The Case for Nuclear Cargo Ships

The shipping industry has been trying to cut its carbon emissions for years, and with little to show for it. Nearly all of the world's ship fleet still runs on diesel fuel, with about a quarter of new ships on order being built to run on somewhat lower-carbon alternatives like liquefied natural gas, methanol, or hybrid propulsion.

The industry now faces serious pressure to pick up the pace. Shipping uses over 300 million tonnes of fossil fuels every year, producing 3 percent of greenhouse gas emissions. At a July meeting of the International Maritime Organization, the U.N. body that governs the industry, representatives doubled down on carbon-reduction ambitions, setting a net-zero emissions goal for 2050. The IMO's previous goal was a 50 percent reduction by 2050 in comparison with 2008 levels. The European Union plans to begin charging shippers for carbon emissions this year.

Hedging its bets, the industry is exploring ammonia, batteries, and hydrogen, among other options for powering ships. A small but growing group of analysts, though, are pushing for a zero-emissions technology that already plows the oceans: nuclear propulsion.

Today, some 200 nuclear reactors are already operating on 160 vessels, mostly naval ships and submarines. Nuclear-powered ships can go years without refueling. They do not need giant fuel tanks, which opens up more space for cargo and passengers. And the reactors themselves are getting better, too: Fourth-generation small modular reactors (SMRs) being developed by companies including U.S.-based TerraPower and London-based Newcleo should be safer and simpler to operate than conventional reactors.

For shipping, nuclear is really the only abundant, realistic, carbon-free option, according to Havard Lien, vice president of research and innovation at the Norwegian shipbuilding company Vard Group. It's becoming more and more apparent that we need to do something about emissions," he notes. At the same time, it's becoming apparent that alternative-fuel solutions we're looking at have big drawbacks, and that producing these fuels will take a lot of green power that will be needed to replace coal and gas on shore. Having an energy source that you can fit onboard a ship and does not compete with shore energy is a very high priority."

Vard Group is part of NuProShip, a consortium of the Norwegian maritime authority, universities, shipbuilders, and shipping companies that aims to develop a Generation IV reactor for marine vessels. The group has shortlisted three designs and plan to have picked one by the end of 2024.

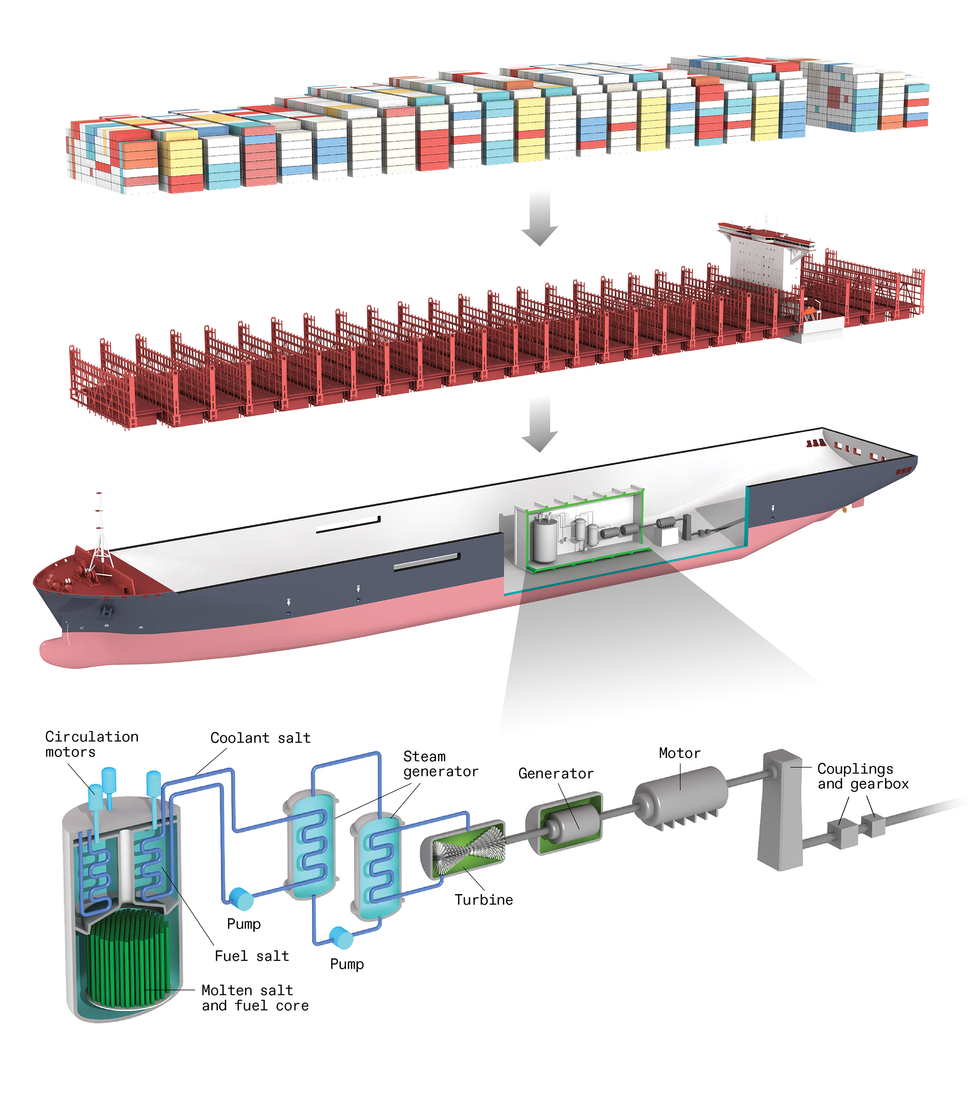

A large merchant ship, capable of carrying thousands of containers, could be powered by two (or more) 30-megawatt reactors. This artist's conception, which is not based on any specific design for a cargo ship, is intended to show the approximate scale of such a vessel. The reactors would be small, modular units. Researchers are considering three different types: a lead-cooled fast reactor, a uranium-fueled, helium-gas-cooled reactor, and a molten-salt-cooled reactor, shown here [above, at bottom]. The reactor would produce steam to spin turbines that would generate electricity to power motors.John MacNeill

A large merchant ship, capable of carrying thousands of containers, could be powered by two (or more) 30-megawatt reactors. This artist's conception, which is not based on any specific design for a cargo ship, is intended to show the approximate scale of such a vessel. The reactors would be small, modular units. Researchers are considering three different types: a lead-cooled fast reactor, a uranium-fueled, helium-gas-cooled reactor, and a molten-salt-cooled reactor, shown here [above, at bottom]. The reactor would produce steam to spin turbines that would generate electricity to power motors.John MacNeill

Also later this year, the Italian shipbuilding company Fincantieri and Newcleo expect to wrap up a feasibility study to assess the practicality of deploying a 30-megawatt reactor on marine vessels. Japanese shipping giant Imabari Shipbuilding, along with a dozen other companies, has invested US $80 million in the British startup Core Power to develop a floating nuclear power plant using SMR technology that could also one day be used in ships.

In South Korea, nine organizations, including shipping companies and the Korea Atomic Energy Research Institute, plan to develop and demonstrate large ships powered by SMRs. The U.S. Department of Energy commissioned the American Bureau of Shipping to conduct a study, recently concluded, to identify suitable reactors for a merchant ship and describe R&D challenges that would have to be overcome before nuclear-powered shipping could become a commercial reality.

Based on the number of players in the United States that are quite far advanced in their development, like TerraPower, my rough guess is that in 10 years we will see the first commercial civilian vessel with [next-generation] nuclear power," says Lien.

Why nuclear-powered ships?Four nuclear-powered merchant ships have been built so far, all of them government-led projects begun mostly for developmental and testing reasons rather than purely commercial ones. The first was the American NS Savannah, built in the late 1950s at a cost of $46.9 million (an eye-popping $495 million today). It was in service from 1962 to 1972, but its pressurized light-water reactor (LWR) proved too complex and expensive for the ship to operate profitably. The Russian cargo vessel Sevmorput, commissioned in 1988, is the only nuclear-powered merchant ship still in operation as of early 2024. The other two ships, the Japanese Mutsu (1970) and the German Otto Hahn (1968), were both refitted with diesel engines partway through their service lives.

Nuclear power has been more successfully applied on submarines and ice-breaking vessels. The very first nuclear-powered vessel was the attack submarine USS Nautilus, in 1954, amid the 1950s heyday of nuclear-power research. Hundreds of nuclear reactors have since been used on ships and submarines. Russia currently operates seven nuclear-powered icebreakers.

Seen here near the port of Seattle, in 1962, the NS Savannah was the first nuclear-powered merchant ship. Built in the late 1950s, the ship's costs were too high for it to operate profitably, and it was deactivated at the end of 1971. Bettmann/Getty Images

Seen here near the port of Seattle, in 1962, the NS Savannah was the first nuclear-powered merchant ship. Built in the late 1950s, the ship's costs were too high for it to operate profitably, and it was deactivated at the end of 1971. Bettmann/Getty Images

Now, the immense scale of shipping's decarbonization challenge, along with new reactor technologies, are prompting a reevaluation of nuclear merchant ships. In fact, for commercial shippers, there aren't any realistic alternatives to nuclear, says Jan Emblemsvag, professor of ocean operations and civil engineering at the Norwegian University of Science and Technology. Engines in ordinary ships are the size of houses," says Emblemsvag, who is leading NuProShip. And a great deal of space is taken up by fuel: A container vessel going from Amsterdam to Shanghai requires roughly 4,000 tonnes of fuel."

An SMR would be much more compact and lightweight. According to Emblemsvag, a molten-salt reactor-which uses a mixture of thorium and hot liquid salts as both fuel and coolant-would also save about $70 million over the lifetime of a ship, compared with a similar vessel powered by engines that burn diesel fuel (or, more precisely, heavy fuel oil). Another plus for nuclear-propelled ships is easy access to an endless supply of cooling water.

Commissioned in 1988, the Russian ship Sevmorput was the only nuclear-powered cargo ship still operating at the start of 2024. A fire on the ship caused minor damage in December 2023. Russian authorities expected the ship to be decommissioned in 2024. Alexander Piragis/Alamy

Commissioned in 1988, the Russian ship Sevmorput was the only nuclear-powered cargo ship still operating at the start of 2024. A fire on the ship caused minor damage in December 2023. Russian authorities expected the ship to be decommissioned in 2024. Alexander Piragis/Alamy

Batteries are an obvious nonstarter, Emblemsvag adds. A large container ship needs about 3,000 megawatt-hours a day, which is roughly the capacity of the biggest grid battery ever built. The battery solution is dead before it starts," he declares. The ship will basically go for one day, and it's over."

Ammonia, meanwhile, has half the energy density of diesel fuel, so ships would need twice as much of it. Ammonia is now made using an energy-intensive process, and no vessels are yet capable of using it. Producing enough renewable, carbon-free ammonia for shipping-about 600 million tonnes a year-using electrolyzers that split water molecules to produce hydrogen, would use 12 megawatt-hours per tonne of ammonia. To make 600 million tonnes of it would require almost three times the power production capacity of the entire European Union in 2022, according to Emblemsvag. So we can make engines that run on ammonia, but there won't be enough ammonia."

How new reactor technology could change shippingThe first step in making nuclear merchant ships a reality will be to build the right kind of nuclear reactors. For ship propulsion, engineers have used pressurized-water reactors because they can produce higher power for a given mass compared with the other kind of light-water reactor, the boiling-water reactor. However, the technology comes with major challenges. They depend on complex control systems that need a technically trained operating crew, and they run on solid fuel rods that need to be replaced every 18 months. There's also a risk, however slight, that the pressure vessel could explode.

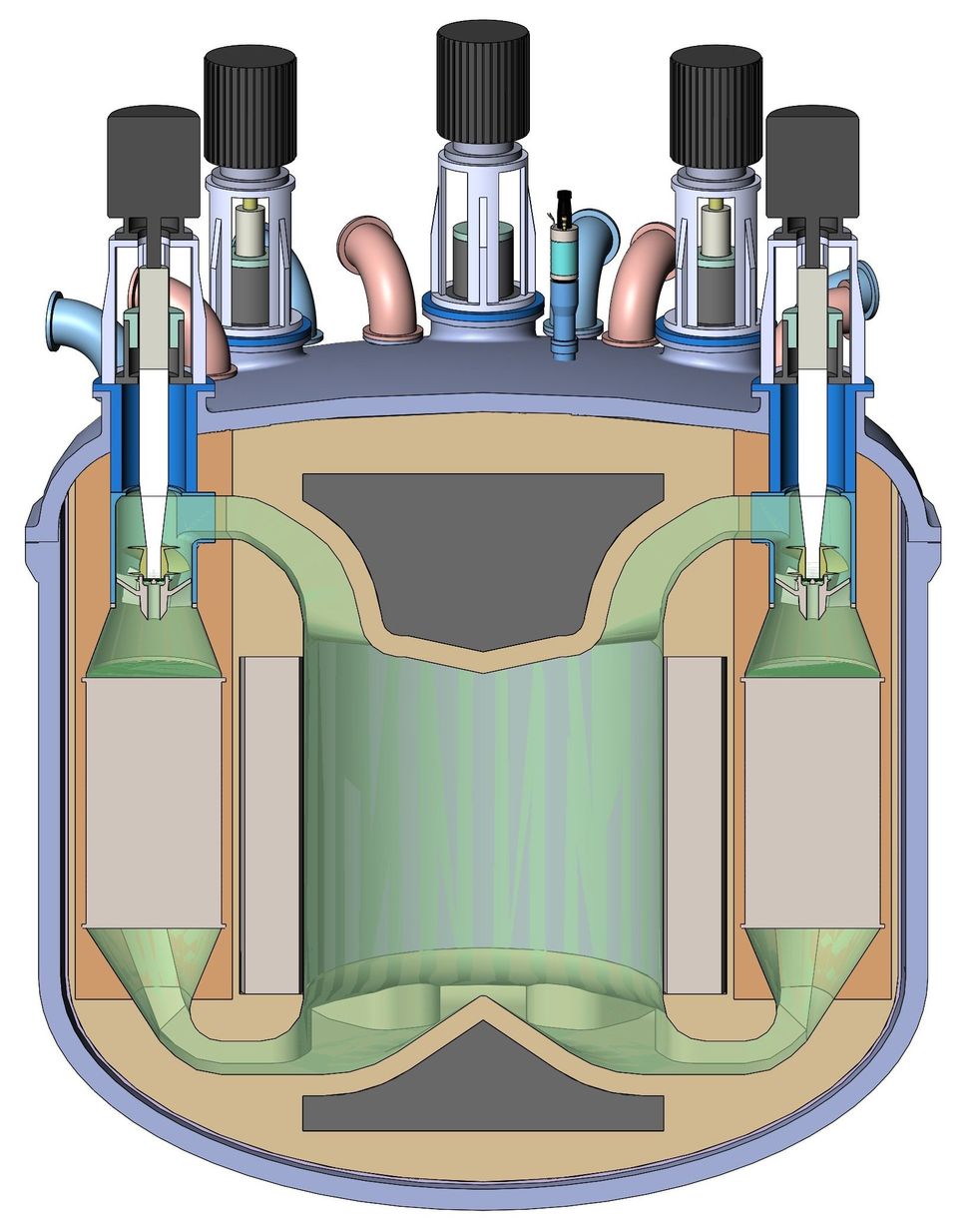

Fourth-generation SMRs avoid all that. Emblemsvag and the NuProShip team picked three reactor designs after analyzing 93 concepts in the International Atomic Energy Agency's SMR handbook. One is a thorium-fueled molten-salt reactor. The second is a lead-cooled fast reactor, which replaces the water coolant of traditional reactors with molten lead. The third option, likely closest to market, is a helium gas-cooled reactor that uses a type of fuel called tristructural isotropic (TRISO), consisting of uranium particles encased in ultratough carbide and carbon layers that can handle temperatures above 2,000 C.

All three reactor types operate at low pressures, making explosion extremely unlikely, Emblemsvag notes. Also, a meltdown is so unlikely as to be irrelevant, in his view. For example, the melting temperature of TRISO fuel is so high that no realistic scenarios could result in the fuel becoming molten.

With the other reactor types, the molten fuel or coolant would solidify before an accident could become a disaster, according to their backers. Giulio Gennaro, technical director at Core Power, likens the molten-chloride-salt reactor the company is codeveloping with TerraPower to a simmering saucepan instead of a pressure cooker: If you make caramel in a saucepan, it's extremely hot; you could burn your finger. But if the pan breaks, you have a leakage on the stove, and the molten caramel quickly solidifies." So contamination would not get far from the reactor in a reactor failure, as opposed to a pressurized vessel explosion that could splatter fissile material kilometers away.

Lead-cooled reactors have a similar advantage: The liquid lead would cool down and solidify in contact with cold water, encasing the reactor core and preventing nuclear material from being released into the environment, says Andrea Barbensi, engineering director at Newcleo. Launched in 2021, the company has designed a lead-cooled reactor that aims to produce its own fuel by recycling the by-products of conventional reactors, offering a circular solution to nuclear waste," he says.

Newcleo is working with governments and industry partners on a small-reactor prototype for industrial use that should be ready in the next 10 years. The feasibility study with Fincantieri will guide how the two companies develop the technology for marine use. Small modular reactors are a relatively new technology, but the interest we have seen from governments and industries across the world is very promising," Barbensi says.

To be sure, plenty of shipbuilders remain skeptical about nuclear-powered vessels. Last July, the American Bureau of Shipping and Herbert Engineering Corp. issued the results of a study addressing shipbuilders' concerns about nuclear reactors. There were lots of questions," says Patrick Ryan, ABS's senior vice president and chief technology officer. Does the reactor eat up all my cargo space? How is it arranged? Where does the crew go? What are the special training requirements? How do I insert this technology? How do I refuel? Does it change how fast I go? We needed to get the conversation started."

The study suggested that putting two 30-MW lead-cooled reactors on one of the largest container vessels would increase cargo capacity and speed, and eliminate refueling needs during its entire 25-year life-span. If there is sufficient industry interest, the ABS will identify the most promising reactor designs and assess risks and safety, Ryan says.

More than 80 SMR designs are being developed around the world, with the largest share in the United States. Yet the nation's shipbuilding industry is tiny. The majority of global shipbuilding happens in South Korea, Japan, and China. So while there is a lot of excitement in the United States about the terrestrial use of SMRs to replace coal power plants, Ryan says, the chatter about nuclear-powered commercial shipping is mostly coming from abroad."

And yet proving SMRs on land will be necessary before they can go onboard ships, says Core Power's Gennaro, and bipartisan support for new nuclear plants in the United States is helping move things along. With $170 million in funding from the Department of Energy, Core Power and TerraPower are building a molten-chloride desktop test reactor that will produce up to 500 kilowatts of power at Idaho National Laboratory; the reactor could start trials in 2025. After that, the companies plan to build a larger reactor for demonstration at sea in the early 2030s.

The challenges to building nuclear-powered fleets are soberingEven among supporters of nuclear ship propulsion, not everyone agrees that putting reactors on ships is the best way to go about it. In the near term, they argue, it makes more sense to use nuclear power as a source of electricity to produce alternative low-carbon fuels. If you use nuclear electricity to electrolyze seawater to make hydrogen, and then you use that hydrogen as a feedstock to make ammonia or methanol, the carbon footprint of the production of fuel is effectively zero," says Ryan.

Putting a reactor aboard a marine vessel has a lot of complicating factors that producing fuel with nuclear power doesn't have," he adds. Even if molten-chloride reactors manage to avoid the technical problems of the pressurized-water reactors used on the earlier cargo ships-spotty reliability, extremely high operating costs, and challenges related to radioactive waste and decommissioning-you would still have problems associated with public perceptions of nuclear power and the likely refusal of some ports to welcome nuclear ships.

Gennaro is convinced that the advantages of the advanced SMRs will be decisive. There are technology risks, but as far as molten-salt fast reactors go, everyone agrees there are no showstoppers," he insists. He adds that SMRs for marine deployment would be built in factories and assembled at shipyards, speeding up construction and lowering cost. Land-based nuclear power plants, for comparison, are constructed on site and typically far exceed their budgets and schedules. Cost also played a big role in NuScale Power Corp.'s plan to end its attempt to build the first SMR plant in Idaho, which would have used six reactors to generate 462 MW.

Gennaro admits that the perception that nuclear reactors are unsafe will be a problem, but he sees it as a challenge that can be overcome. Ryan points out that traditional fossil fuels also carry risks, which is why the ABS creates rules and guidance on how to use those fuels safely. Regulatory agencies would similarly have to devise rules for new propulsion methods. Ammonia, for instance, is very toxic, so a fuel spill would have a different level of concern than fossil fuels, he says. Nuclear reactors for U.S. commercial ships would not only have oversight from the ABS but would also require licensing from the U.S. Nuclear Regulatory Commission.

Unlike land-based use of nuclear power, marine use does bring the challenge of having a reactor on a moving vessel that pitches, rolls, yaws, and slows abruptly when it hits waves. One of NuProShip's tasks is to evaluate each reactor technology on how well it tolerates motion, according to Vard's Lien.

The project hopes to have an SMR prototype to test around 2030. Vard plans to test the SMR on new ships first, but that isn't expected to happen any sooner than 2035. If that goes well, existing ships could be retrofitted by replacing diesel engines with the SMRs, says Lien. The open-ocean vessels that the company builds-ships that lay telecommunication cable, maintenance ships, and fishing vessels-are ideal candidates for nuclear propulsion, he says. They need high amounts of power for operation and have to be at sea for months at a time. It would be a big advantage if they don't have to break off operations and go to port to refuel."

Other kinds of ships may also get the nuclear treatment. Although nobody expects to ever see nuclear-powered cruise ships, even they might benefit indirectly. Norwegian shipbuilder Ulstein has designed a nuclear vessel with a molten-salt reactor that might conceivably serve as a mobile charging station for a future fleet of small, battery-powered cruise ships.

As the shipping industry thinks about nuclear propulsion, SMRs are already starting to get vetted offshore. Russia, China, and South Korea are now working on floating nuclear power plants, mainly water-cooled SMRs that will be either mounted on barges or submerged underwater close to shore. Russia already has one, the Akademik Lomonosov, which has been operating since 2020 in the country's far east, producing electricity and district heating.

One potential snag for future nuclear-powered ships is the problem of fragmented nuclear regulation, says Emblemsvag. Commercial ships traversing international borders will face different regulations at different ports. Right now, a reactor approved in the United States isn't automatically approved for use in France, for example. The good news is that G7 countries with some E.U. countries and the International Energy Agency are working on harmonizing the rules," he says.

Meanwhile, Core Power is trying to harmonize support among stakeholders, including SMR makers, shipbuilders, and regulators. Besides selecting a nuclear technology appropriate for the marine environment, Gennaro says, the company is lobbying to create a market for the technologies. It helped organize an IAEA symposium on floating nuclear power plants this past November that brought together nuclear and maritime regulators, legal and policy experts, and industry leaders.

It's not just about the technology; it's about the entire ecosystem," he adds. If I have a technology ready for use, but the regulatory framework, market, financing possibility, and business model are not there, then the time to market, which for nuclear technology is already not extremely short, gets lengthened. Our goal is to make sure that once the technology is ready, the [ecosystem] is also ready to deploy."

This article was updated on 22 January 2024.