Should You Do Your Own Taxes? (and Why I Don’t)

I've always been a do-it-yourself guy, and will remain so as long as I'm alive. The reason is not money savings but the fundamental recipe for human happiness: you must remain challenged and keep learning throughout your lifetime. People who miss this recipe end up chasing ever more desperately after passive entertainments and pleasures. But they never find the happiness, because it was in the other direction.

I've always been a do-it-yourself guy, and will remain so as long as I'm alive. The reason is not money savings but the fundamental recipe for human happiness: you must remain challenged and keep learning throughout your lifetime. People who miss this recipe end up chasing ever more desperately after passive entertainments and pleasures. But they never find the happiness, because it was in the other direction.

So of course, I've always done my own taxes. Starting at age fifteen, I remember filling out my cute little T-1 tax form back in Canada - working through the single piece of newsprint with a pencil and eraser and a hand calculator. Throughout those teenage years, I enjoyed taking deductions for education and moving expenses and rent and relishing every dollar that I got to keep.

Later I got a fancy adult job and had to deal with higher income, deductions for the retirement account, and capital gains and losses from my early attempts at stock investing. I moved to another country and had to allocate that year's income between the two different tax systems, and nip the little attempts each country made to grab extra taxes from the accounts of the other one. I bought a house in the US and marveled at the tax deductible nature of mortgage interest and property taxes. Started a business and noticed the huge, complex range of tax options that suddenly opened up. Quit the day job and noticed how taxes suddenly cease to matter, because the US government becomes very forgiving to you if you're bringing in under $50,000 per year, even if you're actually a millionaire.

At this point in the story, we hit 2011 - the year that low-key Pete the retired Engineer/Carpenter/Dad started to type some shit into the computer, unwittingly transforming himself into Mr. Money Mustache, Notable Finance and Lifestyle Guru. Things were looking up as our boy was getting older, expensive early business mistakes had been resolved, and both Mr. and Mrs. MM started to make more money in our post-retirement hobbies. Suddenly, we had taxable income again.

I kept doing my own taxes as if it were 2010, but the increasingly favorable life conditions meant my tax bill was growing exponentially. This didn't concern me too much, because it also meant my after-tax income (which was 100% unnecessary anyway - our living expenses are already more than covered by investments) was growing at a similar pace. You have way more money than you could possibly spend, and you're paying a lot of tax. Only an angry ideologue would consider this a bad situation. I decided not to be one of those guys, and instead keep the energy focused only within my circle of control.

However, things kept getting better every year, and several Mustachians (many of whom are accountants) started needling me to improve upon my inefficient tax situation. I knew it could be done, but I was already very happy with life and making full use of my waking hours with a huge backlog of interesting things to learn and do. Did I really want to shut down some of these things in order to reorganize my taxes, in order to add even more unnecessary money to my accounts? I made a mental note to improve the situation, but only if the right opportunity ever came up.

Enter Tax Man

Keith passionately hijacks a session on taxes at Camp Mustache, Seattle, May 2015

Eventually that opportunity arrived. At a weekend gathering of Mustachians, I met an accountant that was genuinely passionate about the field, in the same way I am passionate about building stuff. Keith Schroeder likes optimizing taxes so much that he does it even when he doesn't need the money. He runs the same Wisconsin accounting firm he's had forever, biking down the country roads to his office and dispensing Mustachian life lessons to his employees whenever the chance arises. To me, this is a trust-inspiring place from which to start a business relationship, because you are less likely to get into a fight over who gets which dollar bills*.

So I handed over my financial laundry pile to Keith to see what he would come up with. The results were highly worthwhile, and here are just a few of them:

Changing my LLC from a Partnership to an S-Corporation

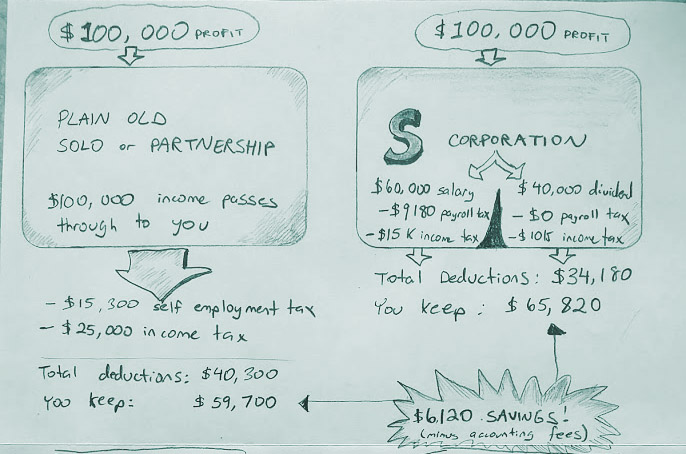

When you start a small business, you bring in some money from your customers, you spend a (hopefully) small amount of it on computers, restaurants, airplanes and taxis, your mobile phone and internet service, and so on. What's left over is the profit, which normally flows straight down to your personal income tax return. Because you're self employed, you have to pay a full 15.3% for Social Security and Medicare fees right off the top of this income, then go on to pay federal and state taxes on that same income. A pretty big bite. Unless you do this:

Figure 1: Saving $6 grand by switching to an S-corp. (Note: I assumed a 25% combined federal/state tax rate throughout this article just to keep things simple).

When you reorganize to an S-corporation, your company makes the profit and you are just an employee (and owner) of the company. The company can pay you a "reasonable" salary, and then hand you the rest of the income as a "dividend", which is exempt from this 15.3% tax.

The bottom line is that re-organizing to an S-Corp can save your company about $6,000 for each $100,000 of gross profit.

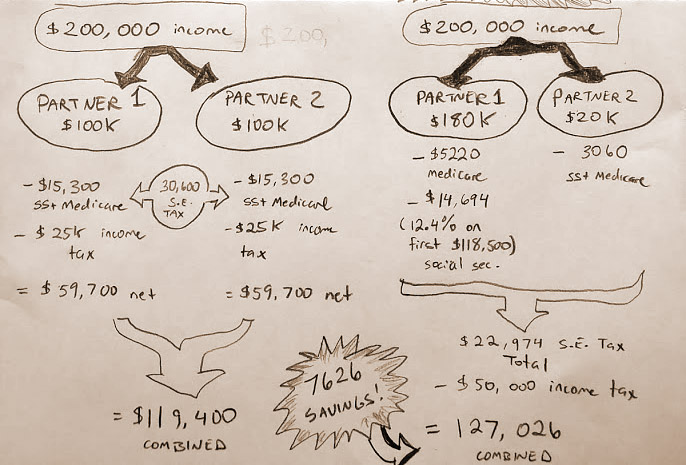

When Income Inequality is a Good Thing

Mrs. MM and I are joint owners of our LLC. Until recently, were simply splitting the income from this entity equally. This meant that if we made enough money, we would both be required to pay Social Security up to the limit ($118,500 of income per person). However, our activities for the company brought in drastically different amounts of money. Since my side includes this blog which is over 75% of the company's income, it was justifiable to make my "salary" higher so that some of it fell into the "Over $118k" portion that escapes above the limit of Social Security contributions. Her salary is lower but fully taxable. Here's an example of how this works with a hypothetical 2-person company making $200,000:

Figure 2: Different pay split saves $7626 per year

These are just two examples of tricks that the accountant brought in, and there are many more including having the business lease an office within your house, making the most of the powerful SEP IRA options open to business owners (you can contribute up to $53,000 per person per year!) and more. Keith even founded a Wisconsin branch of my LLC to allow the blog to at last become an Amazon affiliate. The savings or income from any one of these tweaks should be more than enough to cover his accounting fees for the year, which is exactly how hiring an accountant is supposed to work.

The Downsides of Complexity and Cost

The improvements above are saving me some serious money, but they come at the cost of some added complexity. When you change your simple business to an S-corp with employees, suddenly you have to "do payroll", meaning you write a monthly set of checks to each employee and to the state and federal government. There's also the nonsense of "unemployment insurance" and even "worker's compensation insurance". My accountant thankfully helped me opt out of the second thing (why would I expect to get paid if I injure myself while working for myself?), but the first is mandatory (so I can continue to get paid if I lose my job working for myself!)

My new accountant is handling all of the paperwork, but there are still emails and phone calls to answer occasionally, forms to sign, and obviously the cost of paying his firm to do all this work - roughly $2000 in the first year including the reorganization work, $1200 in ongoing years. A good investment given my current situation, but maybe not in 2010 when income was lower and business was simpler.

So, should you do your own taxes or not?

The average person has a single job, lives in a single house or apartment, and does not own a side business. In this situation, taxes are extremely simple and it is hard to get it wrong - especially if you use automated tax software like TurboTax, TaxAct, or Keith's preference 1040.com. Canadians might check out SimpleTax or StudioTax. If you are mathematically inclined** and enjoy the process, I think filing your own tax return is a beneficial and empowering do-it-yourself activity.

The average Mustachian is more likely to have rental properties or side businesses, and at this level the decision is more of a toss-up: doing your own work brings great benefits, and you can do the job to perfection if you make a point of it. But if you're not at least somewhat passionate about the work, it is easy to miss some details and cost yourself some money. I feel there's no shame in hiring out your taxes in this case, since you're building a new business relationship and the service will effectively cost you less than zero.

People like me are even better candidates for tax outsourcing: despite my earlier interest in DIY tax hacking and a love of spreadsheets and calculators, more recent complacency meant I was still missing out on a lot of the finer points. Doing my own business taxes instead of hiring an accountant was costing me over $10,000 per year and not giving me a proportional boost in life skills or satisfaction. As your income and business complexity rises, your tax abilities need to grow in parallel. If they don't, outsource it and put the saved time and energy into going out for more walks instead.

Is Mr. Money Mustache Out to Lunch?

I've been hesitant to admit to you that I ended up outsourcing my taxes. Given the stories (and excuses) above, what do you think? Is tax accounting outsourcing practical? Or Wussypants, like the outsourcing of your gardening and lawn care work?

I'm enjoying working with this new helper in my life, and the higher net income is worthwhile as well. But I don't want this reliance on another person to shut down my old tax brain entirely, leaving me reliant on professional help to make even the smallest decisions. But so far, so good: thanks to the last six months of working with this accounting firm, I'm feeling more tax-savvy than ever. I wish you similar good fortune this tax season.

Footnotes:

* note that the same effects come up in couple relationships - things are much better if you're not fighting over money.

** If you have simple taxes but insist that it won't be beneficial to do them yourselves, hand it over to an efficient but reasonably priced assistant like MMM reader Bradford Fishback's "Fishback Tax" service for a hundred bucks.

If you have more complex taxes and want to look into the big guns of personalized service, Keith Schroder is willing to take on even more clients at his firm called Tax Prep and Accounting Services. Email them via their website contact form. Since just running an accounting firm and doing tax work for hundreds of people is not enough, Keith also writes a blog called The Wealthy Accountant.

I receive no payment from any of the recommendations in this article, I just think they are useful. However I did provide Keith's affiliate link for 1040.com tax software since it costs us nothing and will benefit his firm.