What to Do About This Scary Stock Market

Recently I've been getting a lot more emails that go something like this:

Recently I've been getting a lot more emails that go something like this:

Dear Mr. Money Mustache,

I'm a new reader and I'm interested in improving my money situation. Spending less, earning more and investing. But when I checked out your article on stock investing with Betterment, it looks like a terrible deal. You've pumped in $116,000 to that account over the last 16 months and yet the current value is only about 110 grand. You've lost almost six thousand dollars!

I think you picked a lemon - I think I'll either find a financial adviser that can make me more money, or stick with my savings account. Half a percent is a lot better than losing six grand!

While these emails are always a little bit unfortunate (because it means I haven't done a great job making my investing articles easy to find), I'm actually thankful for the drop in my account value. And the even larger number of dollars I've lost in the rest of my retirement savings sitting at Vanguard and other places. It's not just six thousand dollars that has disappeared from my net worth in the last sixteen months - it's hundreds of thousands. And yet I feel better about investing than I did at the very peak of the stock market's lofty heights back in summer 2015. How could this be?

Welcome to Real Investing!

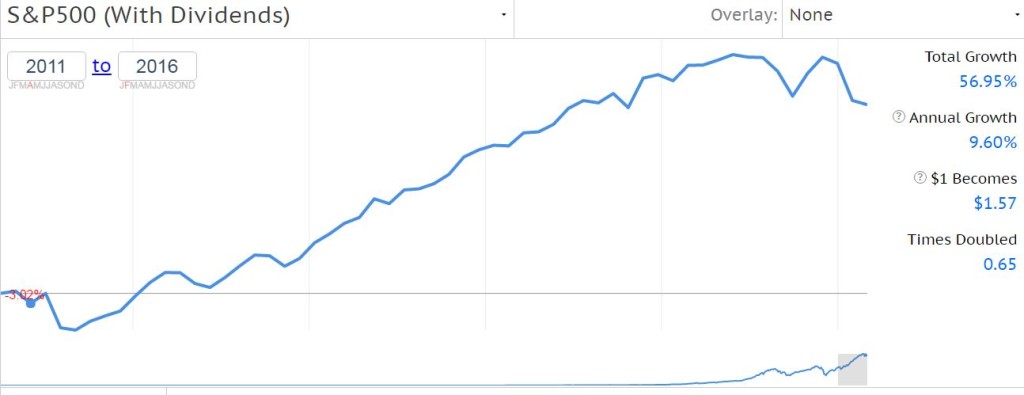

Figure 1: Stock market performance (including dividends) since I started this blog. Results from our IndexView tool.

The reason to celebrate is that is a completely normal and healthy part of investing. Stocks have been on an almost uninterrupted climb since I started this blog in 2011, which may have given beginners an unrealistically rosy picture. But now we're seeing a more natural pattern, and I'm glad. Because this actually means more wealth for all of us. It's a sale on stocks.

Buying Stuff at Lower Prices is Better

Think of it this way: Suppose you're just starting out as an egg farmer, and your goal is to build up a nice, profitable business. You want to build up a flock of hens so big that they are eventually producing thousands of eggs per month. Enough to live off for life and retire.

You buy your first 100 hens, and they get right to work. You allow those eggs to hatch so more hens can be born, and you also continue to buy hens from the farm supply store. Suddenly your phone rings and it's Farmer Joe down the road. "The price of hens has just dropped by 50%! You've just lost five grand on those hundred hens you bought last summer!"

Is this a sensible way to think about it?

No, of course not. You're happy that hens are cheaper, because now you can build your egg business even faster.

Stocks are just like hens. They lay eggs called "dividends", which are real money that can either flow automatically into your checking account, or automatically reinvest itself to buy still more stocks. Some younger companies don't pay dividends, but that doesn't mean they aren't making you money - they are just reinvesting their profits to grow even faster - and eventually become a Super Hen.

There's only one time you care if one of your shares is down: on the day you sell it. And as a wise lifetime buyer of only low-fee index funds, this day is sometime well into your retirement, only after you've spent your dividend income and drained down any other cash reserves you might have sitting around.

How to See a Dividend in Real Life

If you type the name of any stock or exchange-traded fund into a market analysis website like Google Finance, you'll see a field called "Yield". That's the annual dividend payment you get for owning those shares, as a percentage of your investment. Let's try it out:

For Vanguard's "Everything in the US" fund called VTI, you get this:

https://www.google.com/finance?q=VTI

This fund is showing a total annual dividend of 2.04% at the time I type this.

Interestingly enough, when I wrote the basic text of this article a month ago, stocks were 10% lower and that yield was thus 10% higher (2.24%) since the dividend rate hasn't changed even as the price swung around.

Similarly, if you look up the Vanguard "Everything Except the US" ETF with ticker symbol "VXUS", you get this:

https://www.google.com/finance?q=VXUS

And its current dividend yield is 2.94% - much higher because European/World stocks are currently cheaper than US ones.

If you own shares in either of these funds, actual Dividend Eggs show up in your account every 3 months. You can use them to buy more shares, or to buy edible eggs or other groceries.

Selling Stuff over a Long Period of Time means Smooth Sailing

So you're a Mustachian and spend your long 10-15 year career living richly on some of your salary, and accumulating loads of index funds with the other 60% of those earnings. Once your investments reach $1 million, you decide to retire, because the 4% rule indicates that should cover your family's $40,000 annual spending forever.

Given current stock market conditions, a 'stash like that would provide $25,000 per year in dividends alone. So you need to sell a few shares each year ($15k worth) to make up the difference.

$15k is only 1.5% of your million dollars.

Suppose that during the your first year of retirement, the market goes up by 7%, which is roughly what it does each year if you average it out over long time periods:

Now you have $1.07M, so even after the $15k withdrawal (now only 1.4% of your account!) you're still up over fifty grand.

Suppose the market goes down by 13%, which is roughly what happened from the highest peak to the lowest point of this supposedly bad year. Despite this fluctuation in the sticker price, you still had the same number of shares (hens), and they continued to lay about $25,000 in annual dividends.

Now you have $918,000 so your $15k withdrawal on the down year puts you down to $903k. It sounds painful, but your fifteen thousand was still only 1.6% of your balance.

And then the stock market resumes its upward march, which it always does. Some years it goes up 20%, other years it drops by 10%, but overall the continuous stream of dividends (eggs) and growth in company value and productivity (hen size) keep you well fed and happy - forever.

So What Have We Learned?

If you're still earning money and investing it, these are good times. The more the stock market drops, the happier you should be. Just keep your primary life stable (reasonable spending, no consumer debt, good healthy habits), and pour the rest into those investments (max out the 401(k) first, then IRAs, then put the rest into normal taxable accounts).

How to Invest in Stocks:

You can get great results by knowing only one thing: "Buy a low-fee Index Fund that allows you to own a slice of at least the Entire US Market."

There are many funds that accomplish this, but my default choice is Vanguard's VTI. You can buy it by getting a Vanguard account, or from any brokerage account (I have my own VTI shares in a brokerage account with my bank, just because it allows easier transfers to and from the family checking account).

More recently, I switched to dumping extra money into my Betterment account (see ongoing results here). It's the same idea: you end up buying Vanguard index funds but with a better interface, more sophisticated worldwide allocation and tax loss harvesting that makes it worth several times their 0.15% annual service fee to me. But some pretty thoughtful readers have disagreed with my choice - be sure to read the comments below that article to get their perspective.

This article is obviously just a repetition of the oldest of investing knowledge. But it's still a lesson that very few people understand today. Please hit your friends, your financial adviser, or the commentators on your television over the head with it if they ever express fear over a falling stock market in the future.

Further Reading:

How Much is Too Much in your 401(k)? explains why you should still put money in tax-deferred accounts even if you're planning to retire early, because you can get it out early if needed.

The Stock Series by my pal Jim Collins goes through the philosophy of index fund investing at a leisurely pace with plenty of interesting stories and folksy wisdom.