Math Problem For Linda Yaccarino: If 90% Of The Top Advertisers Have Come Back, But Are Only Spending 10% Of What They Used To, How Screwed Are You?

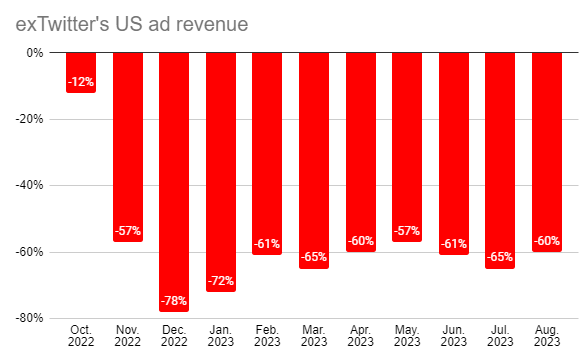

Last week, we highlighted how it appears that exTwitter's ad revenue remains in freefall.

We noted that exTwitter CEO-in-name-only Linda Yaccarino had just gone on stage at the Code Conference to try to dismiss the idea that the ad revenue was in trouble, claiming that reports of a 60% decline were months and months old" information, even though it came from Elon Musk directly just weeks earlier:

The other thing that Yaccarino said to try to convince everyone that the clown car wasn't veering completely off the track was that 90% of the top 100 advertisers have returned to the platform." As we noted at the time, the wording of this is kinda strange, and seems purposely designed to mislead people into thinking the the company's advertising was coming back to old levels.

Except... that's clearly not true. Media Matters has been using ad tracking tools to see how much advertisers are spending on exTwitter, and even the ones that are coming back are basically spending nothing. Some embarrassingly so. So, when Yaccarino crows that Visa" has come back to advertising on the platform, she leaves out that they spent $10 according to the analysis.

What's more, during Yaccarino's tenure as CEO, the majority of Twitter's top 100 advertisers pre-Musk have spent just a fraction - at least 90% less - of what they spent in the 12 weeks prior to Musk's acquisition.

During the September 27 interview, Yaccarino also claimed, In the last 12 weeks alone, about 1,500 [advertisers] have returned. So whether it is small business or big brands, right? Like AT&T, Visa, Nissan, all returning." Of those three companies she specifically mentioned, AT&T is the only one that was a top advertiser pre-Musk, and the company has spent just $781 in the last 12 weeks - 99.96% less than the more than $1.77 million it spent during the 12 weeks before Musk's acquisition.

Visa and Nissan are similarly spending just a fraction of what they spent pre-Musk. Visa spent just $10, and Nissan spent just $687, in the last 12 weeks - 99.99% and 99.77% less than they respectively spent during the 12 weeks before Musk's acquisition.

According to a June report from Reuters, Yaccarino similarly boasted to investors that Walmart had resumed advertising. But Walmart spent just over $100,000 on X ads in the last 12 weeks - 91% less than the $1.1 million it spent during the 12 weeks pre-Musk.

Even the company's top advertiser pre-Musk, HBO, spent only nearly $23,500 in the last 12 weeks - 99.9% less than the $28.3 million it had spent during the 12 weeks before Musk's acquisition.

It sure sounds like part of Yaccarino's strategy is to pretend that everything is coming back by convincing big name advertisers to just try us out again" at a tiny, tiny ad spend (perhaps heavily discounted as well), just so she can tell the media and other advertisers that all these advertisers are coming back," while leaving out the details of how little they've committed.