The first CRISPR cure might kickstart the next big patent battle

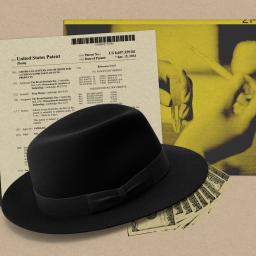

That's a real nice CRISPR cure you have there. It would be a pity if anything happened to it.

Okay. Drop the tough-guy accent and toss the black fedora aside. But I do believe that similar conversations could be occurring now that a historic gene-editing cure is coming to market, as soon as this year.

By the middle of December, Vertex Pharmaceuticals, based in Boston, is expected to receive FDA approval to sell a revolutionary new treatment for sickle-cell disease that's the first to use CRISPR to alter the DNA inside human cells. (Vertex hasalready received regulatory approvalin the UK.)

The problem is that the US patent on editing human cells with CRISPR isn't owned by Vertex-it is owned by the Broad Institute of MIT and Harvard, probably America's largest gene research center, and exclusively licensed to a Vertex competitor, Editas Medicine, which has its own sickle-cell treatment in testing.

That means Editas will want Vertex to pay. And if it doesn't, Broad and Editas could go to the courts to claim patent infringement, demand royalties and damages, or even try to stop the treatment from being sold with an injunction.

I imagine we'll see a lawsuit by the end of the year," says Jacob Sherkow, an expert on gene-editing patents at the University of Illinois College of Law. It's the moment patent litigators in this space have been waiting for."

Now for some disclaimers. Yes, I work for MIT. No, I don't benefit directly from the CRISPR patents. But others around here do. I recently talked to a scientist who, despite having only a secondary role in some follow-up CRISPR research, told me they have been receiving yearly royalty checks sometimes equaling their salary.

Back in 2014, MIT Technology Review broke the story of the infamous battle to control the patents on CRISPR-and almost a decade later the dispute remains one of the foundational narratives around the genetic super-tool, which can be programmed to cut DNA at precise locations.

The dispute pitted Broad Institute gene whiz Feng Zhang against the researchers who eventually earned the Nobel for developing CRISPR editing: Jennifer Doudna of the University of California, Berkeley, and Emmanuelle Charpentier, now with the Max Planck Institute in Germany.

Doudna and Charpentier might have the Nobel, but Zhang's head-turning claim that he was the real inventor of CRISPR genome editinghas so far wonout in the US, despite vigorous and ongoing efforts by Berkeley atappeals. Although Broad's intellectual property quest got little result in Europe, its CRISPR patent still reigns supreme here, in the world's biggest drug market.

And really, what's the point of such a hard-won triumph unless it's to enforce your rights?Honestly, this train has been coming down the track since at least 2014, if not earlier. We're at the collision point. I struggle to imagine there's going to be a diversion," says Sherkow. Brace for impact."

The Broad Institute didn't answer any of my questions, and a spokesperson for MIT didn't even reply to my email. That's not a surprise. Private universities can be exceedingly obtuse when it comes to acknowledging their commercial activities. They are supposed to be centers of free inquiry and humanitarian intentions, so if employees get rich from biotechnology-and they do-they try to do it discreetly.

There are also strong reasons not to sue. Suing could make a nonprofit like the Broad Institute look bad. Really bad.That's because it could get in the way of cures.

It seems unlikely and undesirable, [as] legal challenges at this late date would delay saving patients," says George Church, a Harvard professor and one of the original scientific founders of Editas, though he's no longer closely involved with the company.

If a patent infringement lawsuit does get filed, it will happen sometime after Vertex notifies regulators it's starting to sell the treatment. That's the starting gun," says Sherkow. There are no hypothetical lawsuits in the patent system, so one must wait until it's sufficiently clear that an act of infringement is about to occur."

How much money is at stake? It remains unclear what the demand for the Vertex treatment will be, but it could eventually prove a blockbuster. There are about 20,000 people with severe sickle-cell in the US who might benefit. And assuming a price of $3 million (my educated guess), that's a total potential market of around $60 billion.A patent holder could potentially demand 10% of the take, or more.

Vertex can certainly defend itself.It's a big, rich company, and through its partnership with the Swiss firm CRISPR Therapeutics, a biotech co-founded by Charpentier, Vertex has access to the competing set of intellectual-property claims-including those of UC Berkeley, which (though bested by Broad in the US) hold force in Europe and could be used to throw up a thicket of counterarguments.

Vertex could also choose to pay royalties. To do that, it would have to approach Editas, the biotech cofounded by Zhang and Church in Cambridge, Massachusetts, which previously bought exclusive rights to the Broad patents on CRISPR in the arena of human treatments, including sickle-cell therapies.

It's pretty clear Editas would like to ink a deal. On November 14,at a meeting with stock analysts, Editas CFO Erick Lucera said his company has at least two people working pretty much full time making calls and trying to get other companies developing CRISPR treatments to pay up. Indeed, he said, cashing in on the patents and bringing in revenue from them is a pillar" of the Editas business model.

I think there's a lot of companies that probably are going to have to have a conversation with us about using our license from a freedom-to-operate standpoint, and we are open to those discussions," Lucera told analysts. We're not talking about any particular licenses until they're signed ... But I think you all know the companies that are out there."

You know who you are, Vertex Pharmaceuticals. Tug the fedora for emphasis.

When I contacted Vertex, and later CRISPR Therapeutics, spokespeople at both companies sent me identical replies: I won't have anything to say about CRISPR patents." Okay, then. Maybe a deal is already in the works.

One final thought.If you were to discover a super-technique like CRISPR, it might be smarter to sell non-exclusive rights to all comers. Let a thousand flowers bloom. But that isn't what happened. Instead, universitiessold exclusives to develop CRISPR drugs to startups founded by their own researchers. Thus they planted the seeds of incurable dispute.

On its website, the Broad Institute explains why they did it. Itsays:Exclusivity is necessary to drive the level of investment needed to develop certain technologies to the point that they are safe, effective, and capable of precise editing in specific cell types."

Broad is correct that the CRISPR exclusive to Editas brought investment into that company, but a share of it was then used to fund the CRISPR patent fight. In fact, Editas financial reports indicate the company has been spending roughly $10 million on it per year.

So now, after spending that kind of money, its investors would be absolutely right to demand a return-with a lawsuit if necessary.

That can be considered the initial sin," says Ulrich Storz, a patent attorney in Germany who recently wrote a detailed review of the CRISPR situation for theJournal of Biotechnology. Of course a company wants exclusivity. But why did the university play that game?"