Eight Things to Know About the Wind Energy Industry’s Dramatic Growth

More than 18.2 GW of wind power capacity is currently under construction or in advanced stages of development in the U.S., according to a report released on July 26 by the American Wind Energy Association (AWEA).

That's a lot of new capacity. In fact, it's equivalent to roughly 25% of all currently installed U.S. wind power capacity and more than the country's combined total in 2007.

So, what's driving the growth, where's it happening, and why? Some of the answers to those questions may surprise you.

1. Lawmakers Lend a HandCongress eliminated some uncertainty for the industry when it passed a multiyear extension of the wind energy production tax credit (PTC) last year. The deal allowed the PTC for wind energy to remain at previous levels through 2016, which, at the time of the announcement, AWEA said was worth 2.3 cents per kWh. Although the wind PTC will be reduced to 80% of the present value in 2017, 60% in 2018, 40% in 2019, and then eliminated under the current law, it allows project developers to make long-term plans without fearing elimination of the credit from year to year.

"There's never been a better time to buy American wind energy," said Tom Kiernan, CEO of AWEA. "Smart utilities and other customers are locking in prices at record lows by starting construction this year to qualify for the full-value PTC. The industry is thriving thanks to policy stability and we appreciate support from champions in Congress for a multi-year extension of the PTC."

2. The Public Supports Wind EnergyDuring a press conference announcing the release of AWEA's "U.S. Wind Industry Second Quarter 2016 Market Report," Jim Reilly, AWEA's senior vice president for Federal Legislative Affairs, cited two polls as proof that there is strong backing for wind energy in the U.S.

One was a national poll conducted by Lazard-a global financial advisory and asset management firm-in March 2016 that surveyed 1,000 "likely voters" and 300 "opinion leaders" (defined as college-educated, likely voters who are regular consumers of news, own stock, and have an annual income greater than $60,000). When participants in the poll were asked if they favored "expanding the use of wind power," 91% of likely voters and 90% of opinion leaders said they did. Even 81% of respondents who identified themselves as politically "conservative" favored expanding wind energy, which was up from only 57% when the poll was last taken prior to the 2012 presidential election.

Reilly also referenced a Gallup poll conducted in March 2016. In that random sample of 504 adults, aged 18 and older, living in all 50 states and the District of Columbia, 73% of respondents said the U.S. should "emphasize alternative energy," rather than oil and gas production, to solve the nation's energy problems.

3. Many State Policies Support Wind EnergyA number of states have expanded their renewable portfolio standards (RPSs), helping wind power gain additional traction. For example, California, Oregon, Hawaii, Vermont, and the District of Columbia have all increased RPS targets to 50% or more. Several other states, including Maryland, Massachusetts, New York, and Rhode Island, are considering increases to their standards too.

But some lawmakers are starting to question the need for RPSs. Last year, Texas state Sen. Troy Fraser (R-Horseshoe Bay) introduced a bill (S.B. 931) that would have eliminated his state's RPS and Competitive Renewable Energy Zone program.

At the time, Fraser was quoted in The Dallas Morning News as saying: "Mission accomplished. We set out to incentivize and get wind started in Texas, and we far surpassed that goal." S.B. 931 passed Fraser's chamber by a 21-10 vote, but it failed to get through the Texas House of Representatives.

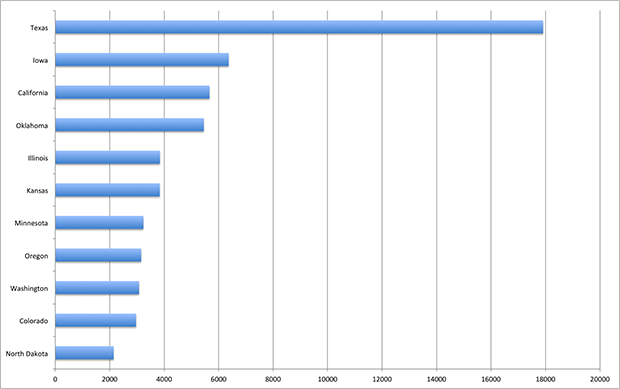

4. Texas Leads the Nation in Wind Energy (or Does It?)Fraser may have thought he had good reason to proclaim "Mission-accomplished," after all, Texas leads the nation in installed wind power capacity-and it's not even close (Figure 1). However, if you dig a little deeper, the lead may not be as lopsided as it appears. In fact, it may not be a lead at all.

|

1. The Lone Star. This chart shows the installed wind power capacity for the U.S.'s top 10 states. Texas has nearly three times the installed capacity of the next highest state. Source: AWEA |

Texas is the largest state in the contiguous U.S. (268,597 square miles). Iowa, with an area of 56,272 square miles, actually has nearly 70% more capacity per square mile than Texas, and both Iowa and California have more turbines per 100 square miles than Texas.

Texas is also the second most populous state in the union. On a per capita basis, North Dakota's wind power capacity leads Texas' by a factor of more than four. And if you look at the percentage of in-state power generated by wind energy, there are at least seven states that rank ahead of Texas, led again by Iowa with more than 31% of its power generated by the wind compared to Texas' 10%.

5. Corporations Are Wind Power ProponentsDuring the AWEA press conference, Jack Thirolf, senior director of regulatory affairs for Enel Green Power North America (EGP-NA), offered one example of how corporations are getting involved in the wind energy industry. In Kansas, EGP-NA began construction on the 400-MW Cimarron Bend wind farm during the second quarter 2016. The project is EGP-NA's first to sell power to a nonutility off-taker, which Thirolf said was a key factor in the development. In Cimarron Bend's case, half of its power will be supplied to Google, while the Kansas City Board of Public Utilities takes the other half.

"This diversification for us is a really key opportunity to grow," said Thirolf. "The companies that we're working with " share our vision for a cleaner energy future and recognize the economic opportunity that's there for wind in the economy."

Hannah Hunt, senior analyst with AWEA, said that the trend toward corporate wind energy purchases really emerged over the last two to three years, with 2015 being a banner year. She noted that 51% of contracted capacity was bought by nonutility corporations last year. Early adopters included technology companies, like Google, that wanted to supply data centers with renewable energy. But now, Hunt said, non-tech companies, such as Dow Chemical, Proctor and Gamble, and Target, are beginning to view wind energy as a low-risk, cost-competitive option.

"From a trend perspective, we do expect more corporate customers to look to renewable energy to fulfill their growing electricity needs now that wind is just as competitive as every other energy source," Thirolf said.

6. Three OEMs Dominate the U.S. Wind Turbine SectorEconomies of scale seem to be crucial for wind industry suppliers. Three original equipment manufacturers (OEMs) installed 99% of all new wind turbines in the U.S. during the first half of 2016. The "big three" are GE Renewable Energy, Siemens, and Vestas.

"Looking also at turbine manufacturers share for projects that are under construction or in the advanced stages of development, GE Renewable Energy and Vestas in particular, have a combined 80% market share for projects that have reported a manufacturer," Hunt said.

But Hunt suggested that smaller suppliers still have opportunities. Before this year, the big three averaged closer to 90% of U.S. installations. Still a high percentage, but other suppliers were competing. Hunt expects that to remain the case going forward, although the recent announcement that Gamesa and Siemens will combine wind businesses will make one member of the big three even bigger.

7. Wind Turbines Are Growing TooEarlier this year, MidAmerican Energy released a video chronicling the construction of the largest wind turbine ever built in the U.S. At 379 feet from ground to hub, the concrete structure is more than 100 feet taller than its neighboring turbines constructed with steel towers.

But at 2.415-MW, the MidAmerican Energy wind turbine is small by European standards. Siemens recently joined Vestas and Gamesa in offering 8-MW turbines to customers. And with greater capacity, comes longer blades. In June, Denmark-based LM WindPower-a leading wind turbine blade supplier-manufactured a blade 88.4 meters long (290 feet).

"The LM 88.4 P blade is an extraordinary example of industrialized innovation at record breaking scale. It is based on innovation building blocks, rooted in 35 years of real life experience, in the design, technology and manufacturing of ultra-long, reliable blades," said LM Wind Power's CEO Marc de Jong.

8. Offshore Wind: Coming Soon to the U.S.While offshore wind turbines, the likes of which LM Wind Power has been supplying for years, are commonplace in Europe, none have yet been completed in the U.S. That is likely to change this year. Deepwater Wind announced on July 25 that installation of turbine towers, blades, and nacelles is scheduled to begin in early August at its Block Island Wind Farm site, which broke ground in April 2015.

The project is located about three miles off the coast of Block Island, R.I. It will consist of five 6-MW turbines supplied by GE Renewable Energy. The final construction phase is expected to take about one month and should finish in early September. Commissioning will begin during offshore installation and is scheduled to take several months.

"It's go time," said Deepwater Wind CEO Jeffrey Grybowski. "We're ready to bring this historic project across the finish line. This is sure to be a momentous summer-not just for this project, but also for the start of a new American industry."

-Aaron Larson, associate editor (@AaronL_Power, @POWERmagazine)

The post Eight Things to Know About the Wind Energy Industry's Dramatic Growth appeared first on POWER Magazine.