5G “Open” Standards Are in Play—Just How Open Are They?

At a June meeting in Osaka, Japan, cellular-industry stakeholders gathered to propose solutions to a technical oddity with surprisingly far-reaching consequences. At stake was who calls the shots when it comes to defining interoperability: big-name vendors, smaller manufacturers of specialized components, cell-service providers, or a mixture across the entire industry.

The interoperability struggle has led to the Open RAN movement, whose supporters hope to disrupt the wireless-industry hierarchy and allow more companies to take more significant roles in network infrastructure.

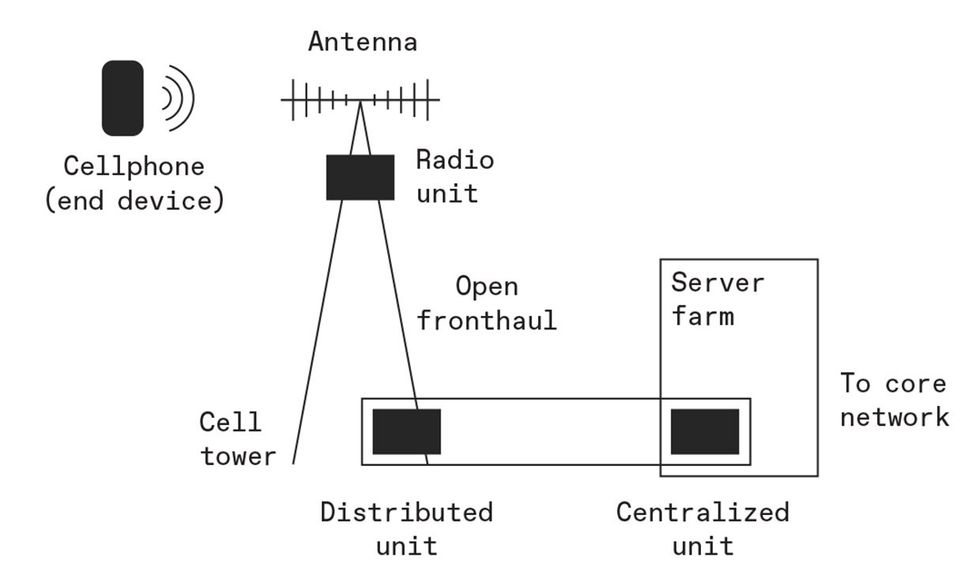

A radio access network (RAN) is the portion of a cellular network that connects individual devices, like phones, to a central, wired core network (think cell towers). Open RAN wants to make the interfaces between individual RAN components open"-capable of interacting with one another regardless of who made each component. The idea runs contrary to traditional RAN development, in which a vendor like Ericsson, Huawei, or Nokia would build an end-to-end network that would not interface with another vendor's components.

After initially resisting the Open RAN movement, large vendors are now actively engaged.

The Open RAN movement gained steam in 2018 with the formation of the O-RAN Alliance, based in Alfter, Germany. Which is not to say the entire industry was on board immediately. Indeed, the industry was initially divided into two camps by the issue.

The radio access network (RAN) functions as a cellular network middleman, connecting end devices like cell phones to the larger world. Open RAN proponents want the interfaces between RAN components, notably the radio unit (RU), distributed unit (DU), and centralized unit (CU), to be standardized so that components from different companies can be mixed and matched. The most popular division, or split," is called 7.2x and prioritizes creating a flexible (hence the x") interface called the open fronthaul between the RU and the DU.IEEE Spectrum

The radio access network (RAN) functions as a cellular network middleman, connecting end devices like cell phones to the larger world. Open RAN proponents want the interfaces between RAN components, notably the radio unit (RU), distributed unit (DU), and centralized unit (CU), to be standardized so that components from different companies can be mixed and matched. The most popular division, or split," is called 7.2x and prioritizes creating a flexible (hence the x") interface called the open fronthaul between the RU and the DU.IEEE Spectrum

On one side were the vendors that build the network components and seek to bake in competitive advantage by making their systems incompatible with another vendor's equipment. On the other side were the network operators-think AT&T, Deutsche Telekom, Orange, or any other cell-service provider-that wanted the opportunity to mix-and-match components and avoid getting locked into one vendor's ecosystem, even across cellular generations.

There was also a hope that opening up the interfaces would allow smaller vendors to enter the market. These vendors would theoretically be able to focus on building one component really well and not have to worry about customers passing them over because they couldn't easily integrate their equipment into an end-to-end system.

Open RAN's progression over the past several years has seemed, at times, both breakneck and stuck in the mud. The O-RAN Alliance, for example, has gone from just five founding members to well over 300 participants in just half a decade, and the group already has 101 publicly available Open RAN specifications, with more being developed by the organization's technical groups.

Whereas half a dozen splits"-ways to divide up RAN components to implement open interfaces-have already been explored across the industry, subsequent developments have zeroed in on a specific split called 7.2x that creates the Open Fronthaul Interface. Open Fronthaul moves data between two RAN components called the radio unit-such as the antennas at the top of a cell tower-and the distributed unit, which checks for errors and duplicated data, among other tasks.

Despite 7.2x's ascendency, progress in other directions has slowed as vendors and operators disagree on what counts as a sufficiently open" interface. And overall investment in Open RAN deployments has fallen: Analysts at Dell'Oro Group recently estimated that revenue from Open RAN will account for only 15 percent of the global RAN market by 2027, which is 5 percent less than they had previously projected. And while Vodafone in the United Kingdom announced earlier this year-following a 2020 order from the UK government to rip and replace Huawei components by 2027-that it would install Open RAN components in 2,500 cell sites, the company is opting to replace far more (3,500 sites) with Ericsson equipment.

Open RAN's progression over the past several years has seemed, at times, both breakneck and stuck in the mud.

Open RAN requires new cellular deployments, and outside of rip-and-replace scenarios, the wireless industry isn't eager for more. After all, the entire industry has just finished its monumental, multiyear effort of initial 5G rollouts. Most operators that I'm familiar with in Western Europe and in the U.S. will probably not for the next five to seven years really start massively deploying something else," says Kim Larsen, a wireless-industry advisor who was previously the chief technology and information officer for T-Mobile in the Netherlands. That kind of timeline aligns with when many network operators will begin thinking about 6G deployments, which is why open RAN may find a larger role in that generation.

Which brings us back to Osaka. There are still plenty of technical questions that require answers as Open RAN continues to take shape. On the agenda in Japan was a specific question about how to incorporate massive MIMO (short for multiple-input, multiple-output) antenna arrays, which incorporate large numbers of antennas to collectively beam precise signals to devices.

At issue was the fact that massive MIMO arrays weren't playing nicely with open fronthaul interfaces. The short version is that because of the particulars of split 7.2x, Open Fronthaul, when paired with massive MIMO, would have to handle too much data traffic. Vendors and network operators were seeing performance degradation up to 40 percent compared to single-vendor RAN installations.

Massive MIMO has seen widespread use in 5G networks and could play an even bigger role in 6G networks, so it's important to make sure it will work with Open Fronthaul. At the Osaka meeting, O-RAN Alliance members agreed to adopt two solutions to the problem as operation modes" that could be selected, depending on the needs of a specific network operator.

The expectation is that the large vendors will just implement both operation modes into their RAN interfaces. The benefit is clear: Rather than developing, manufacturing, and selling two varieties of components, they can provide one solution to any network operator's needs. The trade-off is that the components on either side of Open Fronthaul have become more complex, with duplicated features and functions.

More notable than any specific technical agreement, however, is how the compromise in Osaka is indicative of the larger trend happening in Open RAN's development: After initially resisting the movement, large vendors are now actively engaged in the process. Regarding the Osaka agreement, analyst Caroline Gabriel at Analysys Mason wrote, With the exception of Mavenir, the list of contributors could be related to any traditional RAN standards work." (Gabriel did not respond to requests for comment).

Despite the influx of participation by big players, the O-RAN Alliance says that all players will continue to have an equal opportunity to contribute.

Larsen says it's not accurate to view the industry as entirely recoalescing around the usual vendors. I don't think it necessarily means that if you have been a startup or a smaller player that everything is lost," he says. I think you probably will see a segmentation. Some, and that might be the bigger, usual people on the block like Nokia, Ericsson, and Samsung, will focus on the big incumbent players. And the smaller startups will focus on private networks, which is a really growing business."

UPDATE 15 Sept. 2023: The story was updated from a previous draft of the present story, which was originally posted in error.