporated New Orleans Public Service Inc. (NOPSI) and the Mississippi Power and Light Co. (MP&L) in 1923. In 1924, he completed the 9.3-MW Remmel Dam in Hot Spring County, Arkansas. The iconic hydroelectric station on the Ouachita River cost about $2.2 million. That same year, Couch established Louisiana Power and Light Co. (LP&L) to finance and build the 30-MW Sterlington Generating Station near the center of a newly discovered natural gas field (then the largest in the world). Two additional turbo-generators, each with a capacity of 30 MW, were later placed in service in 1928 and 1929, making the Sterlington station one of the largest power plants in the South.

In 1925, to raise more capital and address growing competition, Couch merged his businesses with the Electric Bond and Share Co. (EBASCO), a General Electric subsidiary, forming the Electric Power and Light Corp. (EP&L). However, in 1935, the federal Public Utility Hold Company Act forced EBASCO and EP&L to break up the multilevel holding. The ordeal of reorganization was amplified by Couch's death in 1941 of cardiac complications at age 64. EBASCO's break up was eventually finalized in 1949, and Couch's system of companies-AP&L, MP&L, LP&L, and EP&L-reorganized as Middle South Utilities. With Edgar Dixon as its first CEO-and its headquarters in New York-Middle South began trading on the New York Stock Exchange in 1949.

Riding on the post-war boom in the 1950s and 1960s, Middle South, like other U.S. utilities, embarked on a power plant-building spree to keep in step with soaring power demand. Middle South put online installations like Ninemile Point, a dual-fuel boiler plant, and Little Gypsy, the world's first fully automated generating unit. The 1970s, however, presented new complexities. While still buoyant on a massive expansion plan, Middle South's plans for conventional generation began to crumble as environmental regulations ramped up. The massive impact of the 1973 Arab oil embargo on fuel prices, meanwhile, heightened concerns about the company's financial health and prompted the company to consider diversifying its fuel mix.

Nuclear was a prime consideration. Middle South had been part of a consortium that built and operated a test fast-breeder reactor from 1969 to 1972 near Fayetteville, Arkansas. But while completion of Middle South's first nuclear plant, Arkansas Nuclear One Unit 1, progressed smoothly and began operations in 1974, delays, regulatory setbacks, and escalating construction costs hit projects like the Waterford plant and Grand Gulf in Louisiana. Grand Gulf, in particular, suffered long delays. The plant took 13 years to build, and when it came online in 1985, its total costs had ballooned to more than $3 billion-far exceeding estimates. The debacle prompted an acrimonious legal dispute about which of Middle South's ratepayers would pay for the cost escalation. In 1989, Middle South sought to repair fractures and quell the crisis within its system by absorbing $900 million it invested in Grand Gulf Unit 2-a second unit at the plant that it scrapped-under an initiative it called, Project Olive Branch."

The Grand Gulf Nuclear Station, a GE boiling water reactor located in Port Gibson, Mississippi, was completed in 1985 amid a financing dispute that precipitated into a political controversy. Construction of a second unit at the site was scrapped in 1990, even though the project was 66% complete. An uprate in 2012 increased Grand Gulf 1's production capacity by more than 13%, bringing its total output to 1,443 MW. While Grand Gulf is today the largest single-unit nuclear power plant in the U.S., it has recently been embroiled in another complex dispute related to customer rate impacts, which was in part resolved by a $300 million settlement with the Mississippi Public Service Commission in June 2022. A December 2022 order from the Federal Energy Regulatory Commission separately required refunds for utility customers in Arkansas, Louisiana, and New Orleans. Courtesy: Entergy

The Grand Gulf Nuclear Station, a GE boiling water reactor located in Port Gibson, Mississippi, was completed in 1985 amid a financing dispute that precipitated into a political controversy. Construction of a second unit at the site was scrapped in 1990, even though the project was 66% complete. An uprate in 2012 increased Grand Gulf 1's production capacity by more than 13%, bringing its total output to 1,443 MW. While Grand Gulf is today the largest single-unit nuclear power plant in the U.S., it has recently been embroiled in another complex dispute related to customer rate impacts, which was in part resolved by a $300 million settlement with the Mississippi Public Service Commission in June 2022. A December 2022 order from the Federal Energy Regulatory Commission separately required refunds for utility customers in Arkansas, Louisiana, and New Orleans. Courtesy: Entergy

The crisis, however, served as a crucial pivotal turning point in the company's history. In 1989, Middle South rebranded under a new name-Entergy. A combination of enterprise, energy, and synergy," the name reflected the company's most valuable aspirations, but it also pointed to the company's new dynamic character. Entergy was effectively moving away from its longstanding role as a traditional utility to a global energy company that could competitively respond to market changes as deregulation took root, it said.

Deregulation through the 1990s reshaped the company further. Spurred by a resurgence of interest in nuclear power and an overhaul at the Nuclear Regulatory Commission, Entergy snapped up several merchant" nuclear plants. In 1999, it bought Pilgrim in Massachusetts for $81 million (becoming the first U.S. company to acquire a nuclear plant through competitive bidding). Strong returns at Pilgrim encouraged Entergy to acquire Indian Point Units 2 and 3, and FitzPatrick in New York, Vermont Yankee in Vermont, and Palisades in Michigan. In tandem, the company made international acquisitions as countries privatized state-owned electric systems, including in Argentina, Pakistan, Australia, Chile, Peru, and the UK. The complexities of an international fleet, however, proved financially hefty. By the early 2000s, it began a divestiture of its foreign businesses to concentrate on what it did best."

Multiple disruptions over the last decade have transformed the company even more. The company has grappled with more stringent environmental policies, decentralization and electrification, a boost in shale gas production, a proliferation of renewable power and battery storage, and an increasing embrace of digitalization. Led by Leo Denault, the company notably set out to execute a multi-year strategy to exit the merchant power generation business and transform the company into a leaner customer-focused integrated energy company. With the exception of FitzPatrick, which Entergy sold to Constellation in March 2017, all of Entergy's merchant nuclear plants have been shuttered.

A Leaner OperationAs Entergy embarks on its 110th year of operation, the company is today a markedly leaner entity. Today, the New Orleans-headquartered power generating giant's business profile comprises two business segments: Utility and Entergy Wholesale Commodities. However, with the closure of the Palisades nuclear plant in June 2022, Entergy no longer considers Wholesale Commodities a reportable business segment.

The Utility segment, meanwhile, covers Entergy's generation, transmission, distribution, and sale of electric power in portions of a four-state footprint that includes Arkansas, Mississippi, Texas, and Louisiana (including the City of New Orleans). The segment also includes the operation of a small natural gas distribution business that provides services to customers in Baton Rouge and New Orleans, Louisiana. The biggest players in the segment, however, are Entergy's five retail subsidiaries: Entergy Arkansas, Entergy Louisiana, Entergy Mississippi, Entergy New Orleans, and Entergy Texas (Figure 3). Each is regulated by the Federal Energy Regulatory Commission (FERC) and their respective state utility commissions (Entergy New Orleans is regulated by the City Council). The company's retail business serves 3 million utility customers.

3. Entergy's electric utilities generate, transmit, distribute, and sell electric power in a four-state service area that includes portions of Arkansas, Mississippi, Texas, and Louisiana, including the city of New Orleans. It also operates natural gas distribution businesses in New Orleans and Baton Rouge, Louisiana. Courtesy: Entergy

3. Entergy's electric utilities generate, transmit, distribute, and sell electric power in a four-state service area that includes portions of Arkansas, Mississippi, Texas, and Louisiana, including the city of New Orleans. It also operates natural gas distribution businesses in New Orleans and Baton Rouge, Louisiana. Courtesy: Entergy

These operating companies recover their fuel, purchased power, and associated costs from customers through rate mechanisms, which are subject to periodic regulatory review and adjustment. Since 2013, however, the companies have also participated in markets managed by the Midcontinent Independent System Operator (MISO), a reliability transmission organization that maintains functional control over their combined transmission systems, and administers wholesale energy and ancillary services markets for participants in the wholesale energy market. Entergy says the nearly decade-long participation has already produced more than $2 billion customer savings."

Finally, a separate subsidiary, System Energy Resources Inc. (SERI), holds a 90% interest in the Grand Gulf nuclear plant, selling capacity and energy to Entergy Arkansas, Entergy Louisiana, Entergy Mississippi, and Entergy New Orleans-its only four customers. Entergy's other operational nuclear plants include Arkansas Nuclear One Units 1 and 2, which Entergy Arkansas owns, and River Bend Station and Waterford 3, which are owned by Entergy Louisiana.

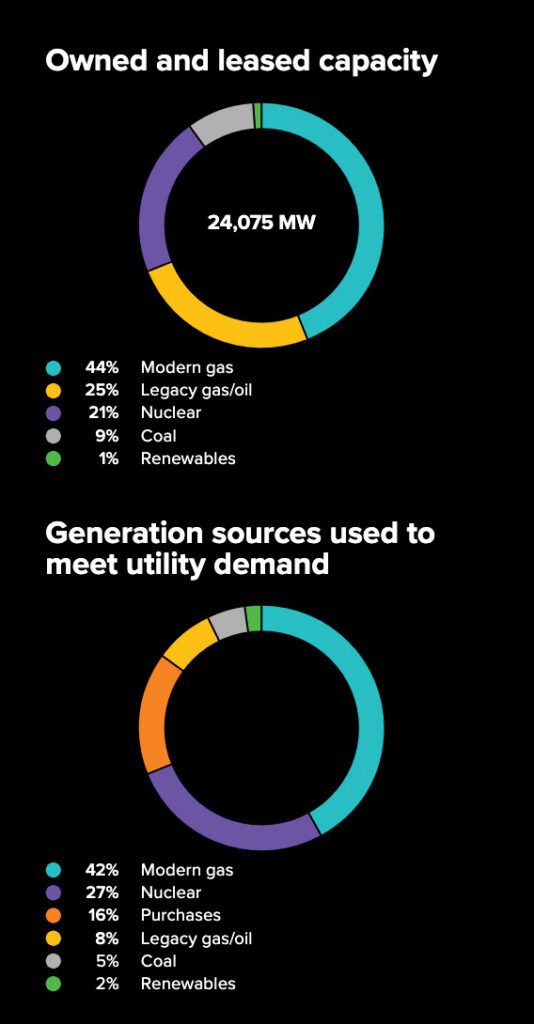

As a whole, the integrated energy company owns and operates a 24-GW generation fleet (Figure 4) and 16,100 miles of high-voltage transmission lines, 105,800 miles of distribution lines, and 1,300 substations, which operate at 69 kV to 500 kV. As of December 2022, the company had about 12,000 employees and annual revenues of $13.8 billion.

|

4. Entergy's utility-owned and leased generation fleet is dominated by modern natural gas plants (10.5 GW), followed by legacy gas plants (6 GW), nuclear plants (5.2 GW), coal plants (2 GW), and renewable energy facilities (814 MW). Courtesy: Entergy |

But like other utilities POWER has profiled as part of this series, Entergy must balance its future growth with several other priorities, including providing reliable electricity and ensuring it is affordable, all while maintaining its values.

The company has said its values are rooted in its 2002-adopted visionary statement" to commit to an environmentally, socially, and economically sustainable business. A premier utility benefits all its stakeholders by delivering long-term, sustainable value," it explained in April. We measure that value through consistently positive customer interactions; high levels of service and reliability; superior and affordable products and services; environmental leadership; highly skilled and engaged employees; strong brand recognition; and industry-leading financial performance."

Those values have fueled new commitments that could have big implications for its future business. Since 2019, for example, the company has been striving to achieve net-zero emissions by 2050. Under newer goals, the company is working toward ensuring half its generating capacity will be carbon-free by 2030. Last year, notably, Entergy Arkansas reached a historic memorandum of understanding with the federal government to work toward delivering 100% carbon pollution-free electricity" by 2030.

Interim goals meanwhile call for Entergy to retire all its coal capacity by the end of 2030 but still provide approximately 40% more power to customers when compared to 2000 by 2030, enabling an estimated 9 million tons of customer emission reductions through electrification by 2030, with additional emission avoidance resulting from clean growth."

Compounding Future Plans: Significant Demand GrowthEnsuring an optimal resource base will be especially crucial for Entergy because the company projects significant load growth over the planning horizon." That growth will be driven in large part by customer decarbonization initiatives and the favorable geography and infrastructure of the areas we serve, particularly the industrial corridor along the Gulf Coast," the company said. The region is attractive to these customers for reasons including world-class infrastructure, favorable commodity spreads, workforce availability, and access to deep-water ports and the Mississippi River," it added. Entergy noted that these advantages could be further bolstered by on-shoring trends and geopolitical events that are driving global market needs and creating opportunities for the U.S. Gulf region to expand capacity for products such as ammonia and liquified natural gas [LNG]."

However, industrial players are already actively looking for ways to reduce emissions, Entergy noted. The company is engaging with customers like Cameron LNG to understand their goals. Broader electrification of processes, transportation electrification, carbon capture and green hydrogen are some of the strategies being considered," the company said. The majority of these applications create more electric demand. The exact timing and magnitude of this transition is uncertain. However, considering the size of the industrial sector in our region, we believe the range of potential incremental electric demand from transitioning to a low-carbon economy could be in the tens of thousands of gigawatt hours over the next few decades."

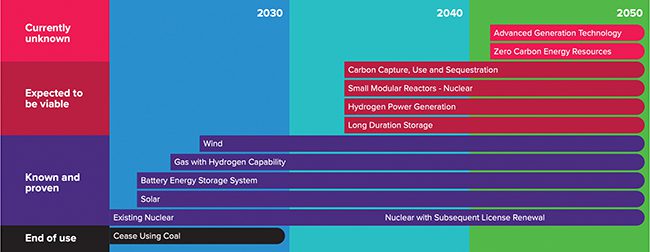

The Technology GapHow Entergy will fill this potentially significant gap between supply and demand remains a question. The company has underscored a future role for existing technologies like nuclear, renewables, and battery hybrids. But some zero-emitting technologies have yet to mature," it acknowledges (Figure 5).

At least through 2030, the company plans to continue operating its existing nuclear plants, transform its natural gas units to hydrogen-capable, modern, efficient units," and procure solar, wind, and short-duration battery storage. The company said that strategy is guided by economics."

|

5. Like many other utilities, Entergy is banking on technology evolution to help it achieve net-zero ambitions by 2050. The transition to cleaner, low- to zero-emitting technologies range from those that exist today to those that have yet to mature," the company says. This graphic illustrates its potential pathways. Courtesy: Entergy |

Over the medium-term (at least until 2040), Entergy may expand its focus on clean hydrogen-generated power; enabling more renewable projects, including offshore wind with long-term storage solutions; extending operation of our existing nuclear fleet through subsequent license renewal; and deploying advanced nuclear technologies, like small modular reactors." Entergy in July 2022 notably entered into a memorandum of understanding with Holtec International to evaluate the feasibility of deploying one or more SMR-160s at one or more of Entergy's five operational nuclear plants.

Getting to a cleaner future" will, meanwhile, require substantial investment-up to $16 billion-Entergy's new CEO Drew Marsh stressed during a February 2023 earnings call. For now, the company plans to dedicate about $6 billion to generation investments. These include investments in renewables and the Orange County Advanced Power Station (OCAPS), a 1.2-GW hydrogen-capable combined cycle power project that the company is preparing to build in Orange County, Texas.

Today, we have just over 800 MW of renewables in service, but we're still in the early stages of our renewables build-out. Over the next three years, we plan to increase our renewable portfolio by approximately 4,500 MW, more than four times our renewable capacity today, and that trend will accelerate beyond 2025 with plans for up to 14 to 17 GW in service by the end of 2031," Marsh said.

However, investments will also focus heavily on accelerated resilience and hardening," as part of the Entergy Future Ready" plan, Marsh noted. Last year, we laid out our $15 billion 10-year plan. It is expected to reduce storm outages, reduce future storm restoration costs and provide a foundation for growth for customers who are dependent on electricity more than ever. Our three-year capital plan includes about $900 million for this work and more investment could be added to this plan once regulatory approvals are obtained."

-Sonal Patelis a POWER senior associate editor (@sonalcpatel,@POWERmagazine).

| Utility Spotlight POWER magazineis exploring the histories of some of the largest utilities in the U.S. as part of the magazine's 140th-anniversary celebration. Other features that are part of this exclusive Utility Spotlight" series are here: New Era for NextEra: A Utility Spotlight(February 2022) History of Power: Duke Energy's Century-Old Legacy(May 2022) Southern Company: A History of a Prolific Power Technology Pioneer(August 2022) History of Power: Dominion Energy's Fluid Transition(November 2022) Why Constellation Energy, a Nuclear-Heavy Giant, Is Primed for Power Futurity (February 2023) |

The post Enduring Value: Entergy's More Than 100-Year-Old Story appeared first on POWER Magazine.